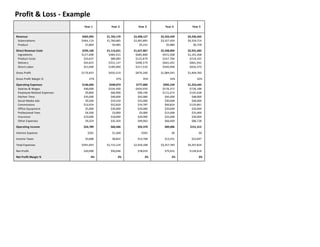

Profit and loss_example

- 1. Profit & Loss - Example Year 1 Year 2 Year 3 Year 4 Year 5 Revenue $465,993 $1,765,170 $2,498,127 $3,333,439 $4,336,442 Subscriptions $464,124 $1,760,685 $2,492,895 $3,327,459 $4,329,714 Product $1,869 $4,485 $5,232 $5,980 $6,728 Direct Revenue Costs $295,160 $1,114,651 $1,627,867 $2,248,894 $2,931,682 Ingredients $127,698 $484,431 $685,889 $915,508 $1,191,268 Product Costs $23,637 $89,083 $125,879 $167,796 $218,102 Delivery $92,825 $352,137 $498,579 $665,492 $865,942 Direct Labor $51,000 $189,000 $317,520 $500,098 $656,370 Gross Profit $170,833 $650,519 $870,260 $1,084,545 $1,404,760 Gross Profit Margin % 37% 37% 35% 33% 32% Operating Expenses $146,044 $590,073 $777,890 $995,539 $1,253,445 Salaries & Wages $49,000 $334,500 $450,950 $578,372 $728,188 Employee Related Expenses $9,800 $66,900 $90,190 $115,674 $145,638 Kitchen Time $35,000 $40,000 $42,000 $45,000 $48,000 Social Media Ads $9,500 $19,550 $25,000 $30,000 $40,000 Commissions $13,924 $52,820 $74,787 $99,824 $129,891 Office Equipment $5,000 $20,000 $20,000 $20,000 $20,000 Professional Fees $4,500 $3,000 $5,000 $15,000 $25,000 Insurance $10,000 $18,000 $20,000 $25,000 $30,000 Other Expenses $9,320 $35,303 $49,963 $66,669 $86,728 Operating Income $24,789 $60,446 $92,370 $89,006 $151,315 Interest Expense $201 $1,568 $583 $0 $0 Income Taxes $3,688 $8,832 $13,768 $13,351 $22,697 Total Expenses $445,093 $1,715,124 $2,420,108 $3,257,784 $4,207,824 Net Profit $20,900 $50,046 $78,019 $75,655 $128,618 Net Profit Margin % 4% 3% 3% 2% 3%