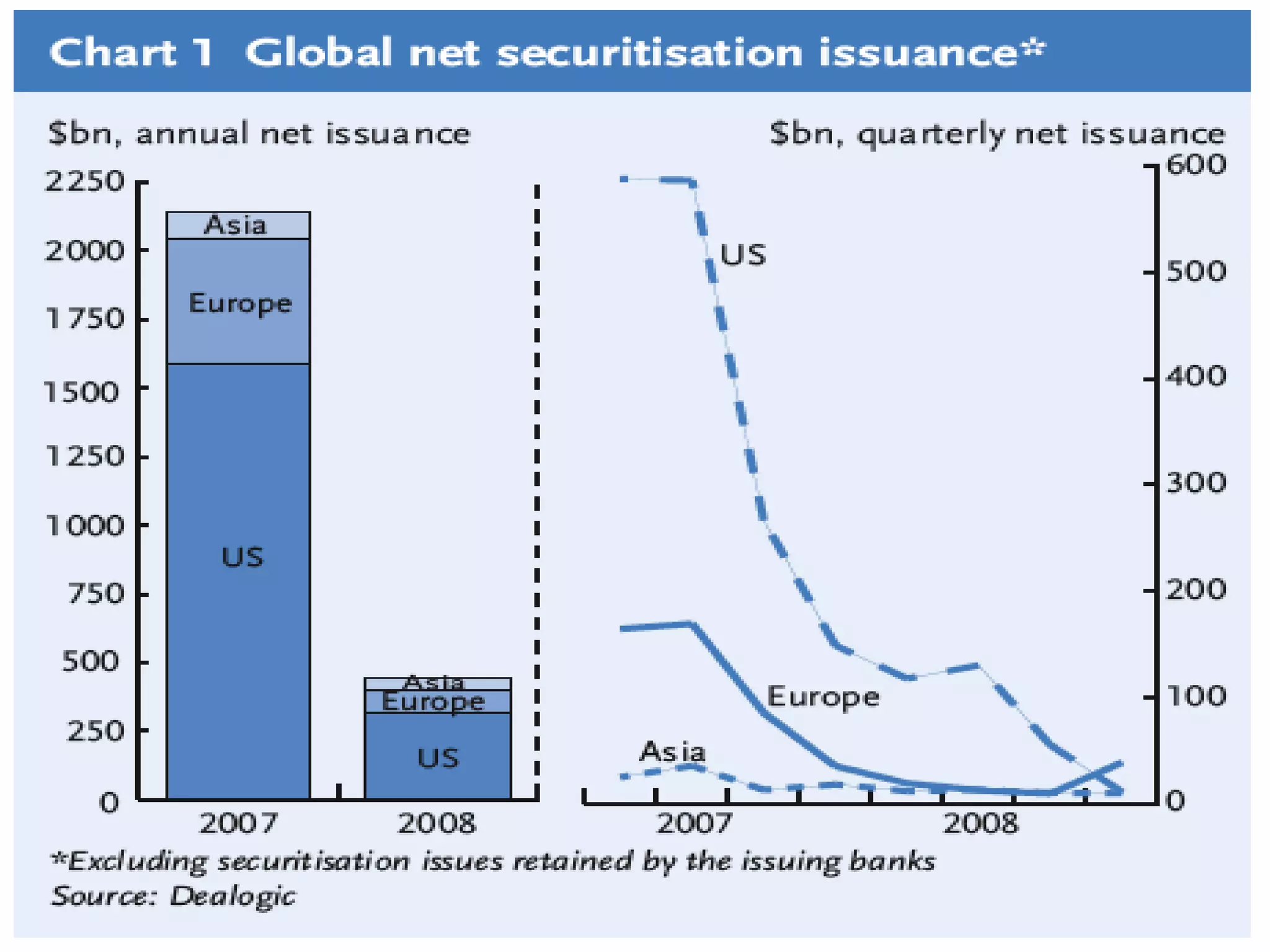

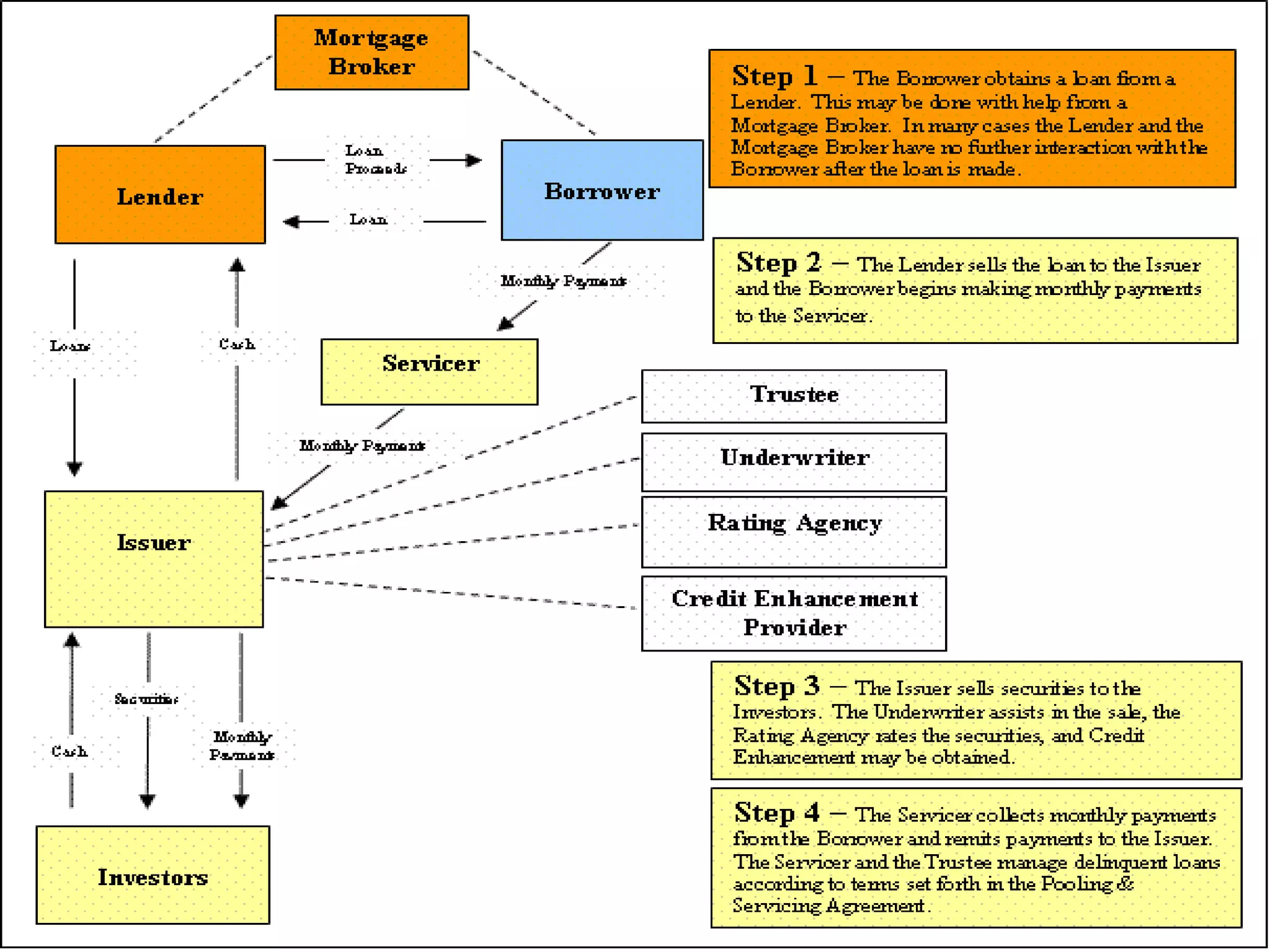

Securitization involves pooling financial assets like loans and repackaging them into securities that are sold to investors. This process reduces risk for lenders by transferring it to investors. However, it also creates incentive problems by focusing only on quantitative loan data rather than qualitative soft information about borrowers. During the subprime crisis, overreliance on securitization led banks to make riskier loans that they offloaded, fueling a bubble. When borrowers defaulted, the financial system suffered as the risks spread widely through complex securities. Government intervention was needed to rescue failing banks and stabilize the markets.