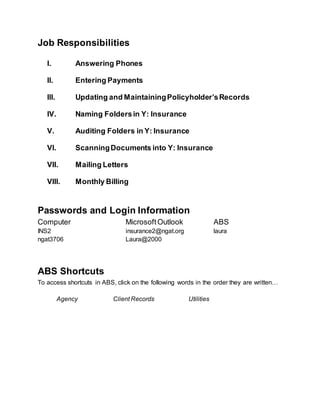

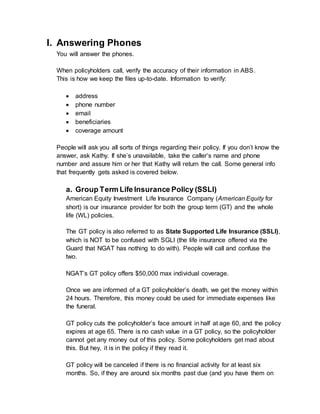

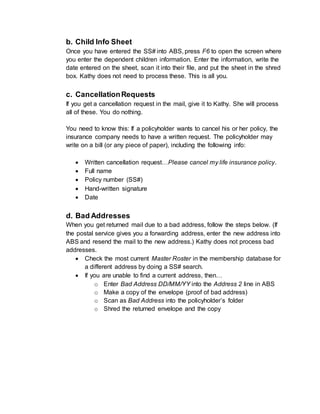

This document provides training and guidelines for an Insurance Assistant position. It outlines responsibilities like answering phones, entering payments, updating policyholder records, and scanning documents. It details how to handle various insurance-related tasks like processing different types of payments, marking policyholders who will retire or cancel coverage, and addressing issues like bad addresses. The document also provides login credentials and instructions for using the ABS software system to manage policyholder information and process transactions.