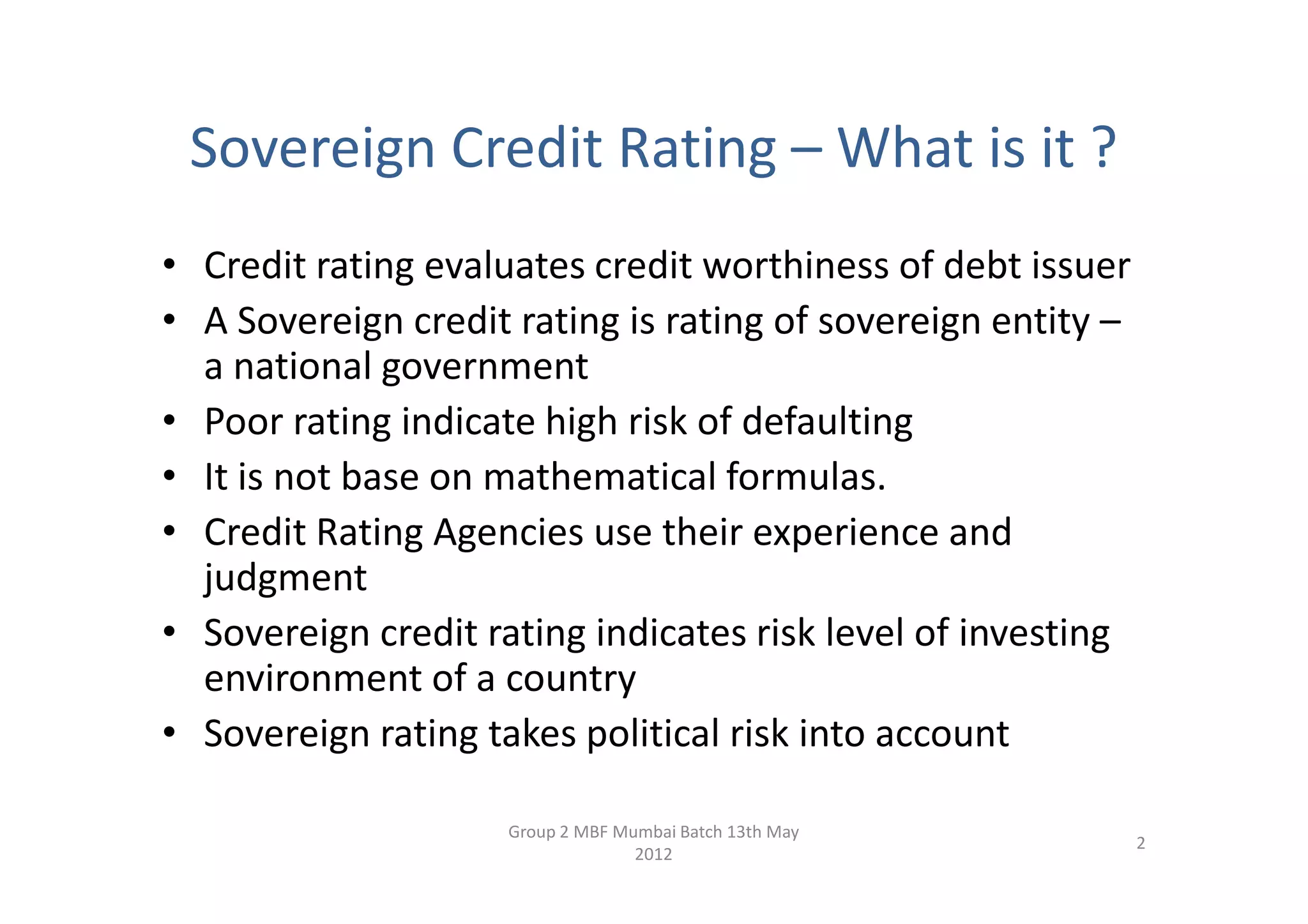

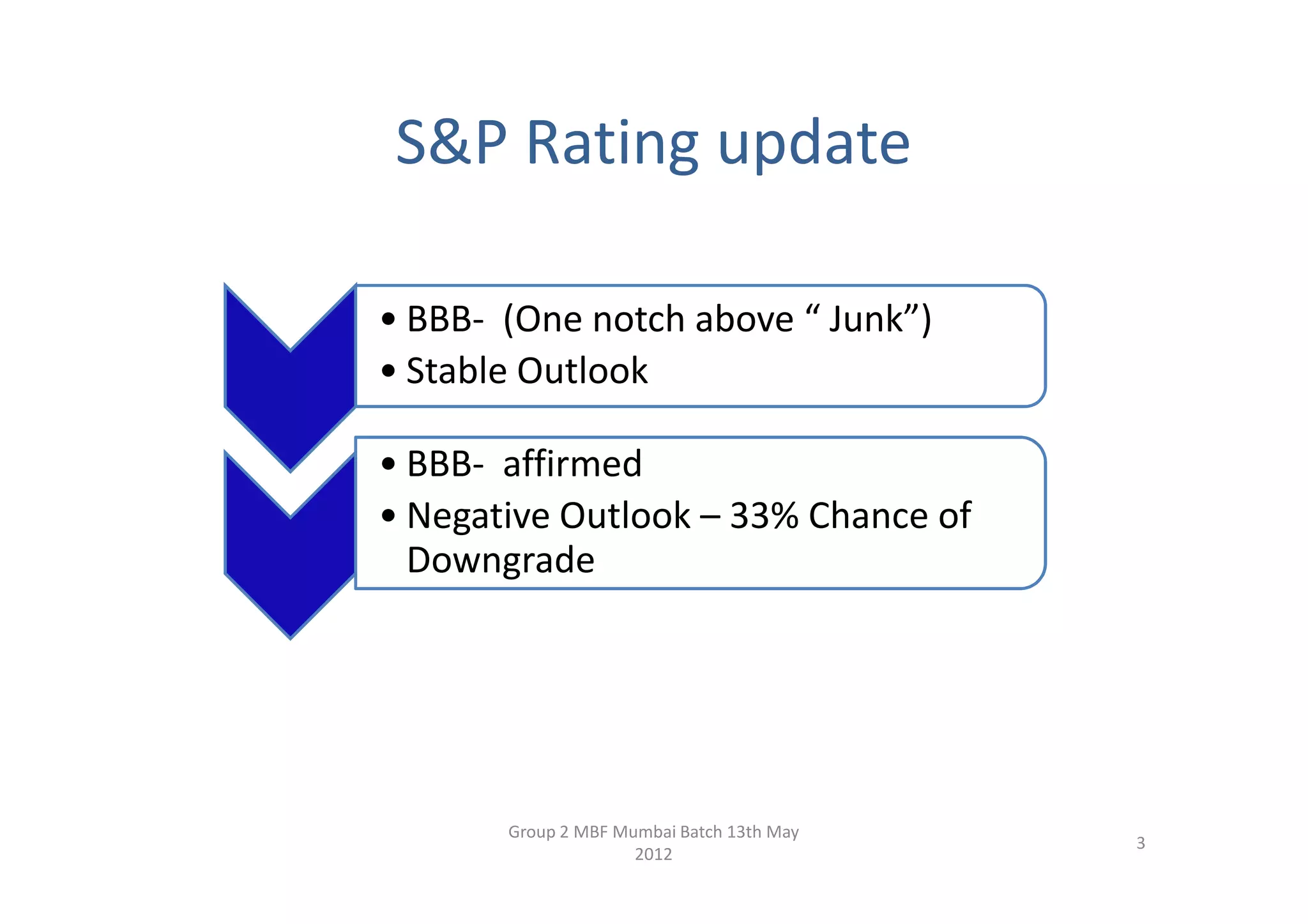

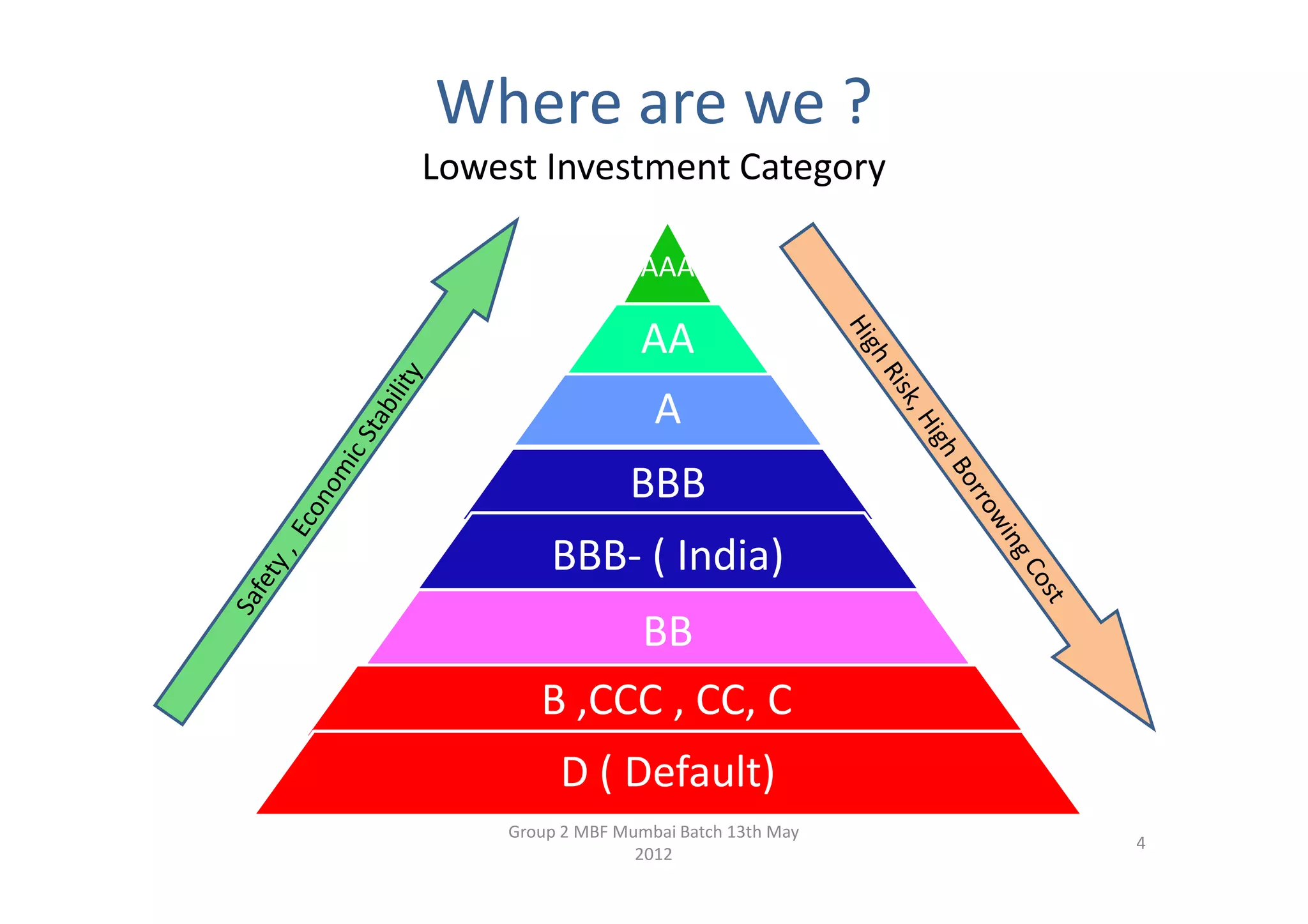

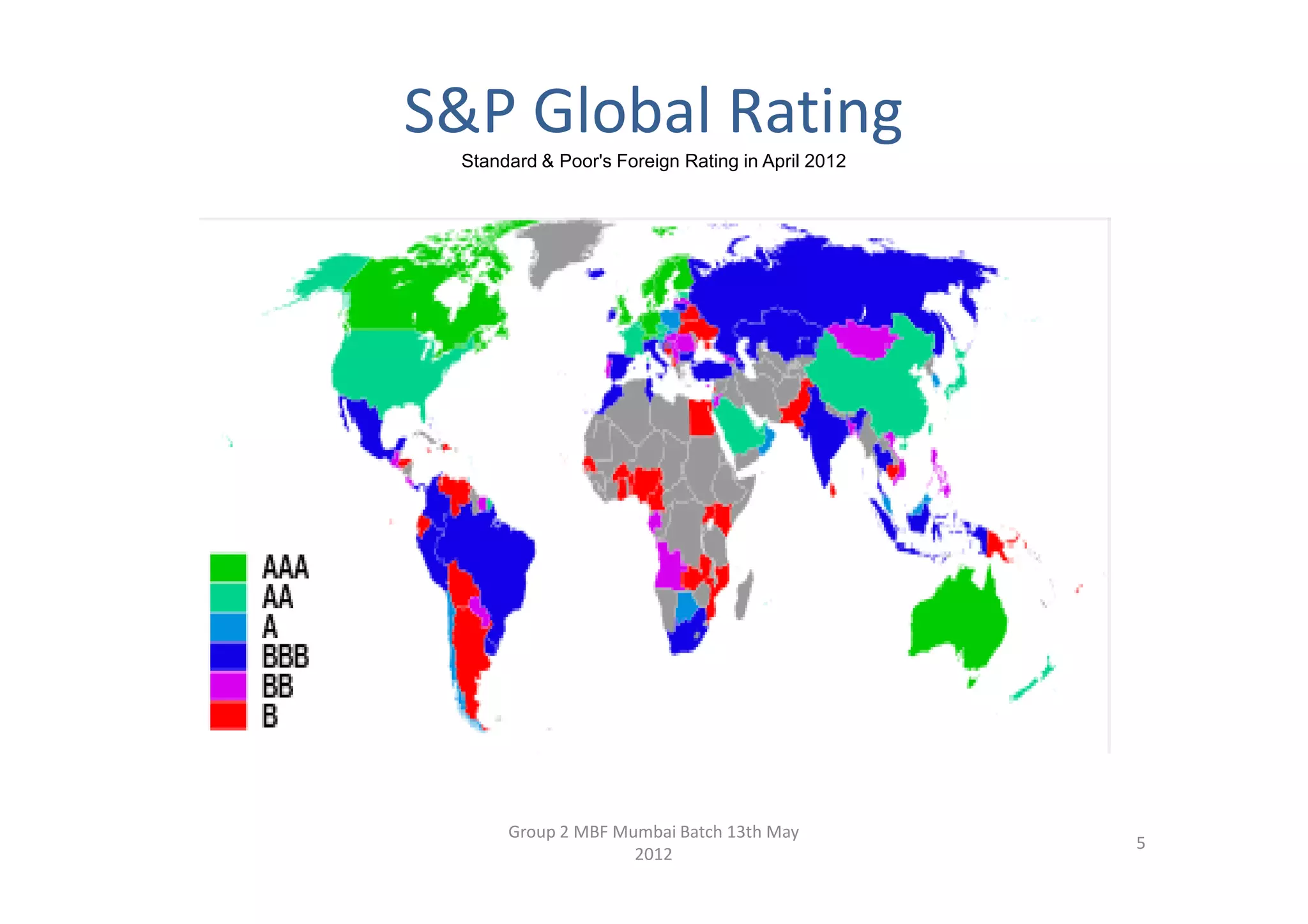

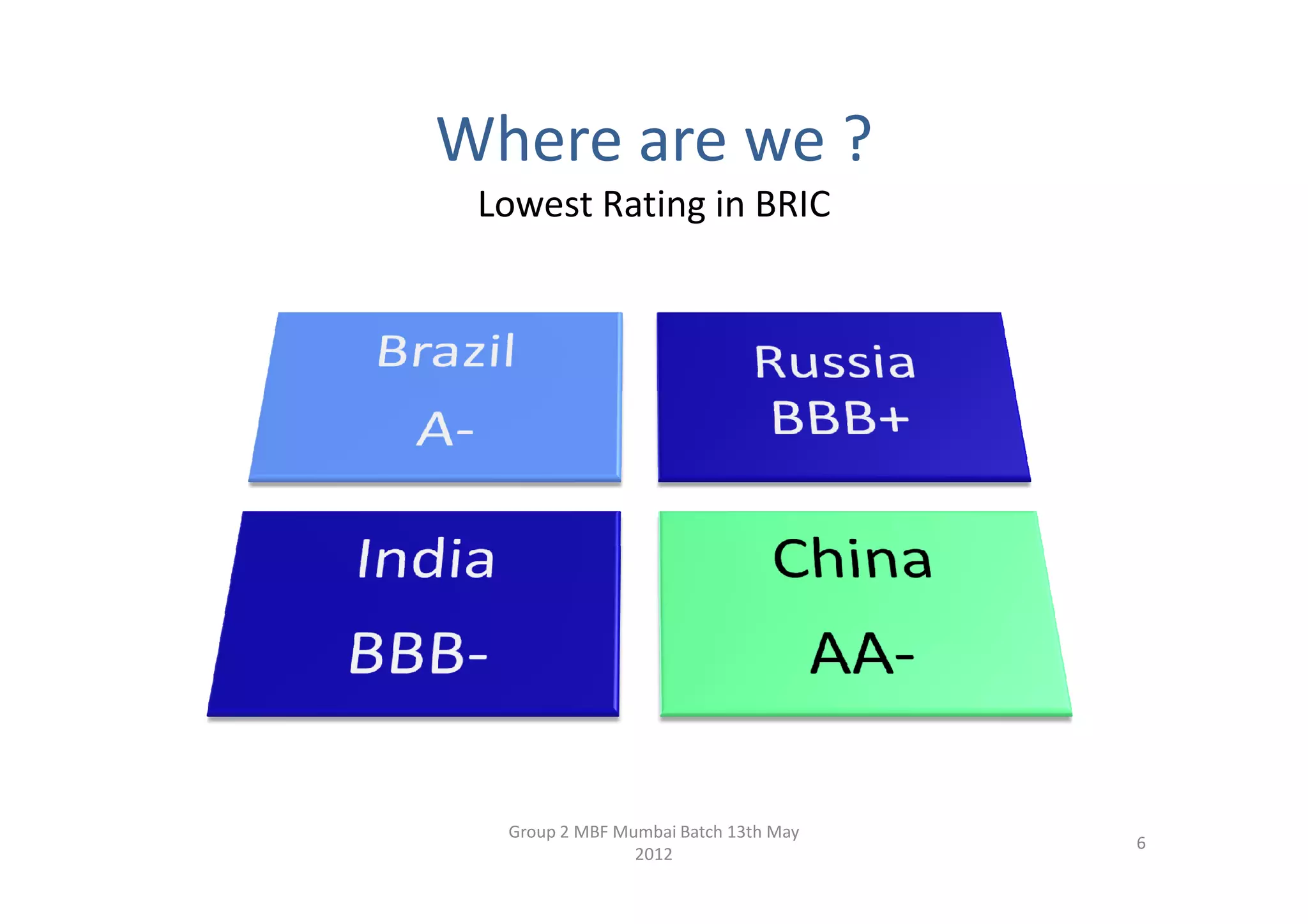

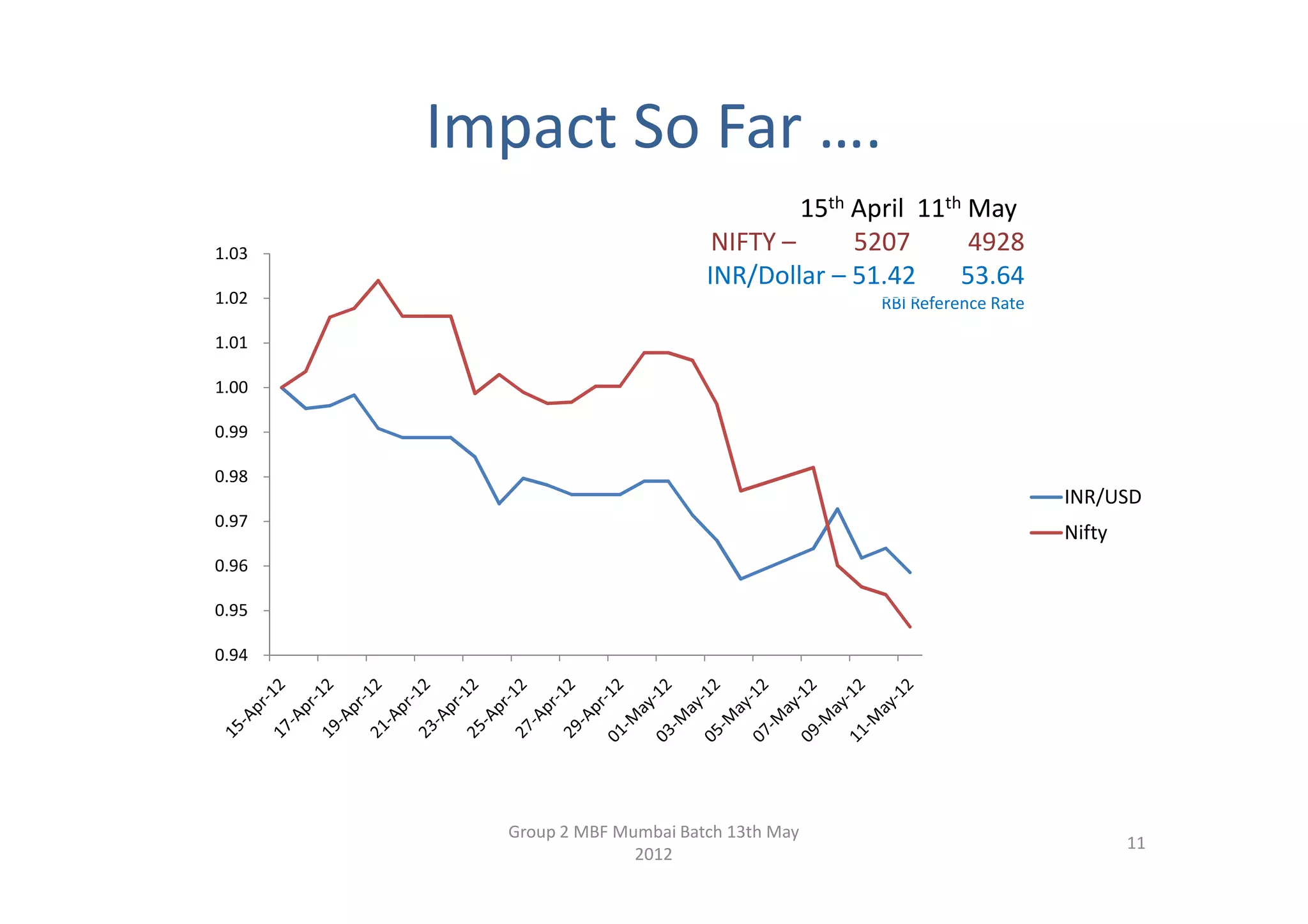

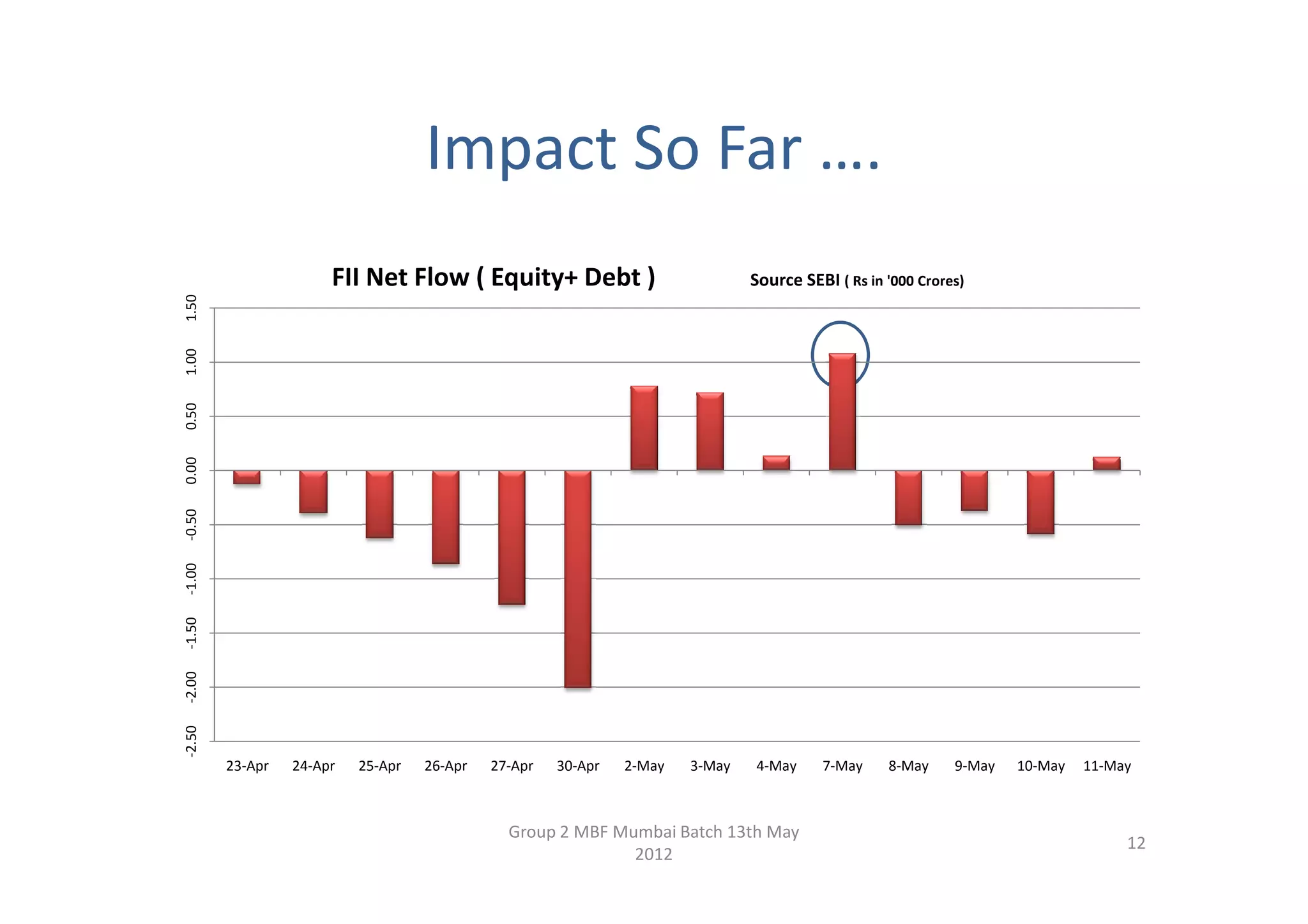

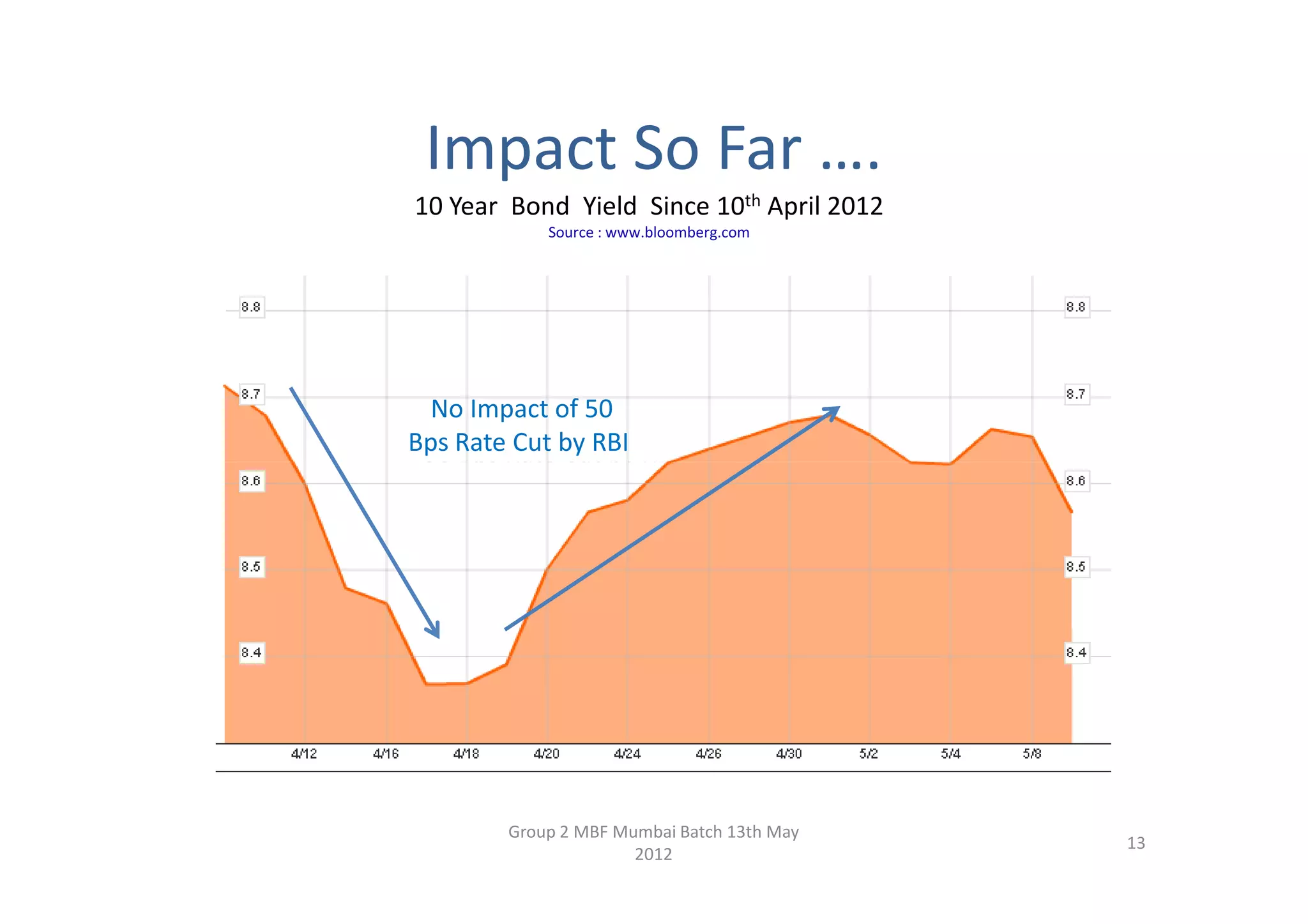

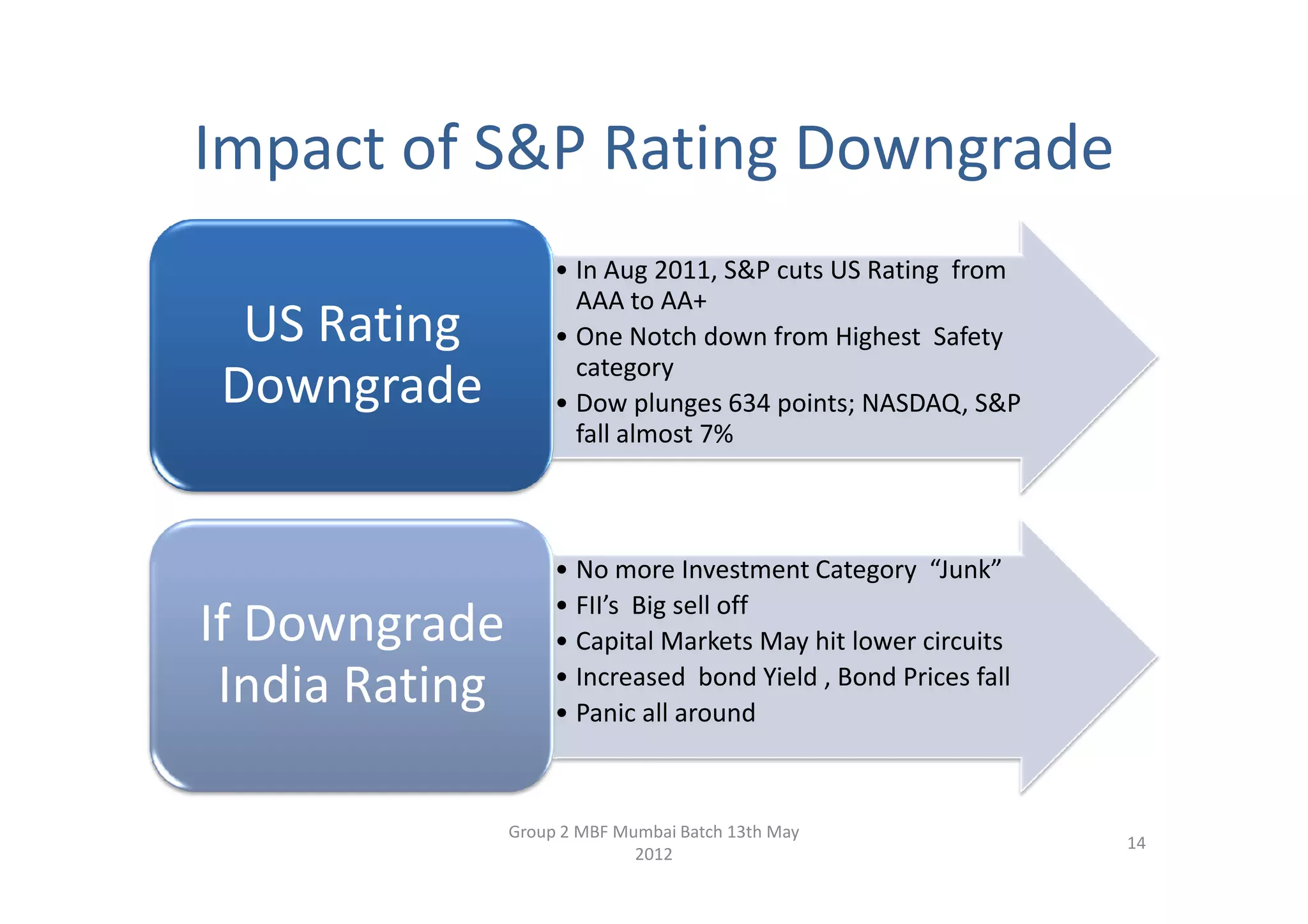

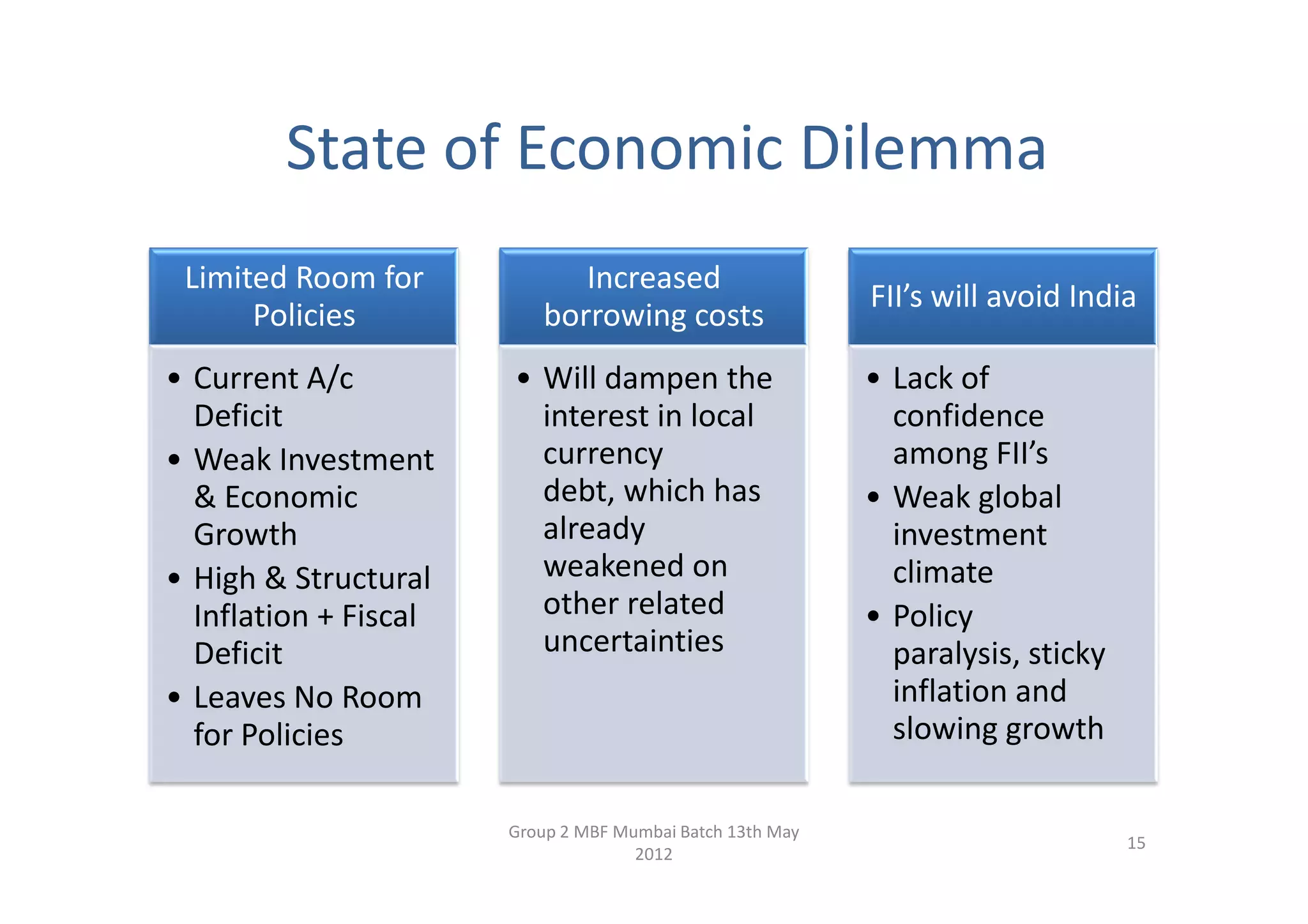

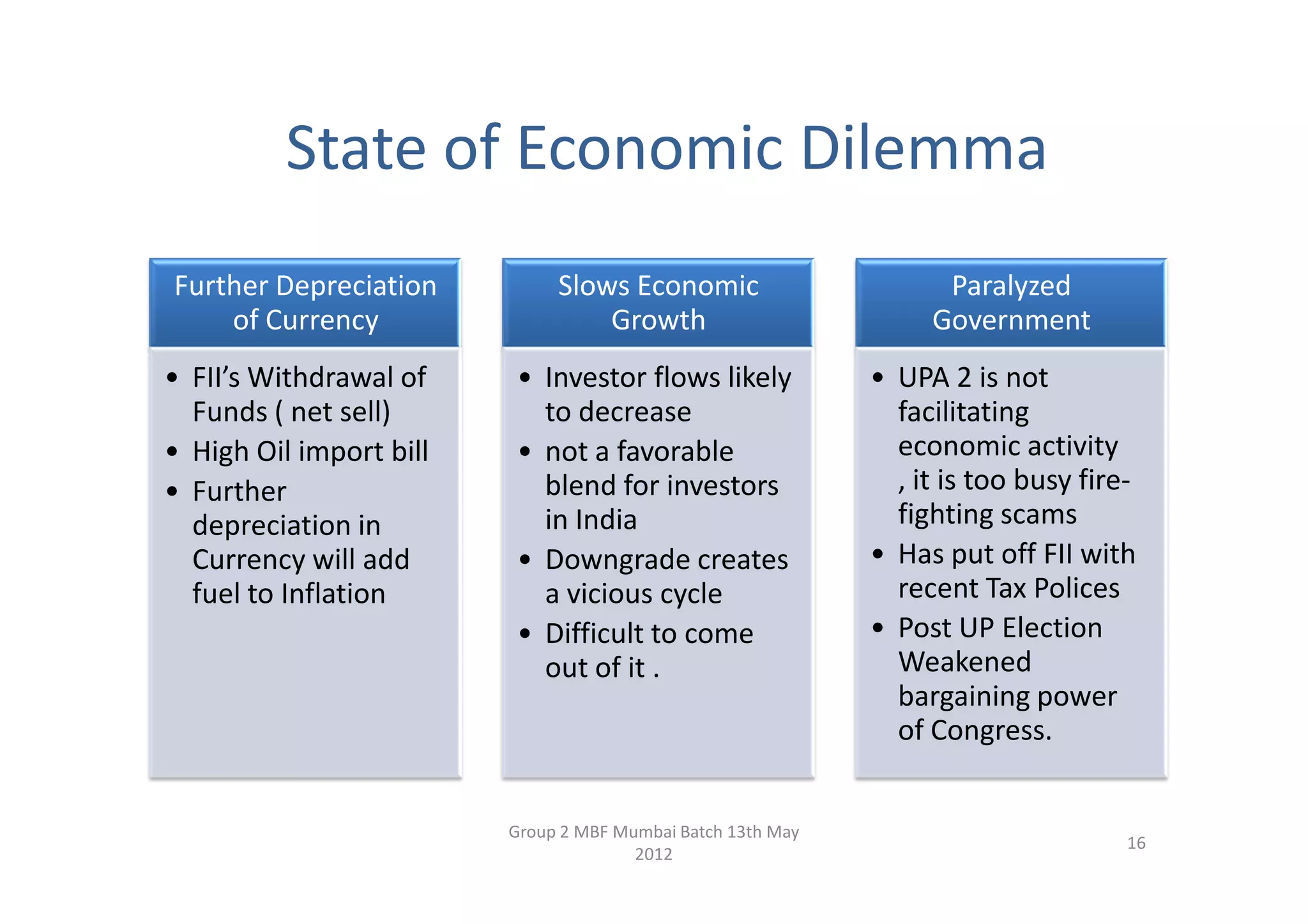

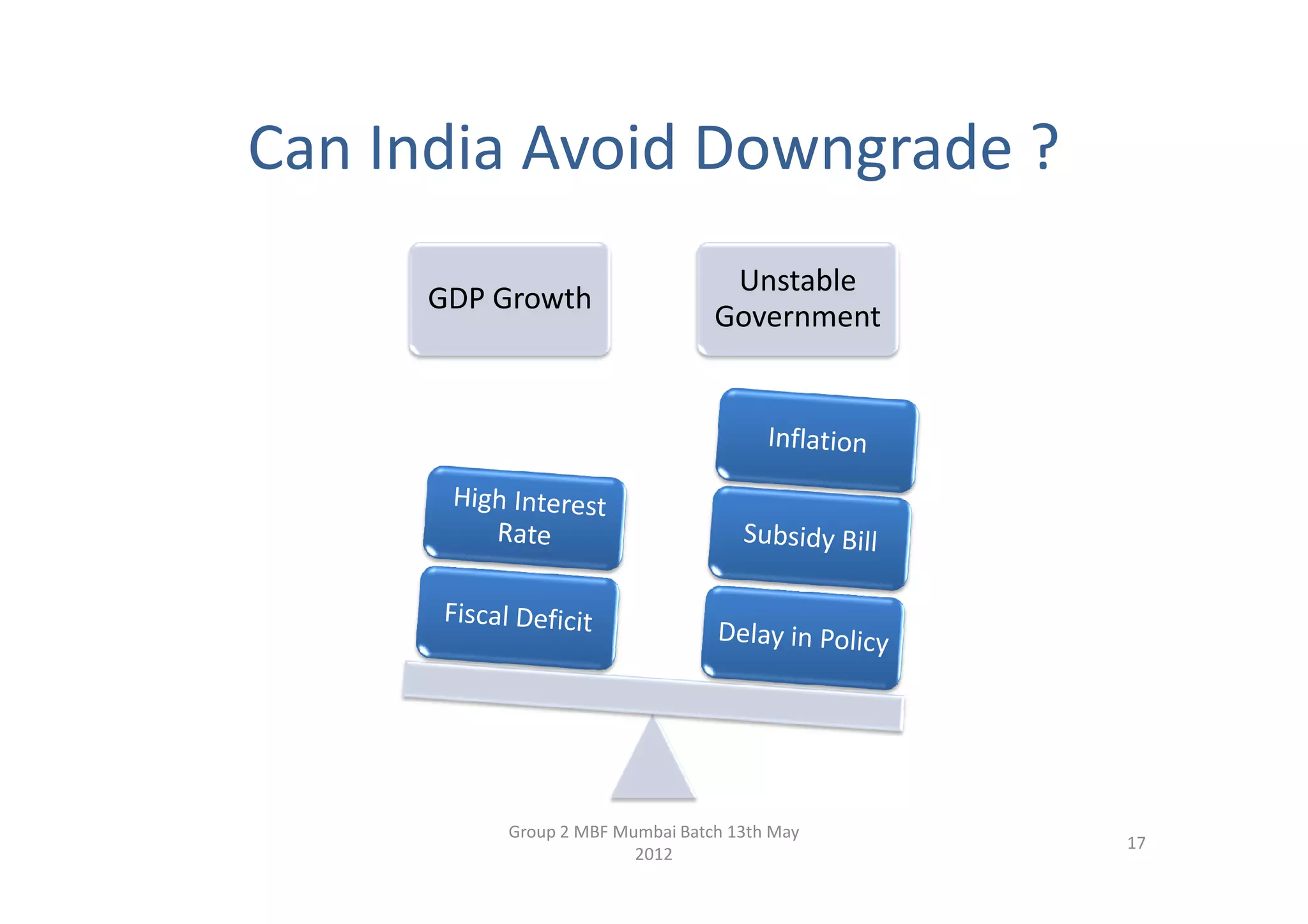

The document discusses Standard & Poor's decision to assign India a negative outlook while affirming its BBB- sovereign credit rating. It provides background on sovereign credit ratings and explains S&P's rationale for the negative outlook, citing India's high fiscal and current account deficits, slowing GDP growth, and challenges with fiscal consolidation. The summary discusses potential impacts of the negative outlook like increased chances of a downgrade, currency depreciation, market declines, and difficulty with overseas borrowing. It also examines India's economic challenges and risks of not addressing fiscal issues, as well as responses from Indian officials who see the outlook as a warning but not a cause for panic.