This document is a dissertation report submitted by Mayank for their Master's degree. The report examines the changing consumer preferences towards organized retailing from unorganized retail in India. It includes an introduction to the Indian retail industry, the major players in the industry, and types of retail. The primary study section outlines the objectives and methodology of the research, which involved collecting data through a questionnaire from 100 customers in Udaipur District to analyze consumer attitudes.

![60

3. How did you make your most recent purchase?

[ ] Online 30

[ ] By phone 10

[ ] By mail/catalogue 15

[ ] In-person/in-store 15

[ ]Through a dealer 20

[ ] Other (please specify) 10

organized

retail

40%

Unorganized

retail

30%

Depends

not fixed

30%

Chart Title](https://image.slidesharecdn.com/b4c40bb2-f5f6-40fd-9075-72edaa7346d5-150622175800-lva1-app6892/85/mayank-dissertation-61-320.jpg)

![63

6. What do you shop, how often from where?

[Organized Retail: - o.r. Unorganized Retail: - U.R.]

Daily Weekly Bimonthly Monthly O.R. U.R.

Vegetables 20 30 10 20 10 10

Grocery(DalRice,Wheat) 20 10 15 5 20 30

v- mart

40%

bigbazar

40%

other

20%

Chart Title](https://image.slidesharecdn.com/b4c40bb2-f5f6-40fd-9075-72edaa7346d5-150622175800-lva1-app6892/85/mayank-dissertation-64-320.jpg)

![66

Other 30

9. What is your gender?

[ ]Male 64

[ ]Female 36

price

40%

place

30%

other

30%

Chart Title](https://image.slidesharecdn.com/b4c40bb2-f5f6-40fd-9075-72edaa7346d5-150622175800-lva1-app6892/85/mayank-dissertation-67-320.jpg)

![67

10. What is your age?

[ ] 18 as under 20

[ ] 19-35 50

[ ] 36-50 20

[ ] 50 or more 10

male

64%

Female

36%

Chart Title](https://image.slidesharecdn.com/b4c40bb2-f5f6-40fd-9075-72edaa7346d5-150622175800-lva1-app6892/85/mayank-dissertation-68-320.jpg)

![68

11. What is your annual household income?

[ ]Under 25000 pm. 30

[ ]25000-50000 20

[ ]50000-75000 20

<18

20%

19-35

50%

36-50

20%

> 50

10%

Chart Title](https://image.slidesharecdn.com/b4c40bb2-f5f6-40fd-9075-72edaa7346d5-150622175800-lva1-app6892/85/mayank-dissertation-69-320.jpg)

![69

[ ]75000-100000 15

[ ]100000 or More 15

12. Do you plan to continue to buy organized/unorganized retail?

[ ] Yes 54 [ ] No 46

35%

23%

24%

18%

Chart Title

<25000 25000-50000 50000-75000 75000-100000](https://image.slidesharecdn.com/b4c40bb2-f5f6-40fd-9075-72edaa7346d5-150622175800-lva1-app6892/85/mayank-dissertation-70-320.jpg)

![71

13. Are you a localite (based out of Dehradun) or are you from other place and

working here?

YES 56

NO 44

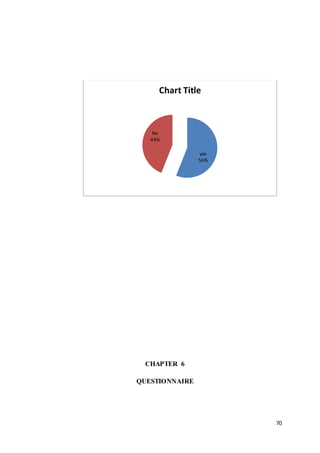

14. Do you prefer to Organized or Unorganized kirana shops for your purchase?

Organized Retail 40

Unorganized Retail 30

Depends/Not Fixed 30

15. How did you make your most recent purchase?

[ ] Online 30

[ ] By phone 10

[ ] By mail/catalogue 15

[ ] In-person/in-store 15

[ ]Through a dealer 20

[ ] Other (please specify) 10

16. How would you rate organized retailing in term of?

Excellent Very good Average Fair Poor

Courtesy and Service: 50 20 10 10 10](https://image.slidesharecdn.com/b4c40bb2-f5f6-40fd-9075-72edaa7346d5-150622175800-lva1-app6892/85/mayank-dissertation-72-320.jpg)

![72

Store Cleanliness: 45 20 15 10 10

Selection and Variety: 30 20 20 20 10

Produce Quality/Freshness: 15 15 20 20 30

Meat Quality/Freshness: 30 20 20 15 15

Dairy Quality/Freshness: 25 30 20 15 10

Bakery Quality/Freshness: 40 20 10 10 20

Regular Prices: 20 10 15 15 40

17. If you organized Retail, Which shop do you prefer?

v- Mart 40

Big Bazar 40

Other 20

18.What do you shop, how often from where?

[Organized Retail: - o.r. Unorganized Retail: - U.R.]

Daily Weekly Bimonthly Monthly O.R. U.R.

Vegetables 20 30 10 20 10 10

Grocery(DalRice,Wheat) 20 10 15 5 20 30

FMCG(Biscuit,Detergent,s

oaps)

30 20 25 5 5 15

Oil 20 30 20 10 10 10

Garments/Clothes 30 20 10 10 20 10](https://image.slidesharecdn.com/b4c40bb2-f5f6-40fd-9075-72edaa7346d5-150622175800-lva1-app6892/85/mayank-dissertation-73-320.jpg)

![73

Utensils 10 20 30 10 10 20

18. Why do you prefer to go for Organized Retail formats?

Less price 45

Near house 25

Other 30

19. Kindly rate the below of an organized retail and unorganized retail based

upon your preference?

Price 40

Place 30

Other 30

20. What is your gender?

[ ]Male 64

[ ]Female 36

21. What is your age?

[ ] 18 as under 20

[ ] 19-35 50

[ ] 36-50 20

[ ] 50 or more 10

22. What is your annual household income?

[ ]Under 25000 pm. 30

[ ]25000-50000 20](https://image.slidesharecdn.com/b4c40bb2-f5f6-40fd-9075-72edaa7346d5-150622175800-lva1-app6892/85/mayank-dissertation-74-320.jpg)

![74

[ ]50000-75000 20

[ ]75000-100000 15

[ ]100000 or More 15

23. Do you plan to continue to buy organized/unorganized retail?

[ ] Yes 54 [ ] No 46

CHAPTER 7

BIBLIOGRAPHY

Websites:

1. http://www.dnb.co.in/IndianRetailIndustry/issues.asp

2. http://digitalcommons.kennesaw.edu/cgi/viewcontent.cgi?article=1098&co

ntext=jekem

3. http://web.yonsei.ac.kr/dslab/Journal/Journal%20of%20International%20C

onsumer%20Marketing%20%202011.pdf](https://image.slidesharecdn.com/b4c40bb2-f5f6-40fd-9075-72edaa7346d5-150622175800-lva1-app6892/85/mayank-dissertation-75-320.jpg)