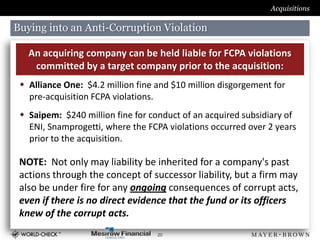

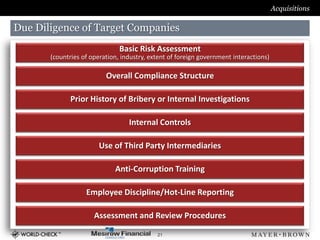

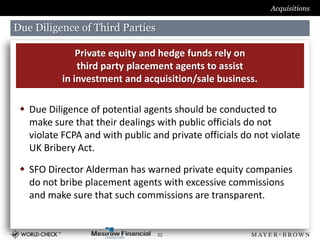

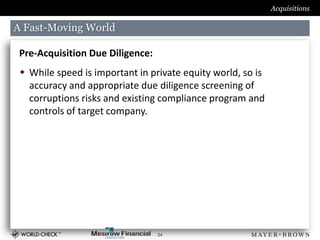

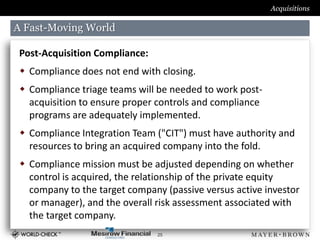

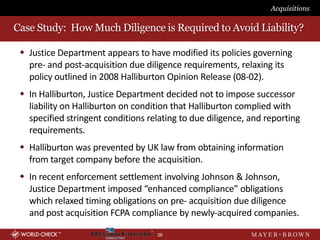

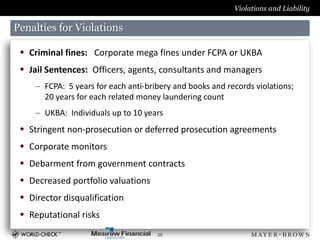

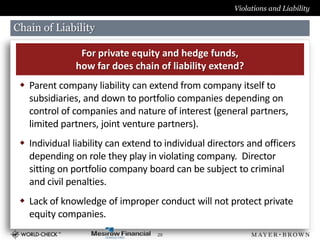

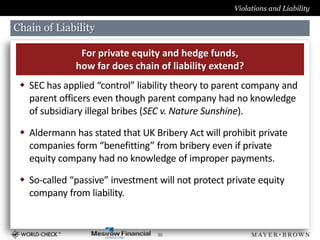

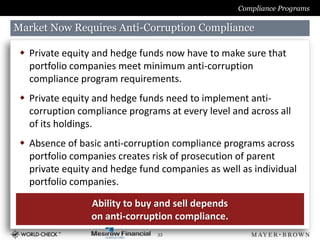

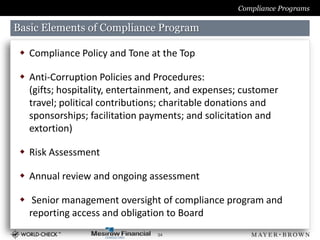

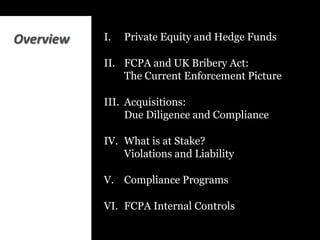

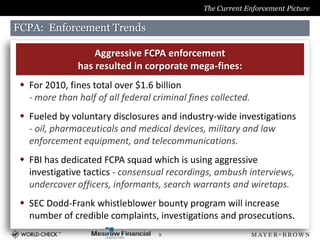

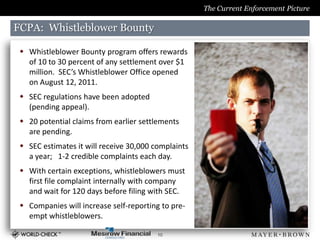

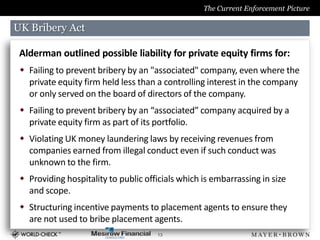

Private equity and hedge funds face increasing anti-corruption compliance challenges due to their international investments and interactions with foreign officials. Enforcement of the FCPA and UK Bribery Act is vigorous, with large corporate fines and potential criminal liability. Thorough due diligence of acquisition targets and third parties is critical to avoid inheriting liability. Effective compliance programs are necessary to prevent and detect violations.

![The Current Enforcement Picture

UK Bribery Act: Relevant Prohibitions

UK Bribery Act extends to non-UK companies

that carry on a business or part of a business in the UK.

Company is strictly liable for failure to prevent bribery of a foreign

public official unless corporation establishes that it had “adequate

[compliance] procedures” in place to prevent such bribery.

Bribery prohibition applies to private and public interactions.

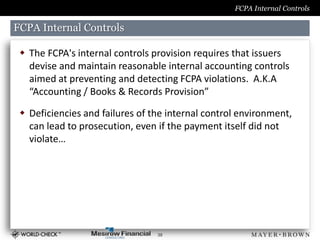

Company must maintain adequate internal accounting controls

as part of an “adequate [compliance] procedure.”

Liability extends to persons associated with a commercial

organization, which includes any person who “performs services

for or on behalf of the relevant commercial organisation” (e.g.

subsidiaries, employees, agents, JV partners, consortium members).

14](https://image.slidesharecdn.com/privateequityandanti-corruptionslidesfinal-111030204926-phpapp01/85/Private-equity-and-anti-corruption-slides-final-14-320.jpg)