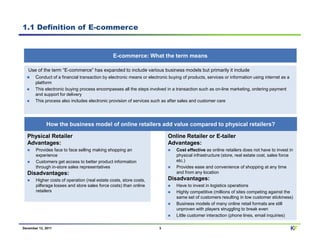

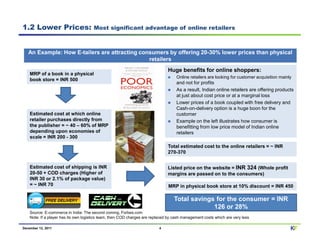

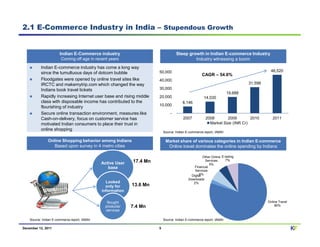

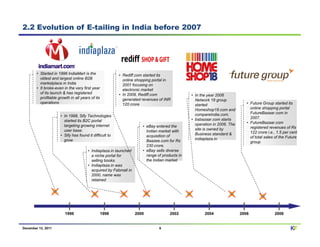

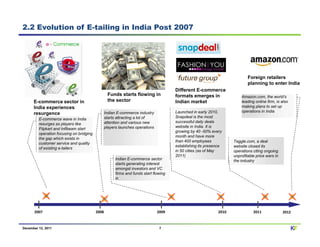

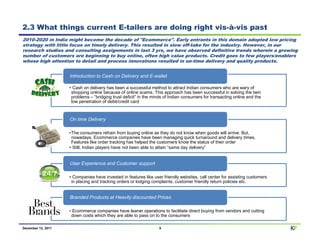

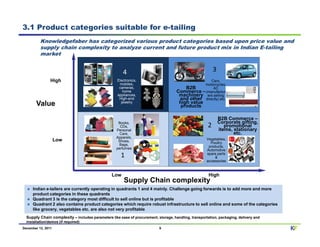

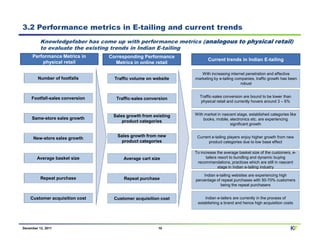

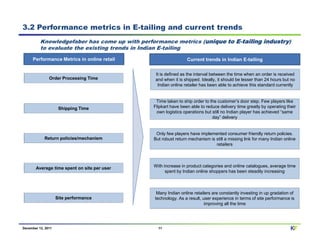

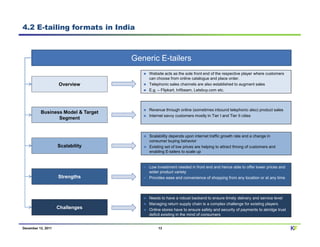

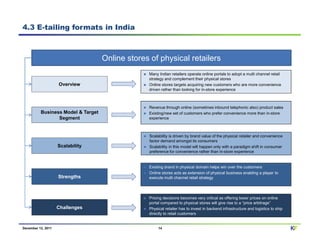

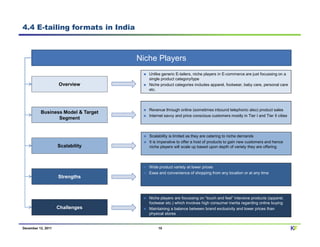

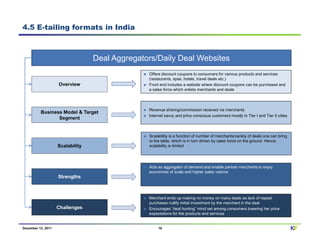

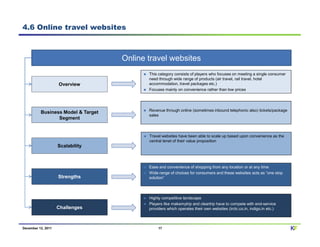

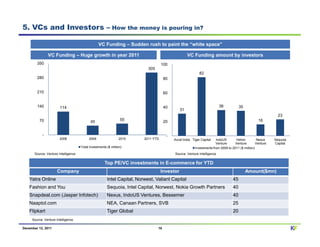

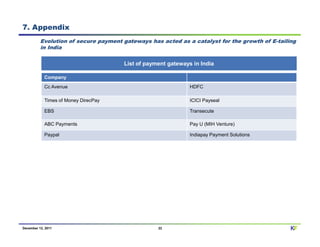

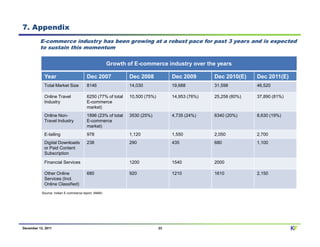

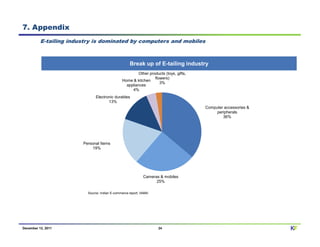

The document provides a comprehensive analysis of the e-tailing landscape in India, detailing the evolution of e-commerce from its inception to the current trends and future projections. It highlights the rapid growth of the Indian e-commerce market, driven by an increase in internet users, innovative payment options like cash-on-delivery, and the emergence of various e-tailing formats. Additionally, the report examines the operational challenges faced by online retailers and the strategies they adopt to enhance customer trust and streamline supply chains.