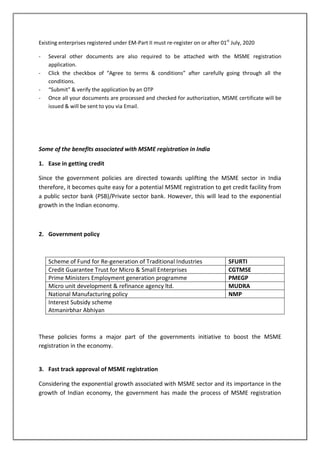

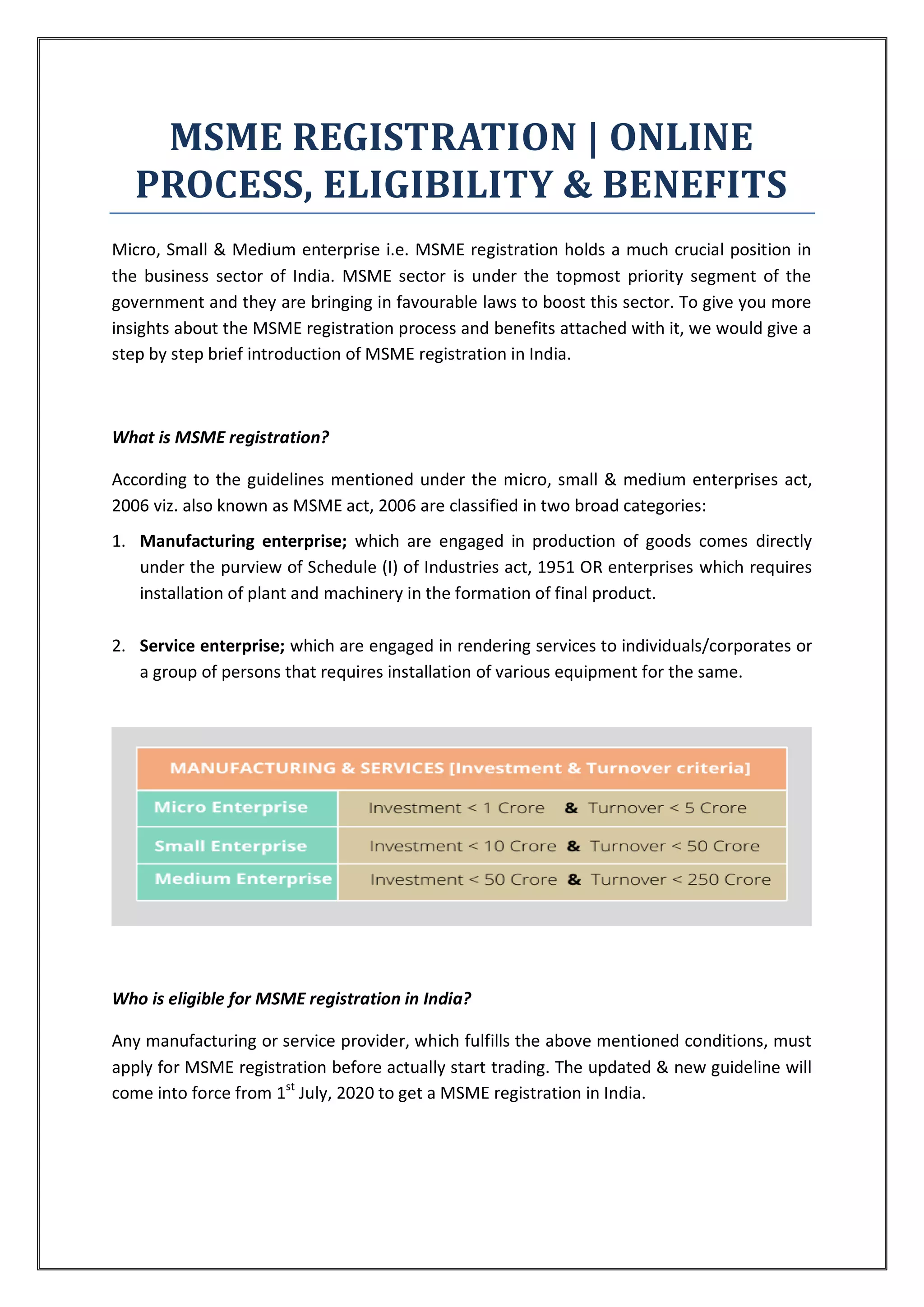

The document outlines the MSME (Micro, Small & Medium Enterprises) registration process in India, detailing its significance to the business sector and eligibility criteria as per the MSME Act of 2006. It describes the online registration procedure and highlights several benefits, including easier access to credit, government policies for support, and a special grievance monitoring system. Additionally, it mentions various initiatives aimed at boosting MSME growth and offers contact information for assistance.

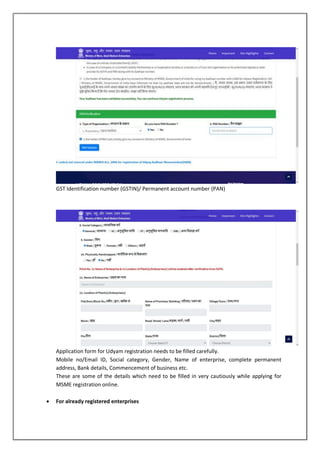

![What is the process of MSME registration/Udyam registration in India?

- Login to Udyam registration portal [https://udyamregistration.gov.in/]

- Choose the appropriate category under which your business lies

For new entrepreneurs

Aadhaar card details & subsequent verification](https://image.slidesharecdn.com/msmeregistrationsunil-201103113206/85/MSME-REGISTRATION-ONLINE-PROCESS-ELIGIBILITY-BENEFITS-2-320.jpg)