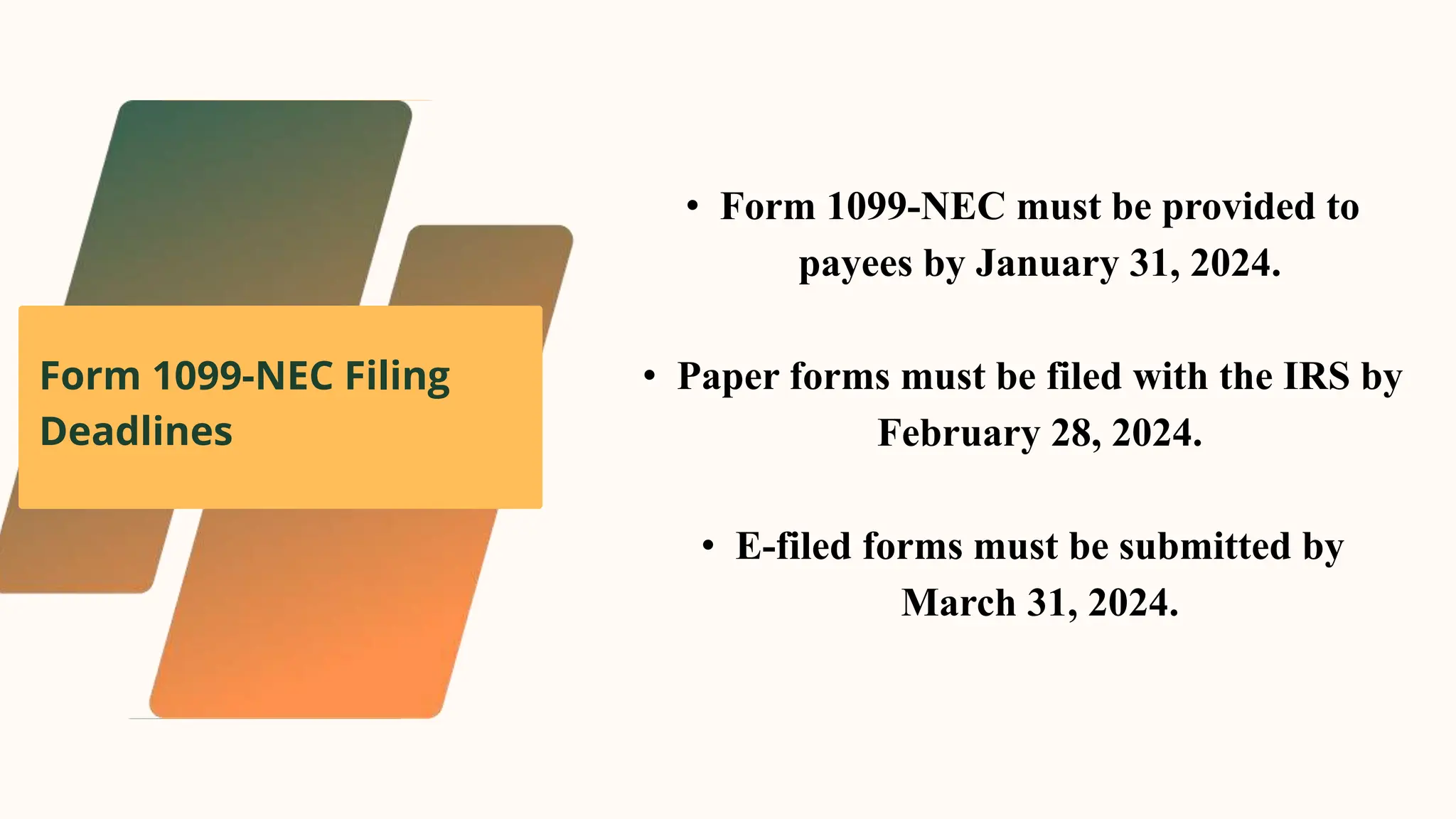

The document outlines Form 1099-NEC reporting requirements for income earned in the gig economy, specifically highlighting that payments over $600 must be reported. Businesses utilizing gig platforms are required to file this form, which includes various types of compensation but excludes expense reimbursements. Key deadlines for providing the form to payees and filing with the IRS are also specified.