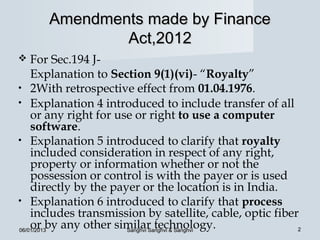

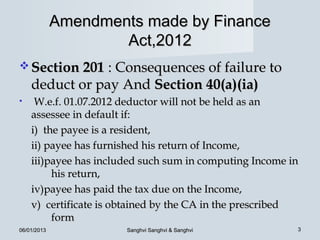

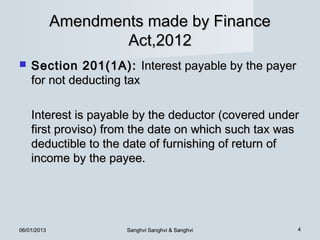

The document discusses amendments made by the Finance Act of 2012 related to tax deducted at source (TDS). Key points include:

- Explanations were added to section 9(1)(vi) regarding the definition of "royalty" and what is included.

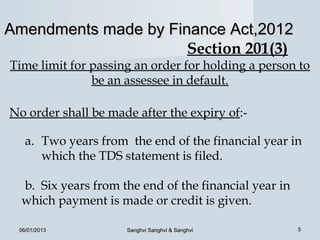

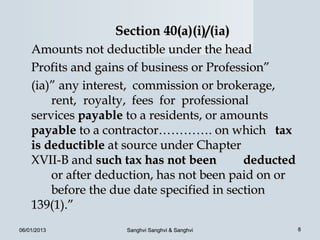

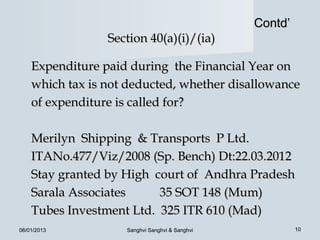

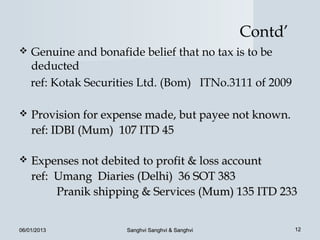

- Amendments to sections 201 and 40(a)(ia) provide that the deductor will not be considered an assessee in default if certain conditions are met by the payee regarding filing of return and payment of tax.

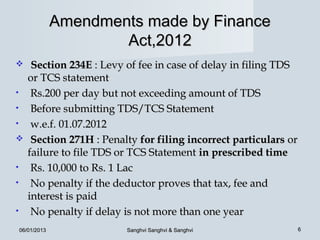

- Sections 234E and 271H were introduced regarding levy of fees and penalties for delayed or incorrect filing of TDS/TCS statements.

- The timeline for passing orders holding a person

![Contd’

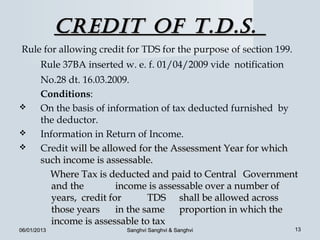

Ref. Sec. 198 :All sums deducted in

accordance with the provisions of this

chapter shall, for the purpose of

computing the income be deemed to be

income received.[Except Salary]

Ref. Sec. 205 : Where tax is deductible at

source under the provisions of this

chapter, the assessee shall not be called

upon to pay the tax to the extent………..

06/01/2013 Sanghvi Sanghvi & Sanghvi 14](https://image.slidesharecdn.com/practicalissuesontdscpc-130114210851-phpapp01/85/Practical-issues-on-tds-cpc-14-320.jpg)