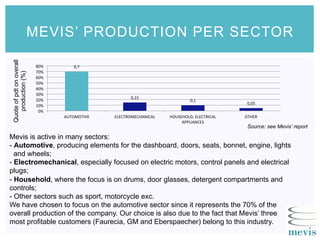

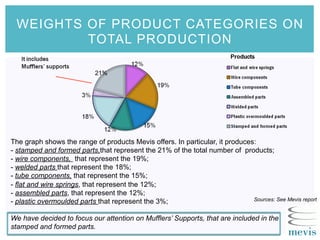

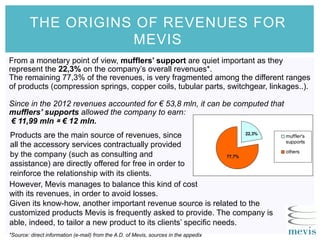

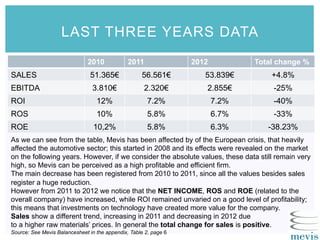

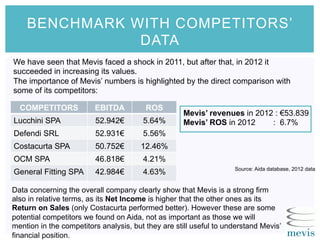

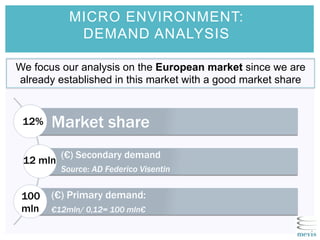

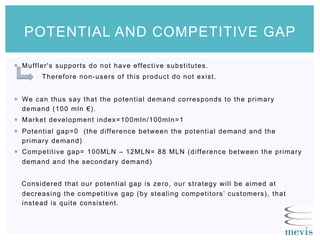

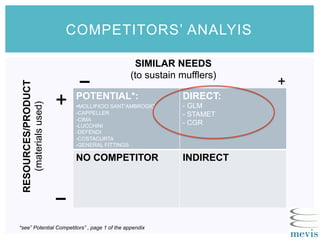

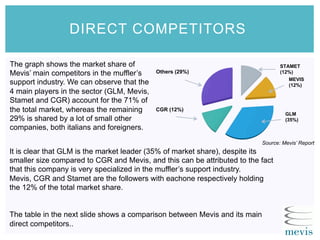

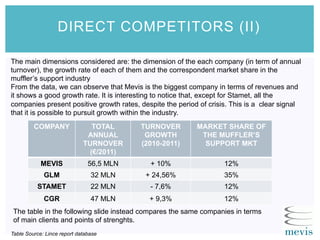

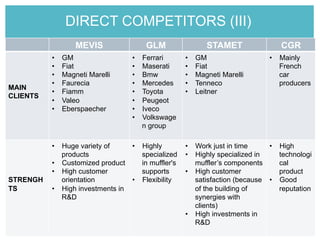

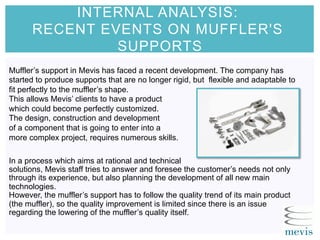

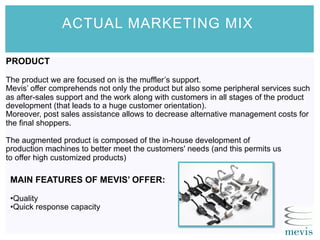

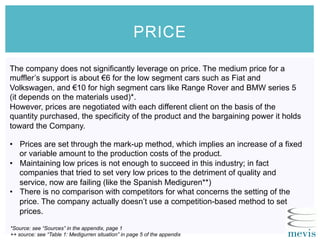

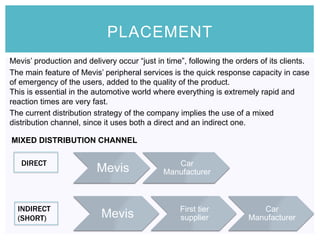

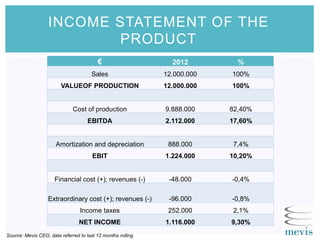

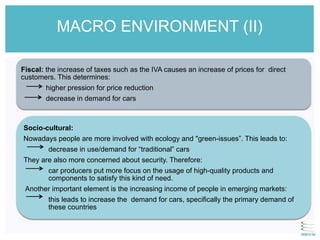

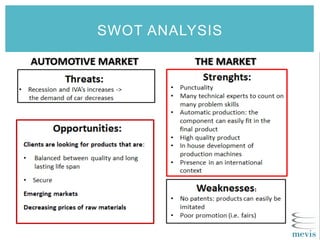

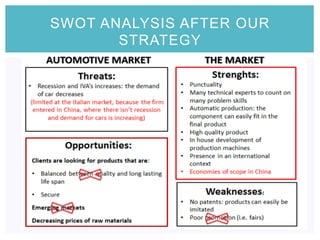

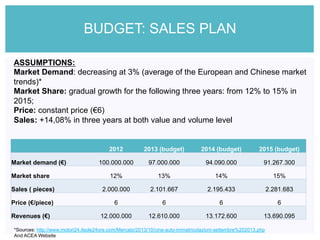

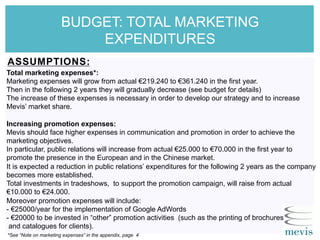

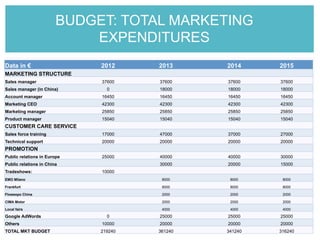

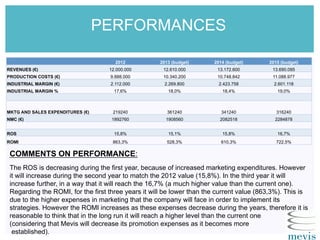

The document outlines Mevis S.p.A.'s marketing plan, detailing its history, production focus, and strategic objectives in the automotive sector, particularly in muffler supports. It includes analyses of the macro and micro environments, competitor landscape, and financial performance, emphasizing the importance of quality, customer satisfaction, and technological innovation in their operations. The plan also identifies market opportunities and threats while illustrating the company's commitment to tailored solutions and relationships with clients.