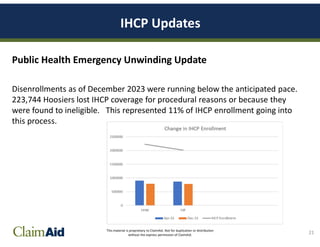

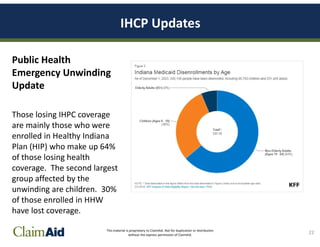

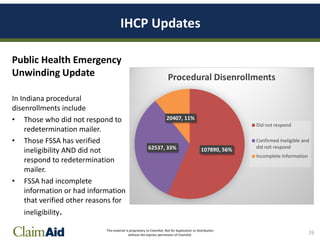

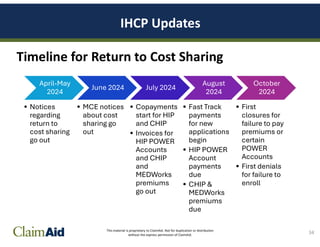

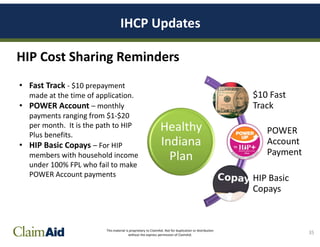

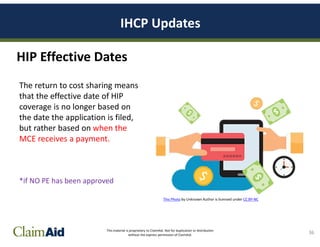

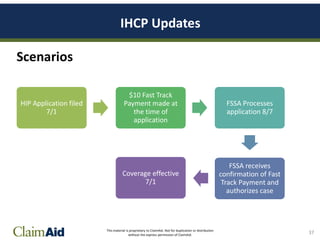

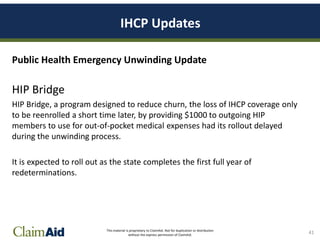

The document discusses the Indiana Health Coverage Programs (IHCP) updates following the public health emergency unwinding, which began in March 2023. It highlights the review of Medicaid eligibility for members, the risk of coverage loss for many, and specific disenrollment statistics, including causes such as procedural disenrollments. Additionally, it emphasizes ongoing changes in cost-sharing structures and the introduction of continuous eligibility for children under 19, aiming to reduce churn in Medicaid coverage.