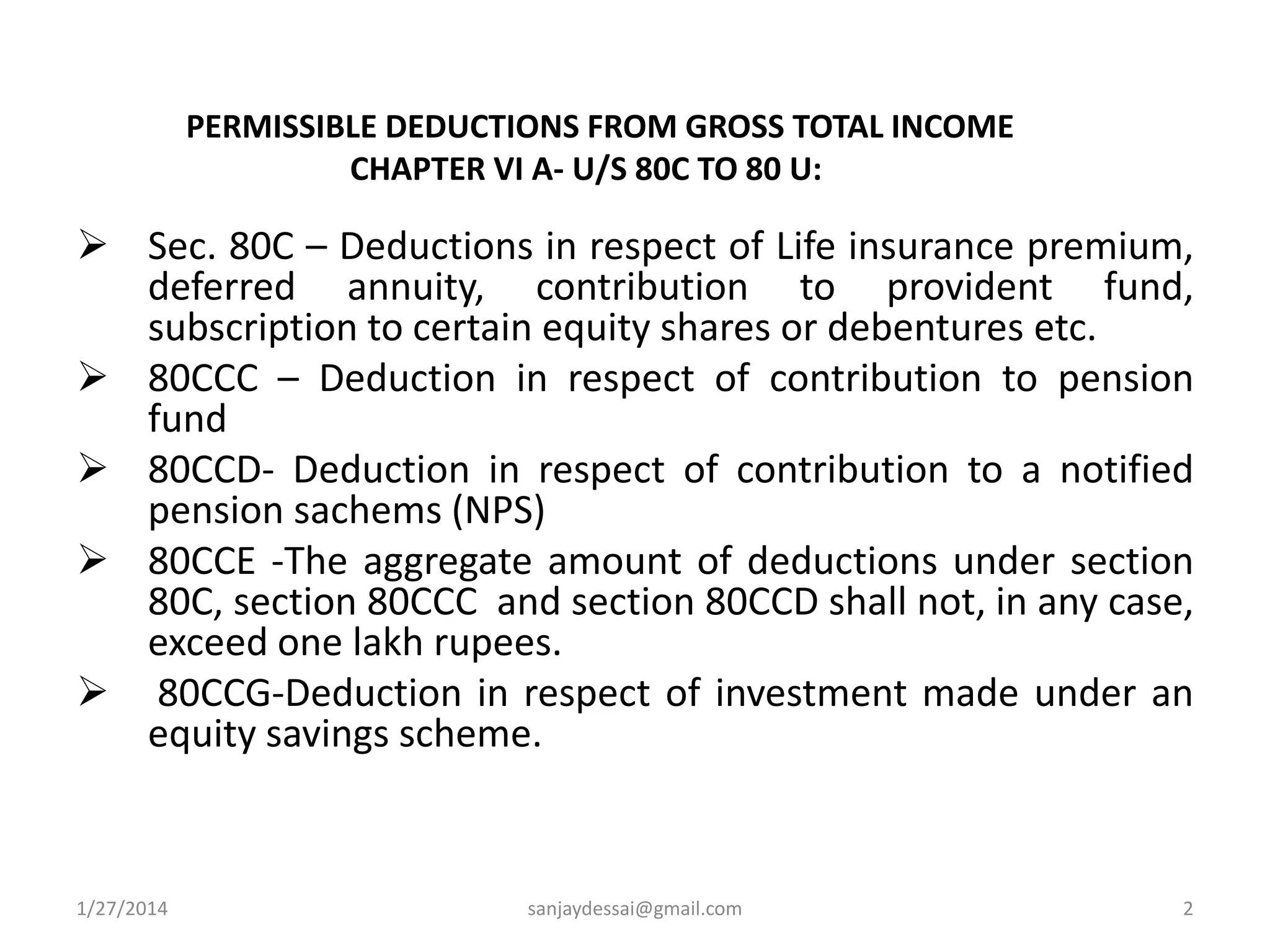

The document presents an overview of various permissible deductions from gross total income under the Income Tax Act 1961, detailing sections 80C to 80U, which cover deductions for life insurance, medical insurance, donations, and investments. Specific limits and requirements for each section are outlined, including eligibility criteria, maximum deduction amounts, and conditions for claiming these deductions. Additionally, the document elaborates on the implications of these deductions for taxpayers, emphasizing the financial benefits available under Indian tax law.