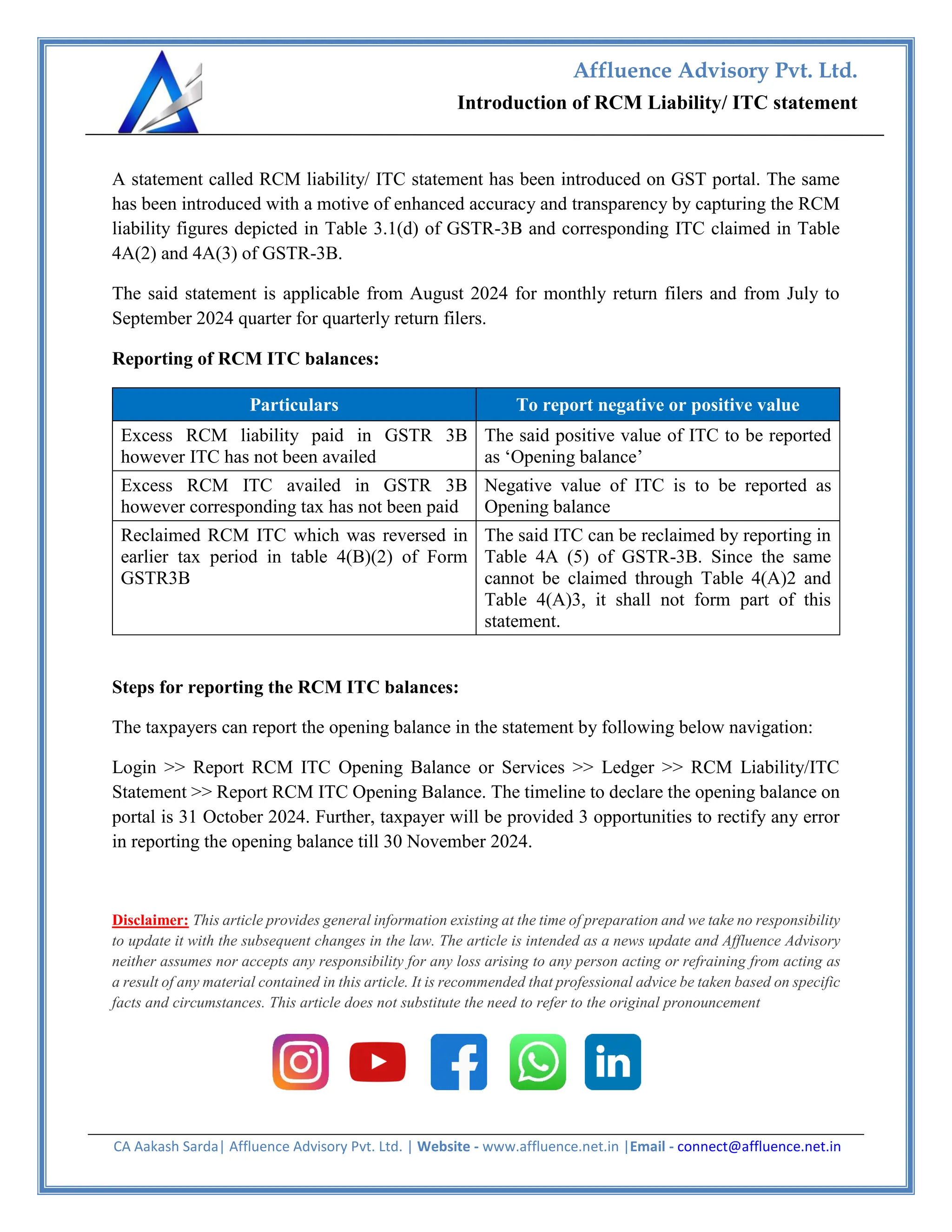

Affluence Advisory Pvt. Ltd. introduced the RCM liability/ITC statement on the GST portal to enhance accuracy and transparency in reporting figures for monthly and quarterly return filers starting in mid-2024. Taxpayers must report their RCM ITC balances, including any excess liabilities or ITC availed, by following specific navigation steps, with a deadline of October 31, 2024, for declaring these balances. The article serves as a general information update and advises consulting professional advice for specific circumstances.