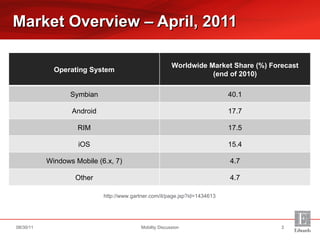

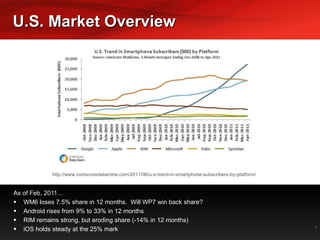

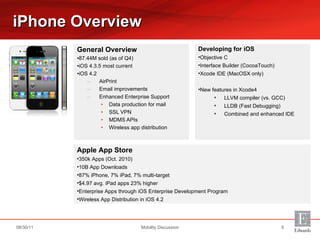

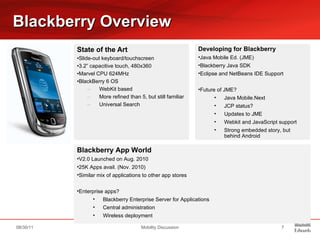

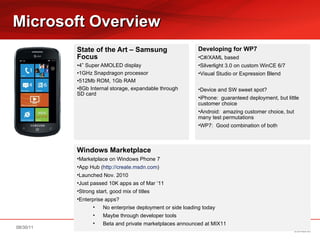

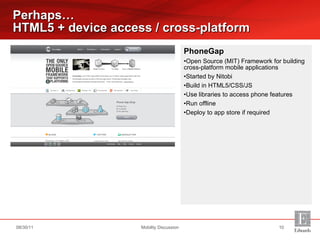

The document discusses mobility trends and platforms including iOS, Android, BlackBerry, Windows Phone 7, and mobile web frameworks. It provides an overview of each platform's market share, development tools and languages, app stores, and enterprise support. Key statistics mentioned include 40,000 iPhone activations per day, over 80 Android handsets/30 tablets, and Microsoft spending $1B on Windows Phone 7 marketing.