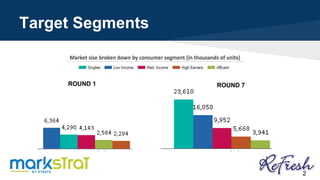

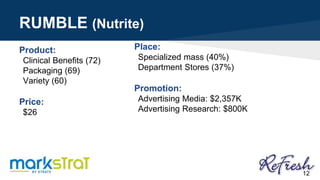

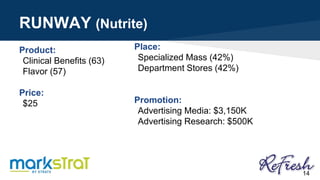

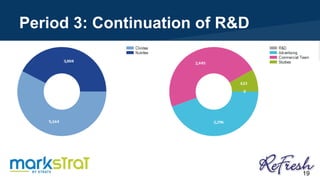

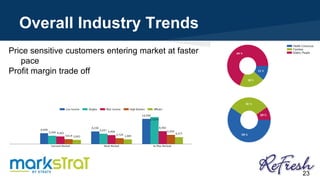

1. The document outlines a company's product targeting and marketing strategies over multiple periods in a simulation. They initially targeted low income consumers but realized private brands would dominate that segment, so switched to targeting singles and median income consumers.

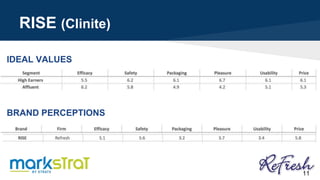

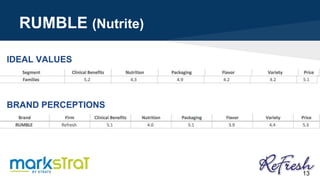

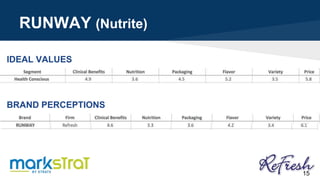

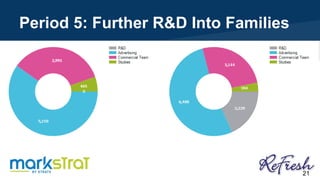

2. They underestimated competition in some segments like affluent consumers but found success targeting health conscious consumers as first movers. They preempted competitors by developing family-oriented products.

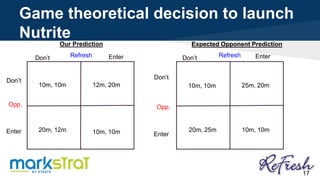

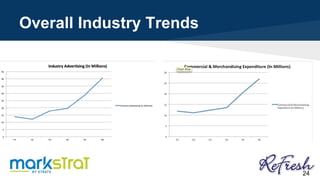

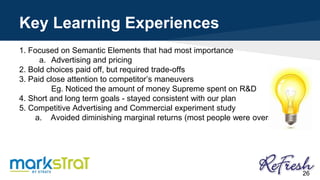

3. Both successes with strategic targeting and failures from underestimating competitors are discussed. Key lessons included focusing on important elements like advertising, making bold choices with tradeoffs, and paying close attention to competitors.