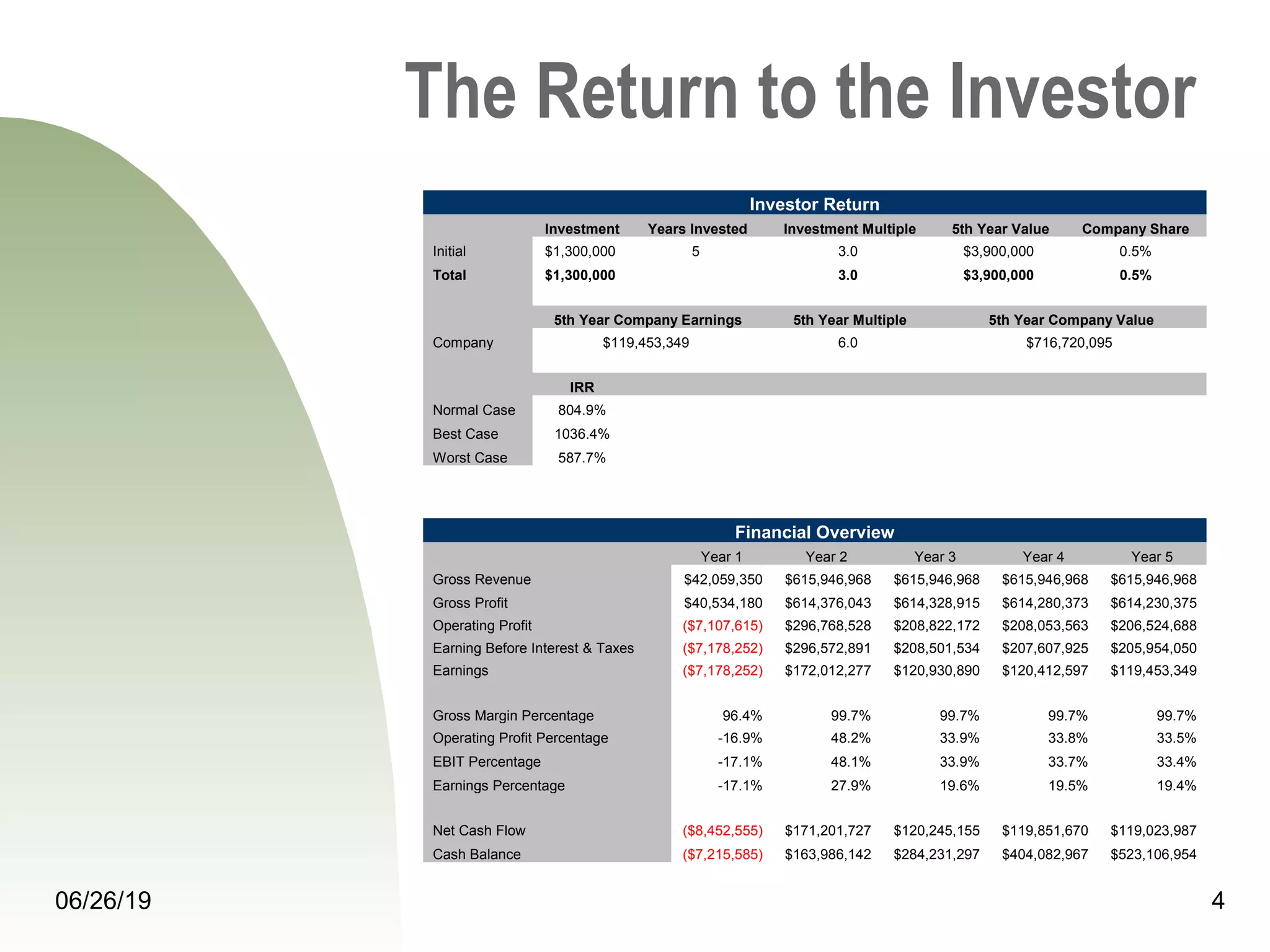

Nascent Applied Methods & Endeavors (NAME) is seeking $1.3 million in investment. It will use funds to acquire existing companies, found educational facilities, develop e-commerce platforms, market services, and hire staff. The company projects $42.1 million in revenue in 2020, growing to over $615 million by 2021 and $3.2 billion by the 5th year as it develops business models and applications using genetic and molecular sciences. It aims to have no direct competitors due to its unique approach and services.

![06/26/19 8

The Financials

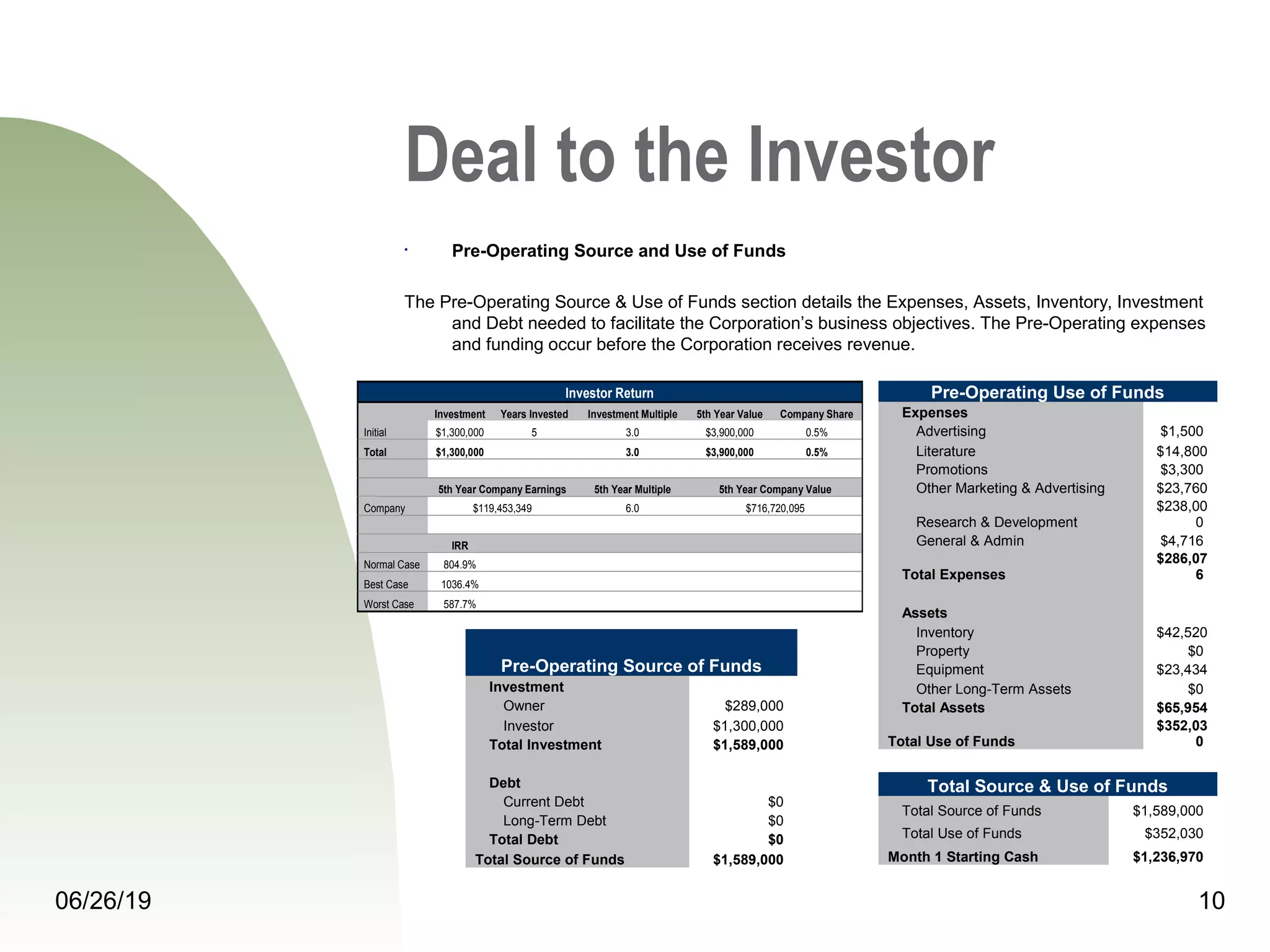

Funding:

• NAME is currently seeking an investment in the amount of $1.3 million or more in exchange for

stock.

Use of Proceeds:

• Acquisition of existing Dot-Com(s) with established customer-bases for use as a distribution

channel & to secure initial round of investments.

• The founding of a series of monetary resources used to finance traditional federal, state & local

networked educational or academic support facilities or think tanks

• Preparation development for expansion.

• Beta testing e-commerce platforms for global experimental R&D Joint-Ventures.

• Marketing business models & copyright or patent upgrade services and products.

• Hiring key internal staff or outsourcing.

• Assembly of Investment Advisory Board, etc.

Revenue Forecast:

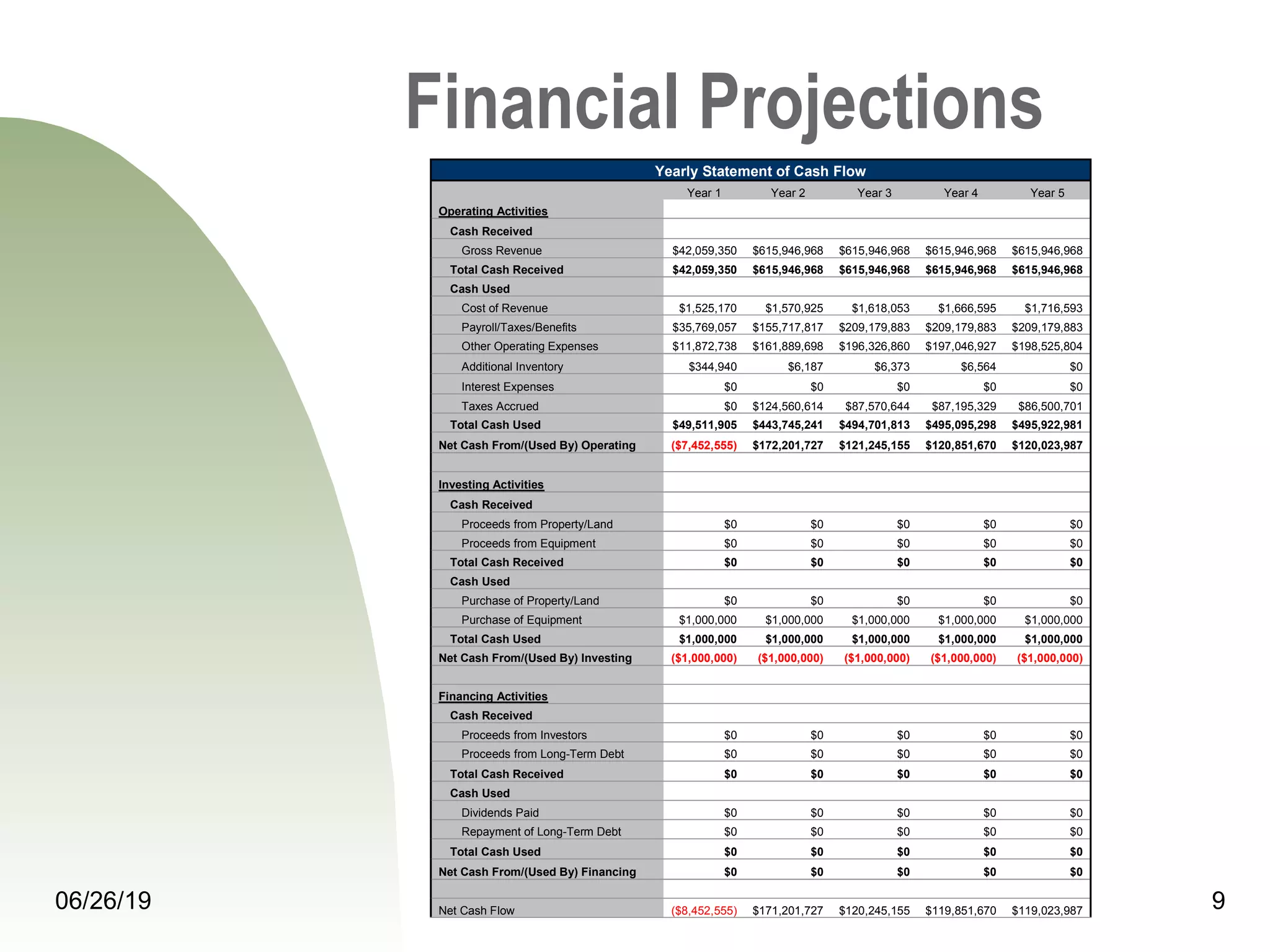

• 2020: $42.1 million

• 2021: $615.1 million

• 2022: $617.4 million

Financial Highlights:

• The Company projects to reach over $3.2 billion in revenue by the 5th year of operations with high

gross margin figures as there are limited direct costs. The Company will be able to break-even

very quickly with the limited costs and high profit margins. Nascent Applied Methods & Endeavors

expects payroll to account for 56% of revenue in the first year and reaching 15% of total revenue in

the 5th year.

• Projected revenues derived from advertising monies associated with the IBOS[DOSA/DALP/IAOA]

technology bases.

• The Pursuit of the Financial Perspective Involving the Implementation of a Da Vinci Kamasutra

Business Modeling of Global Market Economies.

• A Singular Global Economic Mindset from an Integrated Listing of over 600 World Economists Into

a Single Alphanumeric Equation.](https://image.slidesharecdn.com/nascentappliedmethodsendeavors-190626115517/75/Nascent-Applied-Methods-Endeavors-PPT-8-2048.jpg)