Embed presentation

Download to read offline

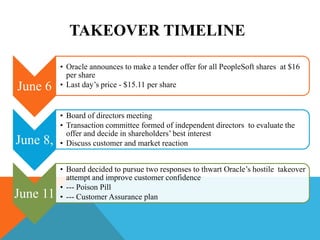

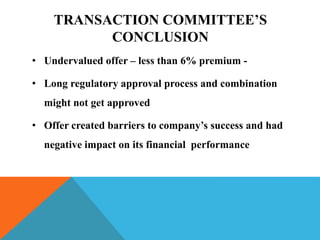

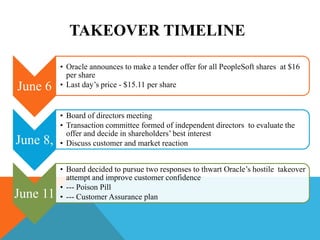

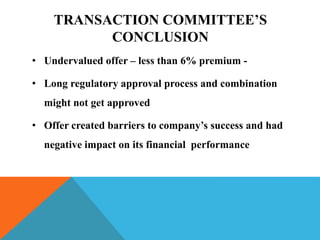

Oracle announced an unsolicited $16 per share cash offer for all outstanding PeopleSoft shares, a small 6% premium over the stock's previous day closing price. PeopleSoft's board of directors formed a transaction committee of independent directors to evaluate the offer. The committee concluded the offer undervalued the company, may face regulatory issues, and could negatively impact PeopleSoft's financial performance. They decided to implement a poison pill and customer assurance plan to prevent Oracle's hostile takeover attempt.