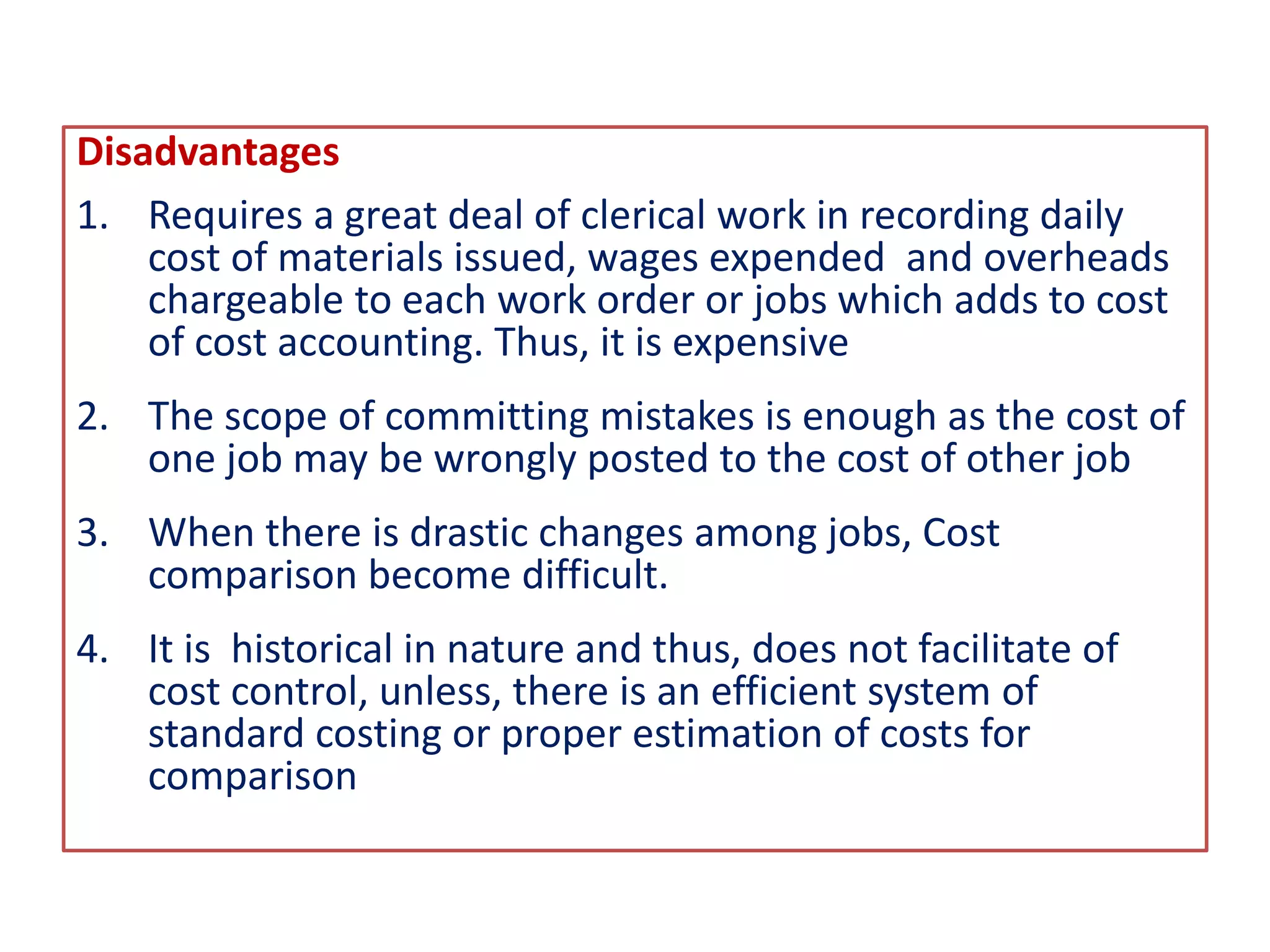

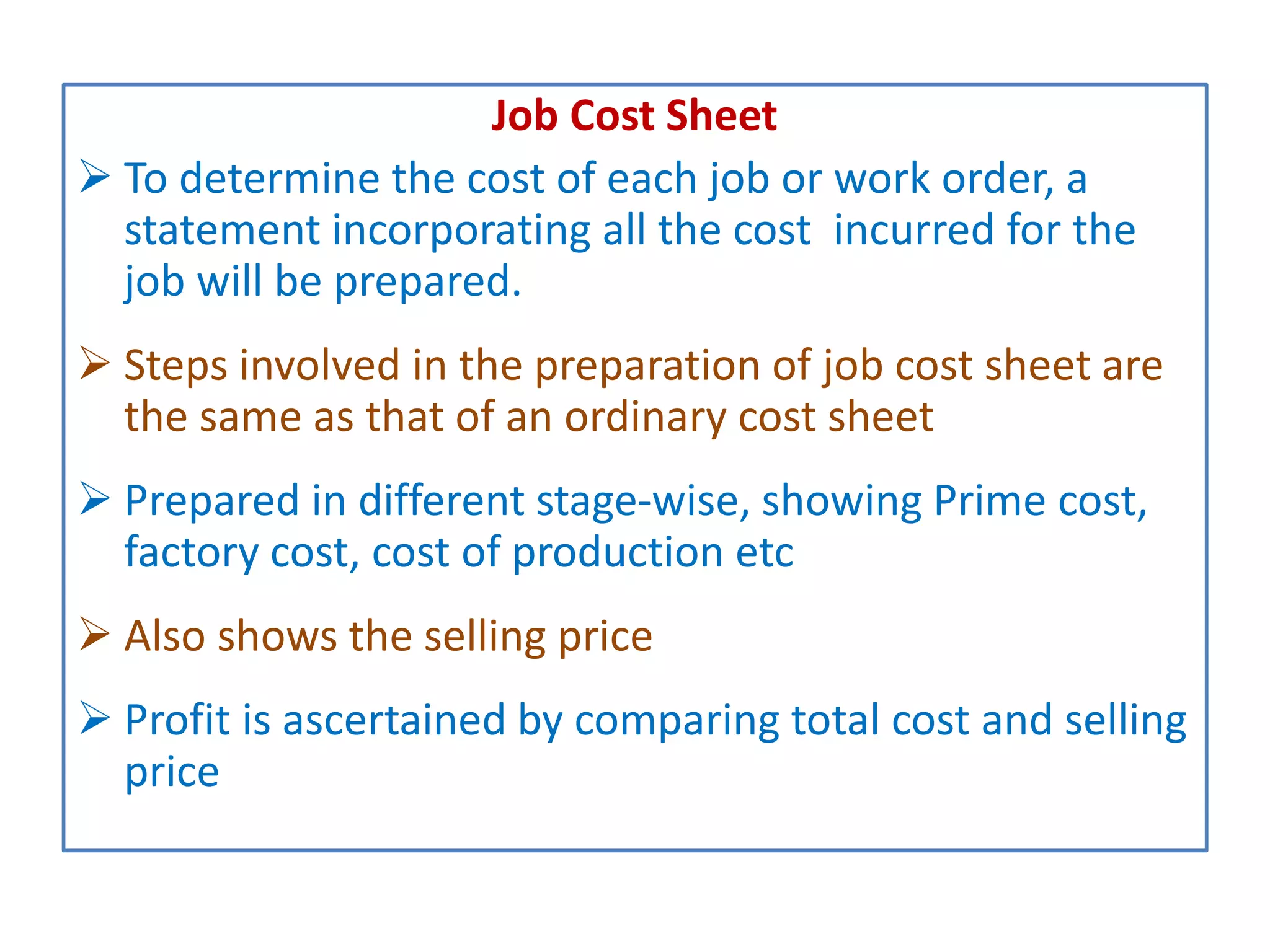

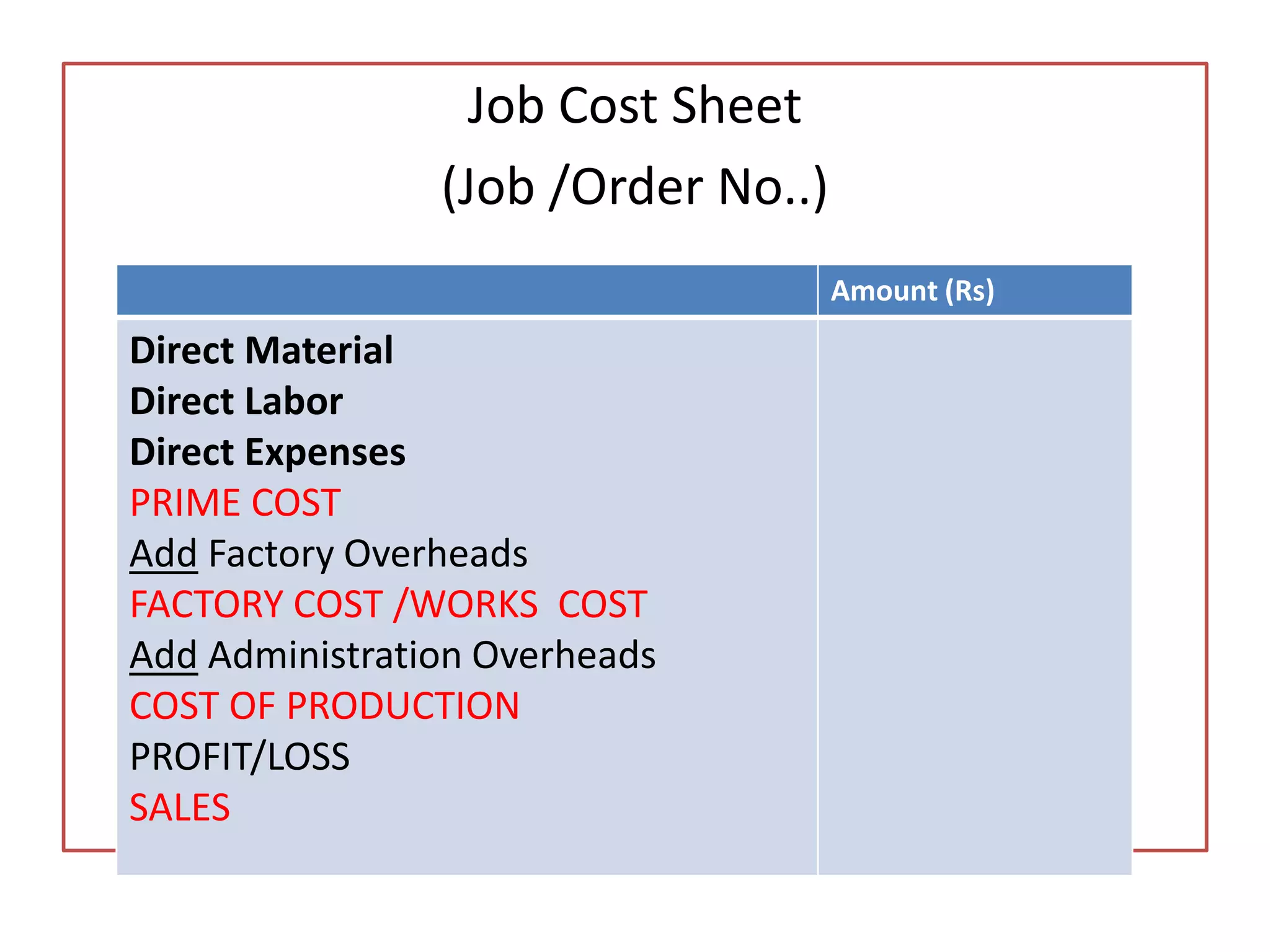

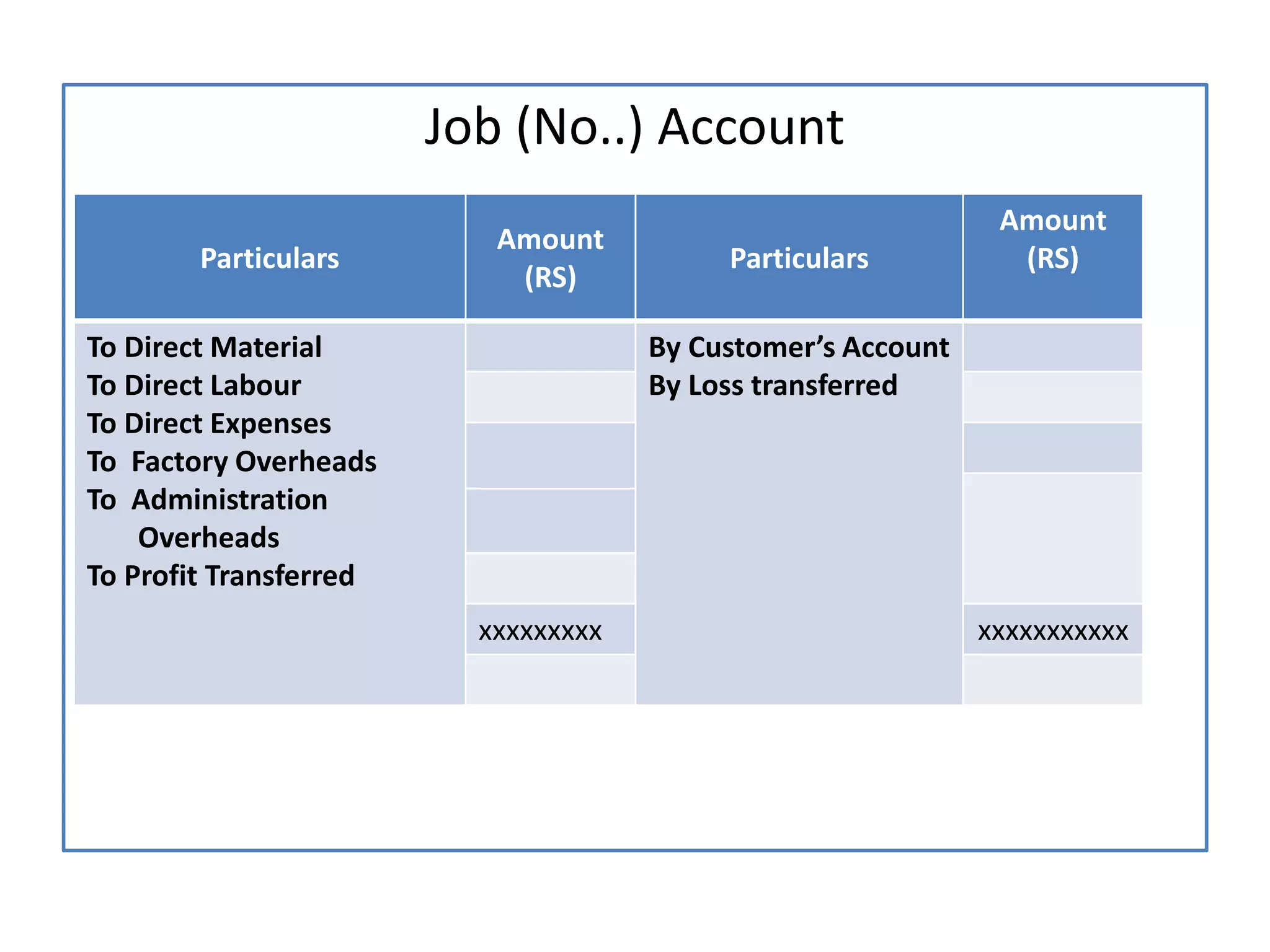

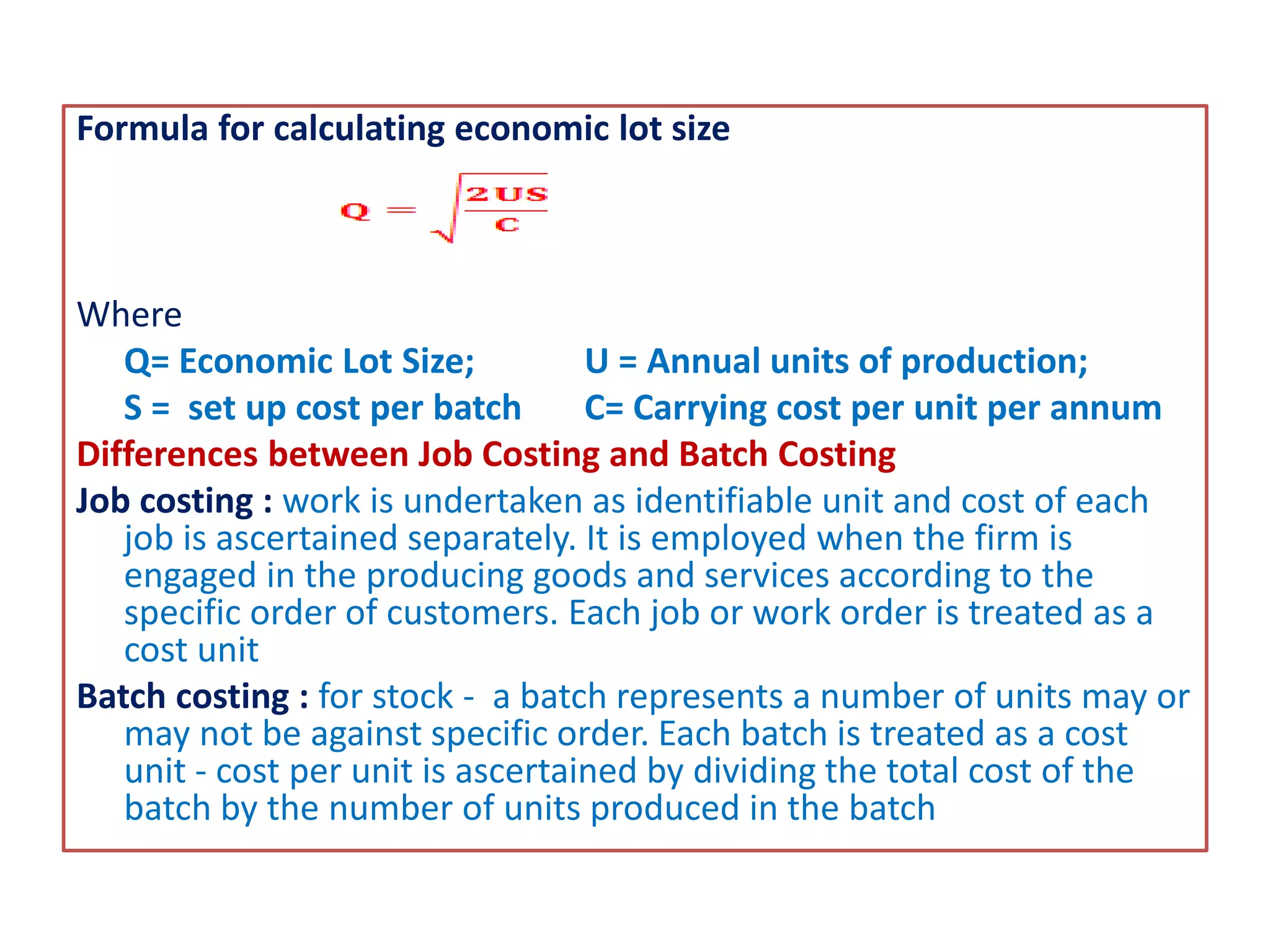

This document discusses job costing and batch costing. Job costing involves compiling costs for specific quantities of goods or services produced according to a customer's order. Costs are accumulated separately for each job. Batch costing is used when a company produces goods in batches for stock. The cost per unit is determined by dividing the total batch cost by the number of units in the batch. The document outlines the key features, objectives, advantages, and disadvantages of job costing as well as providing examples of job cost sheets and how to calculate economic batch size.