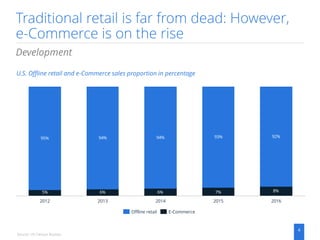

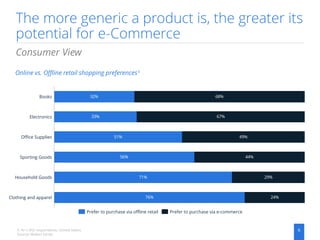

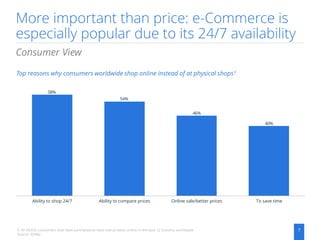

This whitepaper highlights the growing trend of e-commerce, with global online retail revenues projected to increase significantly by 2021, while traditional retail remains dominant but faces challenges. It analyzes consumer preferences, noting that while online shopping offers 24/7 availability and convenience, physical stores still hold advantages like the ability to see and try products. The document discusses the barriers and opportunities for both offline and online retail in an increasingly connected world.