The document discusses the taxation of income from house property under the head "Income from House Property" in India. It defines key terms like total income, owner, deemed ownership. For a property to be taxed under this head, it must be owned by the assessee and not used for business purposes. The annual value is taxable, which is the expected reasonable rent. Standard deductions are available and interest on borrowed capital can be deducted. Unrealized rent is not taxed under certain conditions.

![BASIS OF CHARGE

Chargeability [ Section 22 ]

The basis of charge is Annual Value of the

property

However, if let out, then vacancy allowance

for the vacant period which means rent

received or receivable less local taxes paid

actually.

4](https://image.slidesharecdn.com/incomefromhouseproperty-1-230206152540-6309d2a9/85/INCOME_FROM_HOUSE_PROPERTY-1-pptx-4-320.jpg)

![DEEMED OWNERSHIP [Section 27]

The following persons though not the legal

owners of a property, are deemed to be the

owners, for the purposes of sections 22 to 26.

(i) Transfer of property by an individual to

his/her spouse, without adequate consideration;

but not transferred in connection with an

agreement to live apart.

Cont….](https://image.slidesharecdn.com/incomefromhouseproperty-1-230206152540-6309d2a9/85/INCOME_FROM_HOUSE_PROPERTY-1-pptx-9-320.jpg)

![STANDARD RENT UNDER THE RENT

CONTROL ACTS

A landlord cannot reasonably expect to receive from

a hypothetical tenant anything more than the

standard rent under the Rent Control Act [ Shiela

Kaushish Vs.CIT – 7 Taxman 1 and Amolak Ram

Khosla Vs. CIT[1981] 7 Taxman 51(SC) ]

the annual value of the house belonging to the

assessee must be taken to be the standard rent of the

house determinable under the provisions of the Rent

Act. The revenue will pay the costs of the appeals to

the assessee.](https://image.slidesharecdn.com/incomefromhouseproperty-1-230206152540-6309d2a9/85/INCOME_FROM_HOUSE_PROPERTY-1-pptx-15-320.jpg)

![INTEREST ON BORROWED

CAPITAL [ SECTION 24(b) ]

(1) Deductible on “accrual” basis. It can be

claimed on yearly basis, even if the interest is not

actually paid during the year.

(2) No deduction is allowed for any brokerage or

commission for arranging the loan.

(3) Interest on a fresh loan, taken to repay the

original loan, is also allowable as deduction. [

Circular No. 28,dated august 20,1989 ].

Contd.](https://image.slidesharecdn.com/incomefromhouseproperty-1-230206152540-6309d2a9/85/INCOME_FROM_HOUSE_PROPERTY-1-pptx-24-320.jpg)

![ It is on the balance outstanding on the last

day of each month [Clarification by CBDT

vide Circular No.363, dated June 24,1983 ]](https://image.slidesharecdn.com/incomefromhouseproperty-1-230206152540-6309d2a9/85/INCOME_FROM_HOUSE_PROPERTY-1-pptx-25-320.jpg)

![ARRANGEMENT TO PAY SALE

PRICE IN INSTALLMENTS

If the house property is purchased on installments,

comprising of principal and interest thereon;

The unpaid purchase price is treated [deemed] as

loan from the seller and the interest paid thereon

shall be deducted from rent received u/s 24(b);](https://image.slidesharecdn.com/incomefromhouseproperty-1-230206152540-6309d2a9/85/INCOME_FROM_HOUSE_PROPERTY-1-pptx-26-320.jpg)

![(8) Interest paid on borrowed capital for

acquisition of plot is also allowable as the word

property is used in Section 24(b) and not the word

house property. It was held so in the case-- [ CIT

Vs. Amrit Lal Adlakha [ 2007] [105 TTJ 271]](https://image.slidesharecdn.com/incomefromhouseproperty-1-230206152540-6309d2a9/85/INCOME_FROM_HOUSE_PROPERTY-1-pptx-28-320.jpg)

![INTEREST WHEN NOT DEDUCTIBLE

[SECTION 25 ]

Interest payable outside India shall not

be allowed as deduction

However it is allowable:-

a) If the tax is paid or deducted at source; And

b) there is a person in India, who may be treated

as agent of the recipient.](https://image.slidesharecdn.com/incomefromhouseproperty-1-230206152540-6309d2a9/85/INCOME_FROM_HOUSE_PROPERTY-1-pptx-30-320.jpg)

![WHERE ASSESSEE HAS MORE

THAN ONE HOUSE FOR SELF

OCCUPATION [ SECTION 23(4) ]

The other house(s) will be deemed to be let out

and only one at the option of the assessee shall

be treated as self occupied.](https://image.slidesharecdn.com/incomefromhouseproperty-1-230206152540-6309d2a9/85/INCOME_FROM_HOUSE_PROPERTY-1-pptx-32-320.jpg)

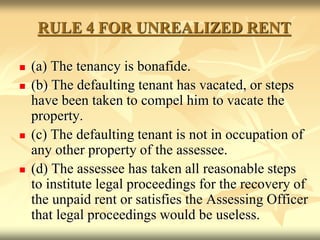

![TREATMENT OF UNREALISED

RENT [EXPLANATION TO

SECTION 23(1)]

The unrealized rent shall not be included

in the rental income, but subject to the

rules made in this behalf to check the

misuse of this concession.

Cont.](https://image.slidesharecdn.com/incomefromhouseproperty-1-230206152540-6309d2a9/85/INCOME_FROM_HOUSE_PROPERTY-1-pptx-35-320.jpg)

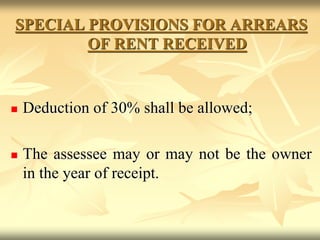

![UNREALIZED RENT RECEIVED

SUBSEQUENTLY TO BE CHARGED

TO INCOME TAX [ SECTION 25A ]

The amount realised subsequently, if not included

in rent earlier, shall be the deemed income in the

year of receipt.

In the year of realisation, the assessee may or

may not be the owner of the property.](https://image.slidesharecdn.com/incomefromhouseproperty-1-230206152540-6309d2a9/85/INCOME_FROM_HOUSE_PROPERTY-1-pptx-37-320.jpg)

![PROPERTY OWNED BY CO-OWNERS

[SECTION 26]

The co-owners having definite and

ascertainable share shall be assessed

accordingly and not as an AOP.

If property is self occupied by the co-

owners the ALV for each shall be nil.

Cont.](https://image.slidesharecdn.com/incomefromhouseproperty-1-230206152540-6309d2a9/85/INCOME_FROM_HOUSE_PROPERTY-1-pptx-39-320.jpg)

![ However entitled to deduction of interest upto

2 lakhs on borrowed capital.

However if co-owners have let it out,

computation shall be made as if it were one

person; [no deduction to each] and there after

the income shall be apportioned according to

their definite share.

Cont.](https://image.slidesharecdn.com/incomefromhouseproperty-1-230206152540-6309d2a9/85/INCOME_FROM_HOUSE_PROPERTY-1-pptx-40-320.jpg)