This document contains a report analyzing bond prices, yield curves, and a bond portfolio over time. It includes the following key points:

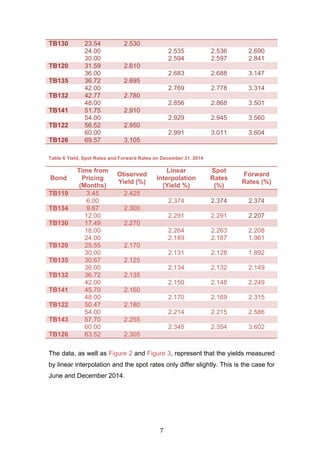

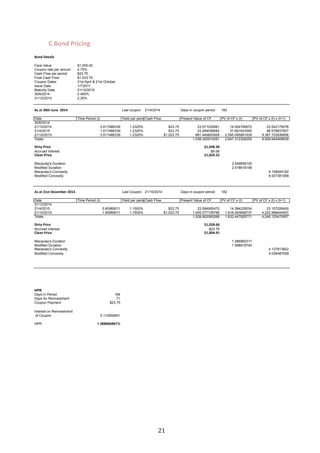

- Bond prices from June 30th to December 31st decreased for short-term bonds but increased for mid-to-long term bonds, due to changes in yield.

- Duration, a measure of price sensitivity, increased over time for longer-term bonds but decreased for shorter-term bonds. The portfolio's duration decreased from June to December as its average maturity shortened.

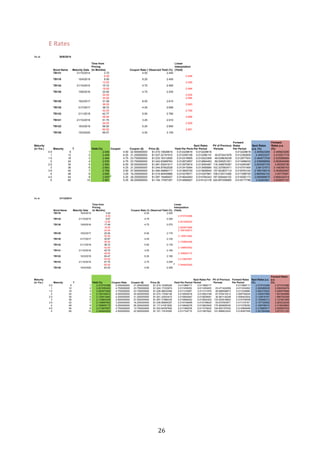

- Yield curves, spot curves, and forward curves were constructed using bond data from the two dates. Forward rates were higher than spot rates, indicating an upward sloping yield curve and expected rising interest rates