This document provides an overview of IFRS 8 Operating Segments. The key points are:

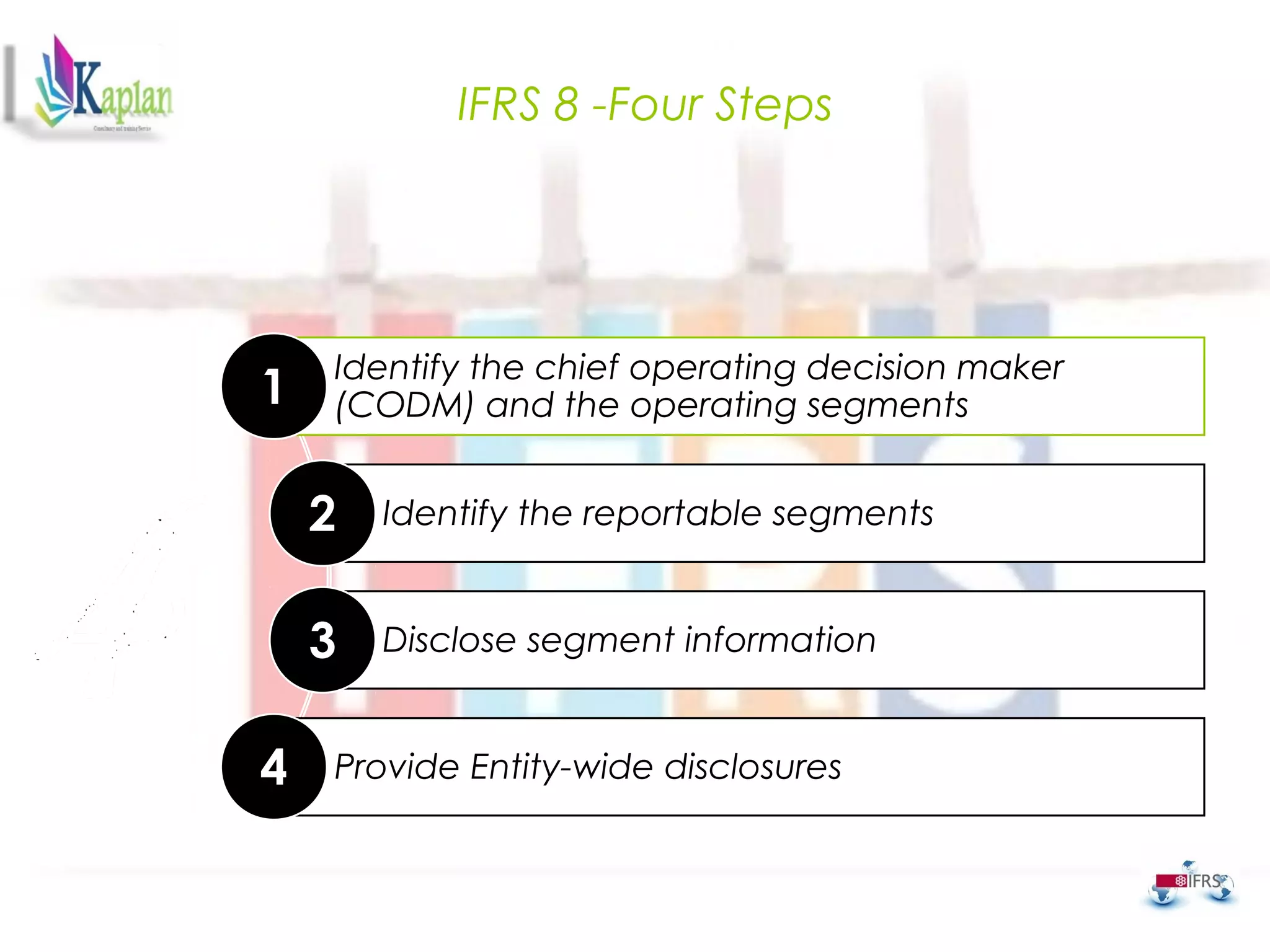

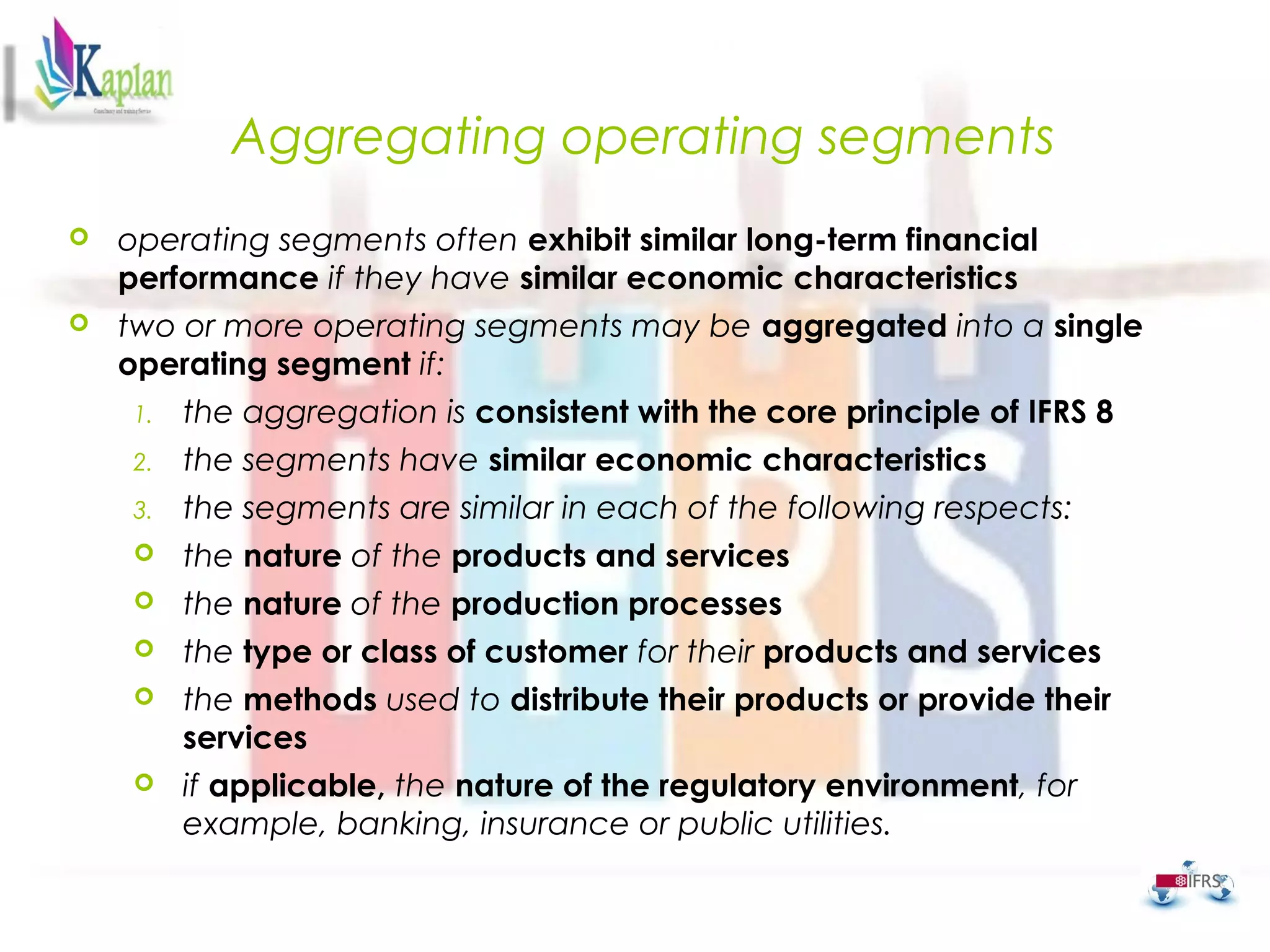

IFRS 8 requires entities to disclose segment information to help users understand its business activities and operating results. It applies to public entities or those filing financial statements. Operating segments are components regularly reviewed by management to allocate resources and assess performance. Reportable segments meet certain quantitative thresholds or are otherwise determined to be reportable by management. The standard outlines requirements for identifying segments, reportable segments, disclosing segment information, and entity-wide disclosures.