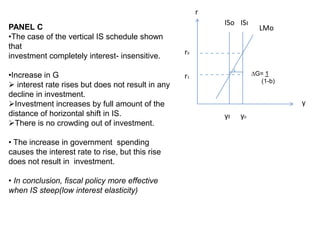

This document discusses the effectiveness of fiscal policy using the IS-LM model. It shows how an increase in government spending shifts the IS curve to the right. The degree of effectiveness depends on the slope of the IS curve, with a steeper curve indicating lower interest rate elasticity of investment. A steeper IS curve means fiscal policy has a greater impact on output as less crowding out of investment occurs from rising interest rates. The document demonstrates this concept through three panels showing different IS curve slopes.

![PANEL A r

•The IS schedule is steep, investment is LMo

relatively

interest inelastic

r1

•Less sensitive the investment is to interest

rate, more effective fiscal policy.

r0 ∆G= 1

• The horizontal distance of the shift in the (1-b)

schedule ∆G [1/ (1-b) ] meaning that the size

of the policy action as well as the

autonomous expenditure multiplier that the

simple Keynesian model as equal. ISo ISı

y

• When G rises, Y rises

r must rises to keep the money market in y0 yı

equilibrium

The rise in r causes investment to fall,

partially offsetting the expansionary effect of

the increase in G.

Interest rate induced declined in I causes

income response given by the multiplier.

• Income rises by less than the horizontal

shift in IS](https://image.slidesharecdn.com/makroslide-121019112617-phpapp01/75/Makro-silide-1-2048.jpg)

![r

PANEL B

• Shows the effects of an increase in

government spending in the case of a LMo

relatively flat IS schedule.

• The increase in government spending shifts r1

∆G= 1

r0

the IS schedule from IS0 to IS1 (1-b)

• The horizontal distance of the shift in the

schedule ∆G [1/ (1-b) ] meaning that the size ISı

of the policy action as well as the autonomous ISo

y

expenditure multiplier that the simple y0 yı

Keynesian model as equal.

• This fiscal policy action is much less effective

in panel B, where the IS schedule is relatively

flat.

• Income in Panel B, increased less than

income Panel A because fiscal policy more

effective when IS steep(low interest elasticity).](https://image.slidesharecdn.com/makroslide-121019112617-phpapp01/85/Makro-silide-2-320.jpg)