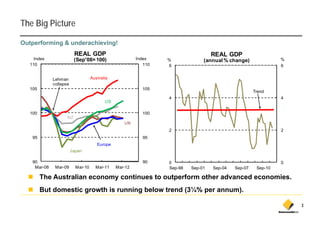

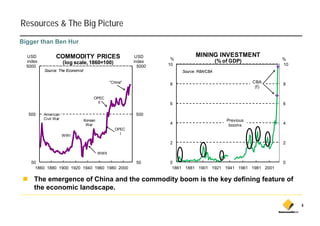

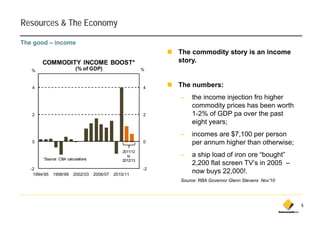

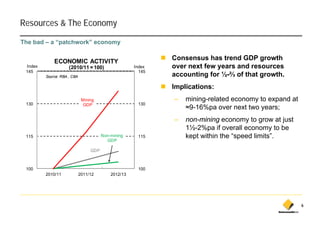

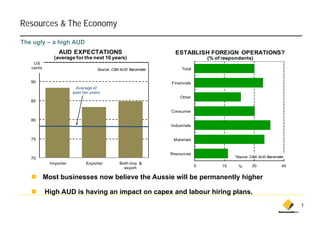

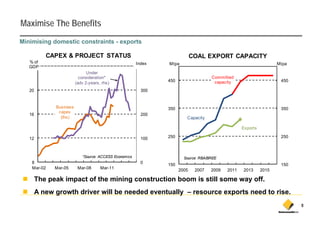

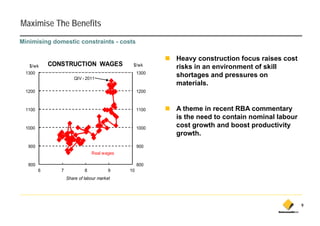

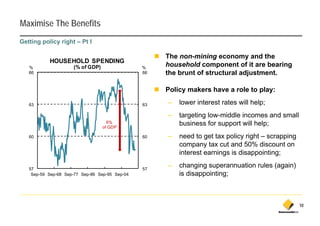

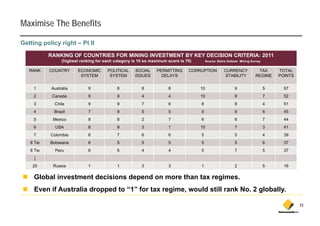

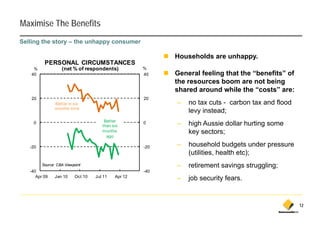

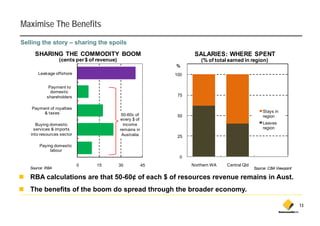

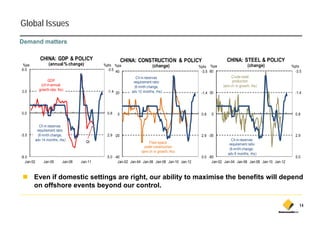

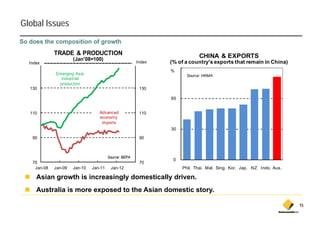

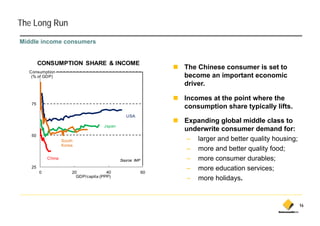

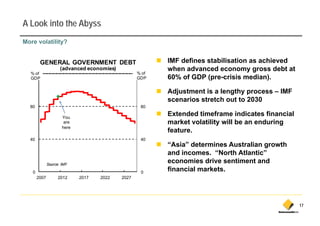

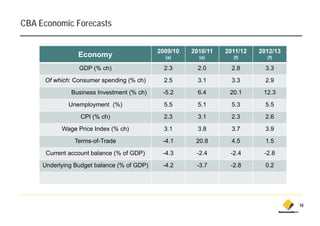

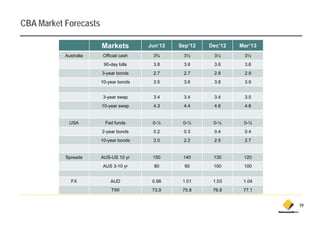

The document discusses the Australian economy's performance, particularly in relation to global commodity markets and the influence of China. It highlights the impacts of high commodity prices on income and economic growth, alongside concerns about a high Australian dollar and its effects on various sectors. The piece concludes with insights on household sentiments regarding resource benefits and economic forecasts moving forward.