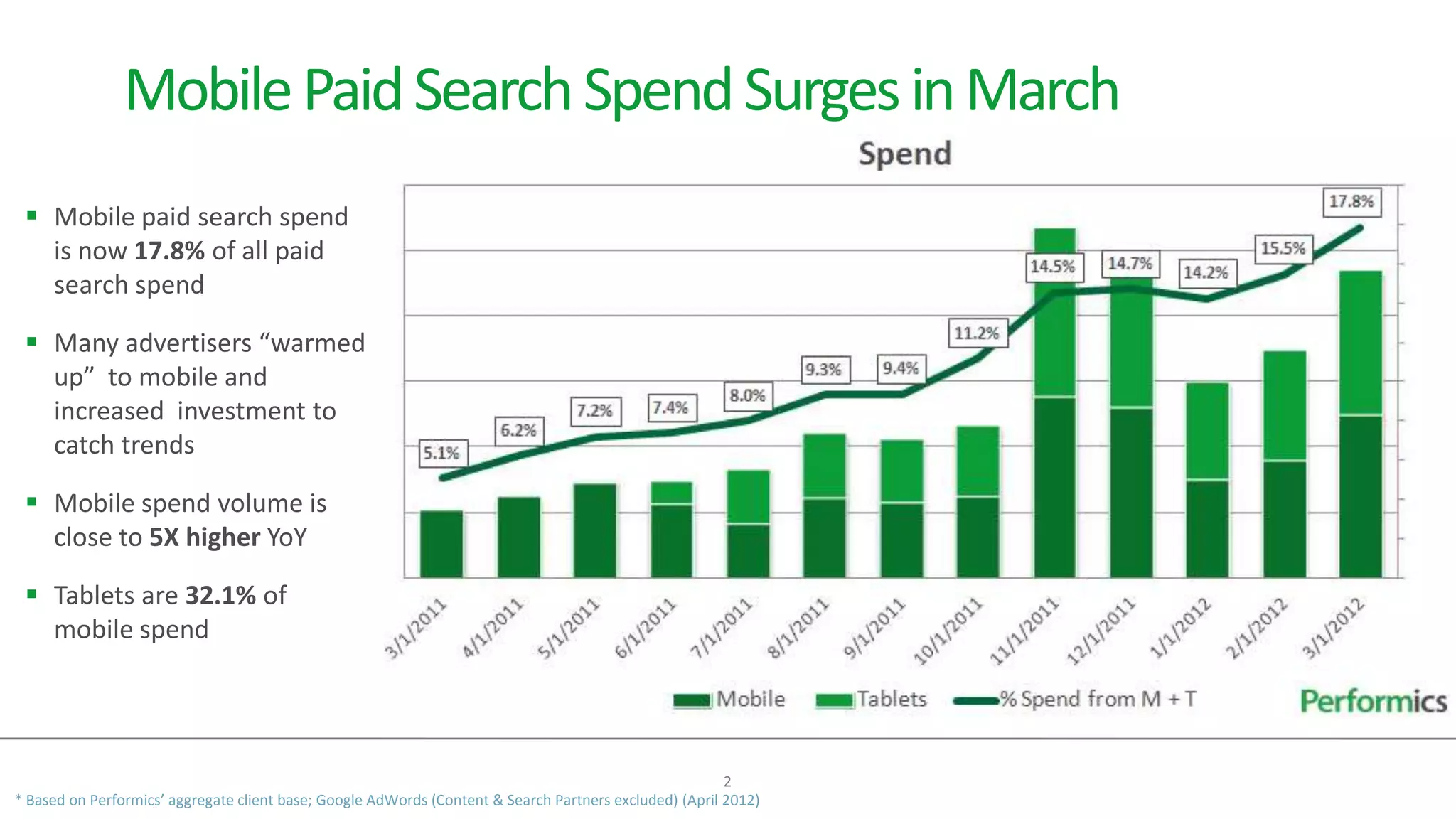

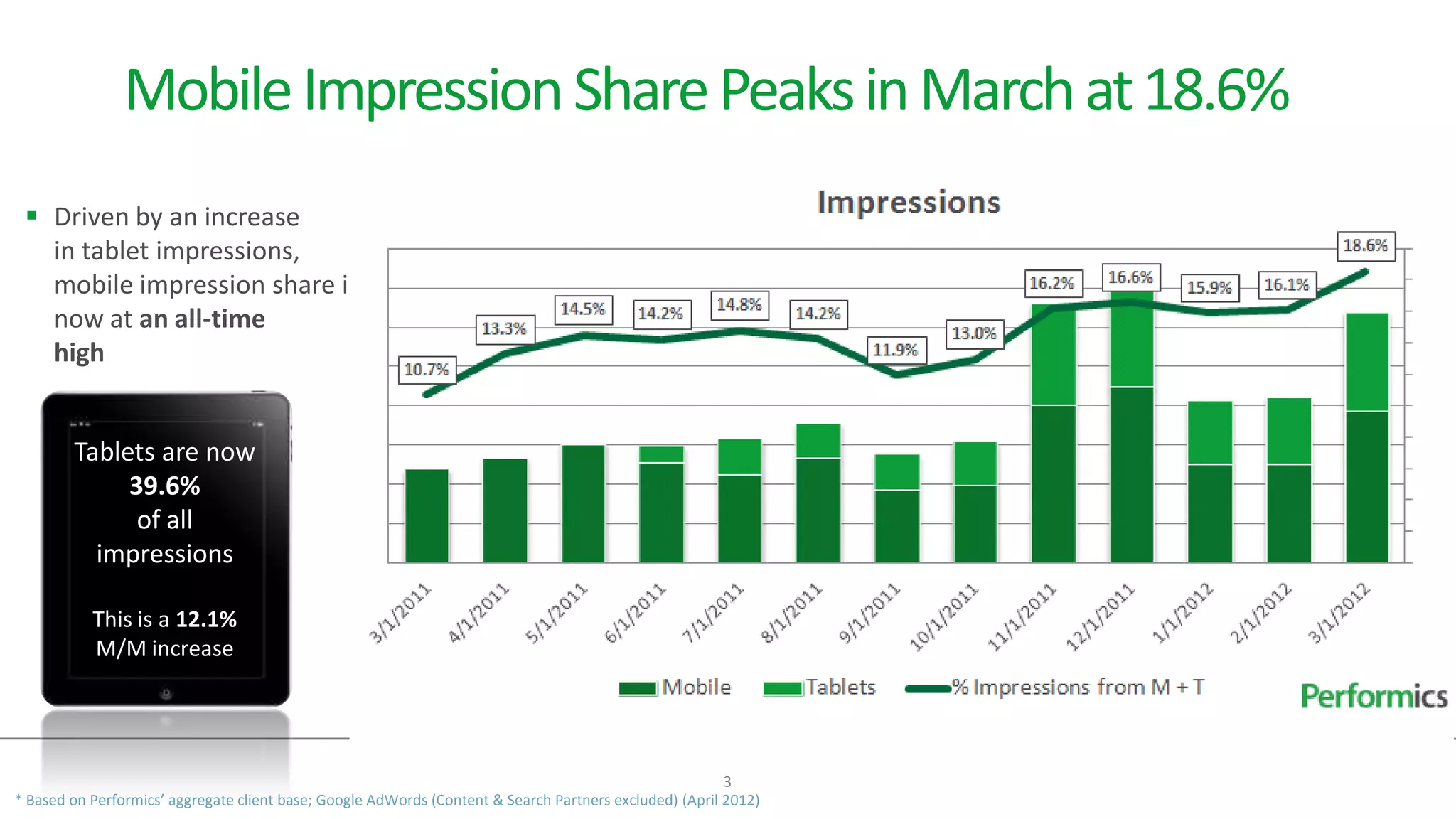

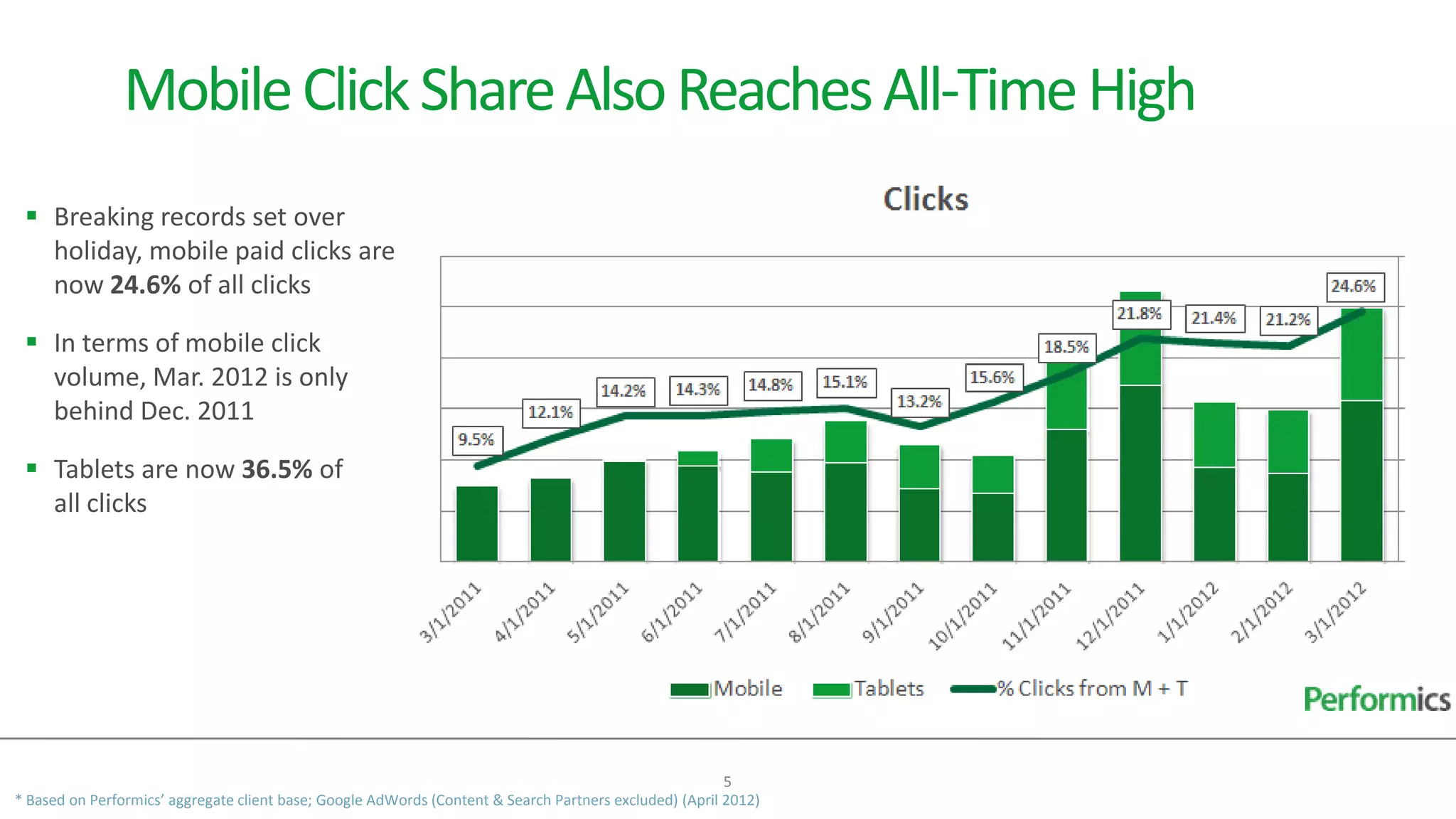

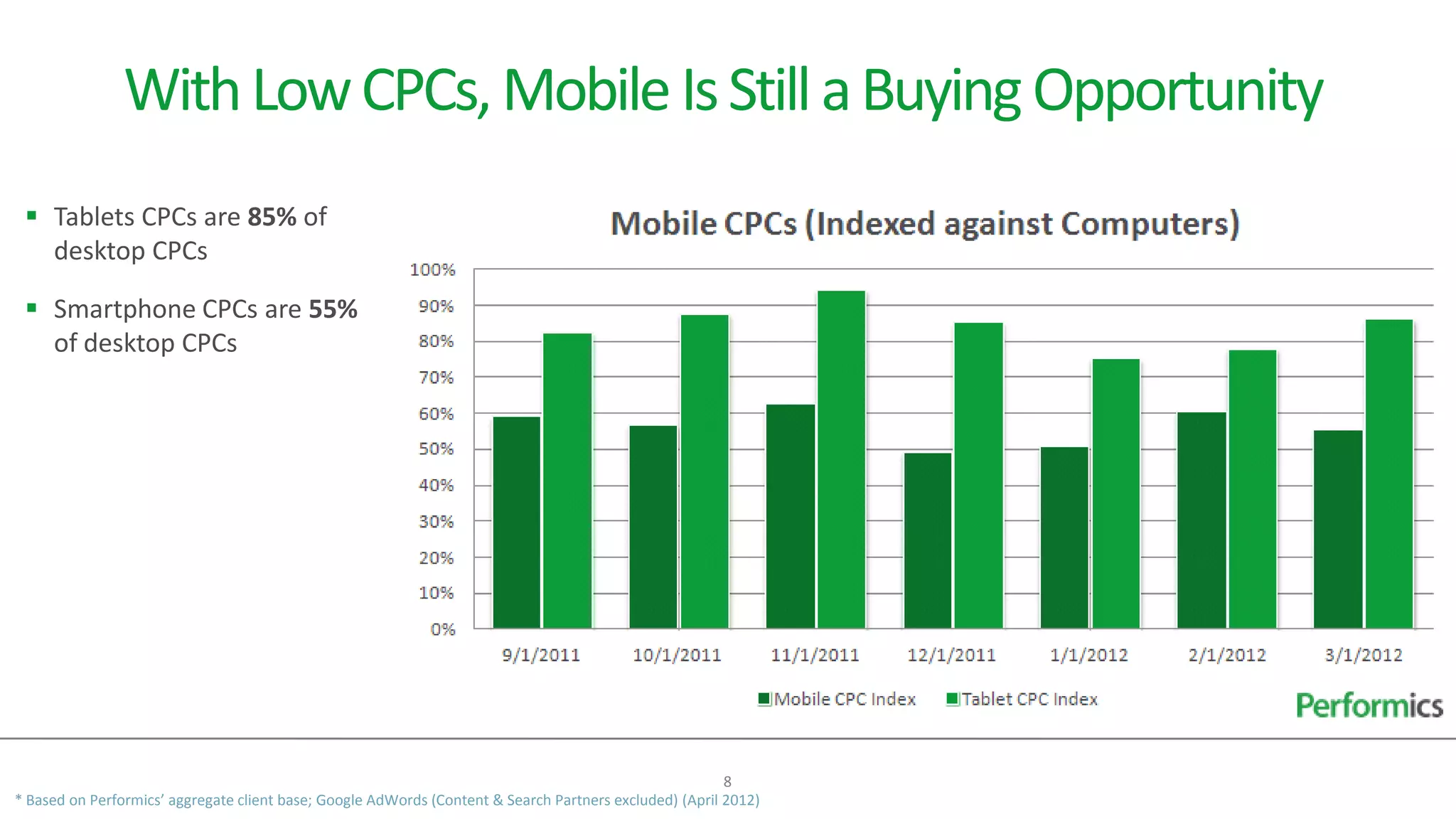

In Q1 2012, mobile paid search spend surged to 17.8% of all paid search expenditures, with mobile click share also reaching an all-time high of 24.6%. The growth is fueled by increased investment in mobile advertising and the distinction between smartphone and tablet users, leading to different strategies for each device. Despite mobile growth, desktop search volume continues to rise, indicating that users are integrating both mobile and desktop searches into their routines.