$PSTI Oppenheimer

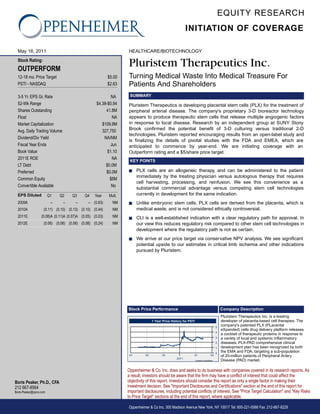

- 1. EQUITY RESEARCH INITIATION OF COVERAGE May 16, 2011 HEALTHCARE/BIOTECHNOLOGY Stock Rating: OUTPERFORM Pluristem Therapeutics Inc. 12-18 mo. Price Target $5.00 Turning Medical Waste Into Medical Treasure For PSTI - NASDAQ $2.63 Patients And Shareholders 3-5 Yr. EPS Gr. Rate NA SUMMARY 52-Wk Range $4.38-$0.94 Pluristem Therapeutics is developing placental stem cells (PLX) for the treatment of Shares Outstanding 41.8M peripheral arterial disease. The company's proprietary 3-D bioreactor technology Float NA appears to produce therapeutic stem cells that release multiple angiogenic factors Market Capitalization $109.9M in response to local disease. Research by an independent group at SUNY Stony Avg. Daily Trading Volume 327,750 Brook confirmed the potential benefit of 3-D culturing versus traditional 2-D technologies. Pluristem reported encouraging results from an open-label study and Dividend/Div Yield NA/NM is finalizing the details of pivotal studies with the FDA and EMEA, which are Fiscal Year Ends Jun anticipated to commence by year-end. We are initiating coverage with an Book Value $1.10 Outperform rating and a $5/share price target. 2011E ROE NA KEY POINTS LT Debt $0.0M Preferred $0.0M s PLX cells are an allogeneic therapy, and can be administered to the patient immediately by the treating physician versus autologous therapy that requires Common Equity $6M cell harvesting, processing, and reinfusion. We see this convenience as a Convertible Available No substantial commercial advantage versus competing stem cell technologies EPS Diluted Q1 Q2 Q3 Q4 Year Mult. currently in development for the same indication. 2009A -- -- -- -- (0.63) NM s Unlike embryonic stem cells, PLX cells are derived from the placenta, which is 2010A (0.11) (0.10) (0.13) (0.10) (0.44) NM medical waste, and is not considered ethically controversial. 2011E (0.08)A (0.11)A (0.07)A (0.05) (0.03) NM s CLI is a well-established indication with a clear regulatory path for approval. In 2012E (0.06) (0.06) (0.06) (0.06) (0.24) NM our view this reduces regulatory risk compared to other stem cell technologies in development where the regulatory path is not as certain. s We arrive at our price target via conservative NPV analysis. We see significant potential upside to our estimates in critical limb ischemia and other indications pursued by Pluristem. Stock Price Performance Company Description Pluristem Therapeutics Inc. is a leading 1 Year Price History for PSTI developer of placenta-based cell therapies. The 5 company's patented PLX (PLacental eXpanded) cells drug delivery platform releases 4 a cocktail of therapeutic proteins in response to 3 a variety of local and systemic inflammatory 2 diseases. PLX-PAD comprehensive clinical 1 development plan has been recognized by both 0 the EMA and FDA, targeting a sub-population Q1 Q2 Q3 Q1 Q2 of 20-million patients of Peripheral Artery 2011 Created by BlueMatrix Disease (PAD) market. Oppenheimer & Co. Inc. does and seeks to do business with companies covered in its research reports. As a result, investors should be aware that the firm may have a conflict of interest that could affect the Boris Peaker, Ph.D., CFA objectivity of this report. Investors should consider this report as only a single factor in making their 212 667-8564 investment decision. See "Important Disclosures and Certifications" section at the end of this report for Boris.Peaker@opco.com important disclosures, including potential conflicts of interest. See "Price Target Calculation" and "Key Risks to Price Target" sections at the end of this report, where applicable. Oppenheimer & Co Inc. 300 Madison Avenue New York, NY 10017 Tel: 800-221-5588 Fax: 212-667-8229

- 2. Pluristem Therapeutics Inc. Table Of Contents Investment Thesis pg. 3 Key Milestones pg. 4 Valuation pg. 4 Risks to Our Thesis and Price Target pg. 8 PLX Technology Background pg. 9 Stem Cells – A New Biologic Drug pg. 10 Peripheral Arterial Disease Background pg. 12 Clinical Data and Development Plan pg. 16 Financial Overview and Projections pg. 18 Management Biography pg. 22 Appendix: Stem Cells Primer pg. 26 Appendix: Angiogenesis Background pg. 28 Appendix: Select Clinical Studies of Cell Therapy in CLI pg. 30 2

- 3. Pluristem Therapeutics Inc. Investment Thesis Pluristem Therapeutics Inc. is a clinical stage biotechnology company developing placental stem cells (PLX) for multiple indications. Unlike research that aims to direct stem cell differentiation to form new tissue, Pluristem utilizes stem cells for their ability to secrete complex and potent signaling molecules and to adjust their molecular signaling to the local microenvironment. As such, Pluristem’s technology is more analogous to a drug, and should not be confused with stem cell-based organ/tissue regeneration. We believe that stem cells offer a dynamic drug delivery approach that cannot be emulated via traditional pharmaceutical techniques, but may be necessary in many regenerative applications. We highlight the following key strengths of Pluristem’s technology: a) Proprietary 3-D Bioreactor. Pluristem uses its proprietary 3-D bioreactor technology (PluriX) to grow the cells in a more natural environment than current standard 2-D techniques. We are encouraged by a confirmation from an independent laboratory that stem cells grown in a 3-D environment produce significantly more growth factors than their 2-D counterparts. b) Convenient Storage and Administration. Pluristem’s technology is allogeneic (not derived from patient cells) and does not require tissue samples from the patient or histocompatibility matching. What this means in practice is that the PLX cells are stored in a refrigerator and can be injected into a new patient at any time, which is very different from requiring a sample from the patient and waiting several weeks until those cells are cultured and returned to physician. We believe that this administration convenience is a key commercial advantage versus competing autologous (taken from the patient) stem cell therapies, simplifying logistics and potentially reducing costs for the patient and the physician. c) Clear Regulatory Path in US and EU. Pluristem received an approval for its pivotal Phase II/III study in critical limb ischemia (CLI) from both the EMEA and the FDA. This suggests that if the study is successful, and the safety database is further confirmed in the IC study, then the same dataset may be used to gain approval in UE and EU. We arrive at our target price of $5/share for Pluristem based on an NPV analysis of PLX in CLI. We estimate a launch in 2016, conservative pricing of $12,000/patient, and US peak sales of $1.3B by 2025. Given the unique nature of the therapy, we do not believe that generic competition is likely in the near future, but to be conservative we only include cash flow through 2025, and exclude potential upside from additional indications, premium pricing, and ex-US sales at this time. Please see our initiation reports on IMMU, KERX, ONCY, and CLDX, also published today. 3

- 4. Pluristem Therapeutics Inc. Key Milestones Event Date Results for BONMOT-CLI (academic CLI study in Germany) May/June '11 Start Phase II study in IC 3Q11 Publication of Phase I/II PLX-PAD study data in journal 4Q11 Update on 12-month safety from Phase I/II PLX-PAD study 4Q11 Start Phase II/III Trial in CLI end of 2011 Phase II/III DSMB Update end of 2012 Completion of enrollment in Phase II/III CLI study end of 2013 Start physician IND muscle injury study 2011 Start Buerger's Phase II/III study 2011/2012 Start diabetic ulcers study 2012 Start neuropathy study 2012 Valuation Initiating With An Outperform Rating And A $5/Share Price Target Peripheral Arterial Disease – A Large Market And Unmet Medical Need Peripheral arterial disease (PAD) is an obstruction of arteries which generally results in reduced circulation to the extremities, usually in the legs. Sedentary lifestyle, high fat/high cholesterol diet, diabetes, inflammatory disease, and smoking are the leading causes of PAD. According to the American Heart Association, PAD affects ~8M Americans, and is more common at older age. CLI (critical limb ischemia) is a severe form of PAD, with an estimated prevalence of 1 ~1.1M in US, and is anticipated to grow to approximately 1.4M by 2015 . Further estimates suggest that approximately 25-30% of CLI patients are not candidates 2,3 for interventional or surgical revascularization . PAD is also believed to be responsible for ~160,000 – 200,000 amputations performed in the US annually. NPV Analysis Suggests Price Target Of $5/Share Development-stage biotechnology companies often present a challenge in applying traditional multiple-based valuation techniques. We believe that valuation based on an EPS multiple is not suitable for Pluristem because ongoing success in additional indications following a potential approval in CLI would lead to increased R&D costs and lower EPS in the initial years of commercialization, versus a less valuable but a higher EPS scenario where these additional indications are terminated in early development. As such, we based our valuation on an NPV 1 Prather W.R., et. al., The role of placental-derived adherent stromal cell (PLX-PAD) in the treatment of critical limb ischemia. Cytotherapy (2009) 00; 1-8. 2 Pignon B. Histological changes after implantation of autologous bone marrow mononuclear cells for chronic critical limb ischemia. Bone Marrow Transplant (2007) 39:647-648. 3 Lawall H, et. al., Treatment of peripheral arterial disease using stem and progenitor cell therapy. Journal of vascular Surgery (2011) 53(2): 445-453. 4

- 5. Pluristem Therapeutics Inc. analysis of PLX in CLI in the US. We conservatively limit our valuation to CLI in US because the timing and probability of approval in other indications and geographies is less certain at this time. In addition to the planned Phase II study in IC (intermittent claudication), we anticipate that a Phase III study would be required prior to label expansion in IC, and we will consider the upside in IC once additional data is available and label expansion studies are ongoing. We exclude current cash balance and European opportunities from our valuation because we believe that the company is likely to invest the current cash balance into research and/or partner ex-US geographies to finance the development of PLX for the US market. We believe that PLX may gain approval based on successful results of the PLX- CLI trial and positive safety findings in the PLX-IC study. We estimate the PLX-CLI study to commence enrollment at the end of this year, and for both studies to complete enrollment at the end of 2013. Adding one year for the observation period and another year for filing and FDA review, we estimate approval late in 2015 and US market launch in early 2016. Based on the disease epidemiology described above, we estimate the prevalence of CLI patients at 1.4M in 2015, growing at a CAGR of 3%. We further estimate that 25% of these patients will not be candidates for surgical revascularization, and are the target market for PLX. Our market share assumption starts at 3% in 2016, as physicians slowly begin to accept a novel therapy, growing to 20% in 2020. We would note that we are utilizing a simple prevalence-based model where we do not exclude treated patients from the future patient pool. We believe that is justifiable because PLX therapy does not address the underlying cause of PAD, such as diabetes, cardiovascular disease, etc., and the newly formed blood vessels are likely to succumb to these underlying ailments just like the prior healthy blood vessels did. Therefore, we believe that PLX is more likely to be a chronic therapy than a one- time treatment. We extend our model through 2025 without assigning a terminal value. Although a terminal value may be warranted, our analysis suggests that even without a terminal value, Pluristem is currently undervalued. We also do not see a generic challenge as an issue for PLX given the complex nature of the therapy, but by 2025 competing technologies may present significant commercial pressure. Based on a conservative launch price of $12,000/patient year, we arrive at peak sales of $1.3B in 2025. To complete our valuation, we estimate COGS of $500/patient at launch, decreasing progressively at larger scale, as well as sales and marketing costs reaching 30% of revenue. In our taxation analysis we modeled the tax incentive granted by the Israeli government to companies in the high tech industry. Our model includes a full recapture of NOL ($82M at launch), followed by a 6-year tax holiday, and 10% tax rate for the subsequent 4 years. To capture the development risk associated with PLX, we applied an overall probability of approval of 40%, and an additional 5% risk of market withdrawal post approval. Applying a 15% discount rate and an estimated fully diluted share count of 70M in mid-2012, we arrive at our target price of $5/share. 5

- 6. Pluristem Therapeutics Inc. Exhibit 1: NPV Valuation Of PLX-CLI In US Year 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 US CLI Prevalence (000s) 1,400 1,442 1,485 1,530 1,576 1,623 1,672 1,722 1,773 1,827 % no option patients 25% 25% 25% 25% 25% 25% 25% 25% 25% 25% US CLI no option patients (000s) 350 361 371 382 394 406 418 430 443 457 US Market penetration 3% 6% 10% 15% 20% 20% 20% 20% 20% US Treated Patients (000s) 11 22 38 59 81 84 86 89 91 Price per patient treated ($000s) $12 $12 $12 $13 $13 $13 $14 $14 $14 Total US Revenue ($MM) $130 $273 $477 $752 $1,054 $1,107 $1,163 $1,222 $1,284 Expenses COGS (per patient, $) $500 $400 $350 $350 $350 $350 $350 $350 $350 COGS total ($MM) $5 $9 $13 $21 $28 $29 $30 $31 $32 R&D Internal $4 $4 $4 $4 $4 $4 R&D External $3 $5 $6 $4 $3 $3 $3 $3 $3 $3 $3 $3 $3 G&A $4 $4 $4 $4 $5 $12 $18 $25 $40 $75 $80 $80 $80 $80 Sales & Marketing $1 $2 $4 $25 $90 $109 $143 $226 $316 $332 $349 $367 $385 Total expenses $8 $12 $15 $18 $38 $114 $139 $185 $289 $423 $444 $462 $481 $500 Pre-tax cashflow ($MM) -$8 -$12 -$15 -$18 -$38 $15 $134 $293 $463 $631 $663 $701 $742 $784 Taxes NOL ($MM) $56 $60 $63 $66 $86 $33 $0 $0 $0 $0 $0 $0 $0 $0 Effective tax rate 0% 0% 0% 0% 0% 0% 0% 0% 0% 0% 0% 0% 10% 10% Taxes ($MM) $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $74 $78 After tax cashflow -$8 -$12 -$15 -$18 -$38 $15 $134 $293 $463 $631 $663 $701 $667 $706 Probability of cashflow 100% 100% 100% 100% 50% 40% 40% 40% 35% 35% 35% 35% 35% 35% Risk-adjusted cashflow -$8 -$12 -$15 -$18 -$19 $6 $53 $117 $162 $221 $232 $245 $234 $247 Discount rate 15% NPV ($MM) $372 NPV/share $5.30 Source: Oppenheimer & Co. 6

- 8. Pluristem Therapeutics Inc. Significant Potential Upside To Our Valuation We believe that our valuation is based on very conservative assumptions. We see multiple potential sources of upsides to our valuation: a) Larger Target Patient Market We only included CLI patients that are not eligible for surgical reperfusion in our model. However, we believe that even if the intermittent claudication (IC) study is not successful, physicians may be more liberal in utilizing PLX therapy in patients that may still be considered candidates for surgery given the risks, pain, and inconvenience associated with the surgery itself. b) Greater Market Share Our market share assumption starts at 3% of eligible patients growing to 20%. However, end-stage CLI patients have no alternative and are generally anticipating an amputation in the near future. We believe that this may lead patients and physicians to seek PLX therapy more aggressively, enabling Pluristem to capture a substantial market share in a short period of time. c) Premium Pricing We modeled a price of $12,000/patient per year. This is a discount compared to chronic biologic therapies such as TNF-alpha’s in rheumatoid arthritis, which cost ~$14-24,000/year. Alternatively, one could use cancer drug prices as a comparator, which would imply prices in the $40-60,000 range. Last, one can use the cost of amputation as a basis to price PLX therapy, which is on par with cancer therapy costs. It is difficult to estimate the price of cell therapies at this time, and the actual pricing is likely to be dependent on the clinical benefit delivered by these treatments, but we believe that $12,000 is a very conservative estimate with room to grow. d) Higher Injection Frequency Pluristem is investigating two injections of PLX four months apart, followed by an 8- month waiting period for a total study length of 12 months in the Phase II/III study. However, if approved, PLX may be used as a chronic therapy dosed on a more regular basis, and a dosing frequency of once every four months seems reasonable to us. Such chronic utilization may substantially increase the number of injections per patient. e) Additional Indications Pluristem is investigating or plans to investigate PLX therapy in several indications outside of CLI, including IC, Buerger’s Syndrome, diabetic ulcers, muscle injury, and neuropathy. Success in any of these indications could significantly expand the market for PLX. f) Ex-US Opportunities Pluristem received approval from the European Medicines Agency (EMEA) to commence its Phase II/III CLI PLX-CLI study, and we believe that if the study is successful, the company may gain approval in the EU in addition to US based on the same study. We are not including ex-US opportunities in our valuation because we believe that they are more difficult to assess at this time and Pluristem may consider partnering certain geographies in order to further finance PLX 8

- 9. Pluristem Therapeutics Inc. development and remain focused on the US market. A favorable ex-US partnership may help add non-dilutive financing as well as significant upside to shareholders. Risks To Our Thesis And Target Price There are multiple risks and uncertainties associated with investment in development-stage biotechnology companies. We recommend investors review Pluristem’s regulatory filings for the detailed summary of investment risks, and below we highlight the top three risks that relate to our thesis and price target. Clinical Trial Risk Pluristem must gain FDA approval (EMEA in Europe) to be able to market its product. Our estimates for commercial launch in 2016 are predicated on success in the Phase II/III CLI study and positive safety confirmation in the IC study. If either of these trials do not meet their endpoints, Pluristem may have to conduct additional clinical studies prior to commercial approval. We view the clinical trial outcome as the highest risk associated with the company at this time. We would like to highlight that in our view positive efficacy is not required in the IC study for Pluristem to gain approval in the CLI indication. Competitive Risk There are several companies developing stem cell therapies for CLI, and if successful, they are likely to compete for the same patients that Pluristem may target. We see commercial competition as a moderate risk. Our view is based on the observation that to the best of our knowledge, no head-to-head trials of competing cell therapies are conducted or planned at this time. As such, even if multiple stem cell therapies are approved for CLI, we believe that without head-to- head comparison, perceived safety and convenience are likely to drive physician prescribing decision. On that front, we believe that PLX’s convenience (simply take a sample out of the refrigerator and inject) may make it one of the more commercially attractive stem therapy options for patients and physicians. Headline Risk Valuation of development-stage biotechnology companies may sway significantly due to headlines associated with competing technologies and/or macro trends in healthcare. Due to the novelty of stem cell therapies, potential limited understanding of the associated technologies by retail investors, and political uncertainties associated with healthcare and stem cells, Pluristem’s stock may be volatile for reasons not directly related to the company’s internal performance. Liquidity and Small Capitalization Pluristem is a small capitalization (<$500M) unprofitable biotechnology company. The company may require additional capital to reach profitability, and an inability to raise capital on favorable terms or at all may significantly impact the company’s valuation. Pluristem’s stock may also exhibit volatility due to events not directly related to its operations, including macroeconomic concerns, healthcare policy, and political developments. Additionally, the stock’s liquidity may limit some investors’ ability to acquire and sell shares in a timely fashion. 9

- 10. Pluristem Therapeutics Inc. PLX Technology Background PLX Technology Addresses Many Cell Stem Challenges Pluristem’s stem cell therapy is based on Placental eXpanded (PLX) platform. Cells are harvested from the placenta following a cesarean section (C-section). The placenta is considered to be medical waste and is not a controversial source of stem cells. Placentas are collected at the maternity ward, transported to Pluristem’s facility, with cell processing commencing ≤4 hours following the C- section. The mother is screened for viral infections prior to delivery, and the placenta is then placed in quarantine for three weeks and screened once again during the manufacturing phase. Following cell harvesting, stem cells are seeded on a polystyrene discs and stacked into a 3-D bioreactor, called PluriX. The cells are then grown in this bioreactor without the use of external growth factors. The entire process takes approximately eight weeks from birth to final product ready for shipping (Exhibit XX). Exhibit 2: PLX Preparation Process Source: Prather W.R., et. al., The role of placental-derived adherent stromal cell (PLX-PAD) in the treatment of critical limb ischemia. Cytotherapy (2009) 00; 1-8. Unique Advantages Of 3-D Culturing Approach Pluristem’s 3-D approach is very different from the traditional stem cell growing techniques. Notably, the standard practice is to grow stem cells in plastic flasks, which are filled with growth media and stacked on top of each other. The stem cells grow at the bottom of flask surrounded by plastic on one end and growth media on the other. This technique is often referred to as 2-D because the growing cells form a flat layer in the flask. Scientific evidence suggests that cell-to-cell signaling (also known as paracrine signaling) may be required for optimal stem cell growth and development. Such signaling is believed to be absent, or highly attenuated, in 2-D cultures due to limited cell-to-cell contact, requiring supplementation of growth factors and other exogenous additive to maintain active stem cell proliferation. Additionally, the lack of uniformity in cell-to-cell contact may lead to batch-to-batch variability of the 2-D grown cells, which may be problematic for commercial medical 4 purposes . An independent academic laboratory (not associated with Pluristem) observed that culturing human stem cells in a 3-D cellular aggregate may lead to enrichment of pro-angiogenic factors and may promote cellular survival compared to traditional 5 monolayer (2-D) culturing techniques . The investigators found that many of the genes upregulated in cells grown in a 3-D environment were associated with 4 Klim J.R., A defined glycosaminoglycan-binding substratum for human pluripotent stem cells. Nature (2010) 7: 989-994. 5 Potanova I.A. et. al., Mesenchymal Stem Cells Support Migration, Extracellular Matrix Invasion, Proliferation, and Survival of Endothelial Cells In Vitro. Tissue-Specific Stem Cells (2007) 25: 1761-1768. 10

- 11. Pluristem Therapeutics Inc. hypoxia (oxygen starvation) and hypoxia-dependent angiogenic pathways, including VEGF, stanniocalcin-1, placental growth factor, angiopoietin 2, transforming growth factor, macrophage migration inhibitory factor, insulin-like growth factor binding proteins 1 and 5, IL-8, IL-1alpha, IL-1beta, acetyl-coenzyme A thiolase, transferrin, aldose reductase, heme oxygenase-1, and cyclooxygenase- 2 (see Appendix for overview of peripheral arterial diseases and angiogenesis). In our view this is very encouraging data that further supports the potential benefits of 3-D cellular growth and the rationale of using PLX cells as angiogenesis therapy. In addition to the angiogenic growth factor secretion discussion above, placental stem cells also have low immunogenic properties. This suggests that PLX cells may be administered to a patient without pre-requisite blood tests for HLA- 6 matching , which is commonly required for bone-marrow derived cells (hence the need to find a matching bone marrow donor). Additionally, stem cells have been shown to express immunosuppressive factors which suppress T-cell proliferation, 7 minimizing potential immune reaction . Placental stem cells are believed to have an even stronger immunosuppressive effect relative to bone-marrow derived stem 8 cells . Placental stem cells have also produced encouraging pre-clinical data in models of CLI (Critical Limb Ischemia), acute myocardial infarction, stroke, and auto-immune disorders, as well as human studies of osteogenesis imperfecta, graft 9 vs. host disease, and CLI . Stem Cells – A New Biologic Drug A lot of emphasis in popular media and science literature is focused on utilizing stem cells to grow new organs in the laboratory and permanently transplant them into patients. While organ regeneration is certainly exciting, we believe that other stem cell-based technologies are often overlooked. Stem cells have been shown to participate in complex cell signaling pathways by releasing potent cell signaling agents. Based on this research, Pluristem is utilizing stem cells as complex biologic drugs delivered directly to the site of injury to secrete a range of therapeutic molecules and not to replace damaged or diseased tissue directly. Instead of injecting a single molecule (or a combination of molecules) that is typical in traditional drug therapy, PLX cells injected into the diseased tissue are believed to secret a complex mixture of potent drugs over a prolonged period of time. The active agents produced by these stems cells may further be adjusted to the local environment based on the interaction between the stem cells and local tissue, something that is generally not possible with traditional pharmaceuticals. Pluristem is initially applying its stem cell therapy to stimulate blood vessel growth (angiogenesis). The cells are optimized to produce a range of cell-signaling 10 molecules (cytokines), including growth factors, which are produced by the body naturally to stimulate the growth and development of blood vessels. Additionally, the stem cells may also produce anti-inflammatory agents, which may be helpful in the treatment of autoimmune and other inflammatory diseases. Many of these 6 Le Blank K., Immunomodulatory effects of fetal and adult mesenchymal stem cells. Cytotherapy (2003) 5: 485-489. 7 Jones B.J., Immunosuppression by placental indoleamine 2,3-dioxygenase: a role for mesenchymal stem cells. Placenta (2007) 28: 1174-1181. 8 Chang C.J., Placenta-derived multipotent cells exhibit immunosuppressive properties that are enhanced in the presence of interferon-gamma. Stem Cells (2006) 24: 2466–2477. 9 Horwitz M.E. et. al., Cytokines as the Major Mechanism of MSC Clinical Activity: Expanding the Spectrum of Cell Therapy. Israel Medical Association Journal (2009) 11: 132-134. 10 Horwitz E.M., et. al., Cytokines as the Major Mechanism of MSC Clinical Activity: Expanding the Spectrum of Cell Therapy. Israel Medical Association Journal (2009) 11: 132-134. 11

- 12. Pluristem Therapeutics Inc. compounds are difficult to produce in the laboratory, and it may not be possible to deliver them by traditional drug delivery techniques. We would like to acknowledge that it is possible that a small fraction of the delivered stem cells may differentiate into endothelial progenitor cells (EPC). EPC are circulating cells that are believed to further differentiate into endothelial cells (cells that line blood vessels), and may play essential role in the maintenance of 11 existing blood vessels and growth of new vessels . Research data indicates that 12 13 14 15 16 age , diabetes , high cholesterol , hypertension , smoking , and coronary artery disease may reduce the availability of EPCs, which may further lead to reduce integrity of exiting blood vessels and/or decrease in the rate of new vessel formation. Multiple animal and human studies have shown that administration of EPC derived from bone marrow may lead to both short-term and long-term 17 improvement in cardiovascular function . One caveat that we would like to add to the EPC discussion above is that we are not aware of data that that shows the conversion of PLX cells to EPCs, and we do not believe that such conversion is necessary for PLX therapy to achieve its intended goal. We are simply highlighting a potential alternative mechanism. PLX’S Convenience Is A Key Commercial Advantage One of the key challenges in utilizing stem cells in clinical application is the ability of producing them in a quick and cost-effective manner. Autologous therapies present a unique challenge whereby cells must be first harvested from the patient, delivered to a manufacturing facility, grown and modified as necessary, formulated for infusion, delivered to the treating physician, and infused into the patient. The logistical process has multiple potential bottlenecks and requires at least two physician visits (initial cell harvest and final administration). Similar logistical challenges have been successfully addressed in autologous cancer vaccine manufacturing, such as Dendreon’s Provenge. However, we believe that the complexities of autologous stem cell therapy may remain a key limitation for companies like Aastrom Biosciences and an advantage to Pluristem. Assuming a scenario where both therapies are approved and available, we believe that the physician is likely to choose PLX as the first treatment because the medical diagnosis, decision, and therapy administration can all be done as part of a single visit, instead of multiple visits. In our view Aastrom would have to show superiority to PLX in order to convince a physician to use its therapy as first line, and we do not anticipate head-to-head studies between the two technologies in the near future to make a claim of superiority. As an anecdotal data point highlighting the importance of administration convenience, we observed that Pluristem chose to decrease the number of injections for PLX administration from 50 per visit in European studies to 30 per visit in the US to address the US physicians’ concern that 50 injections is too time consuming. If the 20 additional injections were viewed as a significant inconvenience by participating physicians, despite the fact that 11 Rafii S., et. al., Therapeutic stem and progenitor cell transplantation for organ vascularization and regeneration. Nature Medicine (2003) 9: 702-712. 12 Rauscher F.M., et. al., Aging, progenitor cell exhaustion and atherosclerosis. Circulation (2003) 108:457-463. 13 Waltenberger J. Impaired Collateral vessel development in diabetes: potential cellular mechanisms and therapeutic implications. Cardiovascular Research (2001) 49:554-560. 14 Hill J.M., et. al., Circulating endothelial progenitor cells, vascular function, and cardiovascular risk. New England Journal of Medicine (2003) 348: 593-600. 15 Vasa M. et. al., Number and migratory activity of circulating endothelial progenitor cells inversely correlate with risk factors for coronary artery disease. Circulatory Research (2001):89-E1-E7. 16 Kondo T. et. al., Smoking cessation rapidly increases circulating progenitor cells in peripheral blood in chronic smokers. Arteriosclerosis, Thrombosis, and Vascular Biology (2004) 24: 1442 – 1447. 17 Shnatsila E., et. al., Endothelial Progenitor Cells in Cardiovascular Disorders. Journal of the American College of Cardiology (2007) 49:741-752. 12

- 13. Pluristem Therapeutics Inc. most of these injections were performed by nurses and not physicians, we believe that logistical hurdles are an even greater inconvenience then additional injections for competing autologous stem cell technologies. Peripheral Arterial Disease Background PAD remains a relatively unknown disease, with approximately 75% of the 18 population unaware of its symptoms and long-term consequences . The prevalence of PAD also increases with age (Exhibit XX), and is anticipated to grow significantly over the next decade due to the aging of the population. Interestingly, prior to 65 years of age, PAD predominantly affects men, but women quickly catch up after 65 years of age. Exhibit 3: PAD Prevalence By Age Source: Rush University Medical Center PAD is a progressive disease. The initial symptoms start with claudication, which is defined as painful and tired feeling in the legs following a brisk walk that is relieved by rest. To put this definition in perspective, approximately one third of patients with intermittent claudication can not walk one city block without experiencing pain, 19 while another third feel leg pain during routine housework . Intermittent claudication incidence is estimated at 5% of men and 2.5% of women over the age 20 of 60 . As stenosis increases, claudication becomes more severe, with ischemic leg pain at rest (pain due to oxygen starvation), which is exacerbated by raising the limb. The next stages of disease involve ulcers and gangrene, which lead to minor (below the ankle) and major (above the ankle) amputations. The severe subset of PAD is also known as Critical Limb Ischemia (CLI). There are two scales that are used to classify PAD in the clinic, Fontaine and Rutherford. In exhibit XX we provide a side-by-side comparison of both scales. 18 Hirsch A. T., et. al., Gaps in public knowledge of peripheral arterial disease. Circulation (2007) 116: 2086-2094. 19 Annex B.H. Cardiology rounds at Brigham and Women’s Hospital (2002) 6(1). 20 Shammas N.W. Epidemiology, classification, and modifiable risk factors of peripheral arterial disease. Vascular Health and Risk Management (2007) 3:2; 229-234. 13

- 14. Pluristem Therapeutics Inc. Exhibit 4: PAD Rating Scales Fontaine Scale Rutherford Scale Stage Symptom Grade Category Symptoms I Asymptomatic 0 0 Asymptomatic II a Mild Claudication I 1 Mild Claudication Moderate - Severe I 2 Moderate Claudication II b Claudication I 3 Severe Claudication II 4 Pain at Rest III Pain at Rest III 5 Minor Tissue Loss IV Ulcers/Gangrege III 6 Major Tissue Loss Source: American Heart Association Many individuals with early stage PAD may not be aware of their condition until they experience the initial symptoms, such as pain and tiredness in the leg and hip muscles while walking due to lack of oxygen. While some patients initially dismiss these early signs as simply aging-associated pain, PAD can be readily diagnosed by a physician using one of several approaches: Ankle-Brachial Index (ABI) is a ratio of blood pressure between the legs and the arms using standard sphyngomanometer (blood pressure meter). A lower blood pressure in the legs vs. the arms indicates blocked arteries. This technique is painless, does not require specialized equipment, and can be performed during routine physical examination. ABI results of 0.9 – 1.3 are considered normal/acceptable, 0.8 – 0.9 suggests mild blockage, 0.5 – 0.8 moderate PAD, and anything <0.5 is considered severe PAD. ABI readings of greater than 1.3 suggest calcification of the artery, and for these subjects ABI is not a suitable metric. Non-invasive imaging, which includes Doppler/ultrasound, CT scans, MRI, and angiograms (X-ray with the use of an injected contrast agent). The exact technique utilized often depends on the available facility and equipment. Buerger’s test (leg elevation). The patients’ legs are elevated at 45% for a short period of time and the change in color at the feet and toes is observed between elevated and sitting state. ABI Measurement Important For Assessing Clinical Trials The introduction of imaging technologies for the assessment and monitoring of PAD resulted in a more quantitative assessment of PAD disease and progression. However, we would like to highlight the significance of ABI measurements. While ABI is viewed by some physicians as a rather crude measurement, due to lack of a unifying protocols, potential for measurement error, and the difficulty presented by calcification, it remains a common metric for assessing PAD progression. Research has shown that ABI correlates well with clinical outcomes such as amputation and mortality. Specifically, chronic ischemia patients with ABI <0.5 experienced limb loss of 28% and 34% at 6 months and 12 months, respectively, 14

- 15. Pluristem Therapeutics Inc. and an overall limb loss of 23% after one year. Overall amputation rate is estimated at 10-40% after one year, with a mortality rate of 20% after one year, 40- 21 70% after 5 years, and 80-95% after 10 years . Multiple studies have shown that PAD is correlated with cardiovascular disease and overall mortality. The data indicates that patients with more severe PAD have a greater risk of death (Exhibit XX), although the median survival varies from ~4-6 years for patients diagnosed with severe forms of the disease, to several decades for those in early stages. The results are confounded by the difficulties of comparing across clinical trials and the co-morbidities of the subjects. Our main takeaways from these mortality statistics are that patients in late stage of disease may seek PAD treatment for 5+ years, and those in earlier stages may require chronic therapy for 10+ years (depending on the safety and efficacy of therapy). 21 Shammas N.W. Epidemiology, classification, and modifiable risk factors of peripheral arterial disease. Vascular Health and Risk Management (2007) 3:2; 229-234. 15

- 16. Pluristem Therapeutics Inc. Exhibit 5: PAD Survival Based On Disease Severity At Diagnosis From Two Independent Studies Source: Crique M.H. et. al., New England Journal of Medicine (1992) 326:381-386 Source: McKenna et. al., Atherosclerosis (1991): 87 Therapeutic Approaches For PAD Management There are multiple therapeutic approaches to treat PAD. The objective of the therapy is to alleviate pain, increase function, prevent/control the underlying cause of PAD (diabetes, high cholesterol, etc.) and reduce the probability of limb amputation, morbidity, and mortality. The recommendation for patients in the early stages of PAD are a better diet, exercise, improved blood sugar control for diabetics, and weight loss as necessary. Patients with intermittent claudication (typically cramping and pain in the calf and other leg muscles) are also given a 16

- 17. Pluristem Therapeutics Inc. similar list of recommendations, but may have a difficult time commencing an active exercise program since movement may trigger painful episodes, limiting their ability to exercise. There are many drugs prescribed to provide temporary symptomatic relief, including aspirin, ACE inhibitors, beta blockers, and cilostazol. However, these agents may take several months to deliver their effect (Exhibit XX), some have been found ineffective, and they fundamentally do not address the underlying blockage of the blood vessels. Additionally, some patients may be contra-indicated for these drugs if they have other underlying conditions such as congestive heart failure, clotting disorders, or simply cannot tolerate the associated side effects. When drugs are not adequate to control PAD symptoms, angioplasty (mechanically opening blood vessels using a wire or balloon catheter) or stenting (inserting metal mesh to keep the blood vessel open) may be employed. It is estimated that 10-15% of PAD patients are treated with an interventional procedure. The last option is surgery, where the surgeon may attempt to remove a large piece of plaque by hand or simply cut out the obstructed artery and replace it with a graft from another part of the body. In all cases surgery is considered the last resort, and is performed in ~5% of PAD patients. Despite the range of available therapies, the underlying occlusions generally worsen with time, ultimately leading the patient to seek more aggressive treatment. Some patients are not eligible for interventional procedures or vascular surgery due to old age, co- morbidities, and vascular anatomy. To help address the need of these end-stage PAD patients, a number of therapies are in development aimed at stimulating the growth of new blood vessels, including PLX cells by Pluristem. Exhibit 6: Walking Improvements With Oral Drugs in PAD Duration of Increase in Peak Increase in Pain-Free Increase in Walking Therapy Therapy Walking Time Walking Time Distance Exercise 12 weeks 123% 165% Cilostazol 24 weeks 54% Statins 6 months 24% 24% Statins 12 months 42% 42% Aspirin or Multiple Little to no observed effect on walking clopidogrel Source: Shammas N.W. Epidemiology, classification, and modifiable risk factors of peripheral arterial disease. Vascular Health and Risk Management (2007) 3:2; 229-234. Clinical Data And Development Pluristem Reports Encouraging Data, Plans To Commence Phase II/III Study This Year Pluristem is currently conducting a Phase I/IIa study of PLX-PAD in 27 patients with Peripheral Arterial Disease (PAD) who are not eligible for surgical reperfusion. The open-label, multi-center, dose-ranging study is conducted at leading medical centers in the US and Germany. The study is aimed at evaluating the safety of PLX-PAD as well as preliminary efficacy at 3 months. Three doses are tested with 50 injections/limb in Germany and 30 injections/limb in the US (Exhibit XX). 17

- 18. Pluristem Therapeutics Inc. Exhibit 7: Phase I / IIa Dosing German # of PLX Cells US Group Dosage Group Group Injected/Dose (n = 15) (n = 12) Single dose; Low Dose 175×106 NA 50 injections Single dose; Single dose; Intermediate Dose 315×106 50 injections 30 injections Single dose; 2 doses 2 weeks apart; High Dose 595×106 50 injections 30-injections each dose Source: Company presentation In September 2010 the company reported encouraging interim safety update from all 27 patients and efficacy results were reported in April 2011. In order to assess immunogenic safety, a total 7 placentas were utilized in the study. Out of the 27 treated patients, six received repeated doses with five of the repeats from the same placenta. The safety findings were unremarkable, with no significant adverse events and no immune response to date. The company plans to follow the US patients (n = 12) for 12 months and European patients (n = 15) for 21 months to assess long term safety. From the efficacy perspective, only 1 amputation was reported, which was two weeks after PLX-injection. This suggests an amputation rate of 3.7%, which is below the 3-months amputation-free survival (AFS) rate of 10-25% observed in other trials. We view these data as encouraging, with a caveat that this was an open-label study with 3-month follow-up, while FDA wants to see AFS results at 12 months from a placebo-controlled study. Pivotal Study In CLI To Start This Year, Other Studies Conducted In Parallel Pluristem met with the FDA and EMEA to discuss its regulatory strategy and received approval for its protocol to commence Phase II/III studies of PLX in CLI patient. This multi-national, multi-center, double-blind, randomized study is scheduled to enroll 450 patients with a 1:1 randomization to PLX and placebo. These patients will have CLI with a grading of III-IV on the Fontaine scale and category 4-5 on the Rutherford scale, and are not candidates for surgical 6 reperfusion. Pluristem plans to advance the intermediate dose (300×10 cells/treatment) into this study, which will be administered twice, at study commencement and after four months. The company plans to only include centers of excellence with prior stem cell therapy experience in this study to minimize variations in the standard of care. The primary endpoint in this trial is major amputation of the lower extremity (MALE), defined as non-traumatic amputation above the ankle (trans-tibial). This includes amputations above and below the knee, but excludes amputations of the foot. The study will report the amputation free survival (AFS) and all-cause mortality at 12 months. Secondary endpoints will include ABI, tissue CO2, cutaneous O2, and quality of life metrics. Based on FDA’s comments, we believe that the 12-months AFS endpoint could warrant approval if the trial shows a 50% decrease in amputation rate. The study is 80% powered to show a p-value of 0.05 based on an assumed amputation rate of 22% in the control arm. Historical data suggests 35-40% amputation rate within one year for these patients. However, we’ve observed variability in this rate, and the RESTORE-CLI study (Aastrom’s Phase II) reported an amputation rate of 25% on placebo at 12 months. 18

- 19. Pluristem Therapeutics Inc. Enrollment is anticipated to commence close to the end of 2011 once the company completes the upgrades to its manufacturing infrastructure. The study will also be monitored by a Drug Safety Monitoring Board (DSMB), which will unblind the study once a predetermined number of amputations has occurred. This unblinding event target has not been announced, and will likely be made public once the trial design is finalized. We estimate approximately two years to enroll this trial, suggesting availability of topline data in late 2014 or early 2015. However, we anticipate the DSMB to look at the data approximately 12 months after commencement of enrollment, and the company may communicate the DSMB’s findings to investors. The DSMB is authorized stop the study for safety or efficacy reasons at any time. Intermittent Claudication Trial To Start In 2011 Pluristem received an approval from the FDA and German regulatory authorities to commence a Phase II study of PLX in patients with Intermittent Claudication (IC). The protocol includes a total of 135 patients split evenly across 3 groups: placebo, 6 6 two low doses (150×10 cells), and two intermediate doses (300×10 cells). The two doses of PLX cells will be administered 4-months apart, and results will be evaluated at 12 months. The primary endpoint is number of patients with a 50% increase in walking distance. We believe that this is a meaningful endpoint not just from the regulatory perspective, but also commercially. Clear Regulatory Path Forward, Estimating Launch In 2016 Pluristem’s regulatory strategy is based on the Phase II/III study in CLI and Phase II trial in IC. According to the company, the safety dataset from both of these trials may be sufficient for the FDA and EMEA approval of PLX if it is consistent with prior safety observed for this therapy. Based on comments from the company regarding its communications with the FDA, we believe that a positive result in the CLI study may be adequate to support US approval of PLX in CLI. Our launch estimate date of 2016 for PLX in CLI is based on this regulatory scenario. However, if the CLI study shows good safety but does not show a 50% reduction in MALE (primary endpoint) with a p≤0.05, we believe that additional studies may be necessary irrespective of the outcome from the IC study. Pluristem also plans to conduct studies in other indications where angiogenesis therapy is warranted, including Buerger’s disease, diabetic foot ulcer, neuropathic pain, and muscle injury. In March 2011 Pluristem announced encouraging results from a preclinical study of muscle injury and a collaboration with NYU Medical Center to commence a preclinical program in diabetic foot ulcers. In our view these are all potentially large commercial opportunities for PLX technology. We anticipate clinical studies to commence in these indications in 2011 and/or 2012, which may provide additional news flow while the CLI and IC studies are ongoing. Financial Overview and Projections Pluristem reported a cash and short-term investments balance of $45M as of st March 31 , 2011. We estimate the company to end June 2011 with $44M in cash and equivalents on the balance sheet, and project a 12-month burn rate (July 2011 – June 2012) of $10M. We anticipate most of the cash to be utilized for ongoing clinical trials as well as other corporate expenses. We believe that the current capital should be adequate to support clinical trials and operating expenses over the next several years, and may be sufficient to complete the Phase II/III study in 19

- 20. Pluristem Therapeutics Inc. CLI. However, the actual cash burn may depend on success in other indications and ongoing studies. Pluristem may be able to generate non-dilutive capital from geographic partnerships for its PLX technology. 20

- 21. Pluristem Therapeutics Inc. Financial Statements Exhibit 8: Historical And Projected Income Statement Sep-10 Dec-10 Mar-11 Jun-11 Sep-11 Dec-11 Mar-12 Jun-12 FY Ending June 30th FY09A FY10A FY11E FY12E 1QA 2QA 3QA 4QE 1QE 2QE 3QE 4QE Revenue 0 0 0 0 0 0 0 0 0 0 0 0 Expenses Research and development 4,792 6,123 1,501 2,186 2,145 2,000 7,832 2,600 2,800 2,900 3,000 11,300 less participation by the Office of the Chief Scientist (1,651) (1,822) (503) (608) (598) (1,000) (2,709) (900) (900) (900) (900) (3,600) Research and development, net 3,141 4,301 998 1,578 1,547 1,000 5,123 1,700 1,900 2,000 2,100 7,700 General and administrative 3,417 3,138 756 1,246 1,152 900 4,054 900 1,000 1,000 1,000 3,900 Sales and Marketing 0 0 0 0 0 0 0 0 150 200 250 600 Operating expenses 6,558 7,439 1,754 2,824 2,699 1,900 9,177 2,600 3,050 3,200 3,350 12,200 Financing expenses (income), net 78 14 (65) (3) (86) 20 (134) 20 20 20 20 80 Net loss (6,636) (7,453) (1,689) (2,821) (2,613) (1,920) (9,043) (2,620) (3,070) (3,220) (3,370) (12,280) Basic and diluted loss per share (0.63) (0.44) (0.08) (0.11) (0.07) (0.05) (0.29) (0.06) (0.06) (0.06) (0.06) (0.24) Weighted average shares 10603 17005 21,012 24,897 36,677 42,233 31205 45,708 51,408 54,858 56,058 52008 Source: Company reports, Oppenheimer estimates. 21

- 22. Pluristem Therapeutics Inc. Exhibit 9: Historical Balance Sheet Sep-10 Dec-10 Mar-11 FY09A FY10A ASSETS 1QA 2QA 3QA Current Assets Cash and equivalent 2,339 1,583 1,127 4,739 44,866 Short term bank deposit 0 913 517 0 Prepaid expenses 100 41 80 56 213 Accounts receivable from the Office of the Chief Scientist 383 706 318 361 324 Other accounts receivables 113 362 71 375 214 Total current assets 2,935 3,605 2,113 5,531 45,617 Long-term assets Long-term deposits and restricted deposits 171 168 169 176 183 Severance pay fund 154 294 327 359 410 Property and equipment 1,203 1,555 1,756 1,816 1,943 Total long-term assets 1,528 2,017 2,252 2,351 2,536 Total Assets 4,463 5,622 4,365 7,882 48,153 LIABILITIES AND STOCKHOLDER'S EQUITY Current Liabilities Trade payables 487 791 673 926 1,283 Accrued expenses 81 118 157 85 107 Other accounts payable 272 372 400 468 515 Total current liabilities 840 1,281 1,230 1,479 1,905 Long-term liabilities Long-term obligations 23 Accrued severance pay 206 360 403 420 503 STOCKHOLDER'S EQUITY Common stock par value 0 0 0 0 0 Additional paid-in capital 36,046 44,086 44,526 50,598 92,973 Accumulated deficit during development stage (32,652) (40,105) (41,794) (44,615) (47,228) Total stockholder's equity 3,394 3,981 2,732 5,983 45,745 Source: Company reports. 22

- 23. Pluristem Therapeutics Inc. Management Biography Zami Aberman Chairman and Chief Executive Office Mr. Aberman joined Pluristem in September 2005 as Chairman and CEO and changed the Company’s strategy towards cellular therapeutics. Mr. Aberman's vision to use the maternal section of the Placenta (Decidua) as a source for cell therapy, combined with Pluristem’s 3D culturing technology, led to the development of company unique products. Mr. Aberman has 20 years of experience in marketing and management in the high technology industry. He has held positions of Chief Executive Officer and Chairman in Israel, the USA, Europe, Japan and Korea. He has operated within high-tech global companies in the fields of automatic optical inspection, network security, video over IP, software, chip design and robotics. Mr. Aberman serves as the Chairman of Rose Hitech Ltd., a private investment company. He has served in the past as the Chairman of VLScom Ltd., a private company specializing in video compression for HDTV and video over IP and as a Director of Ori Software Ltd., a company involved in data management. Prior to that, he served as the President and CEO of Elbit Vision Systems (EVSNF.OB), which supplies inspection systems for the microelectronic industry. Mr. Aberman has served as President and CEO of Netect Ltd., specializing in the field of internet security software and was the Co-Founder, President and CEO of Associative Computing Ltd., which developed an associative parallel processor for real-time video processing. He has also served as Chairman of Display Inspection Systems Inc., specializing in laser based inspection machines and as President and CEO of Robomatix Technologies Ltd. (RBMXF.OB). In 1992, Mr. Aberman was awarded the Rothschild Prize for excellence in his field from the President of the State of Israel. Mr. Aberman holds a B.Sc. in Mechanical Engineering from Ben Gurion University in Israel. Yaky Yanay Vice President of Finance and Chief Financial Officer Prior to joining Pluristem, Mr. Yanay was the Chief Financial Officer of Elbit Vision System Ltd. (EVSNF.OB), a company engaged in automatic optical inspection. He has extensive experience in the financing and management of technology companies. He played a major role in planning and executing a turn-around plan for Elbit Vision System, including the completion of three acquisitions and the raising of more than $20 million, resulting in a tripling of the company’s revenues and attaining profitability. Mr. Yanay began his financial career at Ernst & Young Israel in 1999, where he served as a manager of audit groups for the technology sector. He joined Ernst &Young’s financial team after serving in the Israeli Ministry of Foreign Affairs since 23

- 24. Pluristem Therapeutics Inc. 1993. Mr. Yanay holds a bachelor’s degree with honor in business administration and accounting from the College of Management Studies in Rishon Le Zion, Israel and is a Certified Public Accountant in Israel. William R. Prather RPh, MD, Senior VP Corporate Development William R. Prather RPh, MD, is a Registered Pharmacist as well as a Board Certified Internist and Geriatrician. Dr. Prather received his BS in Pharmacy (1970) and medical degree (1973) from the University of Missouri. He practiced internal medicine in the Kansas City, MO and Vail, CO areas until leaving Internal Medicine in 1987 to pursue a Fellowship in Geriatric Medicine at Harvard University. He completed this Fellowship in 1989. In 1992 Dr. Prather left the practice of medicine to pursue a career in the financial industry where he has held Senior Healthcare research positions for a variety of investment banks. Dr. Prather co-founded Panacos, Inc. (NASDAQ:PANC), a public pharmaceutical company. Additionally, he has been on the Boards of several public and private companies, including Boston Biomedica Inc. (a public medical diagnostics company), PriMed (a private medical device company), MdBio (a Maryland healthcare venture firm), and sat on the Advisory Board of MDS Capital Management (a Canadian venture firm). Frida Grynspan, PhD, Vice President of Research & Development Prior to joining Pluristem, Dr. Grynspan served as Vice President of R&D of a pioneering cell therapy company in Israel, where she was instrumental in bringing its first cell therapy product to a multinational, multi-center Phase III clinical trial and participated in the development of its pipeline. Before that, Dr. Grynspan served as Senior Scientist at Intelligene Ltd., a developer of molecular biology diagnostic and therapeutic tools, and as an instructor and biochemist at Harvard Medical School. Dr. Grynspan has extensive experience in the fields of biochemistry, cell biology and molecular biology and has authored numerous scientific papers in the fields of autoimmune and degenerative diseases. Dr. Grynspan earned her Ph.D. in Chemistry/Biochemistry from the University of Illinois, Chicago and her post-doctoral degree from Harvard Medical School/McLean Hospital, where she worked in the areas of Multiple Sclerosis and Alzheimer's Disease. Chaya Mazouz Vice President of Clinical and Regulatory Affairs Prior to joining Pluristem, Chaya Mazouz held the position of Clinical Operations Director for Medgenics, a clinical-stage biopharmaceutical company involving gene therapy, where she engineered Phase I/II clinical studies. Previously, Ms. Mazouz served as Clinical Manager for TransPharma Medical, a drug delivery company, 24

- 25. Pluristem Therapeutics Inc. where she was responsible for managing all of the company's clinical activities. In previous positions, Ms. Mazouz led a multi-center Phase II study for Pharmos, a pharmaceutical company, and was CRA and Project Manager at IDgene, a startup company engaged in gene discovery. Ms. Chaya Mazouz received her BSc in Nursing and MA in Philosophy of Science from the Hebrew University in Jerusalem and is a registered Nurse. Ms. Mazouz joined Pluristem in August 2008 to lead the Company’s clinical trials. Amit Avrahami Vice President of Operations and Production Mr. Avrahami brings has 20 years of experience in Operations and Production management in various industries such as: Pharmaceutical, Hi-Tech, Medical Devices and Bio-Tech. Prior to joining Pluristem, Mr. Avrahami was "Site Manager & Director of Operations" at Colbar Life Science, a Johnson & Johnson subsidiary, which develops and produces Purified Collagen products. In his position Mr. Avrahami upgraded the Operations system, dramatically improving product quality and reducing the product costs. Previously, Mr. Avrahami was part of the team that established the Operations division at Verint, a Hi-Tech subsidiary of Comverse. He scaled-up the operations & production capability from $50 Million to $130 million. Mr. Avrahami holds a Bachelor's Degree in Industrial Management from Shenkar College, Israel and a Master's in Business Administration from Heriot-Watt University, England. Efrat Livne Hadass Vice President of Human Resources Ms. Livne-Hadass joined Pluristem in 2007 and is responsible for all aspects of Human Resources management, including recruitment, professional training, and well being. Prior to joining Pluristem and during the years 2001-2005, Efrat held the position of Human Resources Manager at Elbit Vision Systems, a company engaged in automatic optical inspection, located in Yokneam, Israel. While holding that position, she was involved in some major challenges and change processes which the company was going through, including managing HR in a small yet global and public company. Ms. Livne-Hadass holds an Executive M.A for Human Resources managers from the department of Labor Studies, Tel-Aviv University and a B.Sw. degree from the Haifa University, majoring in public healthcare services. 25

- 26. Pluristem Therapeutics Inc. Daya Lettvin Director of Investor & Media Relations Daya Lettvin is the Investor and Media Relations Director of Pluristem Therapeutics. In this position, Mrs. Lettvin is involved in investor relations, media outreach, marketing communication, business development and reimbursement for cellular therapies. When Mrs. Lettvin first arrived at Pluristem Therapeutics in 2005, she created the Quality Assurance and Quality Control Department, bringing her extensive experience in the biotechnology and pharmaceutical industry. Prior to working at Pluristem, she spent seven years in various scientific positions at Merck & Co. Inc, focusing on the quality of biological pharmaceutical products. Mrs. Lettvin received her honorary bachelor’s degree in Biological Sciences from Rutgers University. 26

- 27. Pluristem Therapeutics Inc. Appendix Stem Cells Primer All living organisms are composed of cells. While the size, shape, and functionalities of the cells found in complex, multi-cellular organisms may differ substantially, all these cells trace their origin to a zygote (Exhibit XX). A zygote is the initial cell formed from the genetic combination of gamete cells from the two parents. In mammals the zygote begins to divide into multiple cells shortly after fertilization, with each of the nascent cells carrying the entire genetic content of the original zygote. After three days the ball of cells is called a morula. The cells in the morula begin to secrete a fluid, which spreads the cells into a sac called blastocycst. As the cells grow and divide, each division produces a copy of the parent cell which can either produce more copies of itself or specialize into a specific cell type. Cells that are unspecialized and can produce identical copies of themselves are called stem cells. Exhibit 10: Progression Of Stem Cell Development Source: www.wikipedia.org. Stem cells have two defining characteristics: a) they can undergo division and create identical copies of themselves, often after a long period of inactivity, and b) they can differentiate into more specialized cells. Stem cells are often defined by their potency, which is the range of cells they could potentially become. Totipotent cell is the most undifferentiated stem cell. A totipotent cell can produce all other stem cells and can develop into a viable organism. The splitting of topipotent cells shortly after fertilization can result in multiple identical births, such as twin and triplets. Pluripotent stem cells descend from totipotent cells and can develop into all the tissues of the organism. Their ability to differentiate into any somatic organ cell type makes them a focus of a lot of regenerative medicine research with the aim of 27