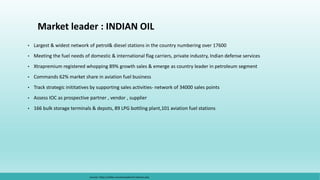

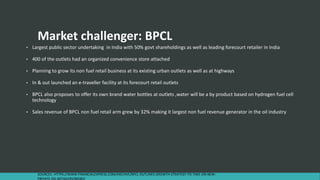

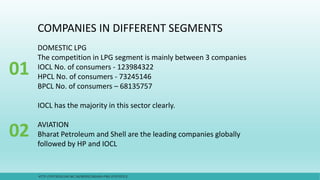

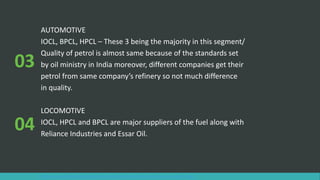

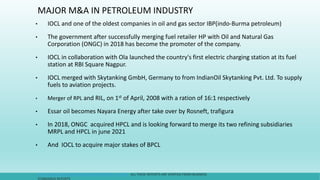

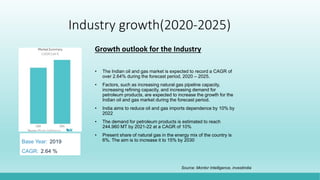

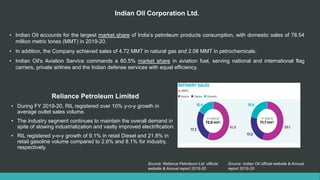

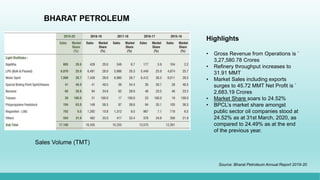

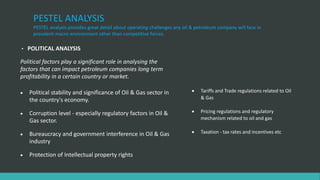

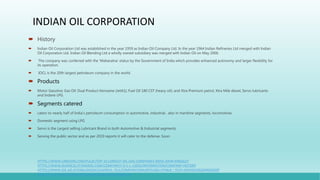

This document provides an overview of the petroleum segment. It begins by defining alkanes, which are saturated hydrocarbons and the main component of petroleum. It then discusses the size and growth of India's petroleum market from 2015-2018 and 2020-2025. The market is expected to grow at a CAGR of over 2.64% during this period. It also profiles the top three players in the Indian market - Indian Oil Corporation, Reliance Petroleum, and Bharat Petroleum - and provides details on their operations and market share. The document concludes with a PESTEL analysis of the industry.

![RELIANCE PETROLEUM LIMITED

• History

• in 1991,Indian The Comp. was incorporated under the name Reliance Refineries Private Limited on 3rd September, in the State of Maharashtra, Mumbai.

• 1993, The name of Comp. was changed from Reliance Refineries Pvt. Ltd., to Reliance Refineries Ltd on 6th March. And on 26th March, the name of the company

was changed from Reliance Refineries Ltd., to Reliance Petroleum Ltd. promoted by Reliance Industries Limited [RILs]

• Products

• Indian Liquefied Petroleum Gas (LPG)

• Propylene

• Naphtha

• Gasoline

• Jet /Aviation Turbine Fuel

• Superior Kerosene Oil

• High-Speed Diesel

• Sulphur

• Petroleum

• Segments catered

• Industrial and domestic segment, transportation segment in terms of fuels, pharmaceutical and fertilization, petrochemicals feedstock, aviation as well as power

plants and cement plants through coke

HTTPS://WWW.RIL.COM/OURBUSINESSES/PETROLEUMREFININGANDMARKETING.ASPXTER

HTTP://WWW.SOURCE2UPDATE.COM/COMPANY-HISTORY/RELIANCE-PETROLEUMOLD-RELPT.HTML](https://image.slidesharecdn.com/petroleumbsppresentation-210413110929/85/Petroleum-bsp-presentation-17-320.jpg)