The document provides a key information memorandum for the IDFC Dynamic Equity Fund. The fund is an open-ended dynamic asset allocation fund that aims to generate long-term capital appreciation with lower volatility through systematic allocation of funds into equity and equity-related instruments. It also aims to generate income and capital appreciation through investment in debt and money market instruments. The fund uses a quantitative model to determine equity exposure based on the Nifty 50 PE ratio. It can invest 65-100% in equities, equity derivatives and 0-35% in debt. The primary risks associated with the fund are market risk, liquidity risk, credit risk and risks associated with equity and debt investments.

![Cut-off timing for Redemption including Switch-outs

i) In respect of valid applications received upto 1.00 p.m. at the Official Points of

Acceptance of Transactions, the closing NAV of the day of receipt of application shall

be applicable.

ii) In respect of valid applications received after 1.00 p.m. at the Official Points of

Acceptance of Transactions, the closing NAV of the next business day shall be

applicable

Minimum Application Purchase Additional Purchase Repurchase

Rs.5000/- and any

amount thereafter

Rs.1000/- and any amount

thereafter

Rs.500/- and any amount

thereafter.

SIP - Rs. 100/- and in multiples of Re. 1 thereafter [Minimum 6 installments]; SWP - Rs.

500/- and in multiples of Re. 1 thereafter; STP (in) - Rs. 1000/- and any amount thereafter.

Despatch of

Repurchase

(Redemption)

Request

Within 10 working days of the receipt of the redemption request at the authorised centre of

IDFC Mutual Fund.

Benchmark Index 50% S&P BSE 200 TRI + 50% NIFTY AAA Short Duration Bond Index

Dividend Policy Under Dividend Option, dividend will be declared subject to availability of distributable

surplus and at discretion of AMC / Trustee. The undistributed portion of the income will

remain in the Option and be reflected in the NAV, on an ongoing basis. The Trustee’s

decision with regard to availability and adequacy, rate, timing and frequency of distribution

of dividend shall be final.

Name of the Fund

Manager

Equity Portion : Mr. Sumit Agrawal and Mr. Arpit Kapoor (Managing the fund since March

1, 2017)

Debt Portion: Mr. Arvind Subramanian (Managing the fund since November 9, 2015)

Dedicated fund manager for overseas investments – Mr. Viraj Kulkarni

Name of the Trustee

Company

IDFC AMC Trustee Company Limited](https://image.slidesharecdn.com/keyinformationmemorandum-210316153329/85/IDFC-Dynamic-Equity-Fund_Key-information-memorandum-8-320.jpg)

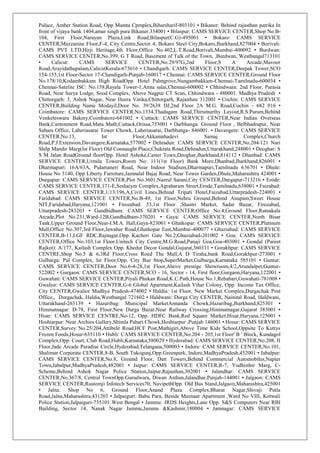

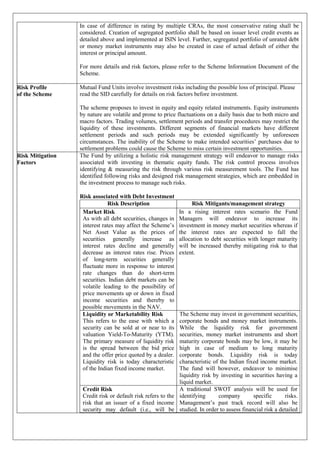

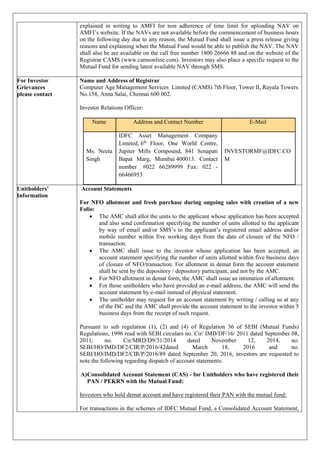

![Performance of the

scheme

Return (%) of Growth Option as at August 31, 2020

Period Scheme Returns % Benchmark Returns %

Direct Regular Direct Regular

1 Year 12.62 11.13 7.88 7.88

3 Years 7.60 6.05 6.36 6.36

5 Years 8.19 6.76 8.71 8.71

Since

Inception

8.07 6.63 8.63 8.63

Benchmark - 50% S&P BSE 200 TRI + 50% NIFTY AAA Short Duration Bond Index

(w.e.f. Nov. 11, 2019)

Date of Inception: Direct Plan – 10th October 2014 Regular Plan – 10th October 2014.

[With effect from February 2018, we are comparing the performances of the funds with the

total return variant of the benchmark instead of the price return variant.]

Expenses of the

Scheme

(i) Load Structure:

Exit Load: In respect of each purchase of Units:

- For 10% of investment: Nil

- For remaining investment: 1% if redeemed/switched out within 1 year from the date of

allotment.

It is clarified that the redemptions/switches of Units will be considered on First-in-First-Out

(FIFO) basis

(ii) Actual expenses for the previous financial year 2019-2020 (inclusive of Goods &

Services tax and Additional TER, if any):

Regular Plan – 2.23% ; Direct Plan – 0.88%

Waiver of Load for

Direct Applications

Pursuant to SEBI circular no. SEBI/IMD/CIR No.4/ 168230/ 09 dated June 30, 2009, there

is no entry load for Mutual Fund schemes. Hence, the procedure for waiver of load for

Direct Applications is no longer applicable.

Tax treatment for the

Investors

(Unitholders)

Investor will be advised to refer to the details in the Statement of Additional Information

and also independently refer to his tax advisor.

Daily Net Asset Value

(NAV) Publication

NAV will be determined for every Business Day except in special circumstances. NAV

calculated upto two decimal places. NAV of the Scheme shall be made available on the

website of AMFI (www. amfiindia.com) and the Mutual Fund (www.idfcmf.com) by 11.00

p.m. on all business days. In case the NAV is not uploaded by 11.00 p.m it shall be

-15.00

-10.00

-5.00

0.00

5.00

10.00

15.00

20.00

FY 2019-20 FY 2018-19 FY 2017-18 FY 2016-17 FY 2015-16

Chart Title

IDFC Dynamic Equity Fund - Dir - Growth

IDFC Dynamic Equity Fund - Reg - Growth

50% S&P BSE 200 TRI + 50% NIFTY AAA Short Duration Bond Index](https://image.slidesharecdn.com/keyinformationmemorandum-210316153329/85/IDFC-Dynamic-Equity-Fund_Key-information-memorandum-9-320.jpg)

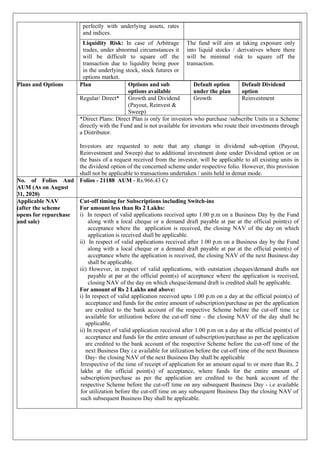

![Portfolio Turnover

ratio

Portfolio Turnover ratio of the scheme for the period September 1, 2019 to August 31,

2020 is 2.83*.

[Portfolio Turnover Ratio is calculated as lower of purchase or sale during the period

Average AUM for the last one year (includes Fixed Income securities and Equity

derivatives)].

Comparison with Other equity schemes of IDFC Mutual Fund:

Name of the

scheme

Category of the

scheme

Type of scheme

IDFC Regular

Savings Fund

Conservative Hybrid

Fund

An open ended hybrid scheme investing predominantly

in debt instruments

IDFC Dynamic

Equity Fund

Dynamic Asset

Allocation Fund

An open ended dynamic asset allocation fund

IDFC Hybrid

Equity Fund

Aggressive Hybrid

Fund

An open ended hybrid scheme investing predominantly

in equity and equity related instruments

IDFC Equity

Savings Fund

Equity Savings Fund An open ended scheme investing in equity, arbitrage

and debt

IDFC Arbitrage

Fund

Arbitrage Fund An open ended scheme investing in arbitrage

opportunities

Please refer to the Statement of Additional Information and Scheme Information Document for any

further details.

Note: The Trustees have ensured that the Scheme approved by them is a new product offered by IDFC

Mutual Fund and is not a minor modification of an existing scheme / fund / product

Dated: September 19, 2020

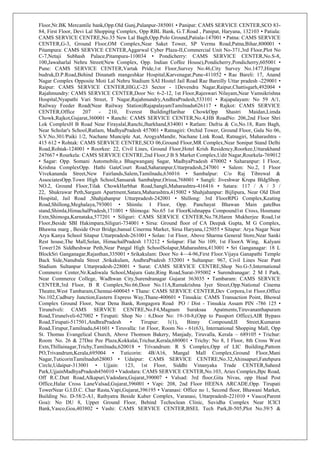

26.2%

8.6% 7.7% 7.5% 7.4%

5.3%

3.7% 3.4% 2.7% 2.5%

0.8%

FINANCIAL

SERVICES

Sovereign

ENERGY

IT

PHARMA

CONSUMER

GOODS

TELECOM

AUTOMOBILE

CEMENT

&

CEMENT…

INDUSTRIAL

MANUFACTURI…

CONSTRUCTION](https://image.slidesharecdn.com/keyinformationmemorandum-210316153329/85/IDFC-Dynamic-Equity-Fund_Key-information-memorandum-15-320.jpg)