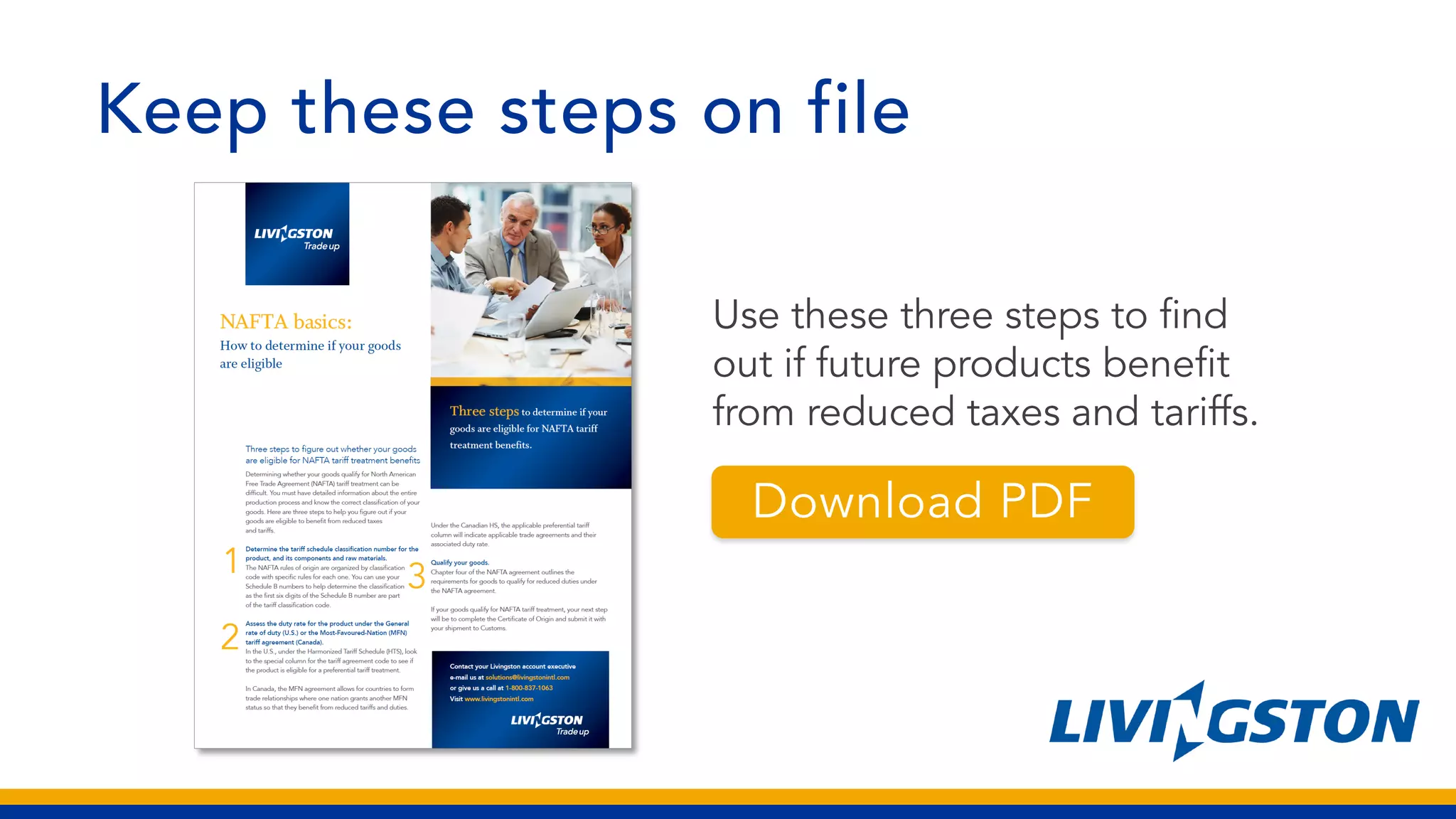

The document outlines three steps to determine if goods are eligible for NAFTA benefits, including reduced duty rates. It details the need for classification of goods using tariff schedule codes, assessment of duty rates in both the U.S. and Canada, and finally, the qualification process as per NAFTA rules. To qualify for reduced duties, a certificate of origin must be completed and submitted with the shipment.