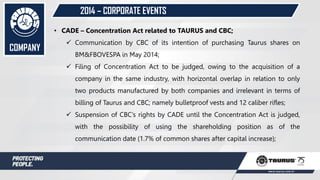

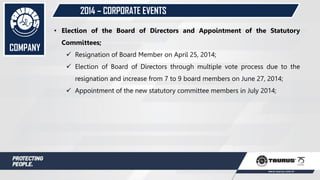

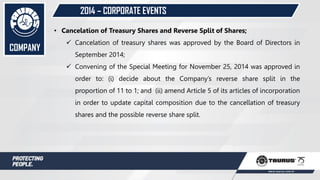

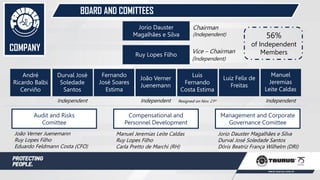

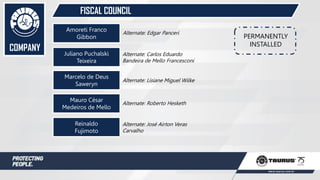

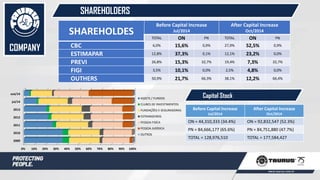

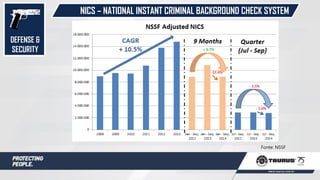

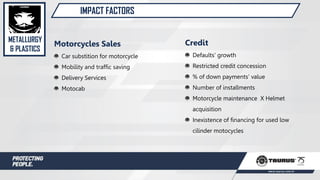

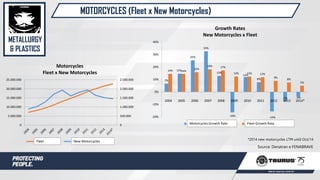

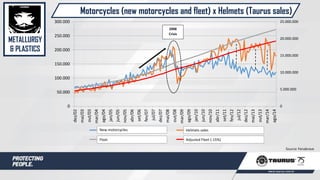

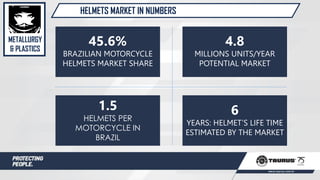

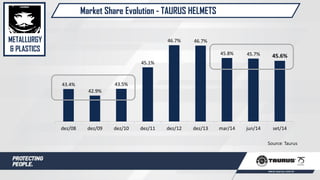

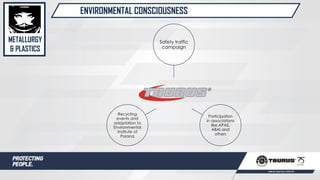

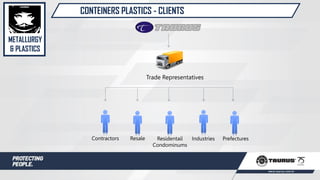

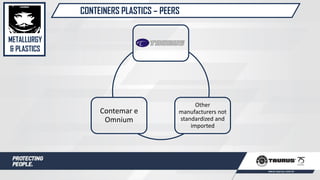

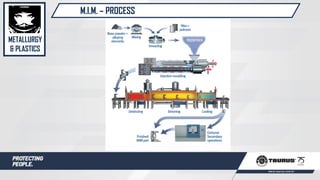

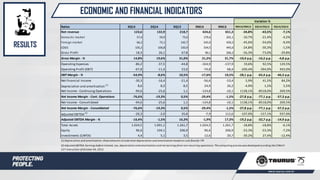

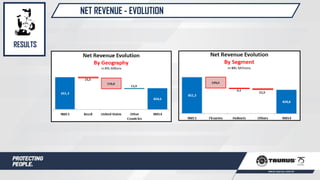

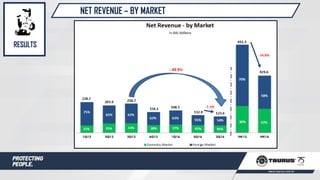

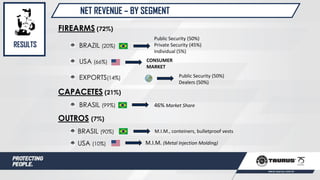

Taurus is a Brazilian company that is the largest manufacturer of revolvers and a leading producer of helmets. It has various facilities in Brazil and the US. The document discusses Taurus' history and timeline of acquisitions. It also summarizes recent corporate events, including restatements of financial statements, changes in shareholding and control, and plans for a capital increase and share consolidation. Finally, it provides an overview of Taurus' defense and security business as well as its metallurgy and plastics division.