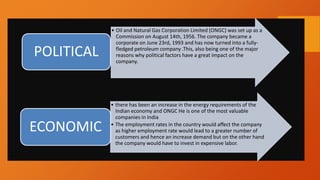

The Oil and Natural Gas Corporation (ONGC) is an Indian state-owned oil and gas company headquartered in New Delhi. It was established in 1956 by the Government of India and is overseen by the Ministry of Petroleum and Natural Gas. ONGC explores and produces oil and natural gas in India and overseas and is one of the largest state-owned oil and gas exploration and production companies in the world.

![ALL ABOUT COMPANY

Type Public

Traded as •NSE: ONGC

•BSE: 500312

•BSE SENSEX Constituent

•NSE NIFTY 50 Constituent

Industry Energy: Oil and gas

Founded 14 August 1956; 65 years ago

Headquarters Dehradun, Uttarakhand, India

Key people Alka Mittal (Chairman)

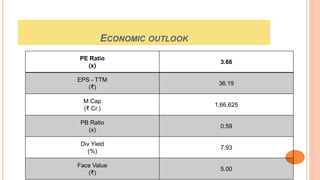

Revenue ₹539,199 crore (US$71 billion) (2022)

Net income ₹47,830 crore (US$6.3 billion) (2022)

Total assets ₹585,449 crore (US$77 billion) (2022)

Total equity ₹259,502 crore (US$34 billion) (2022)

Owner Government of India (60.41%)

[3]](https://image.slidesharecdn.com/ongc-220730054537-82399a96/85/ONGC-pptx-3-320.jpg)

![MOAT [Competitive Advantage]

has highly skilled human resource with excellent technical

and management capabilities.

ONGC has a unique and distinct advantage in terms of being a

horizontally integrated player, with in-house infrastructure for

oil field services.

Experienced and professionally competent manpower is

another huge advantage with ONGC.](https://image.slidesharecdn.com/ongc-220730054537-82399a96/85/ONGC-pptx-9-320.jpg)