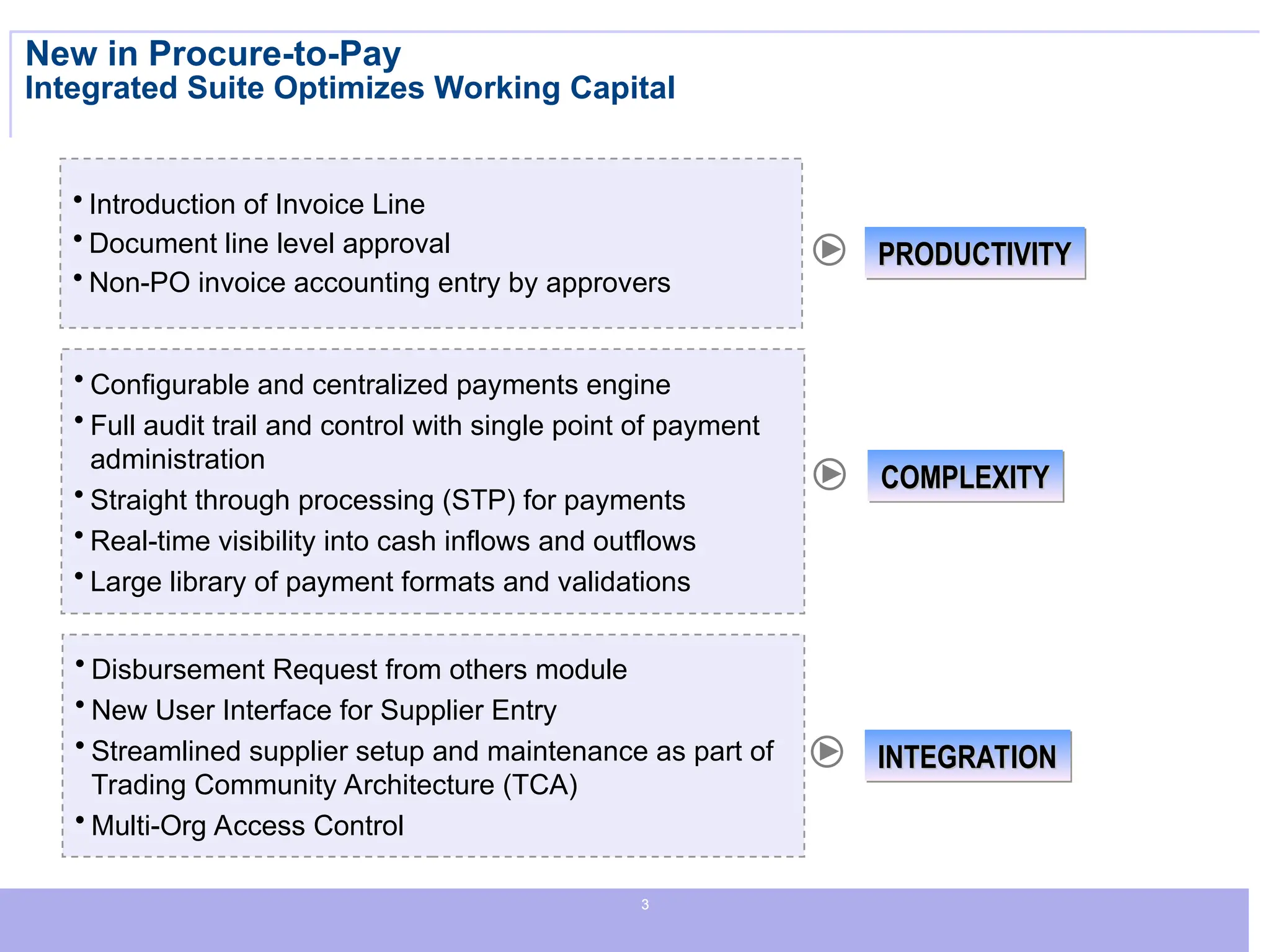

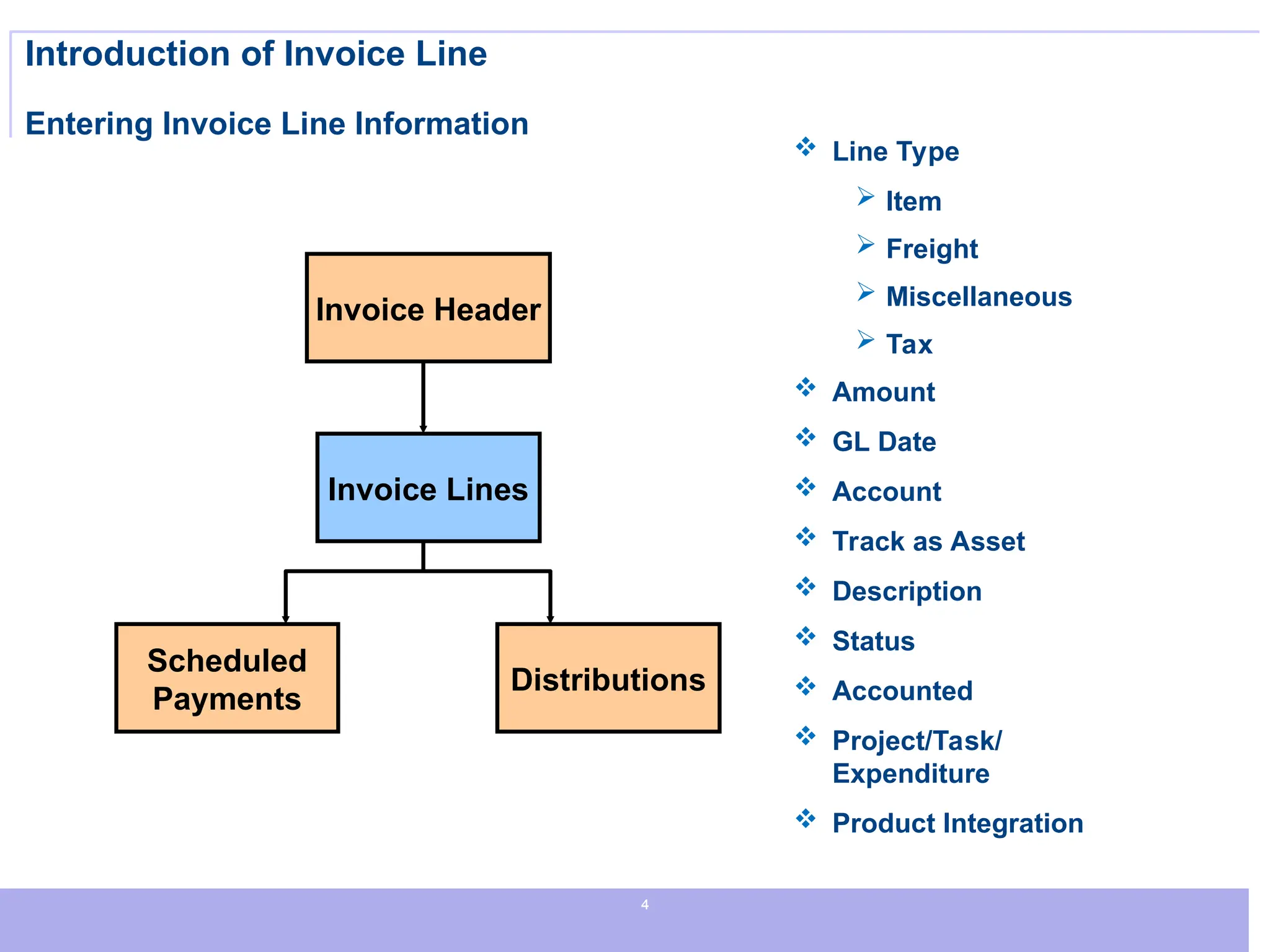

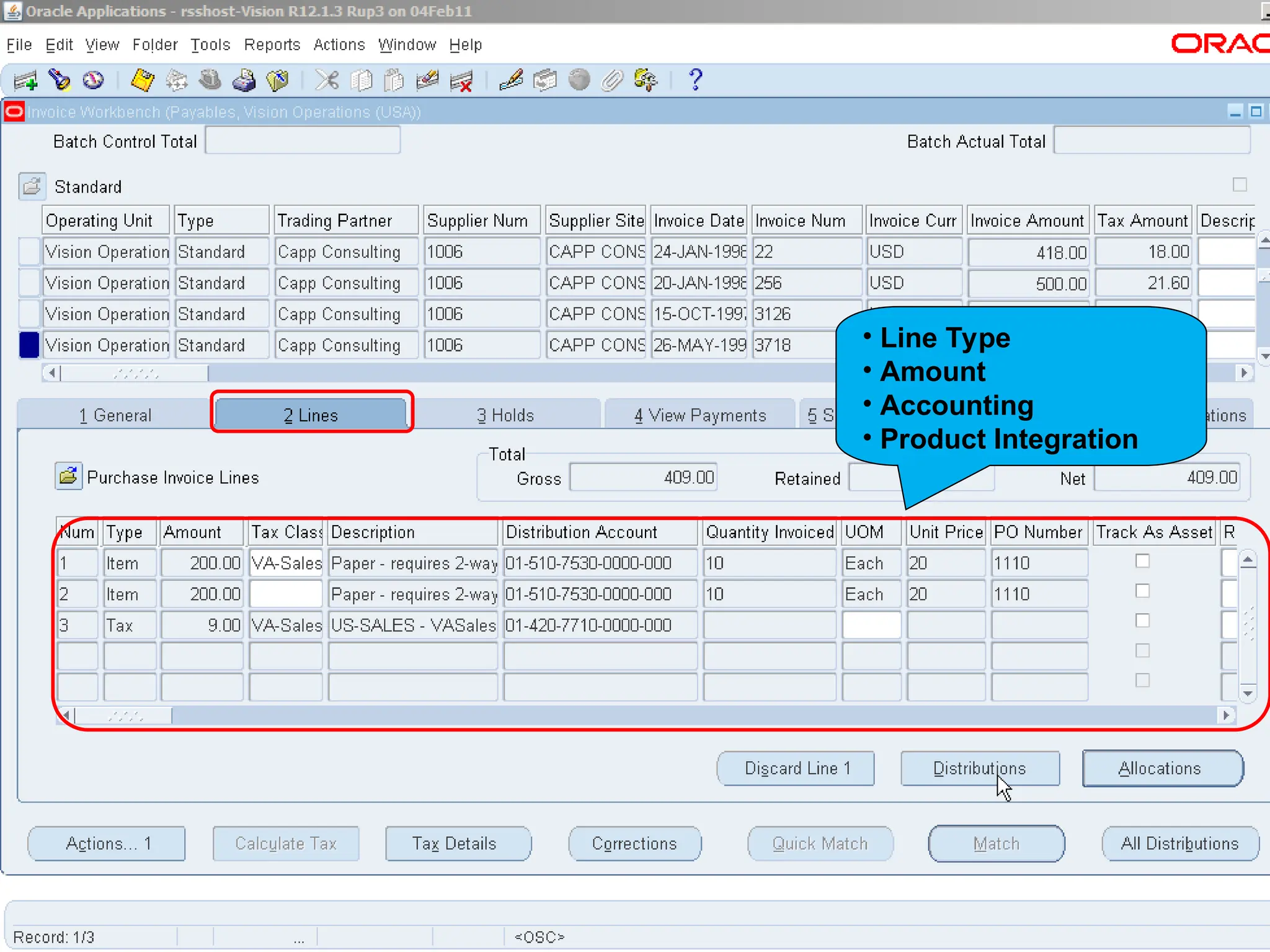

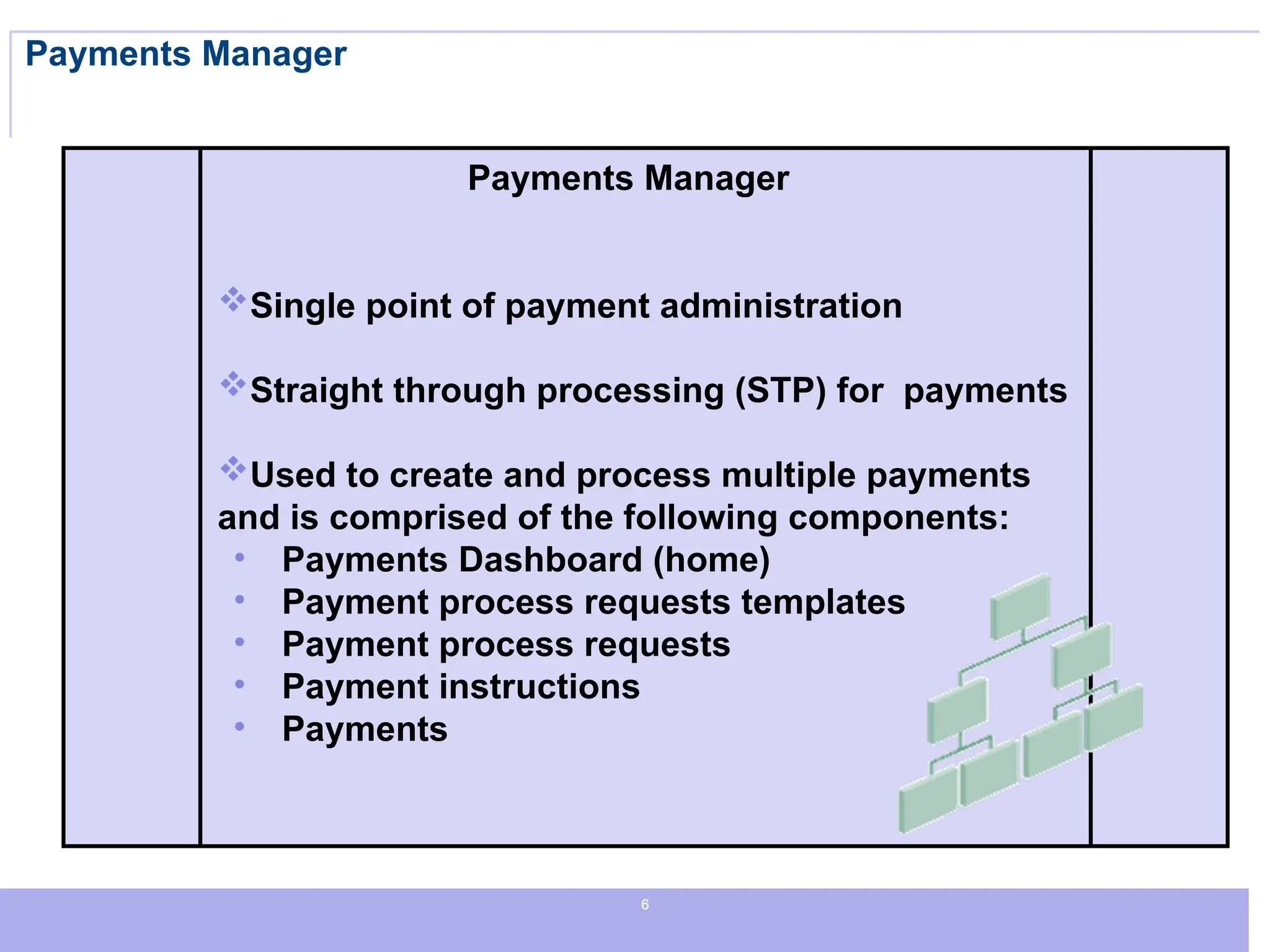

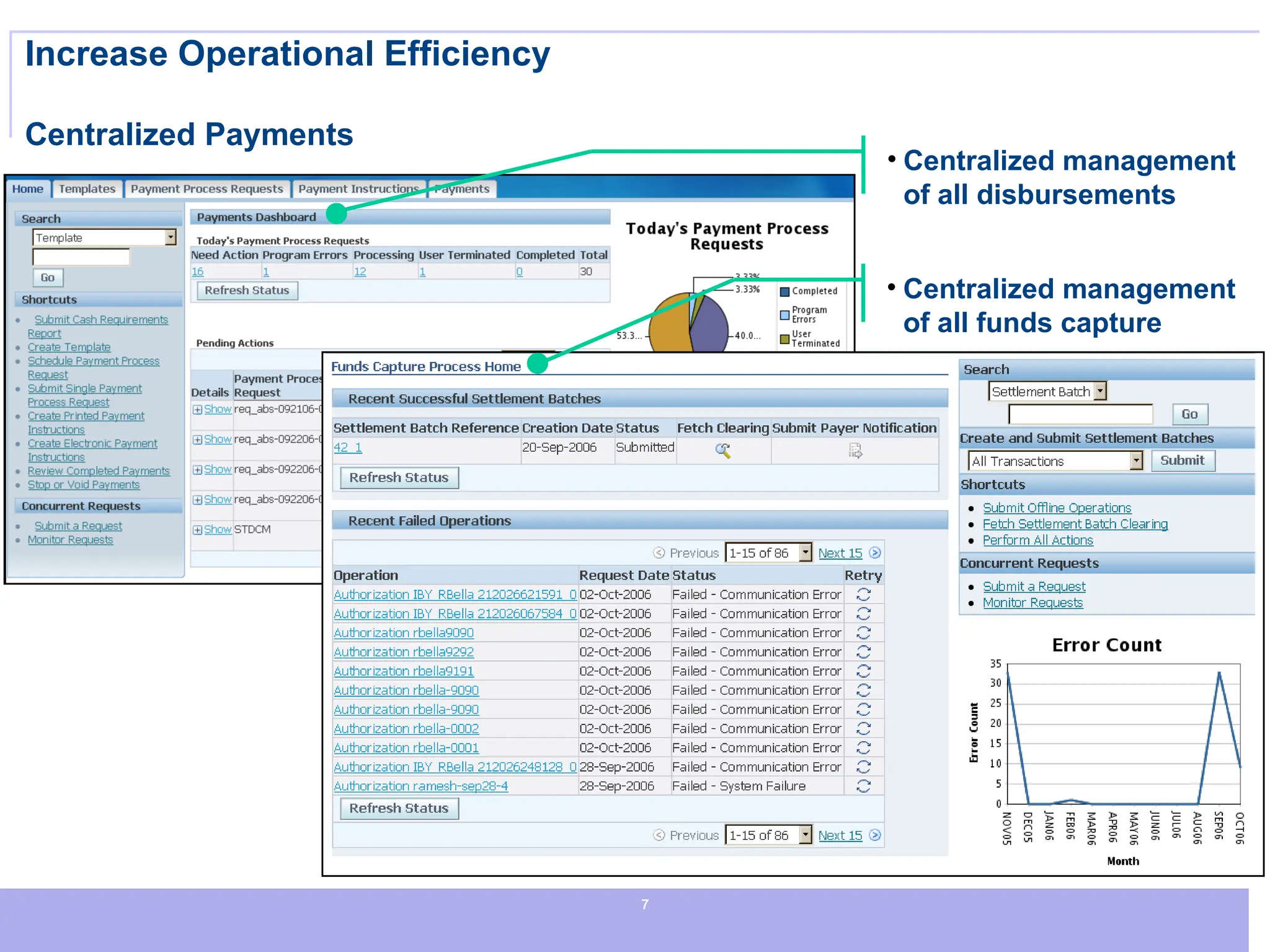

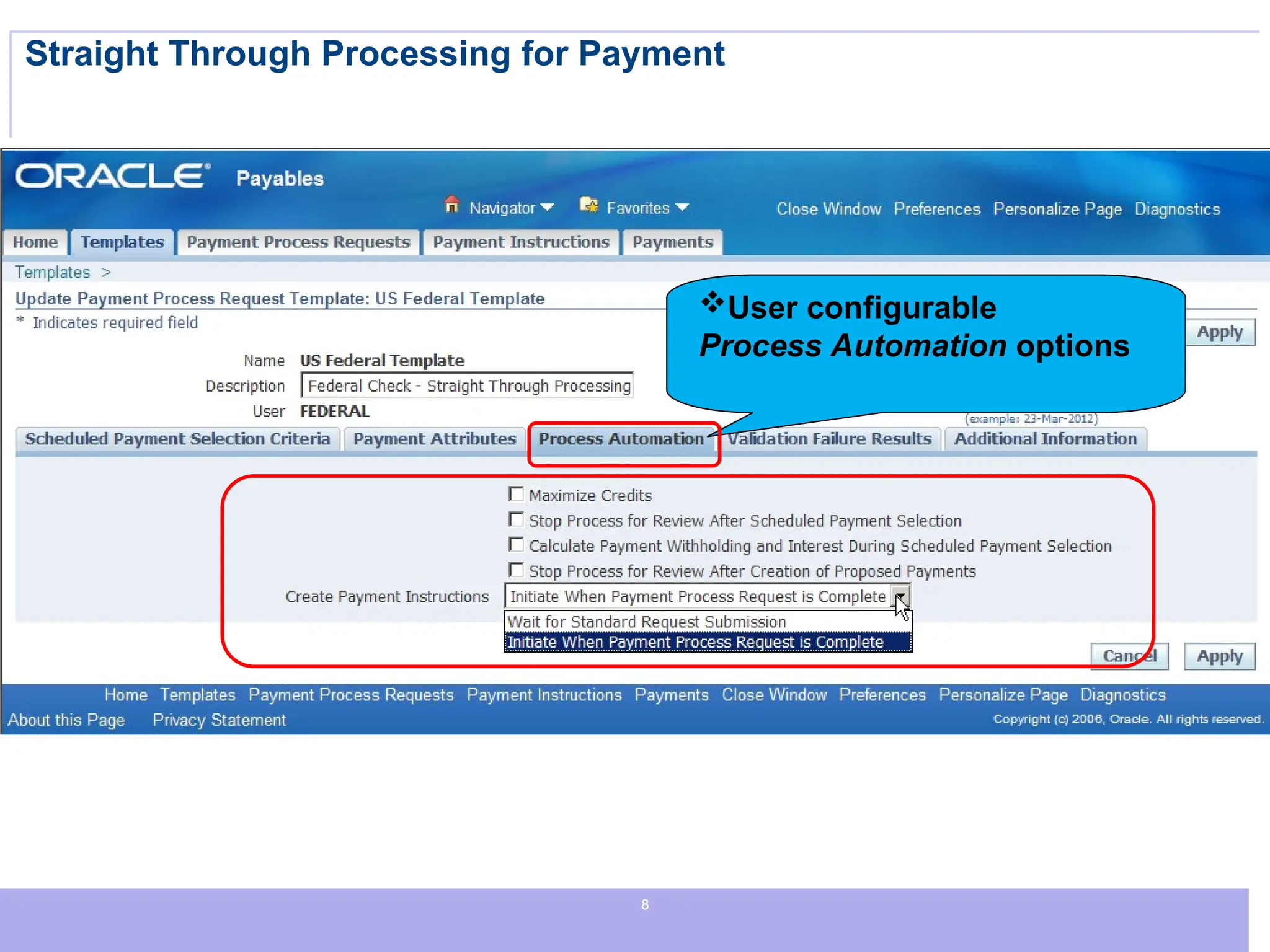

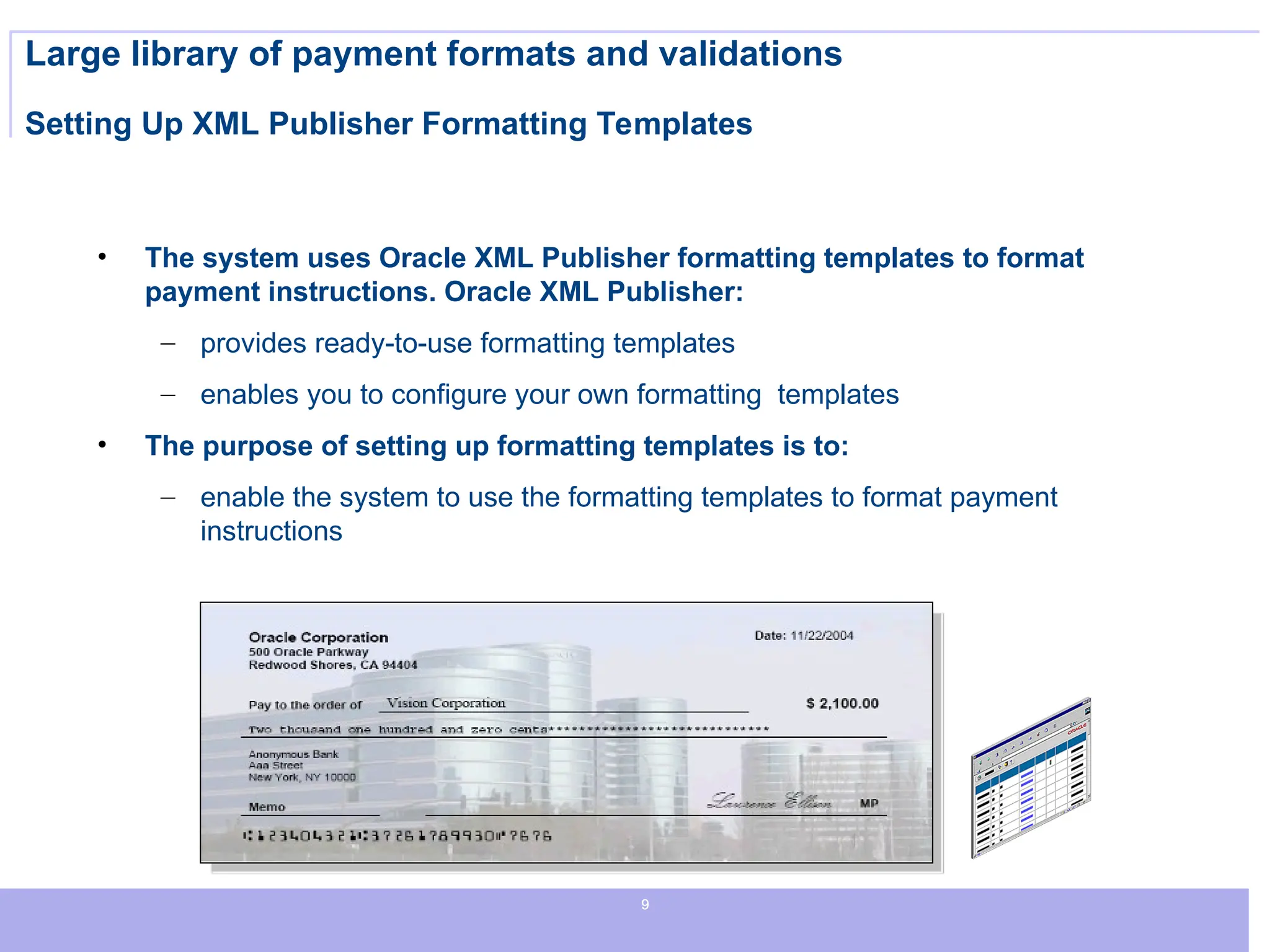

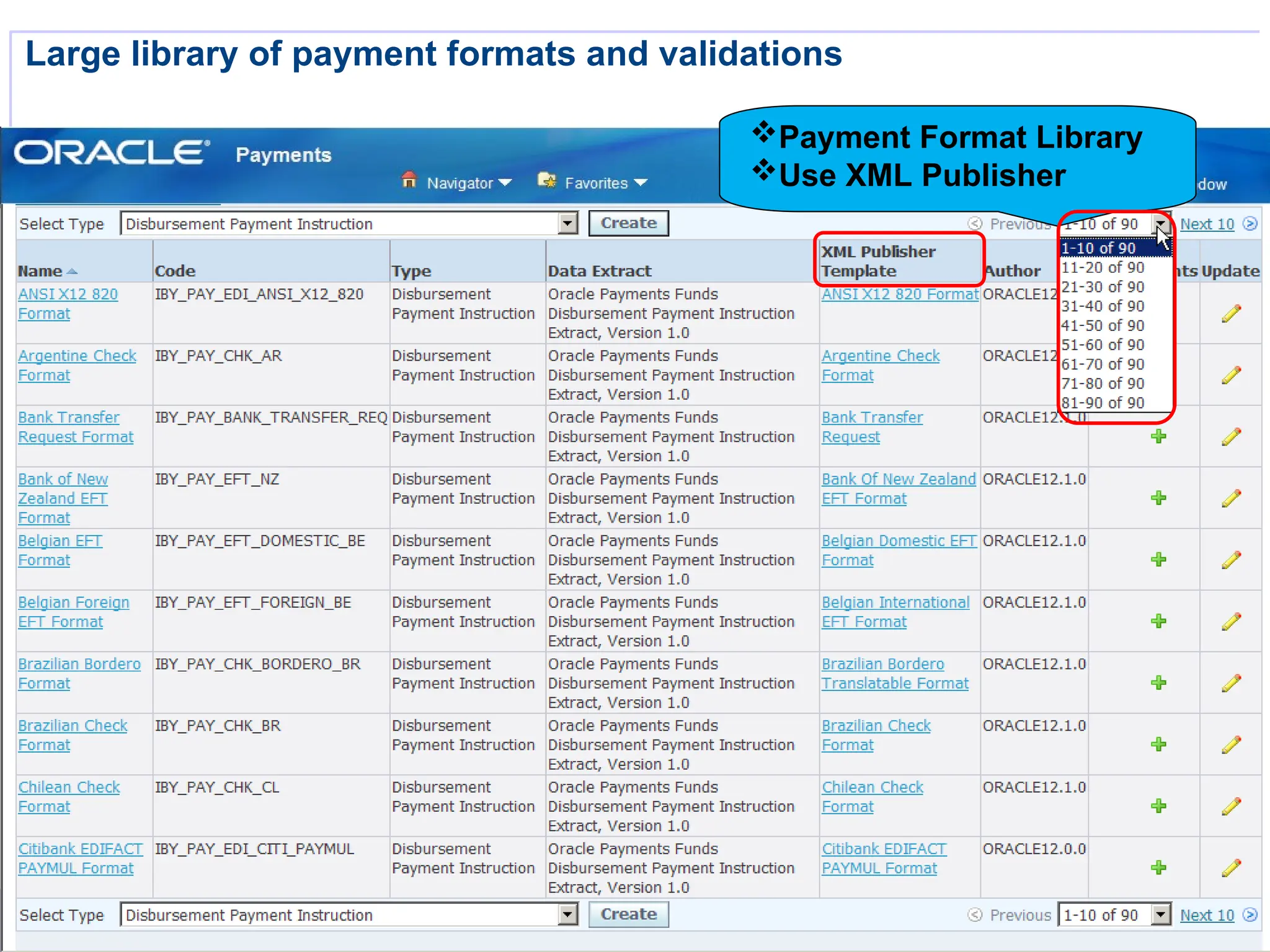

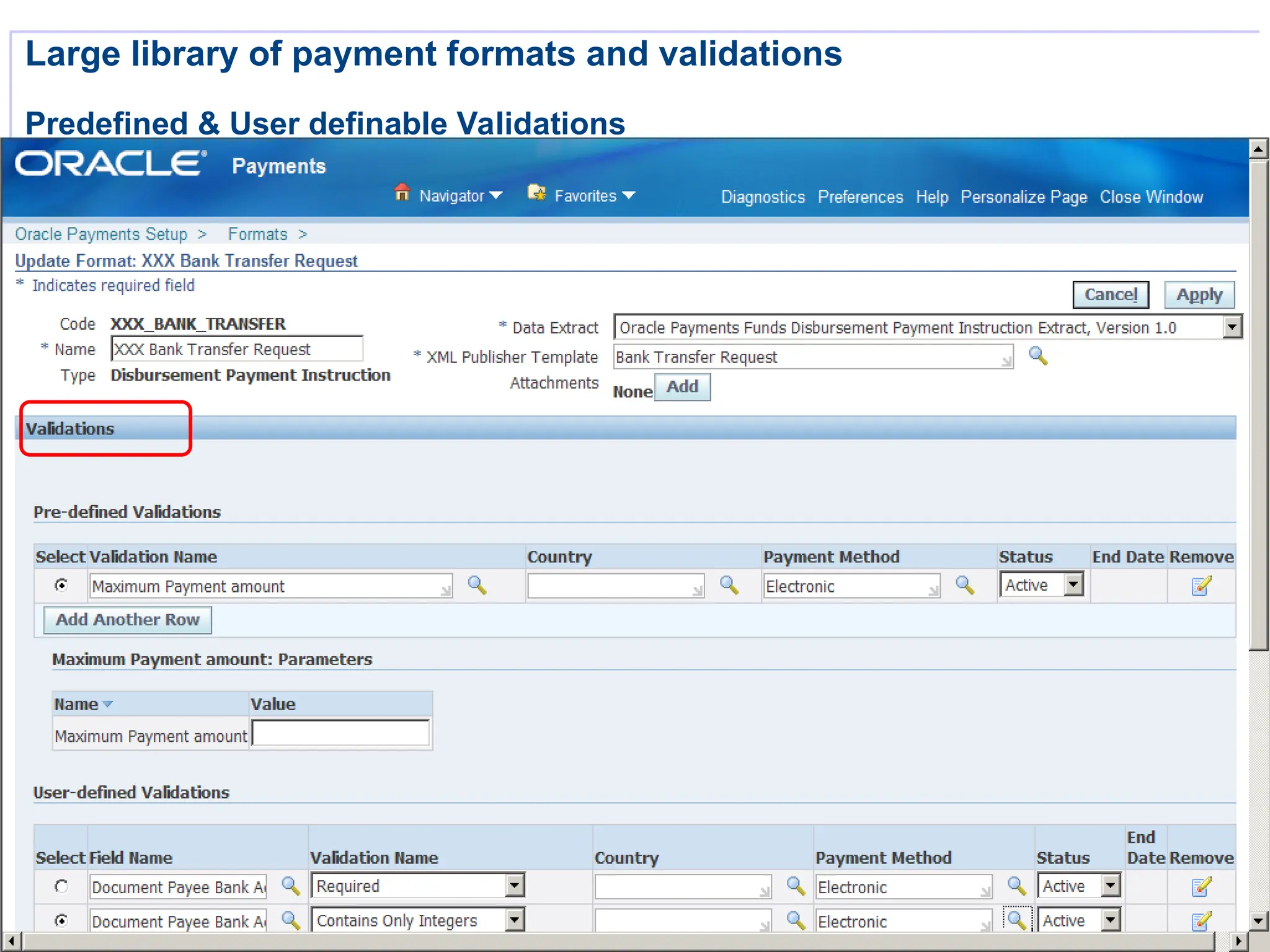

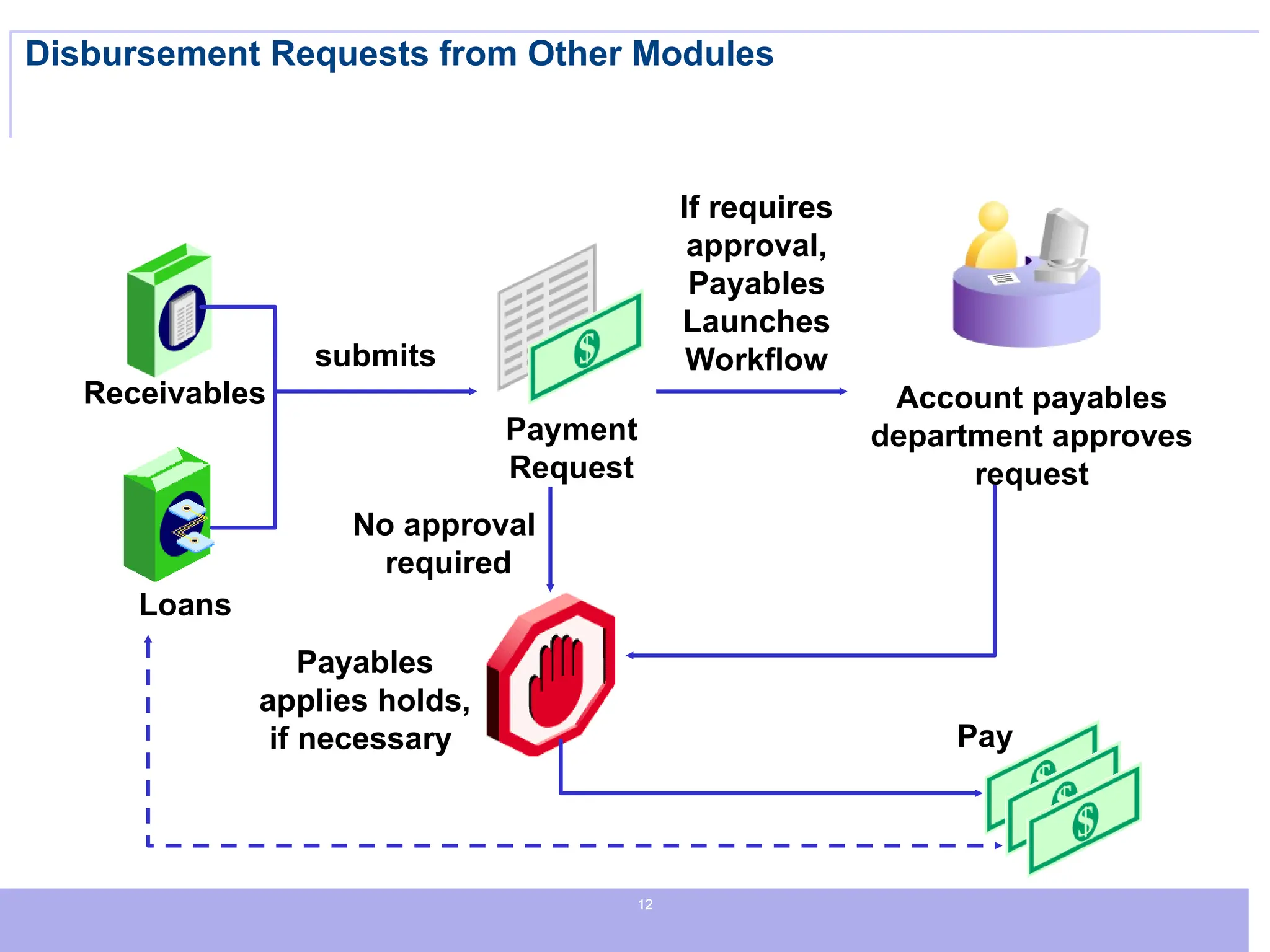

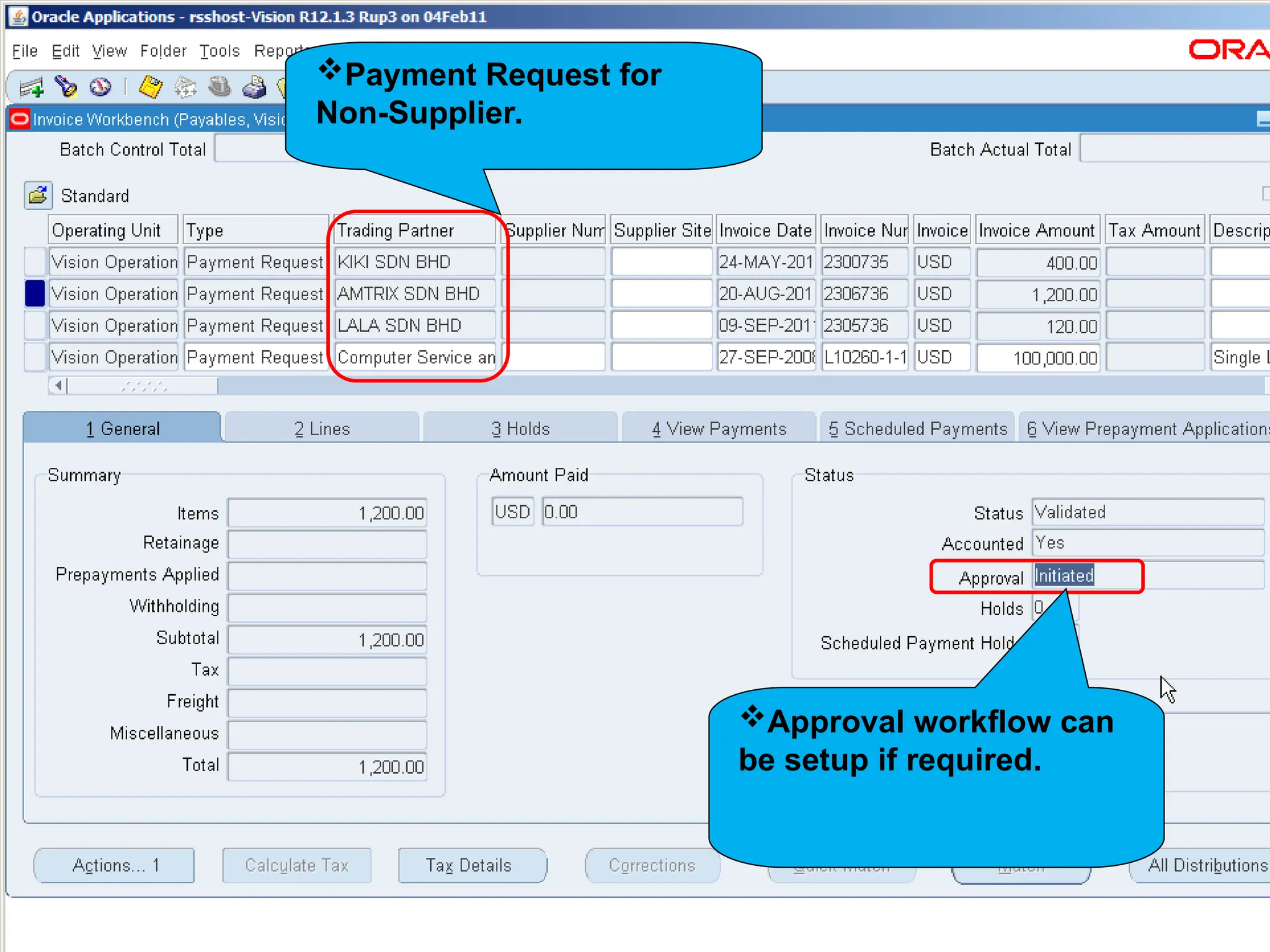

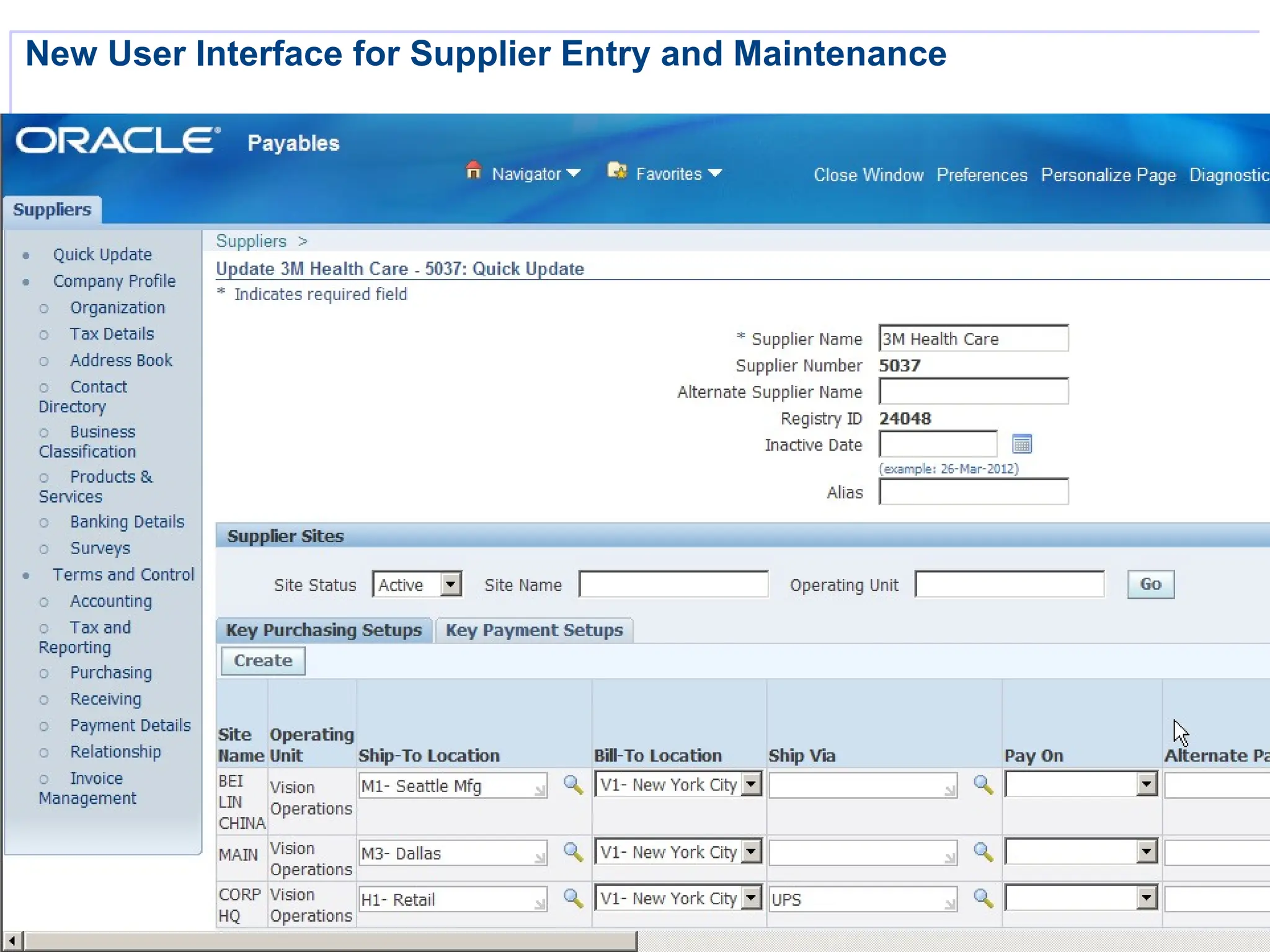

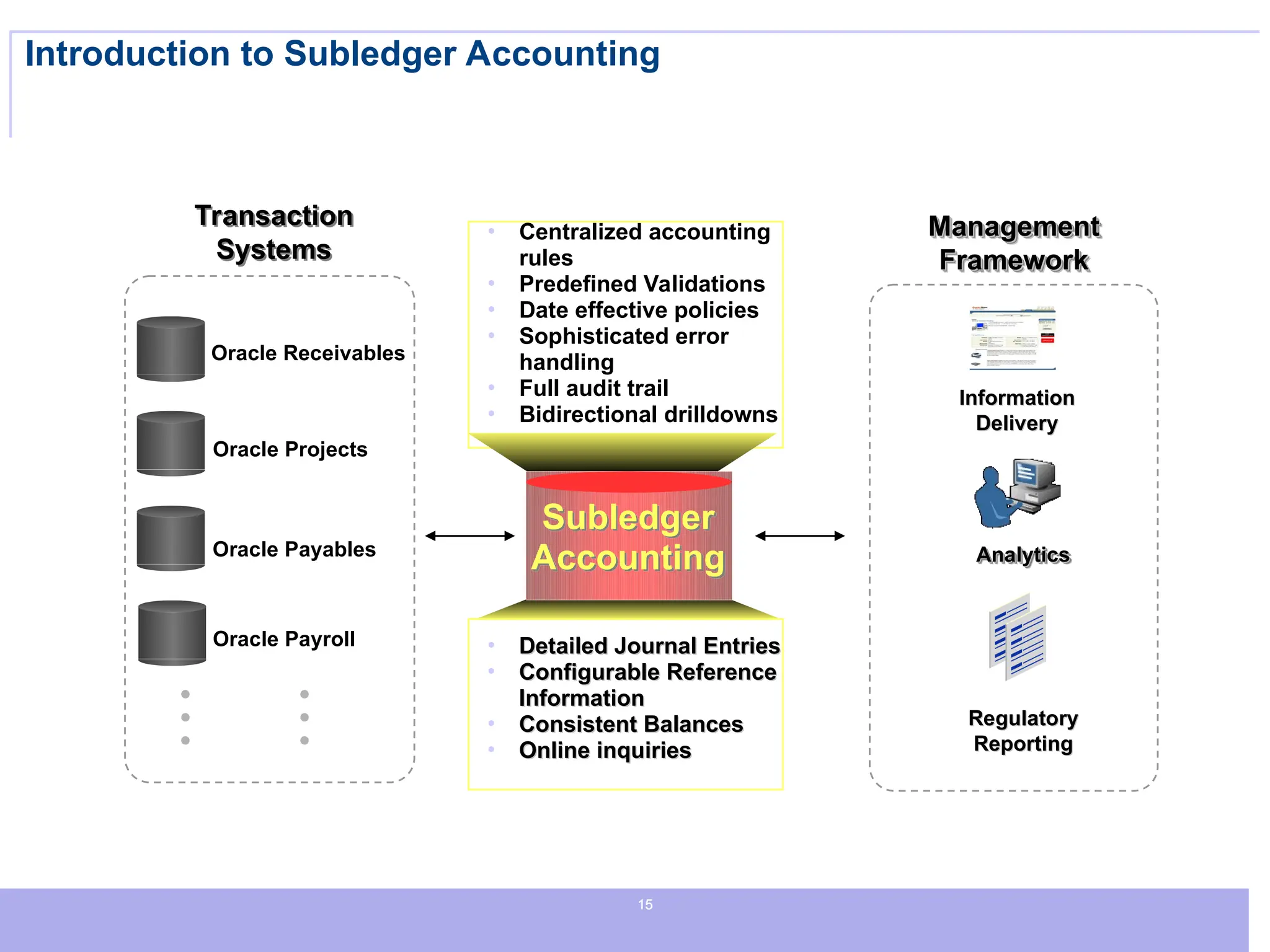

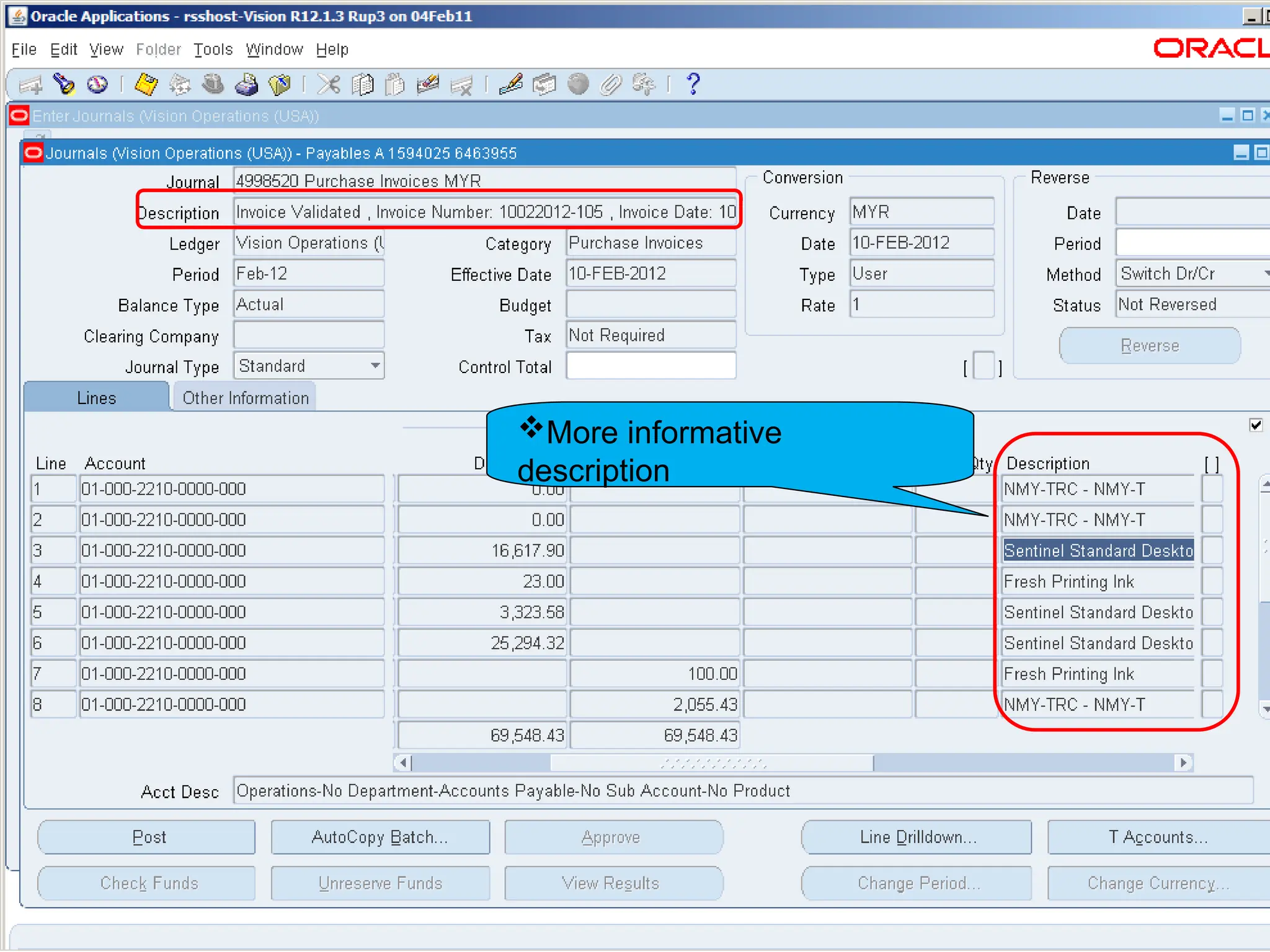

The document outlines new features in Oracle Apps R12 Financial, focusing on enhancements in the procure-to-pay integrated suite, including streamlined invoice processing and a centralized payments engine. It highlights capabilities such as straight-through processing, improved user interfaces for supplier management, and robust audit control. Additionally, the document emphasizes the implementation of a large variety of payment formats and validations to optimize financial workflows.