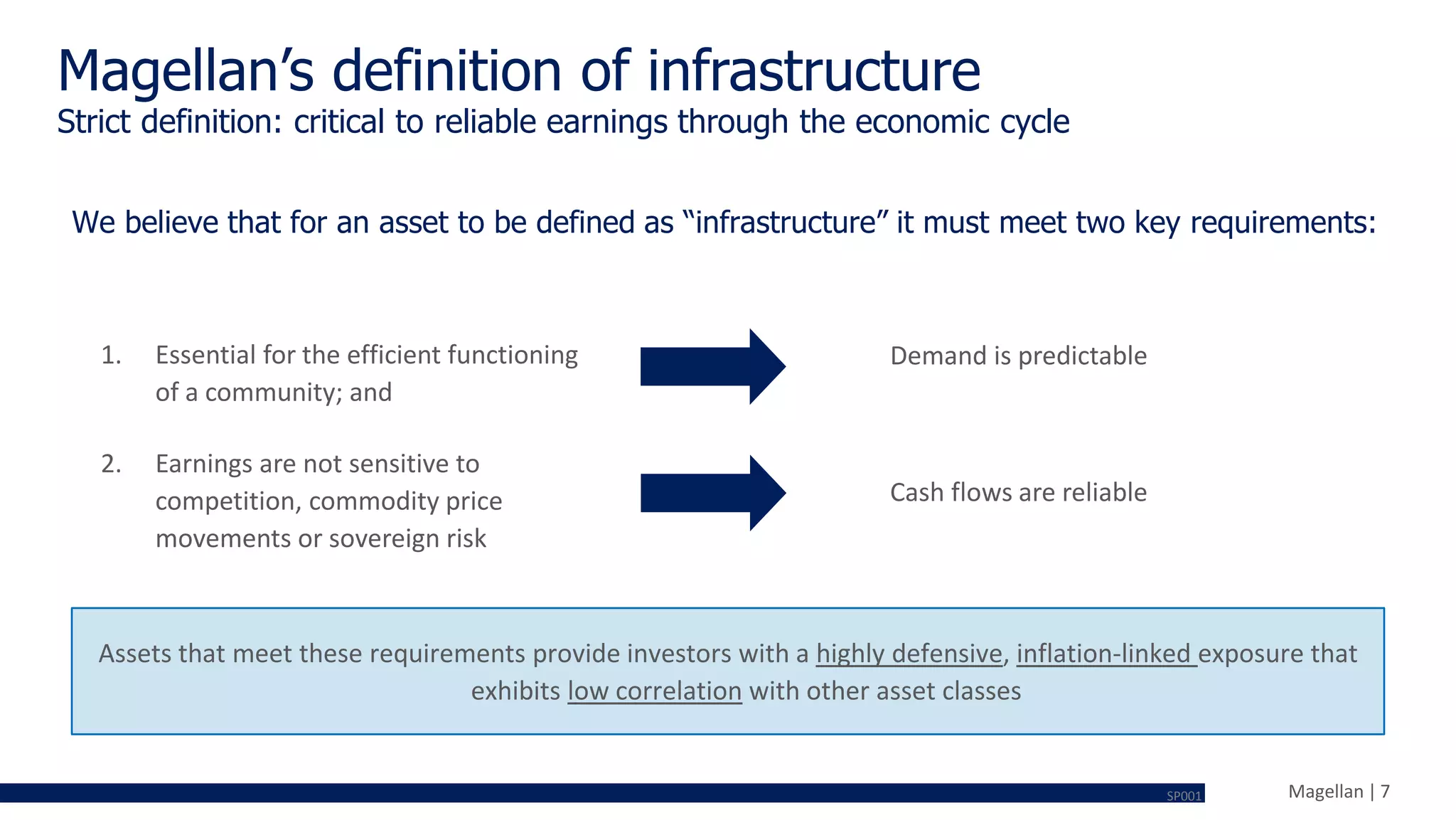

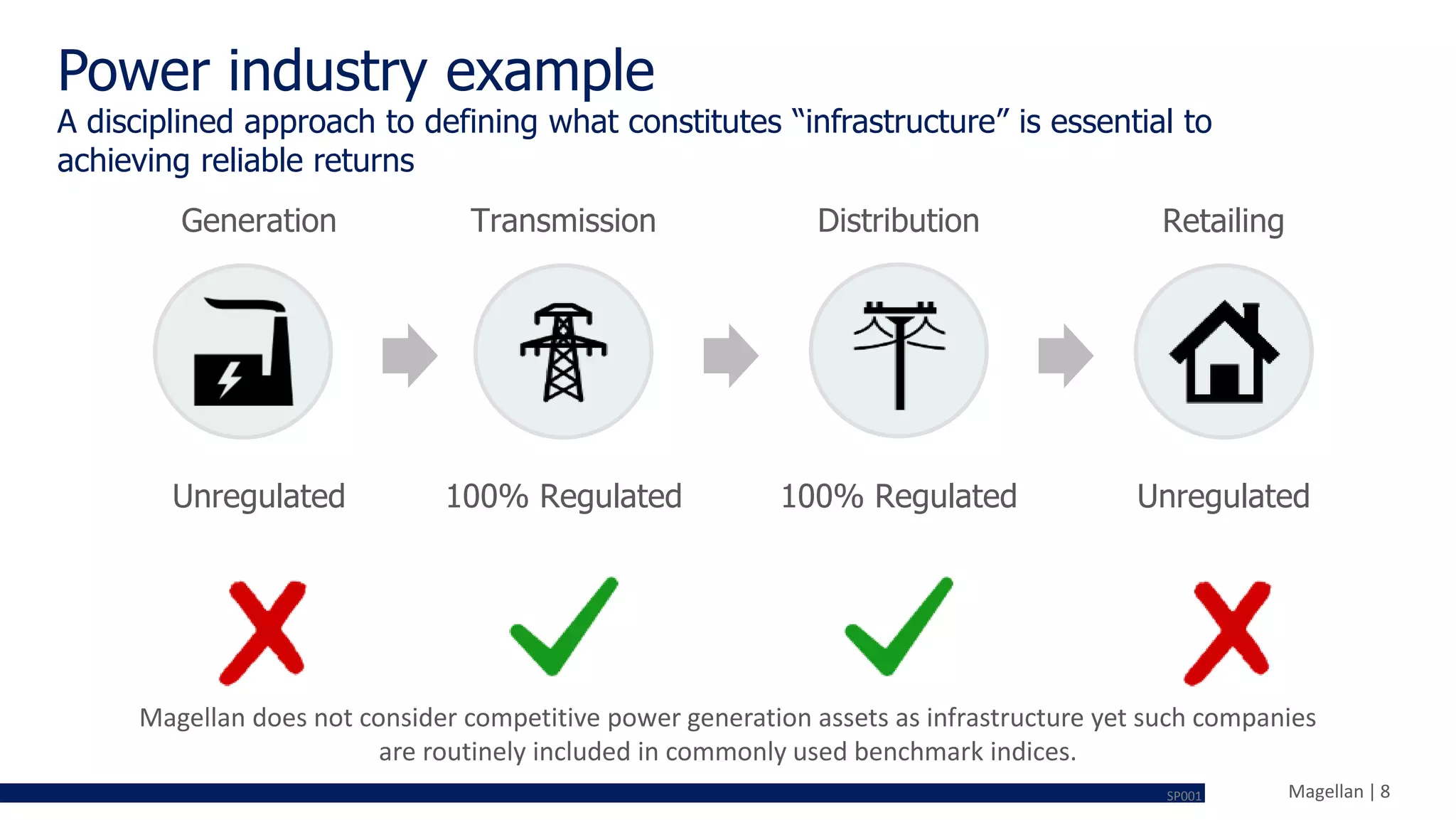

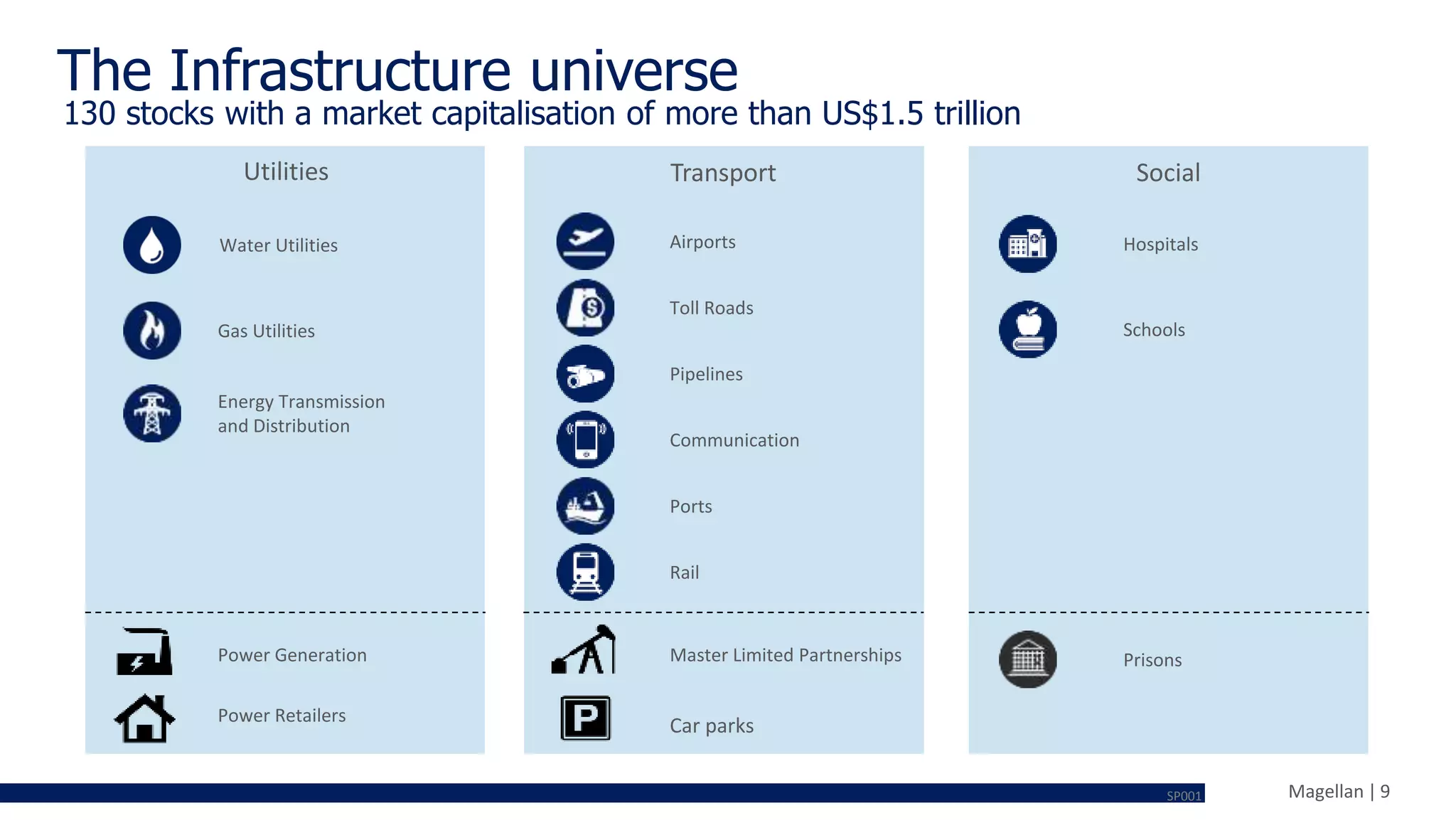

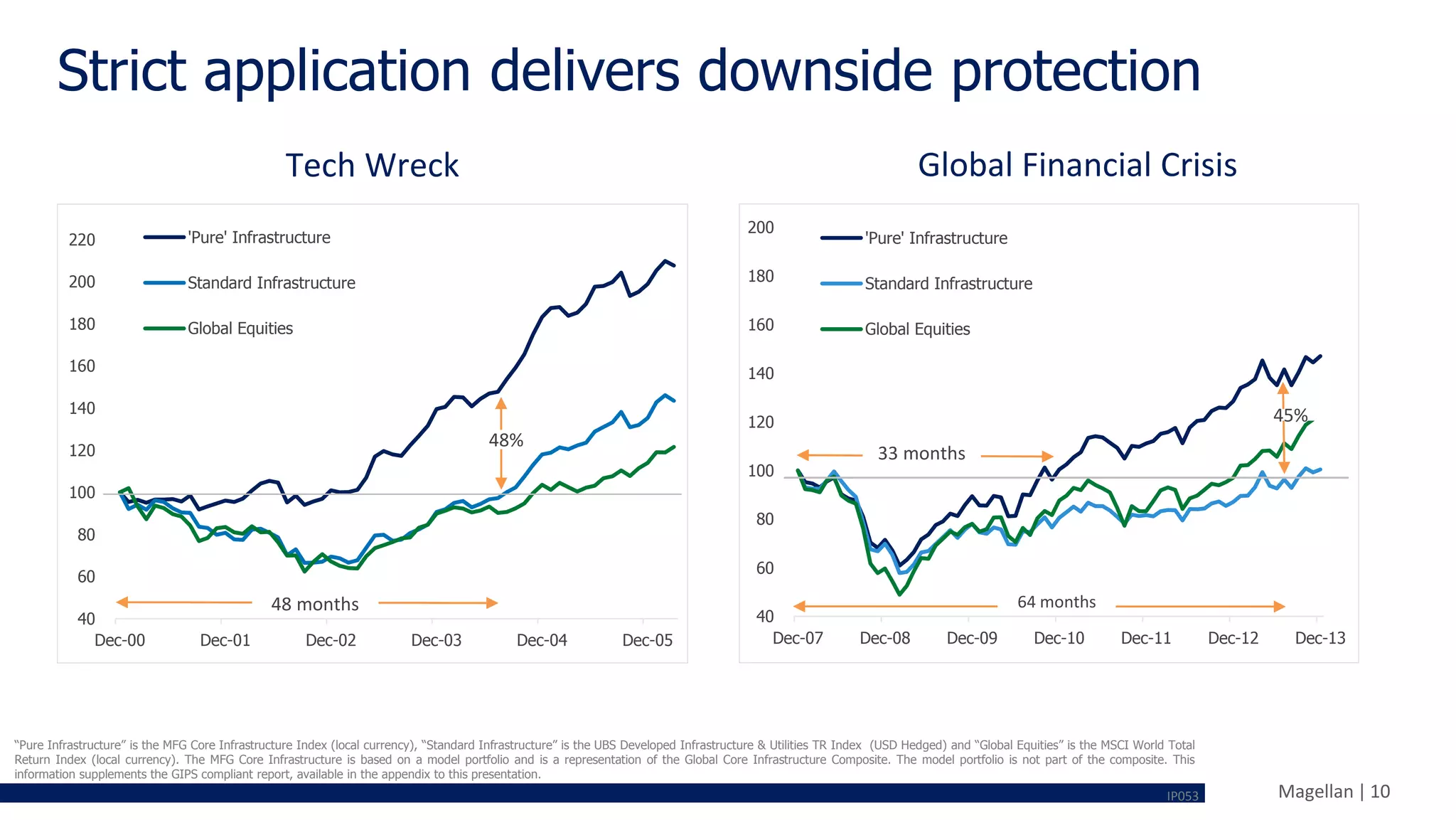

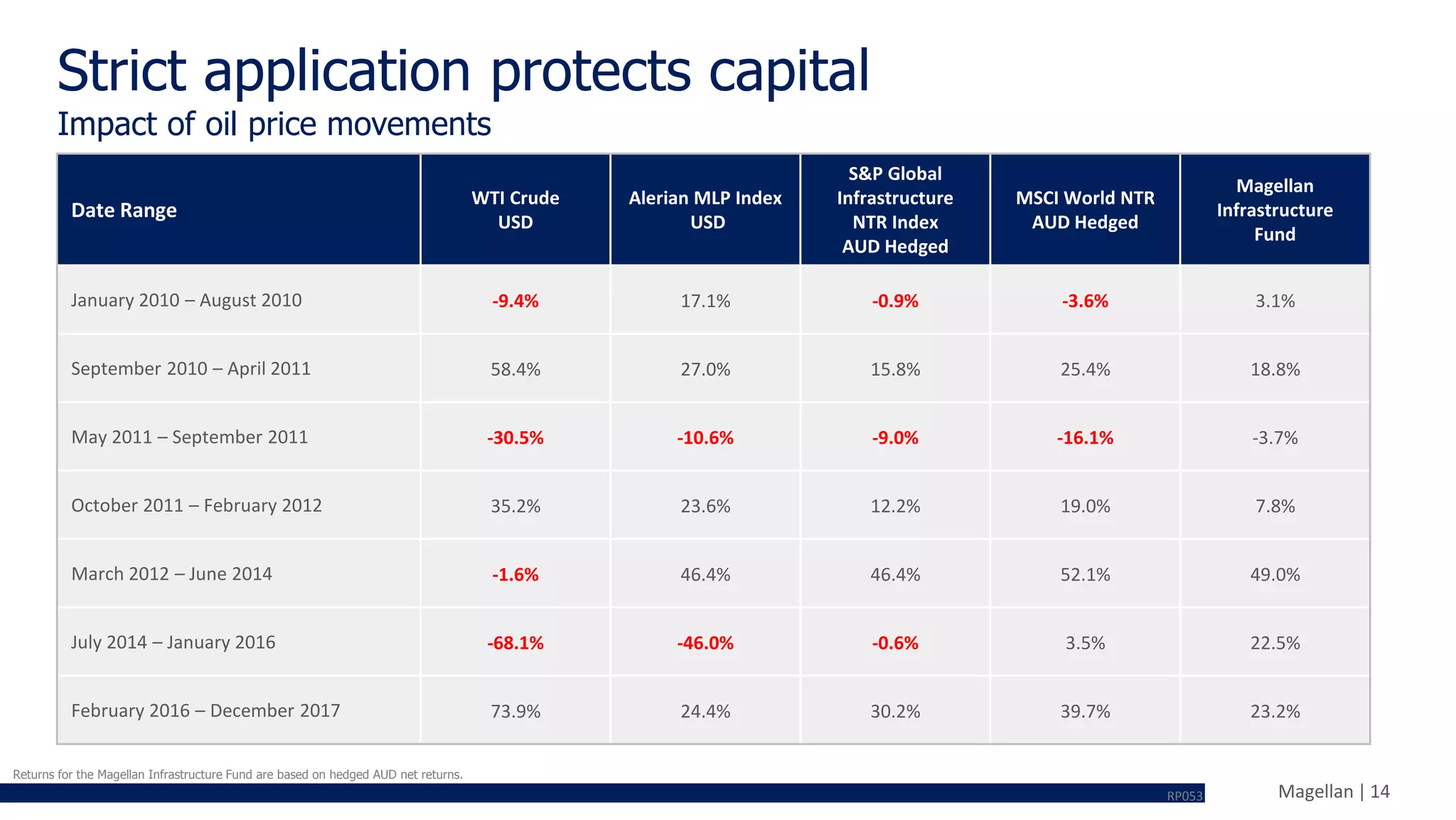

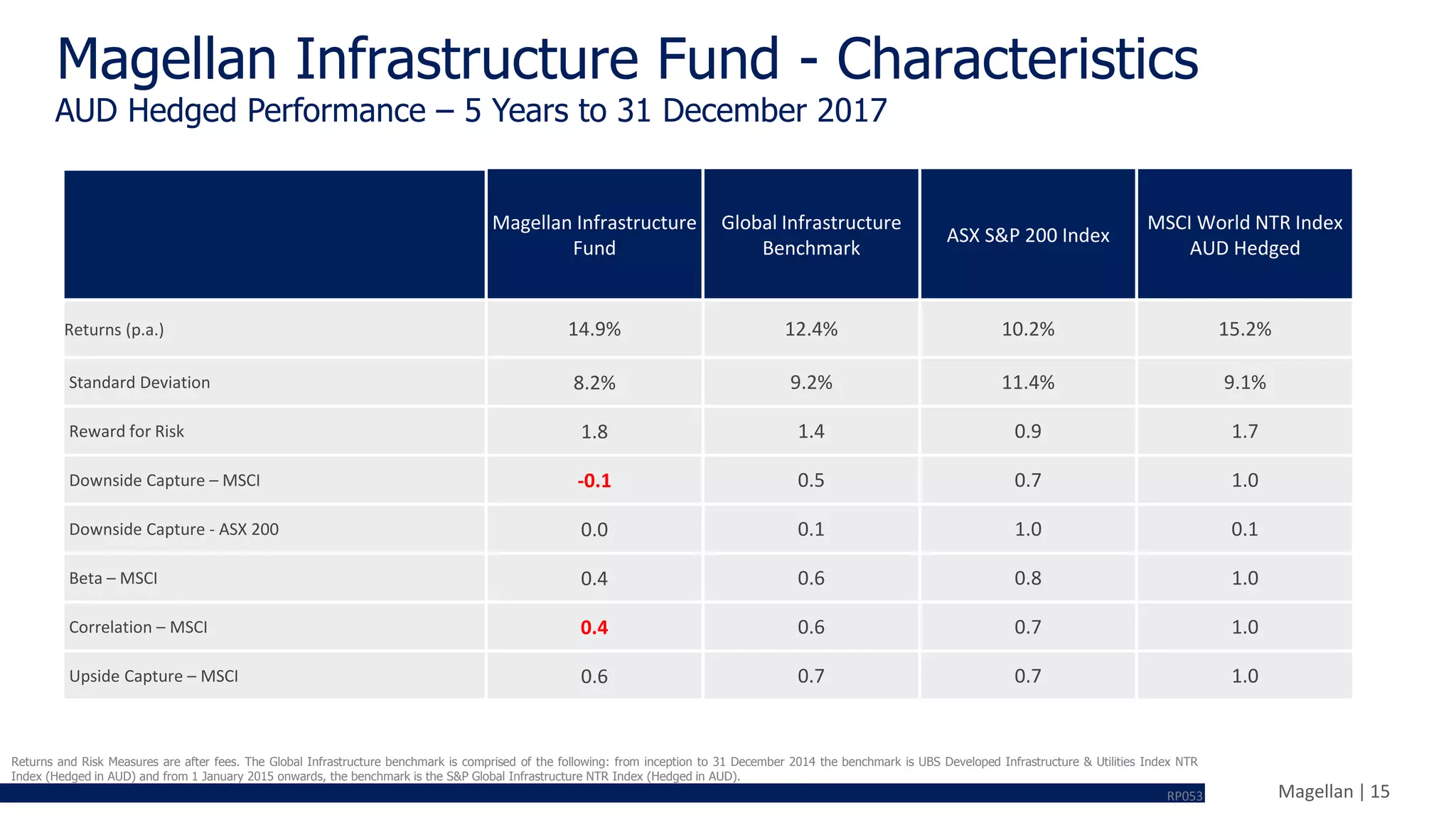

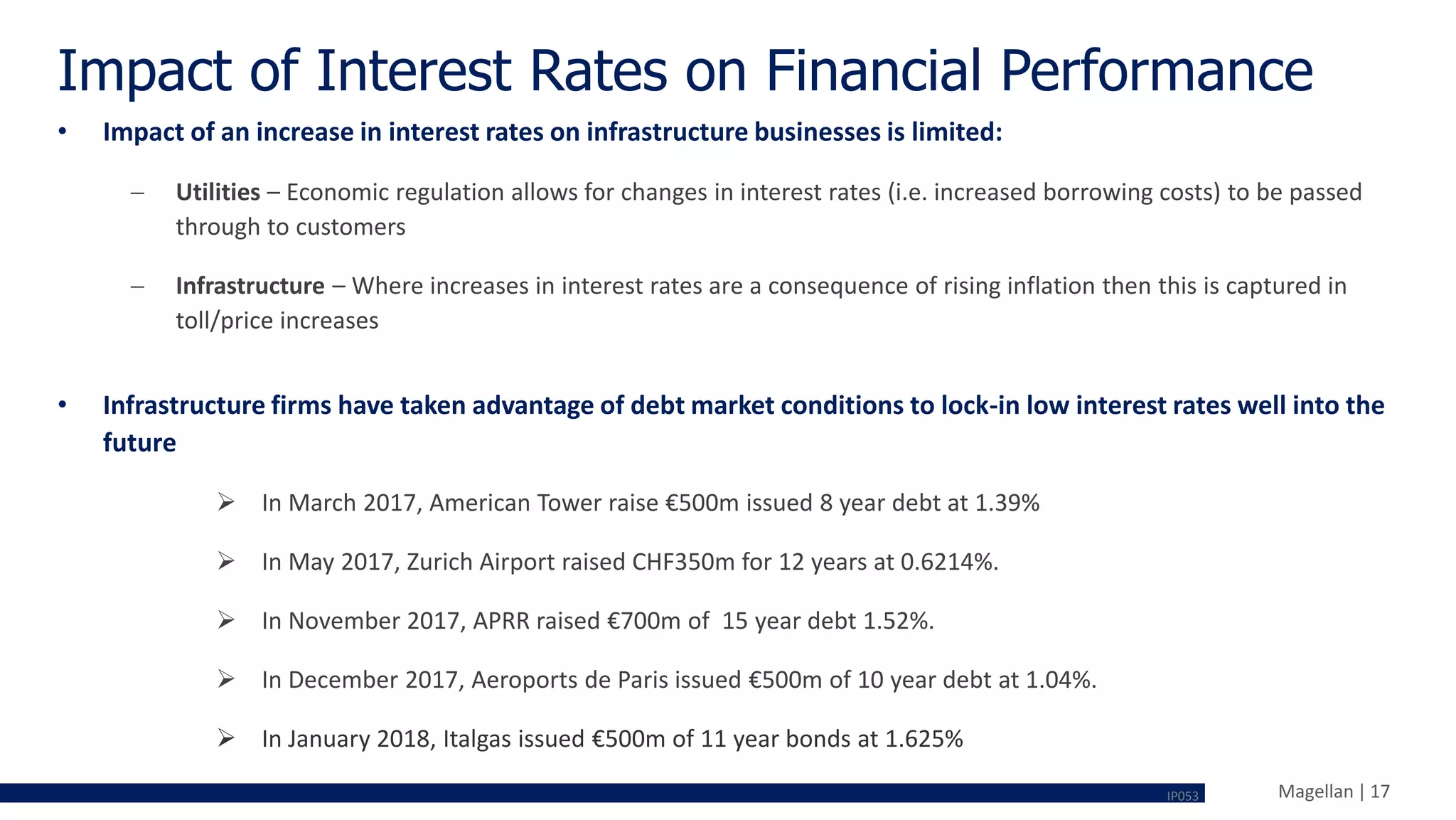

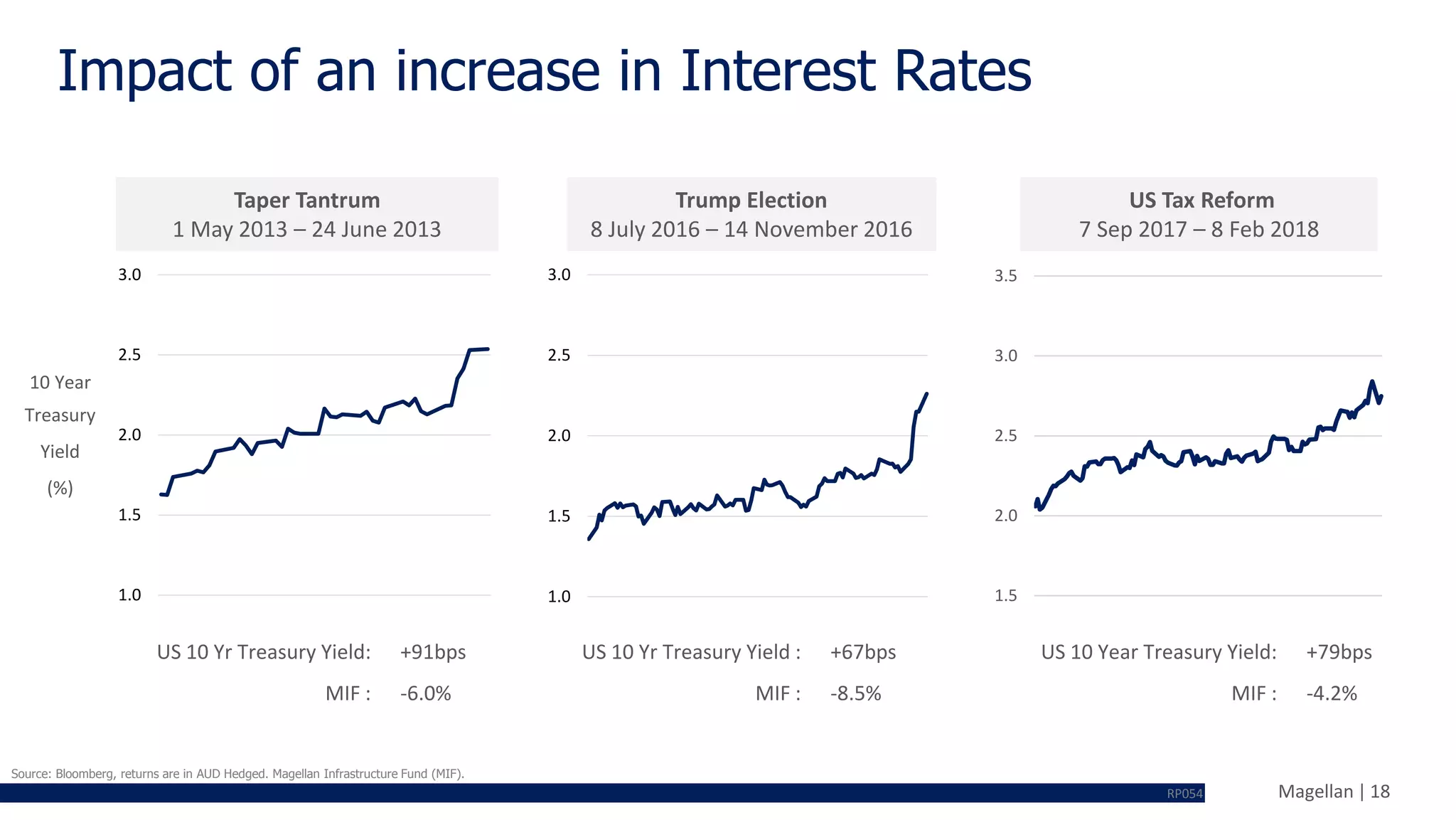

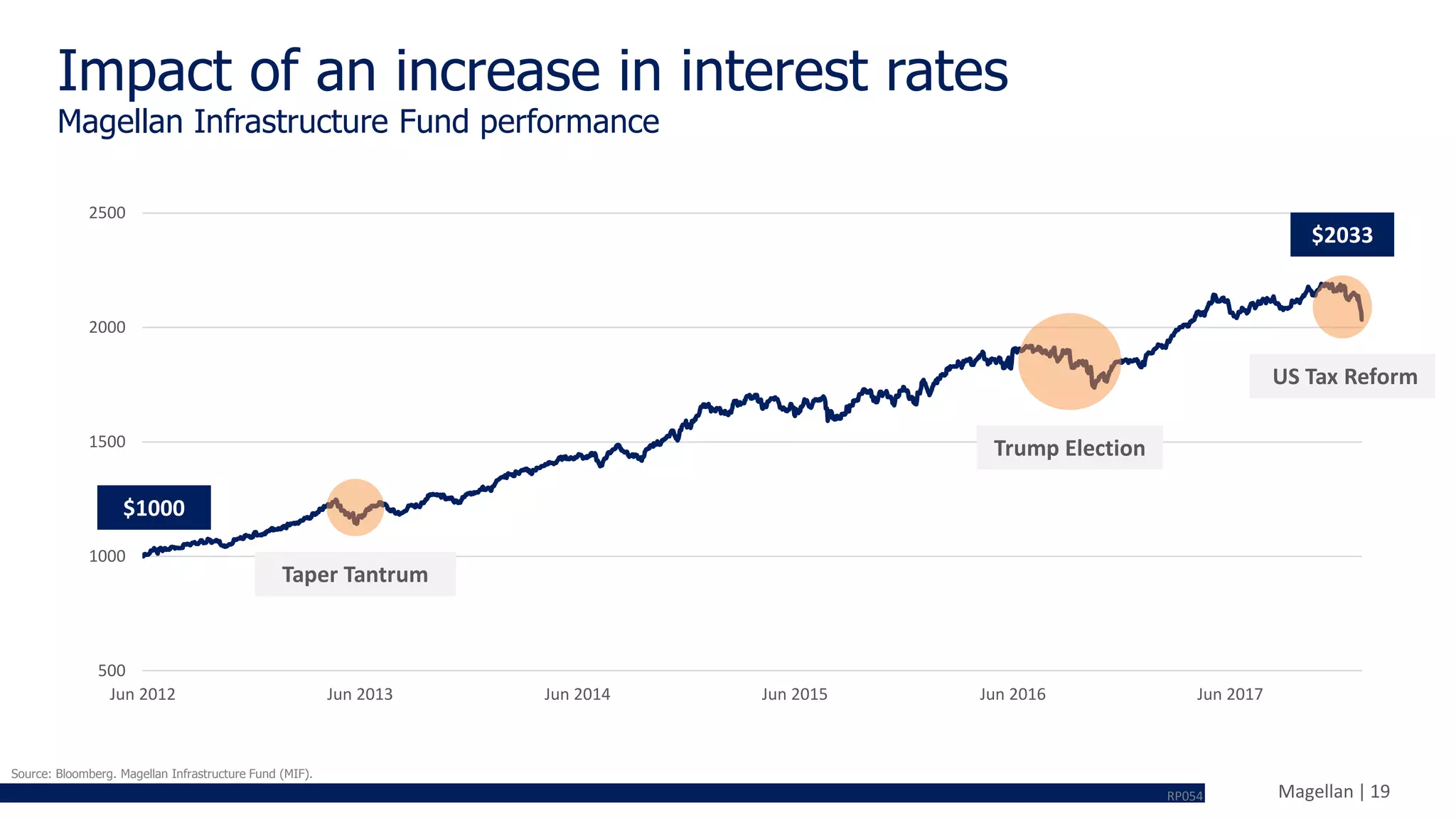

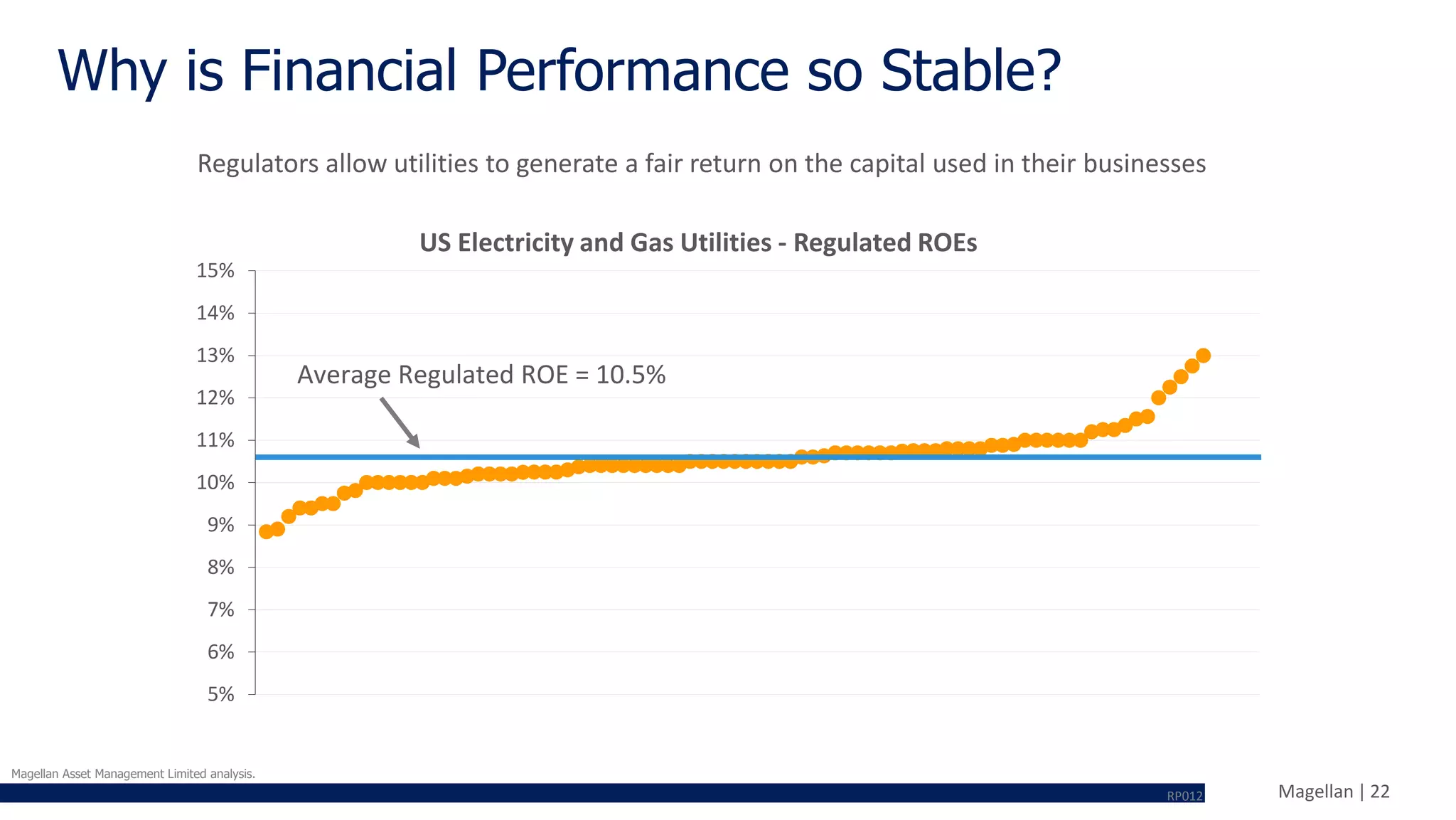

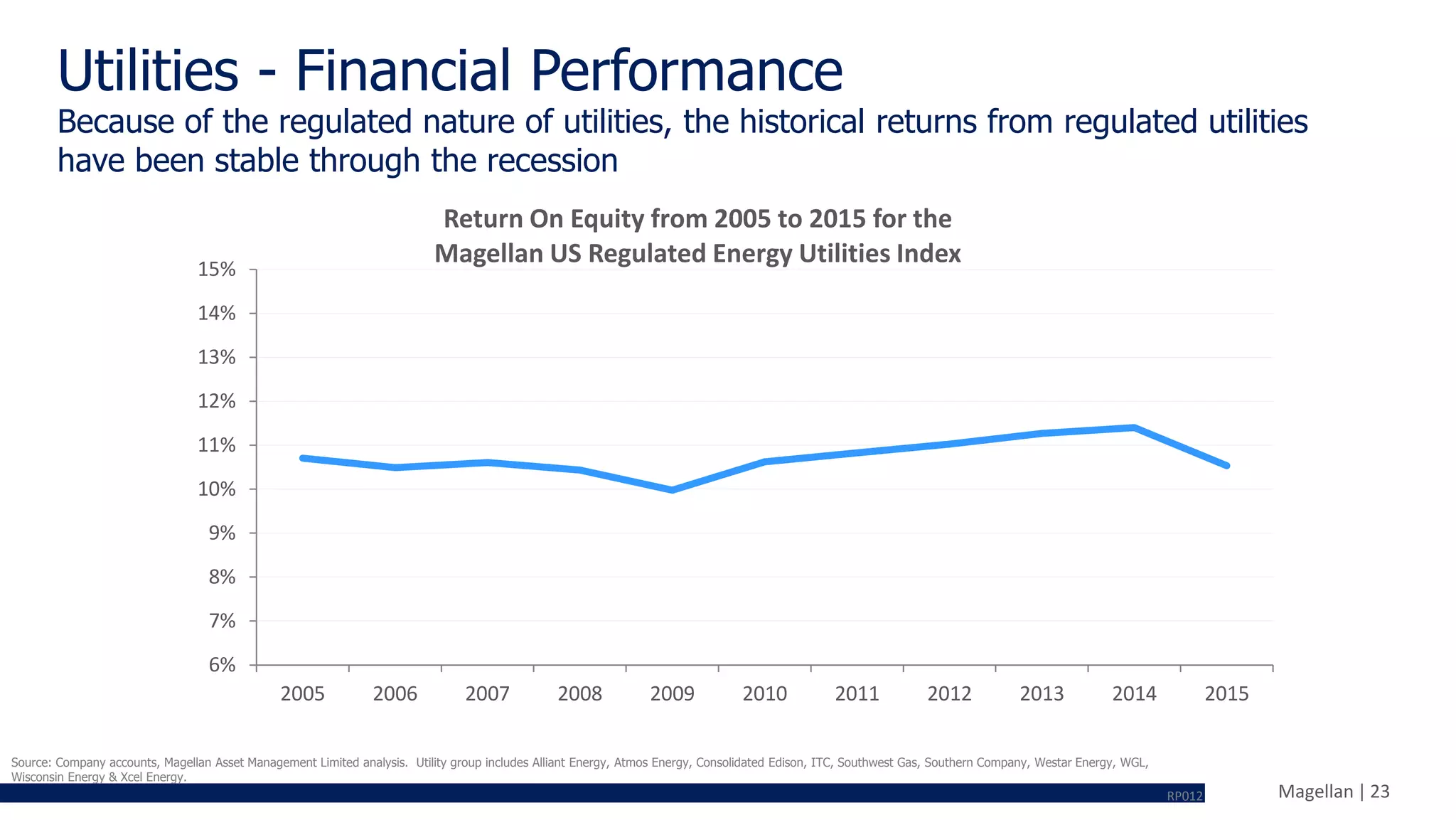

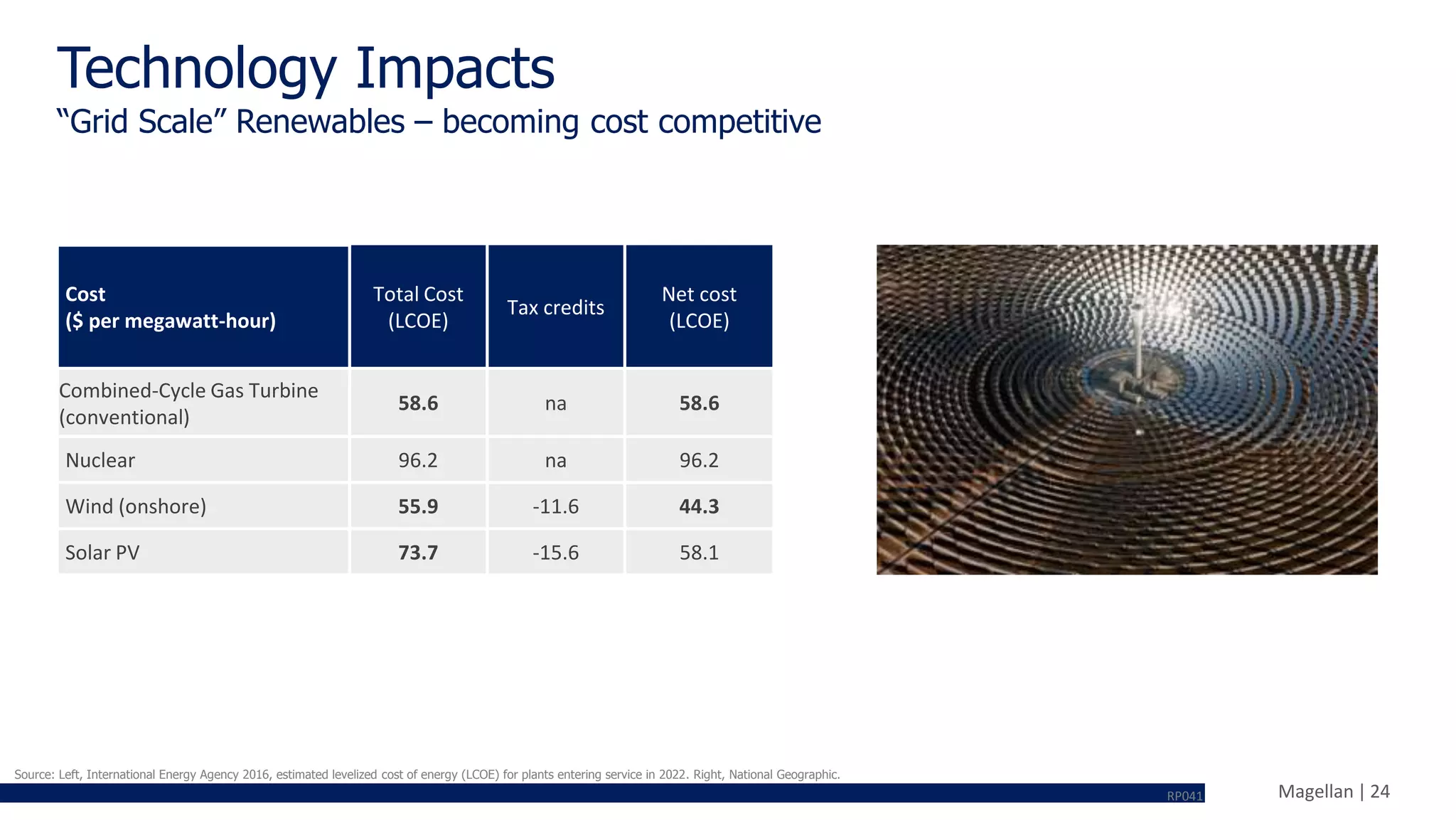

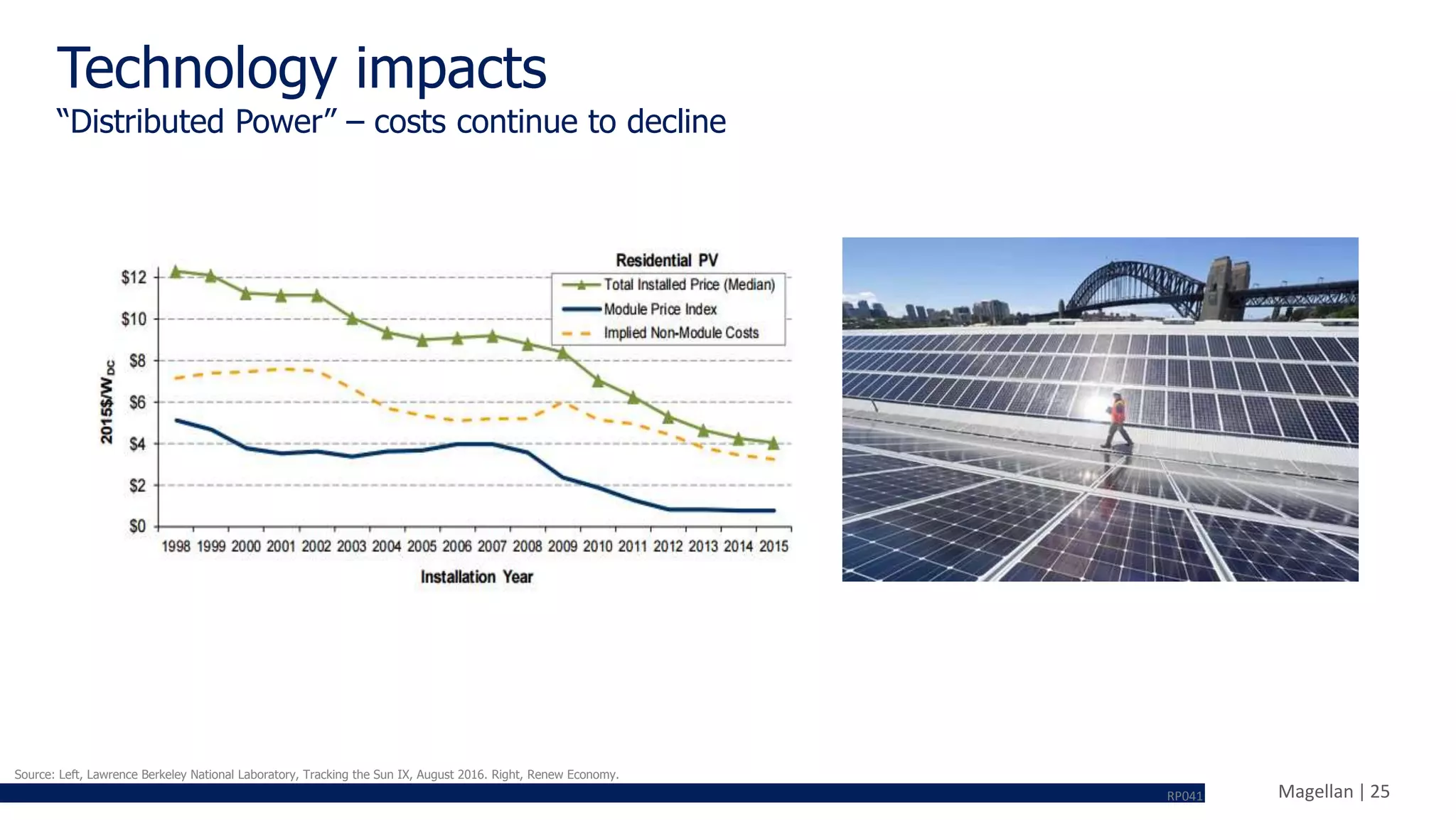

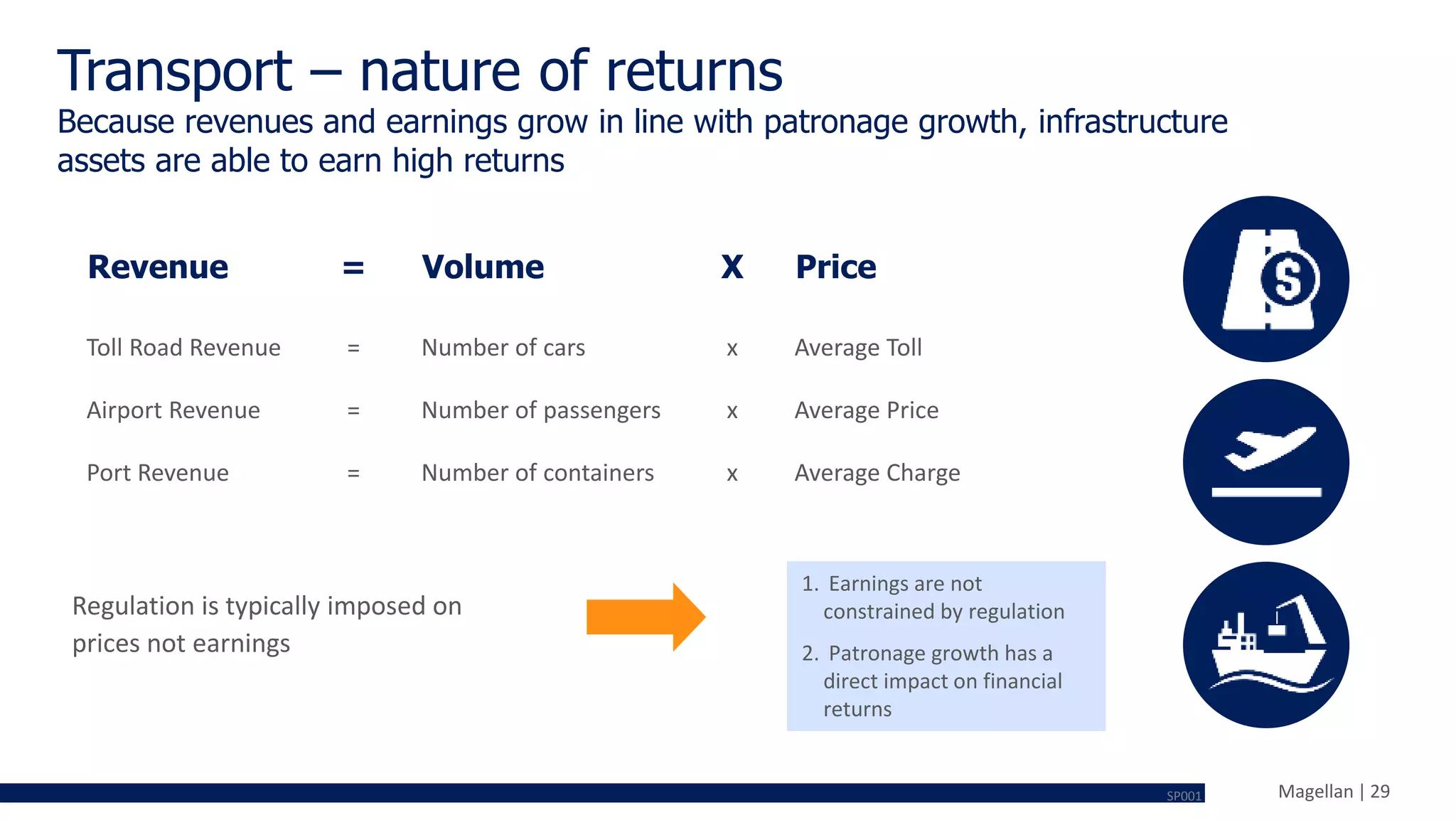

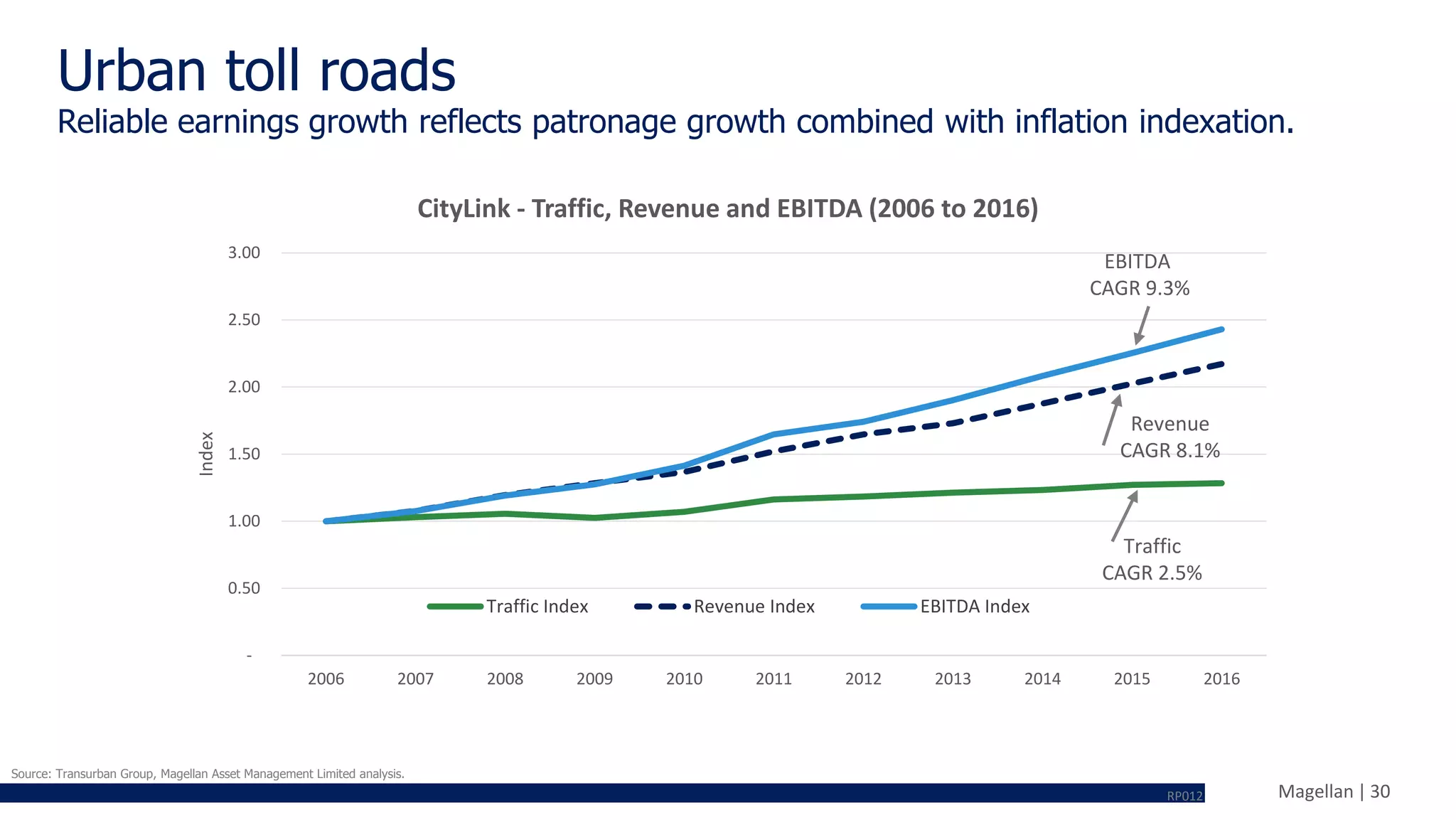

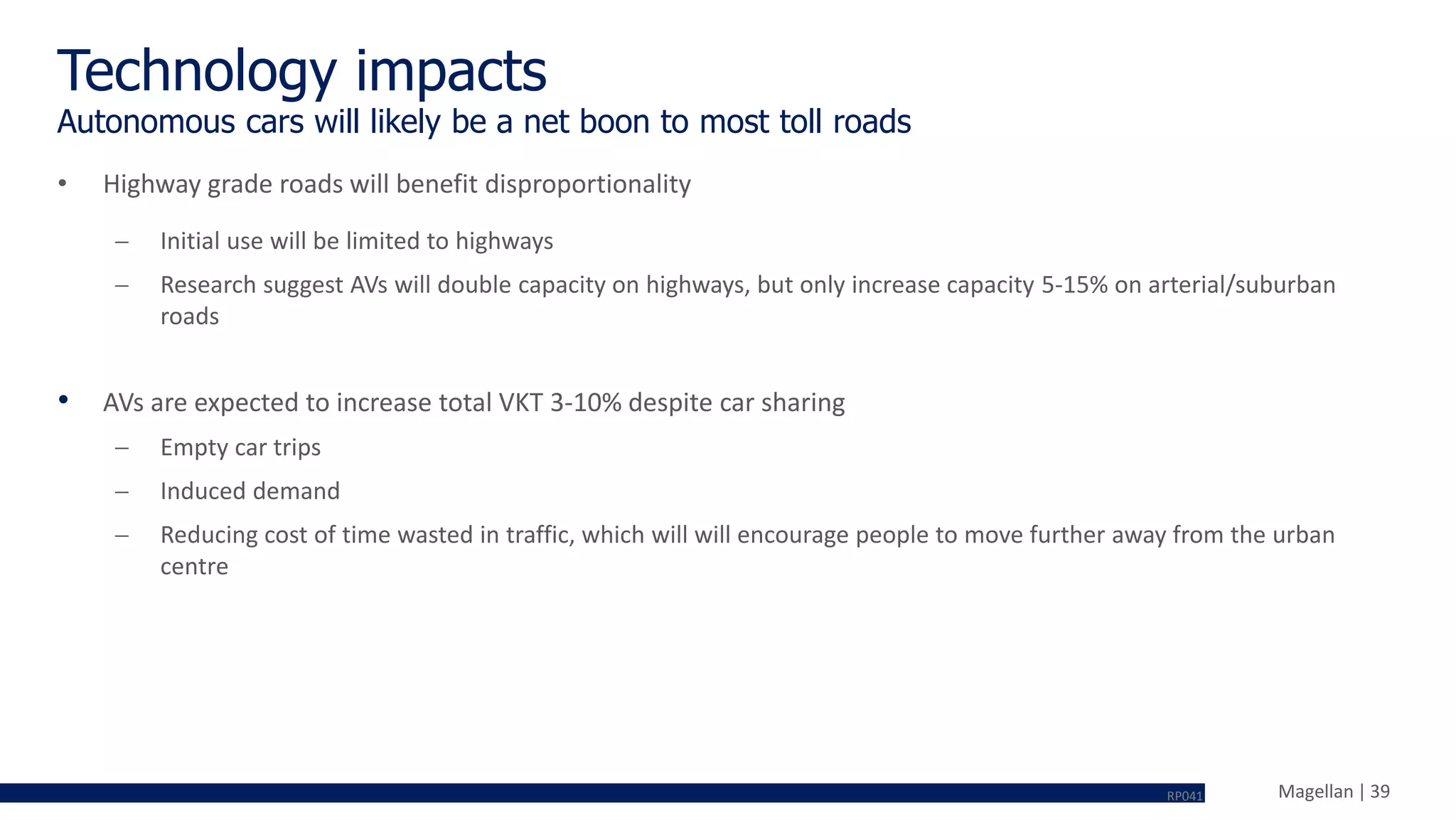

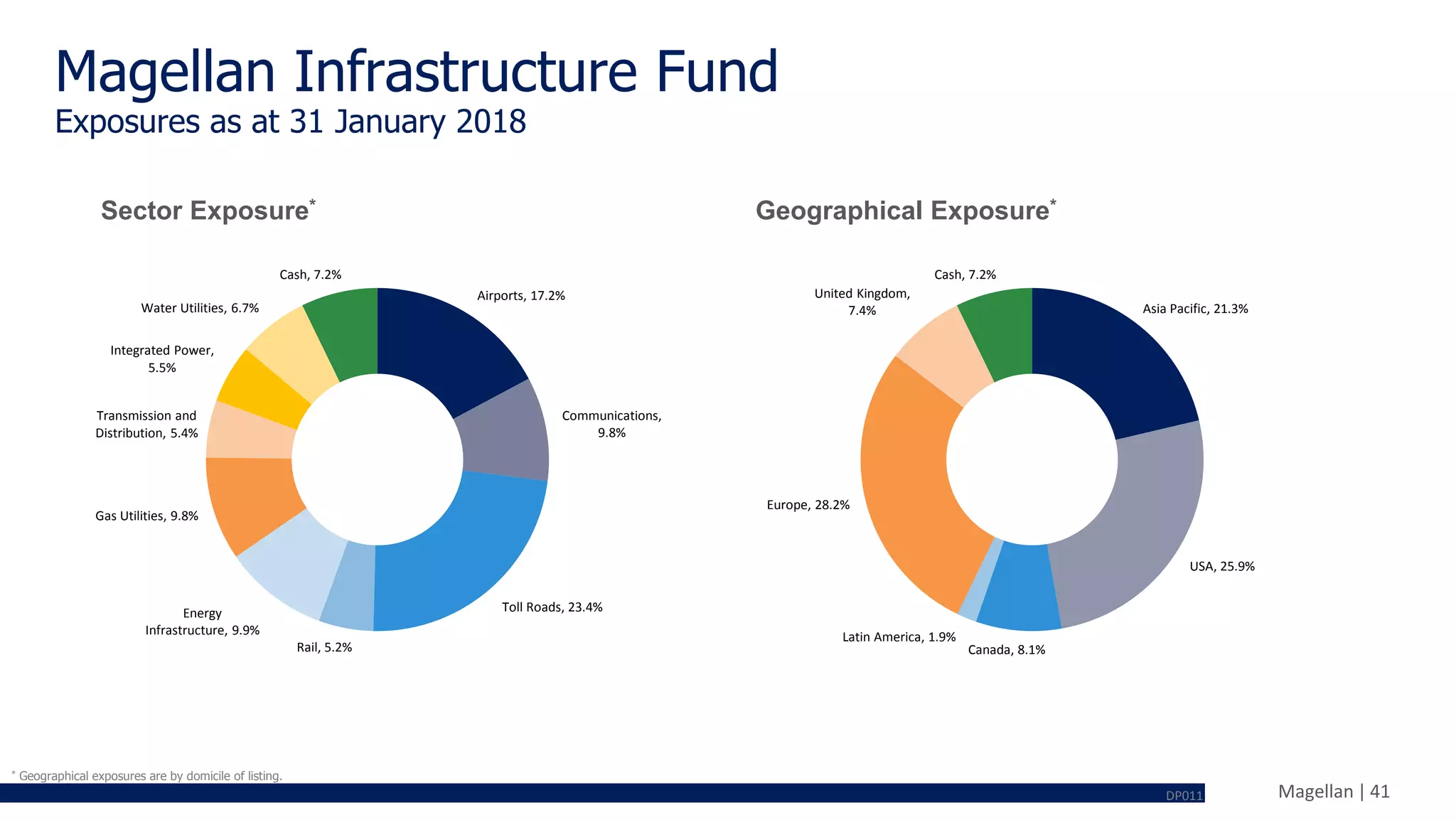

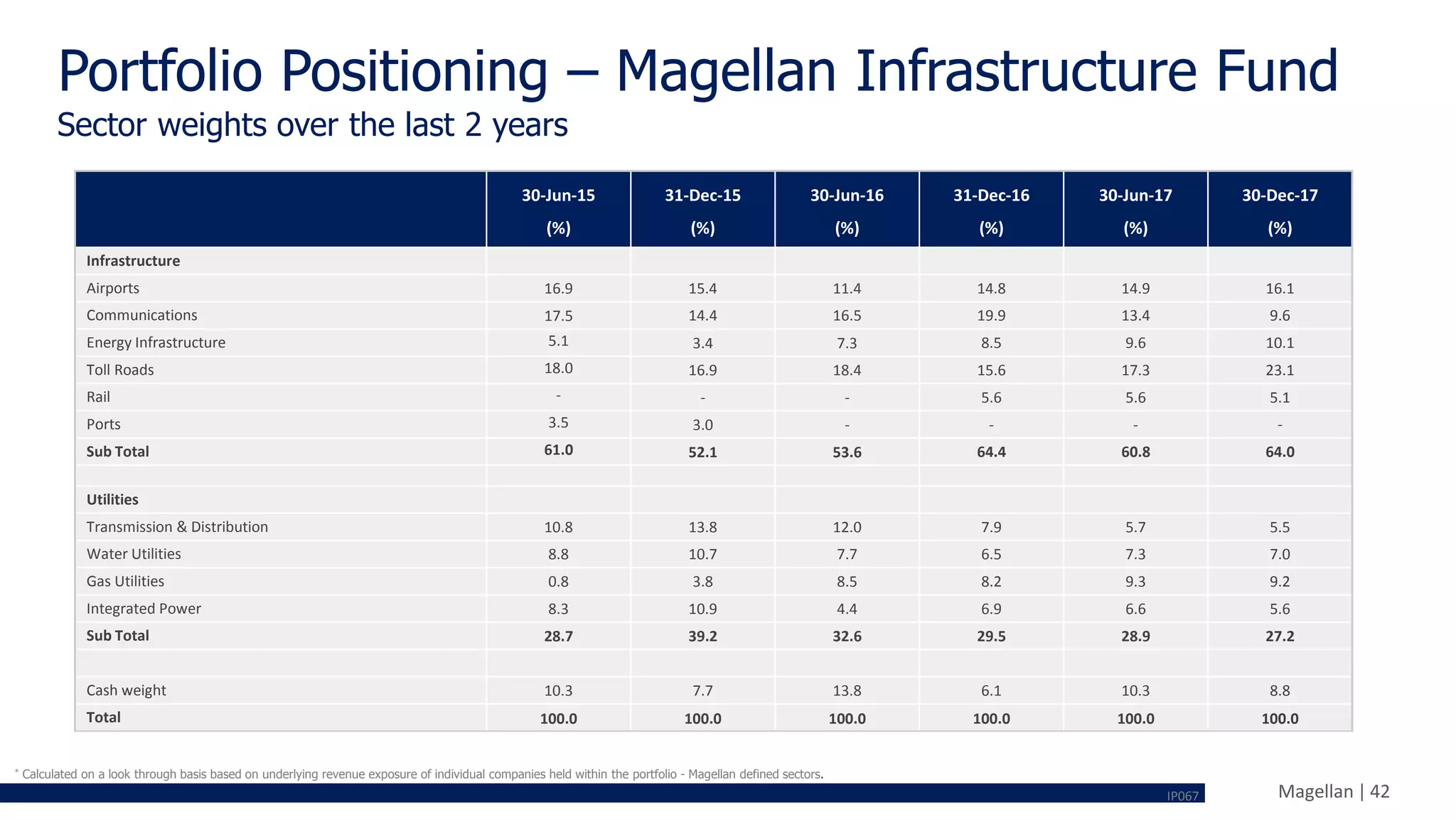

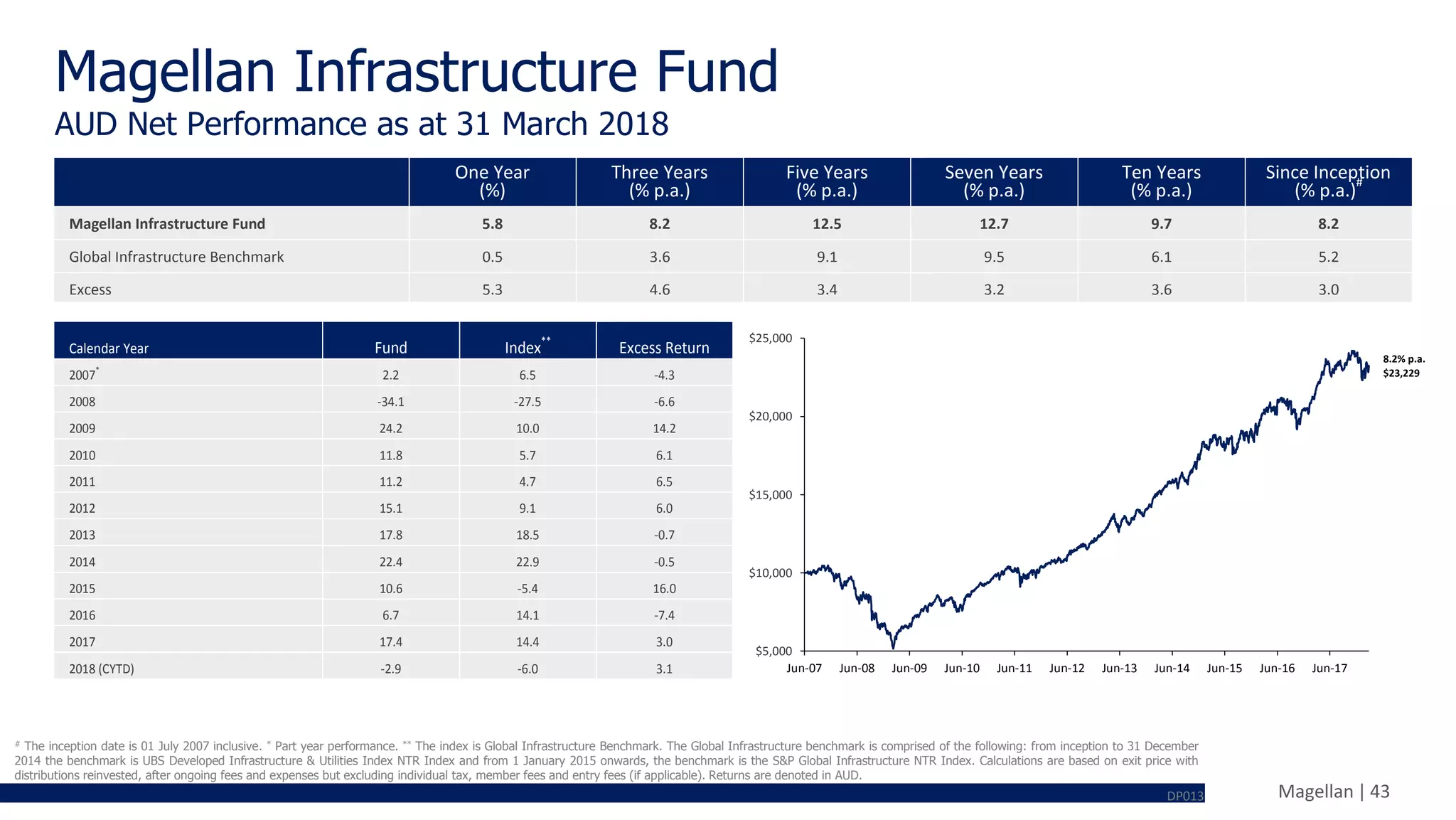

The webinar presented by Ofer Karliner from Magellan Asset Management discusses the importance of defined infrastructure investments for achieving stable returns and capital protection. It outlines that 'infrastructure' assets should be essential for community functioning and have predictable cash flows, distancing from competitive risks. The presentation emphasizes the performance of infrastructure investments compared to global benchmarks and how regulatory frameworks contribute to stable financial returns.