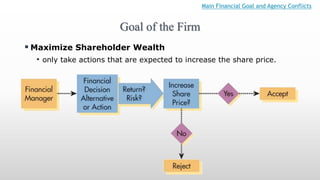

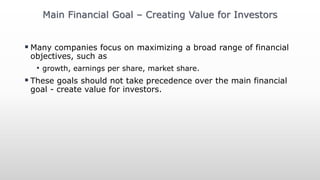

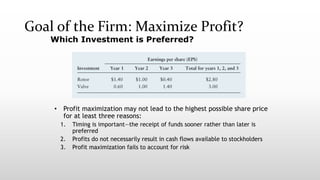

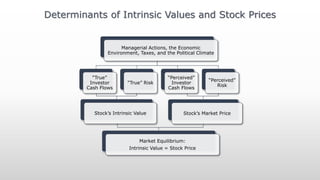

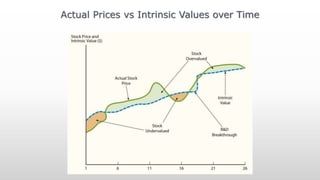

The document discusses the goal of the firm and agency conflicts. The main financial goal of a firm is to maximize shareholder wealth by increasing share price over the long run. However, there are agency conflicts as managers may prioritize their own goals over shareholders. Steps like incentive compensation plans, the threat of takeover, and bond covenants aim to align manager and shareholder interests. Firms also consider stakeholders and act socially responsible while still pursuing the primary goal of shareholder wealth maximization.