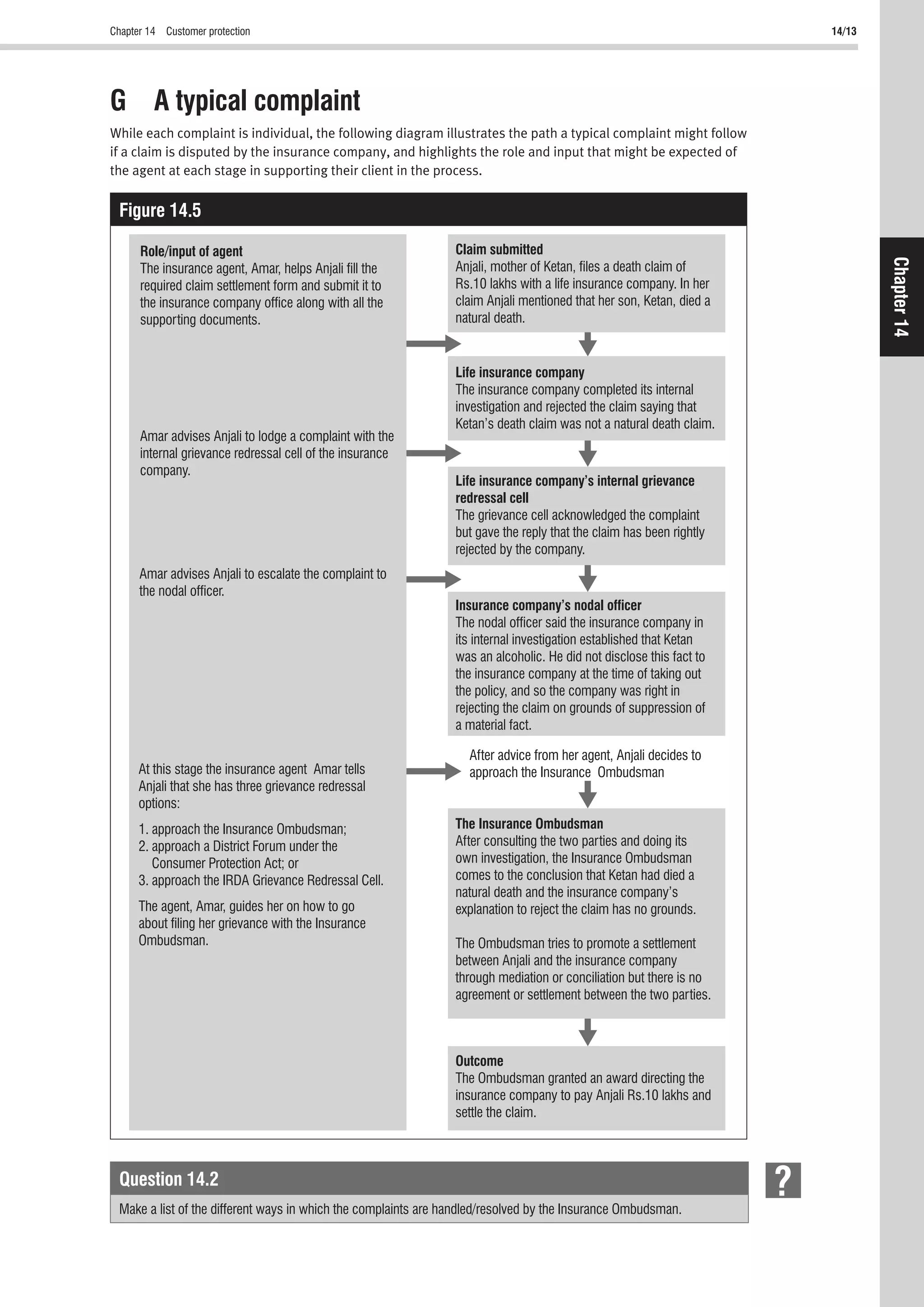

This document provides an overview of the insurance market in India. It explains what insurance is and how it works through risk transfer. Insurance benefits both individuals and society by providing protection from financial losses and supporting economic development. A professional insurance market that practices needs-based selling and disclosure helps build public confidence, increase insurance penetration, and maximize social benefits.

![Chapter 3 Part 2: Insurance practices 3/27

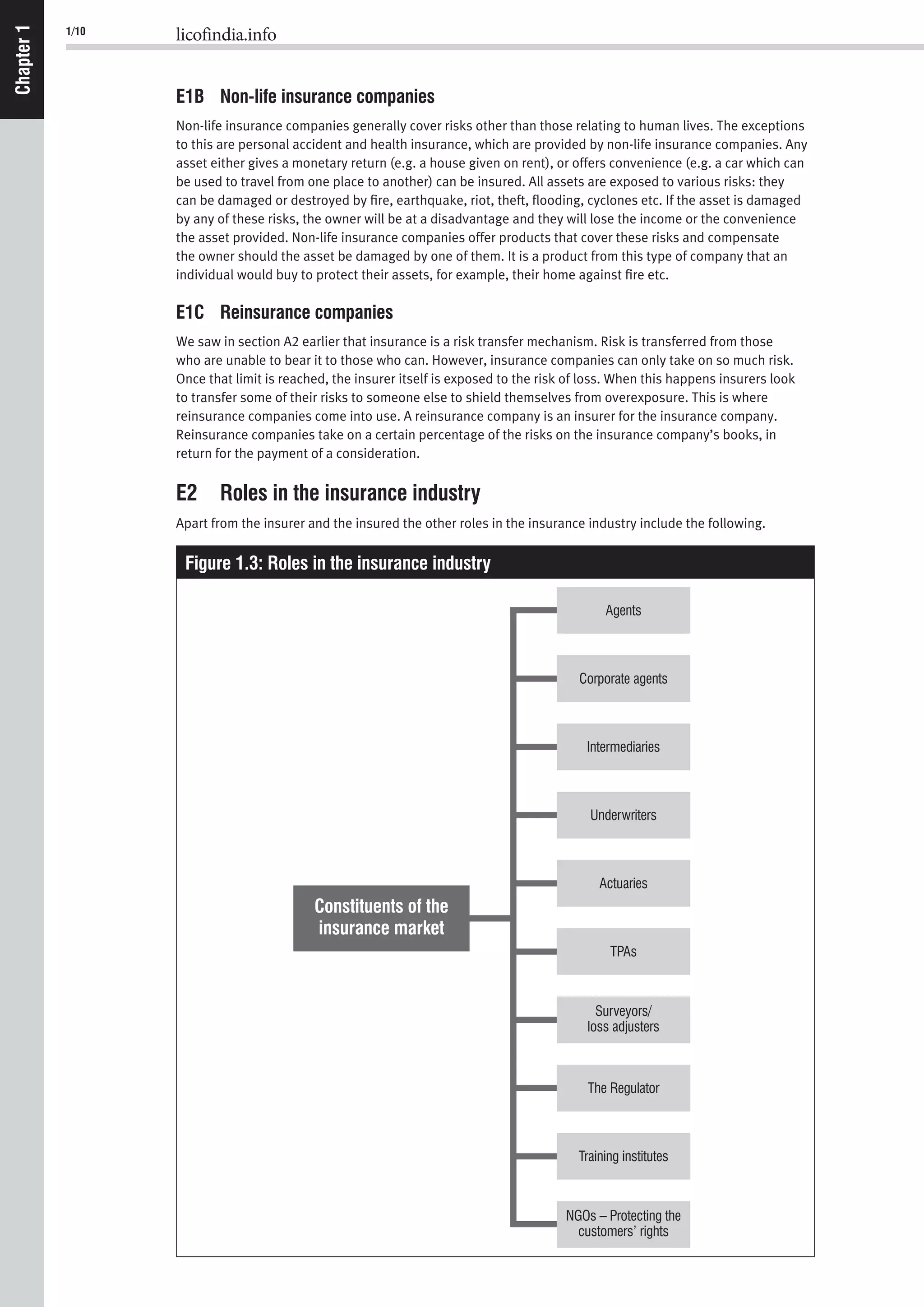

Chapter3:2

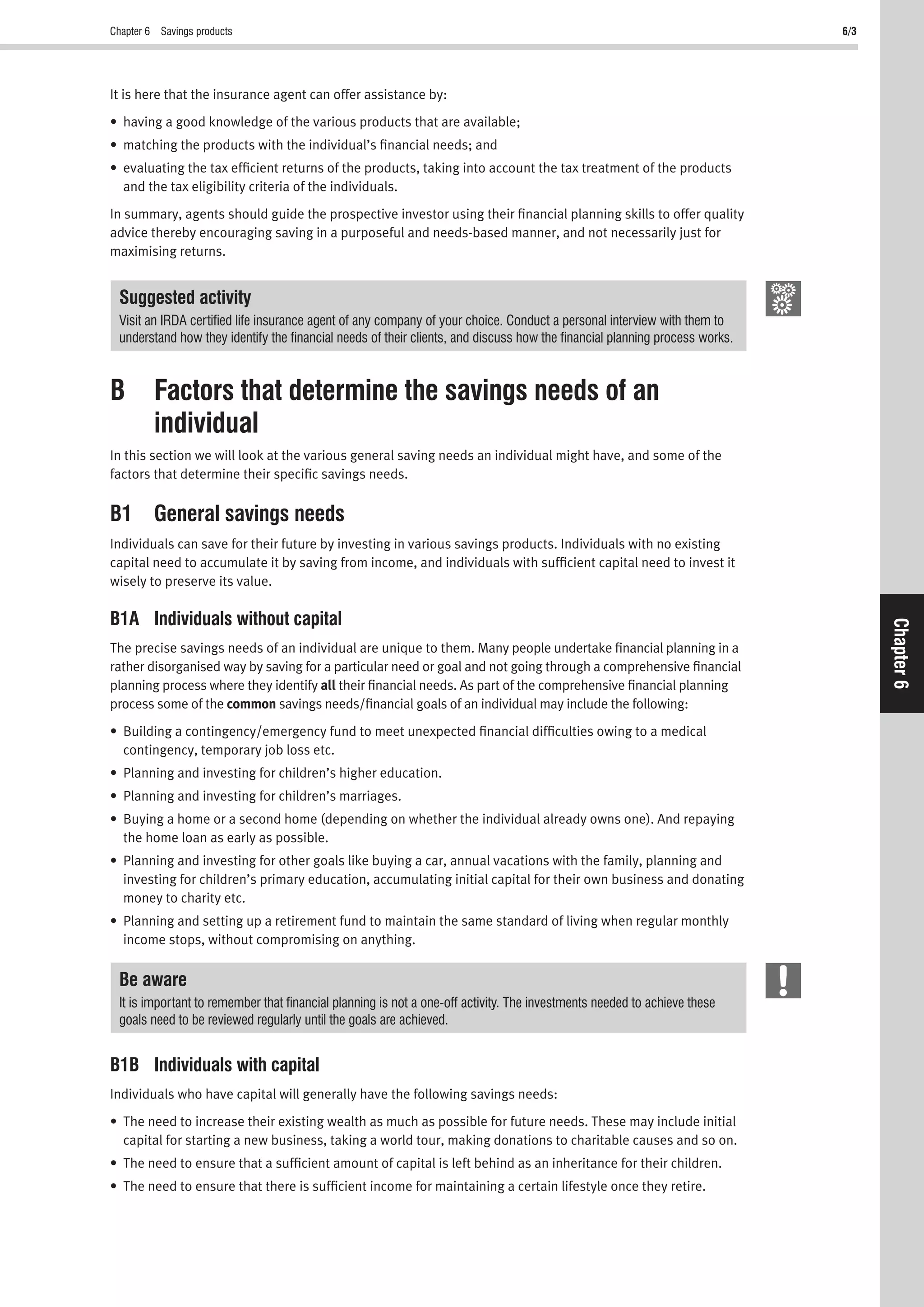

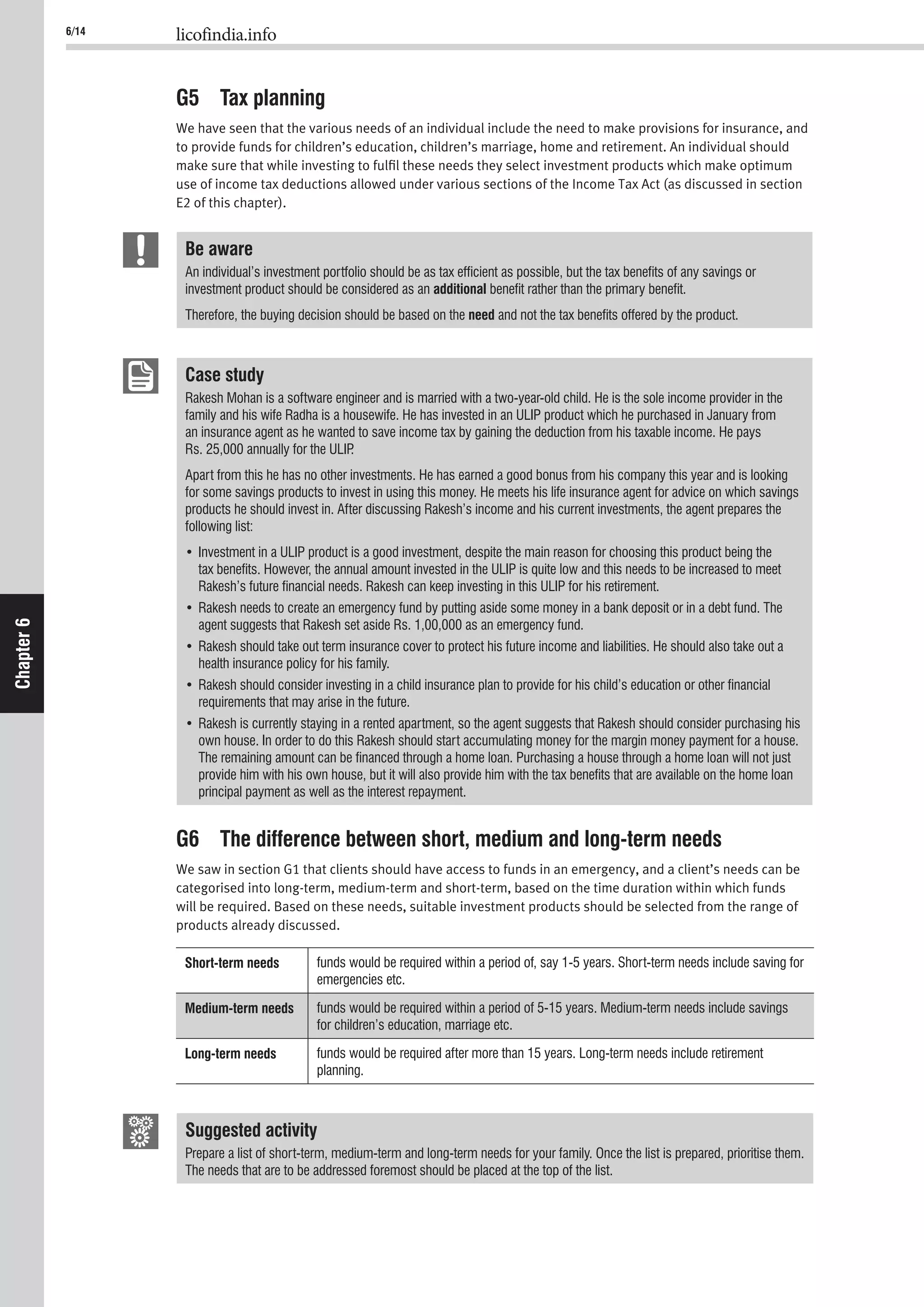

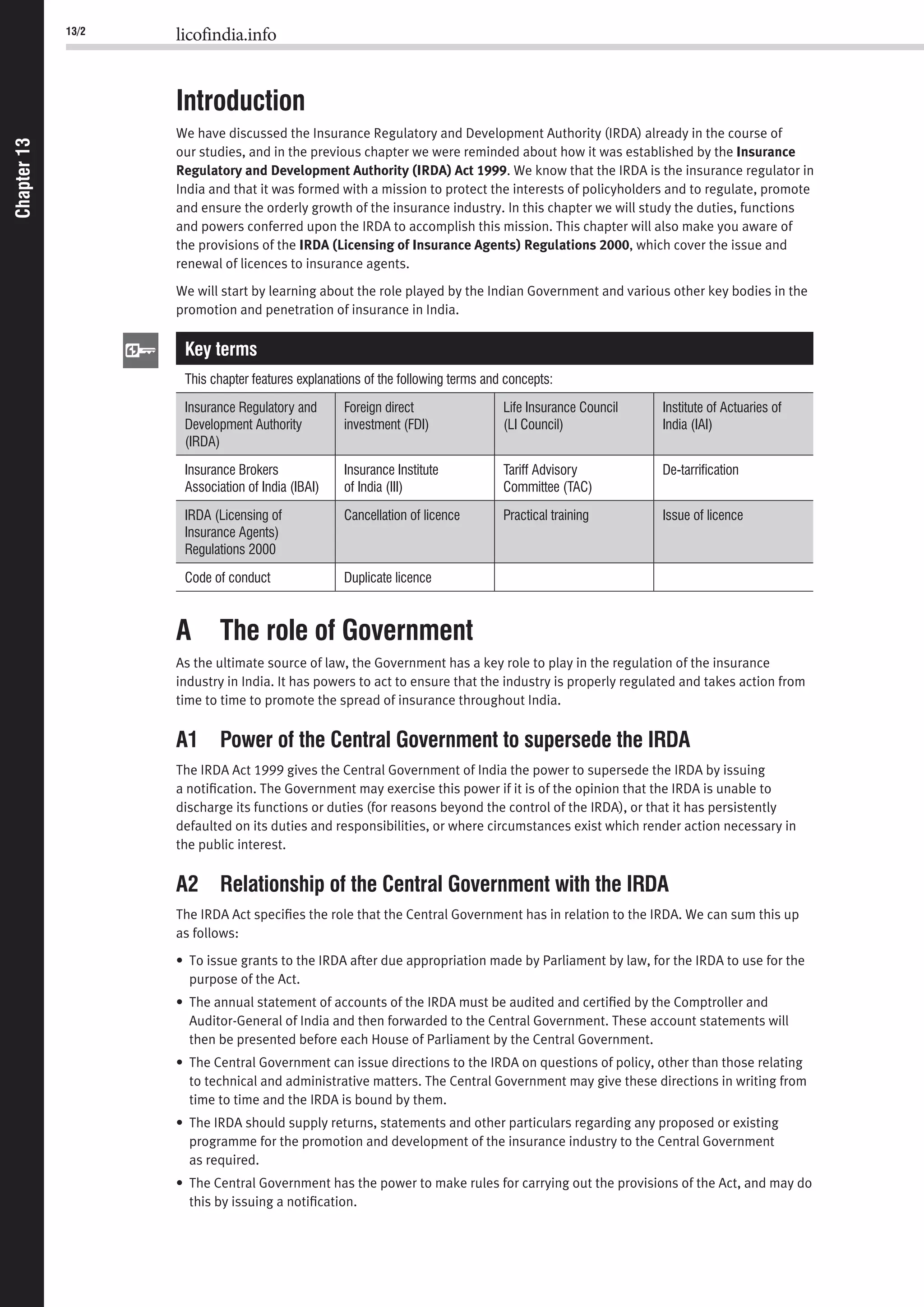

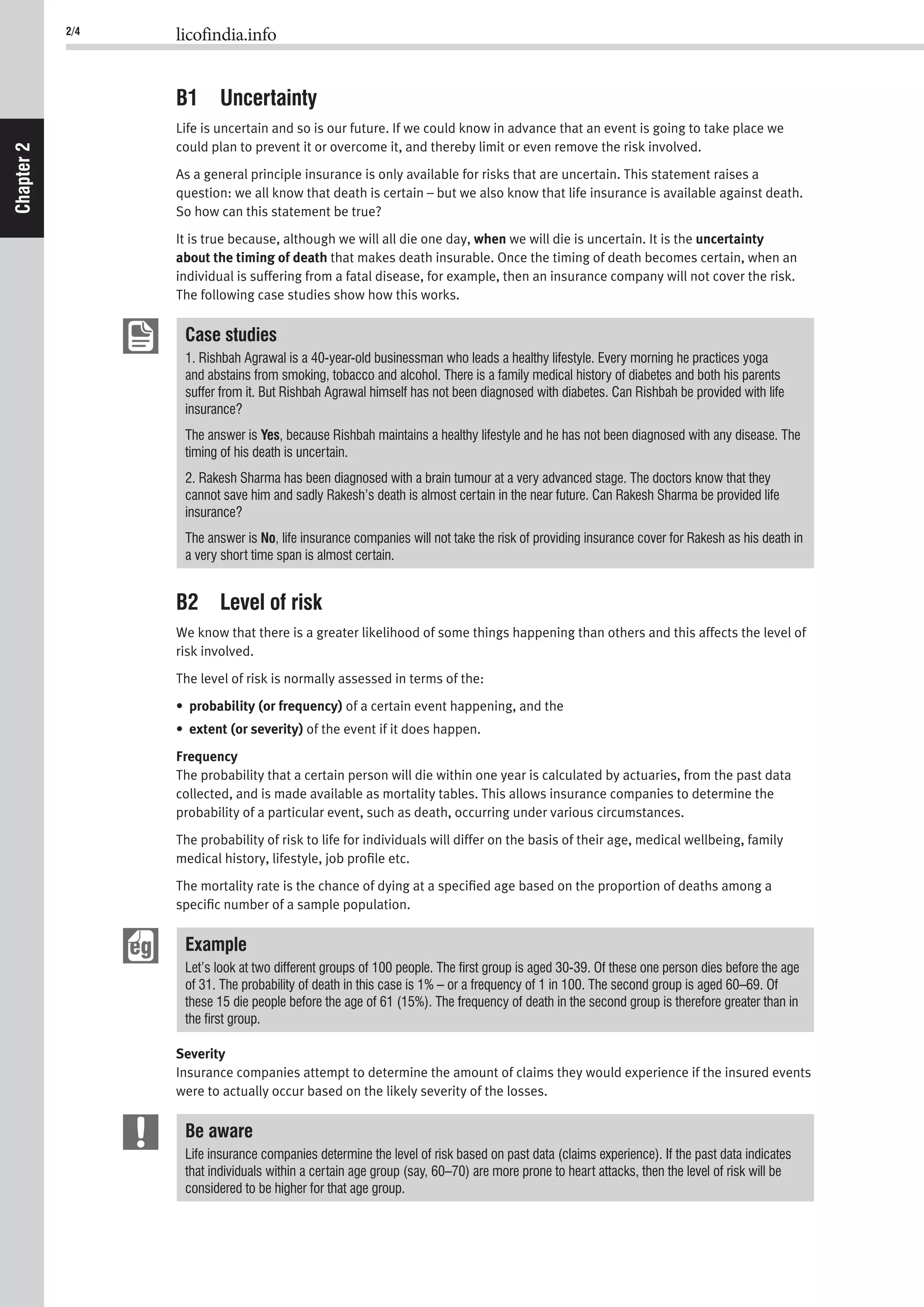

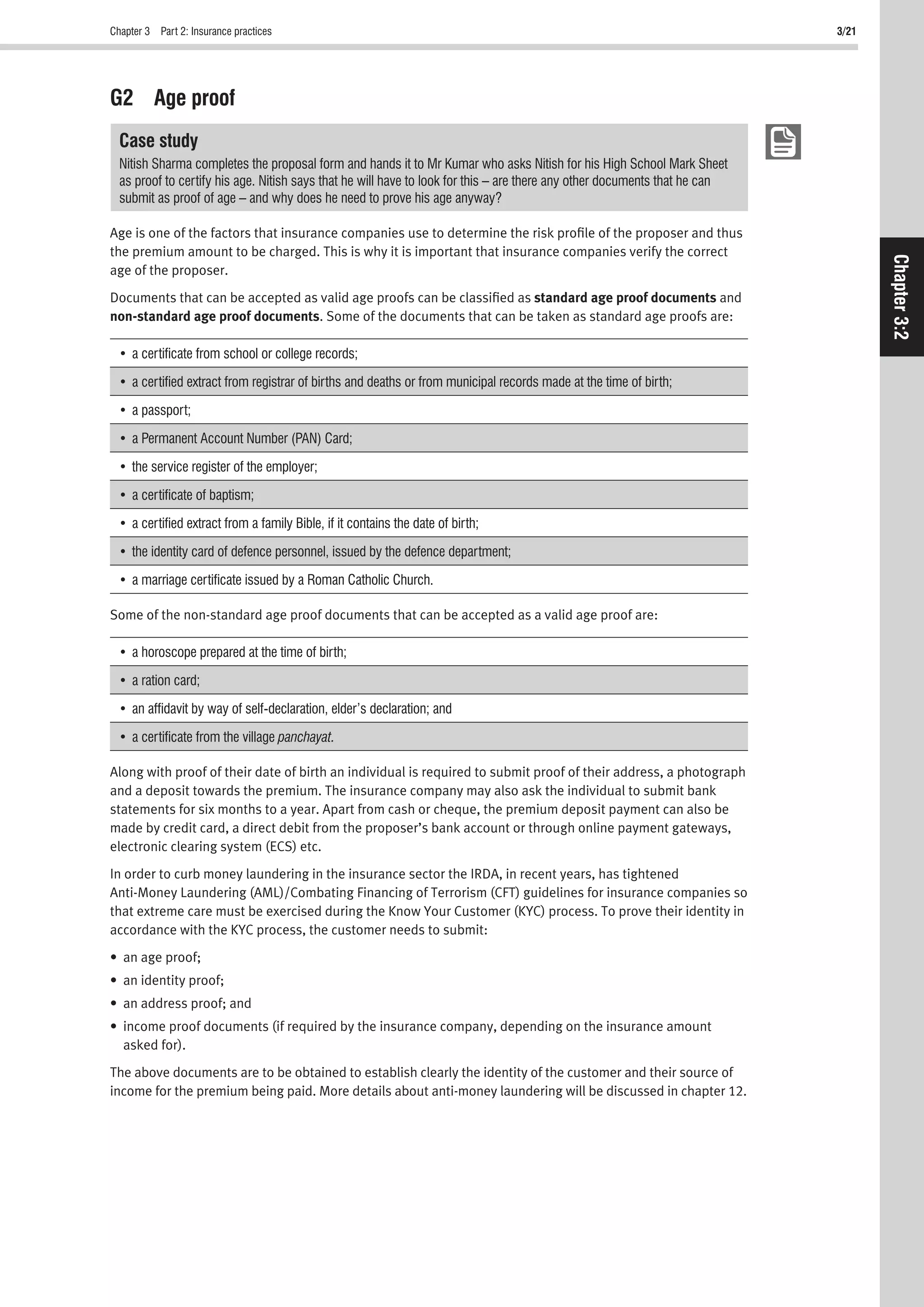

H1B Paid up value

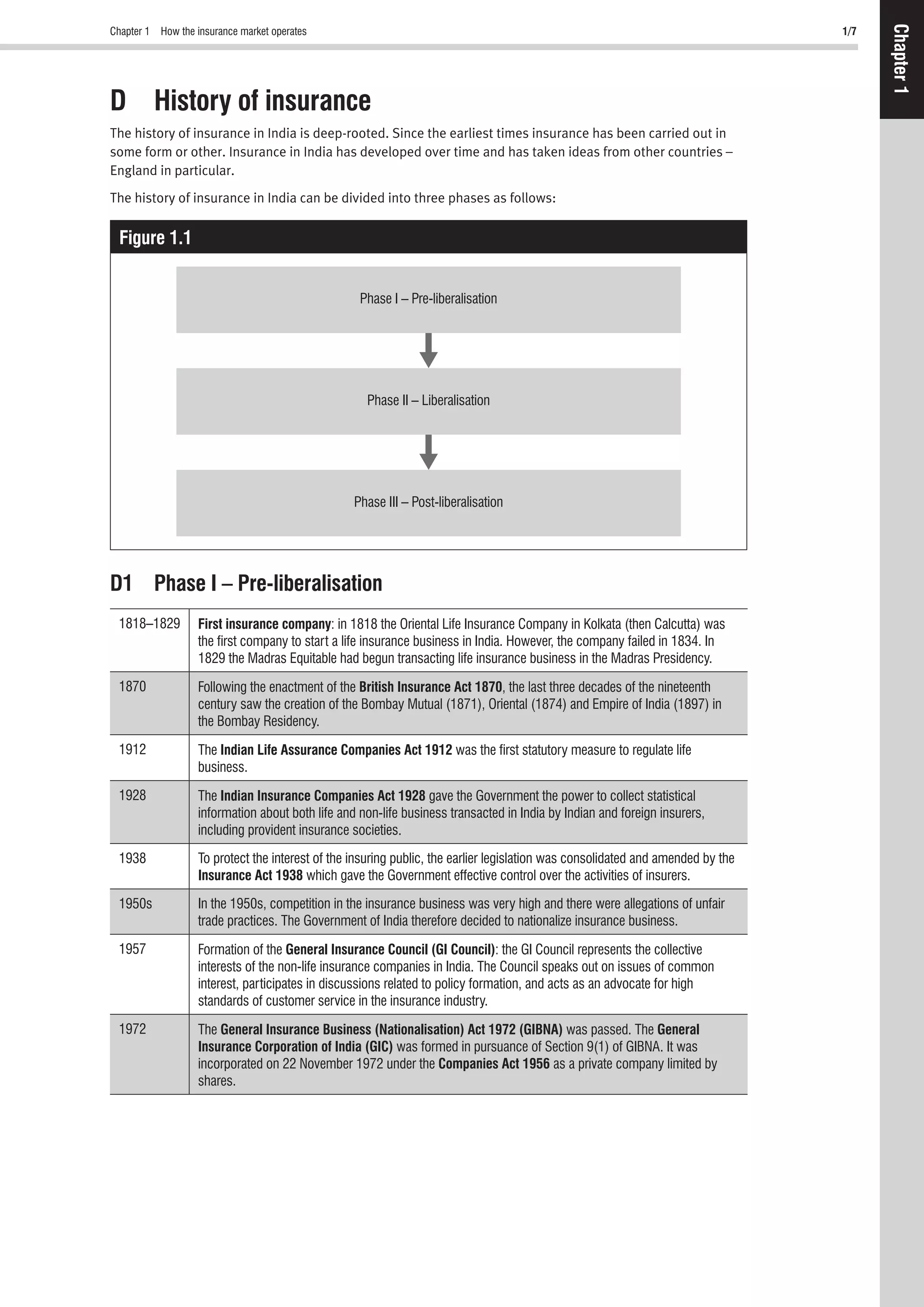

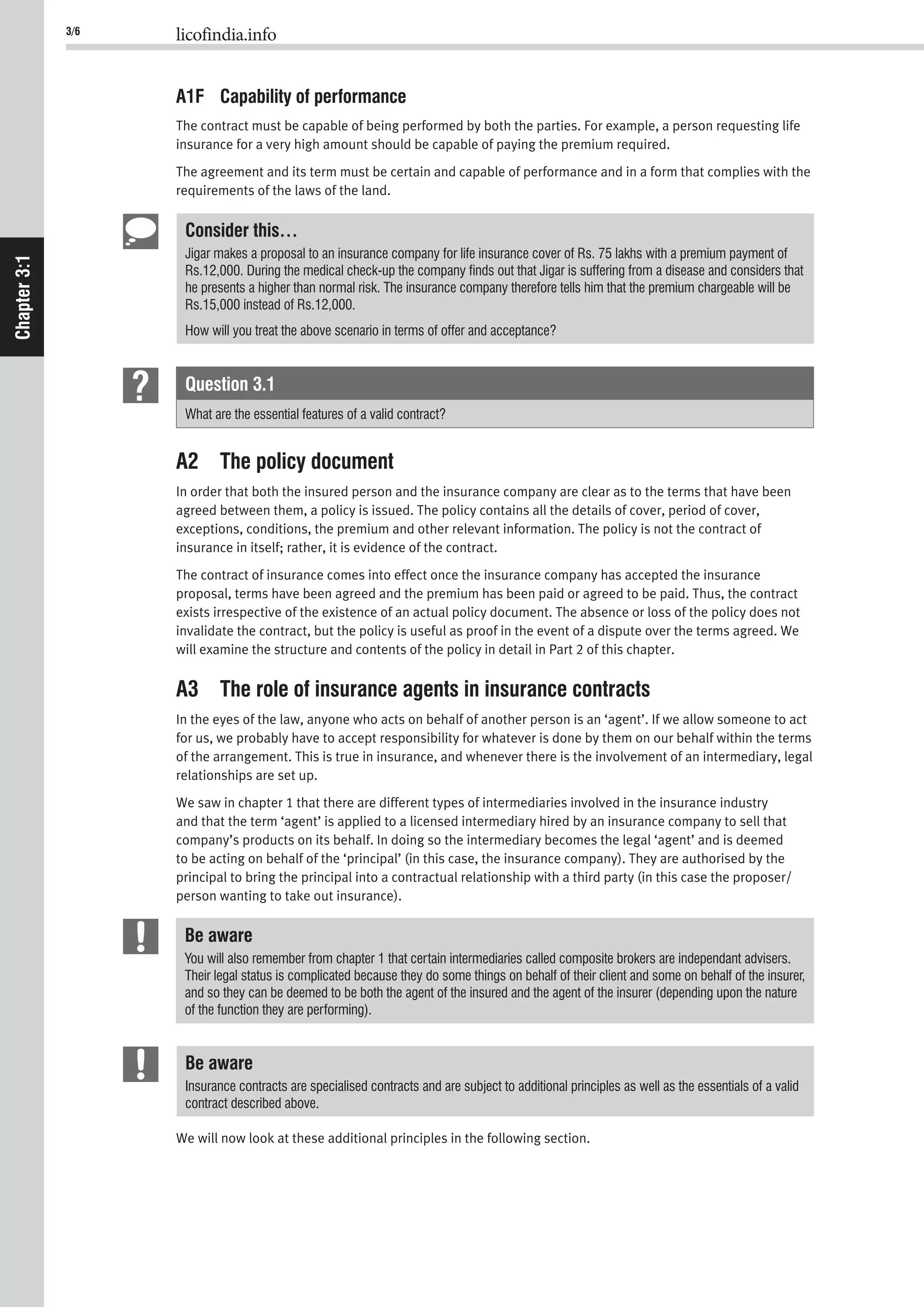

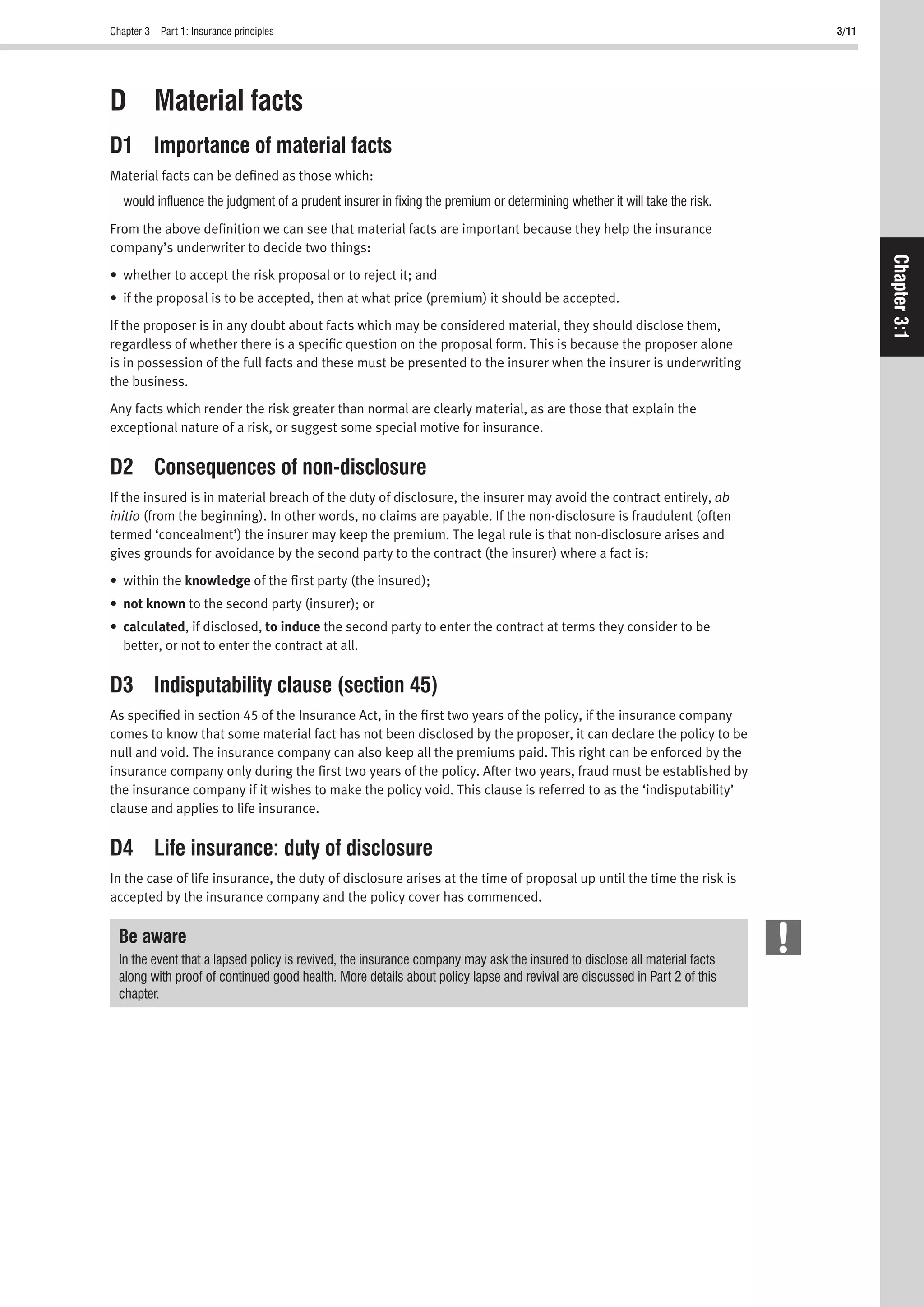

If a policyholder fails to pay a premium on a policy that is capable of having a value (e.g. an endowment or

savings plan) and the policy lapses, then the insurance company is not liable to pay the full sum insured.

Such a lapsed policy can be made a paid up policy. In a paid up policy the sum insured is reduced to an

amount based on the amount of premiums already paid.

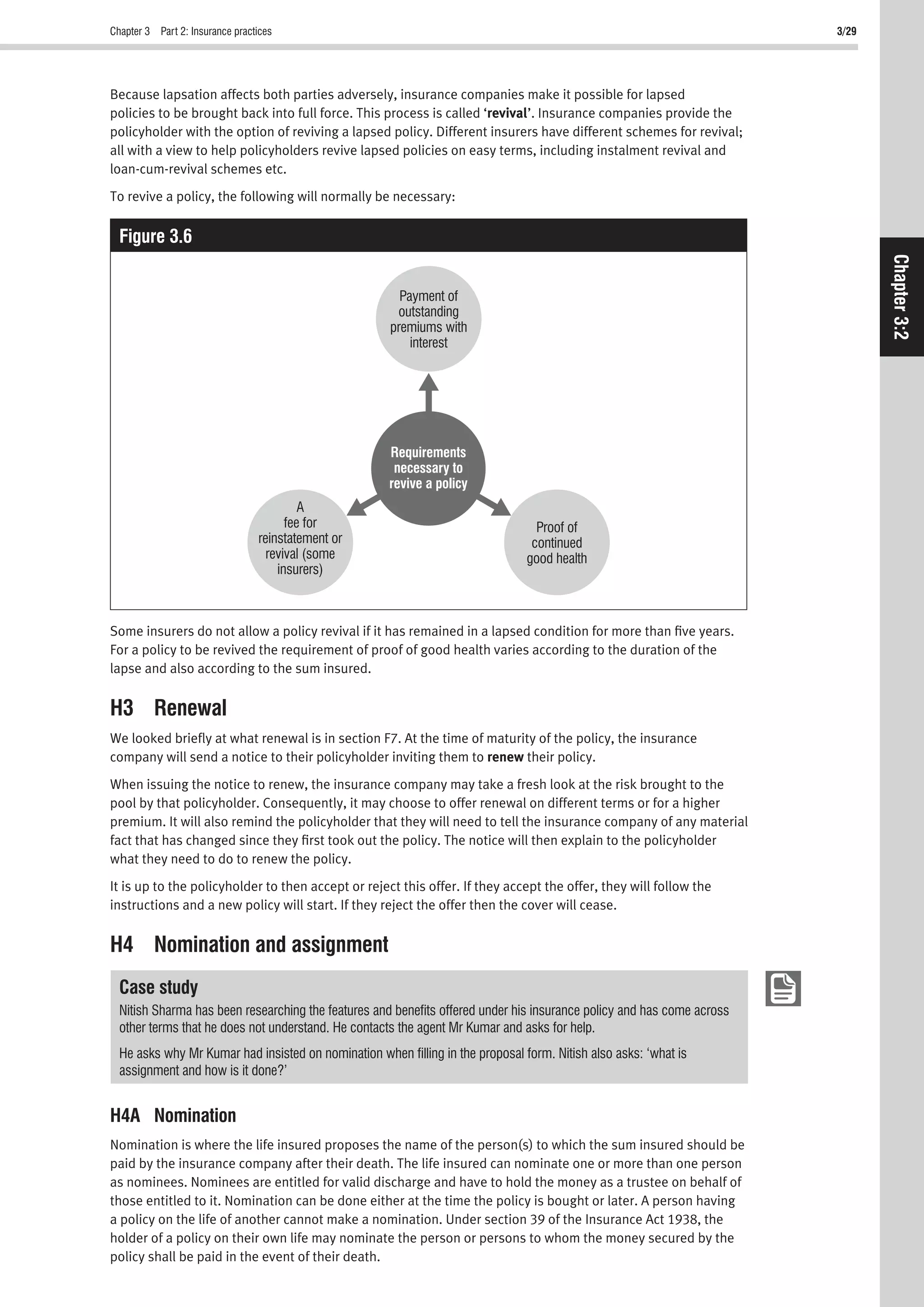

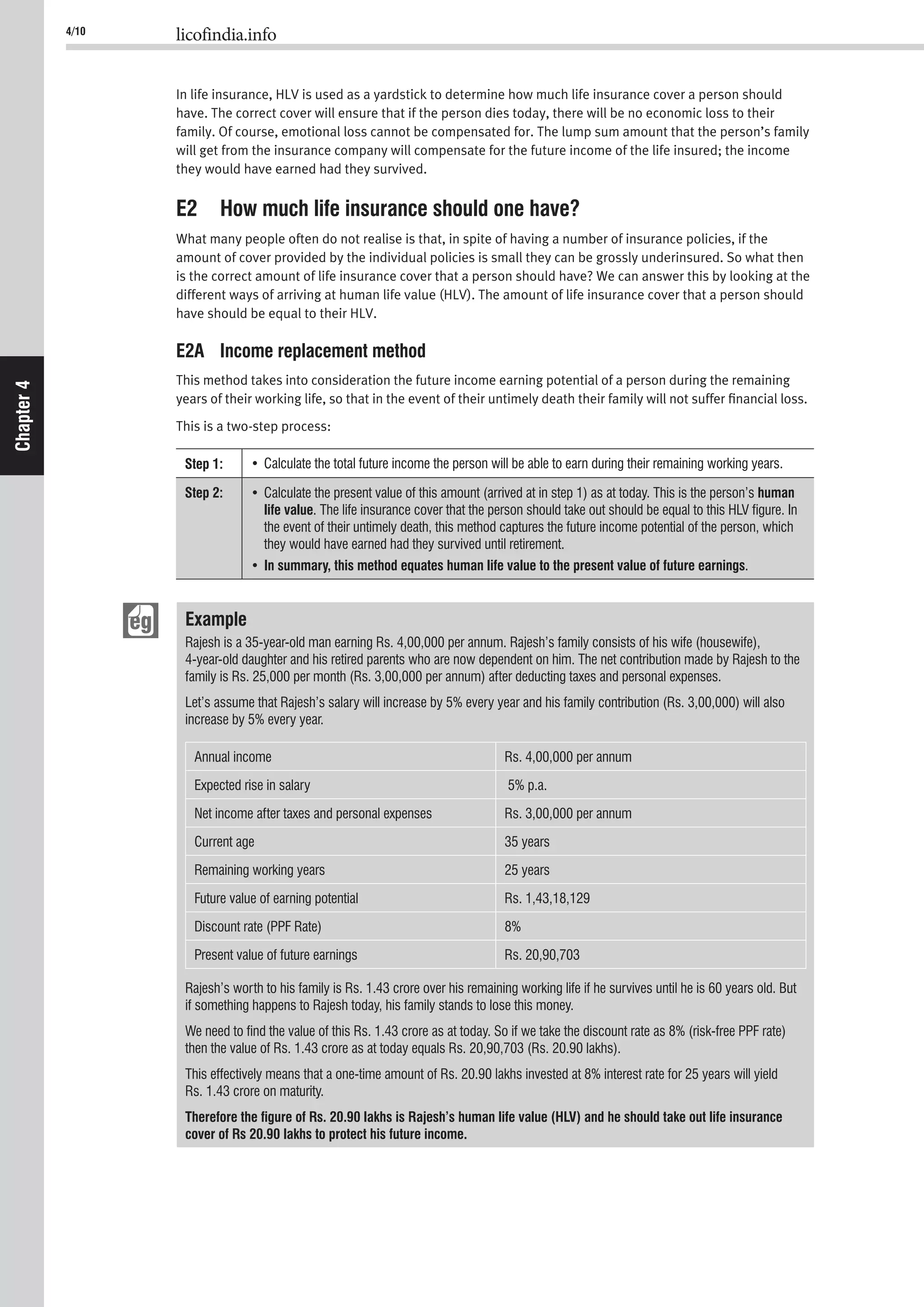

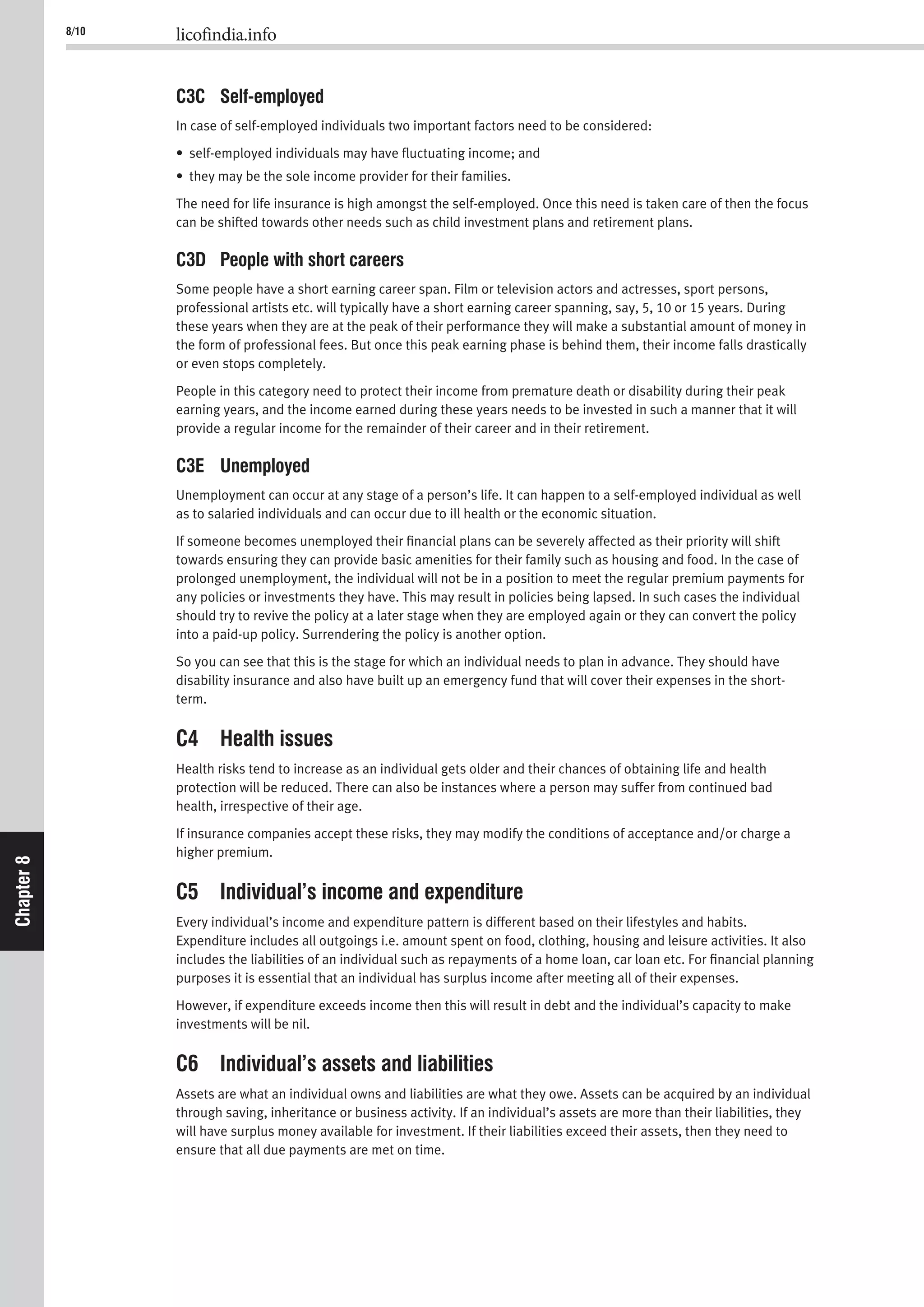

The formula for calculating paid up value is:

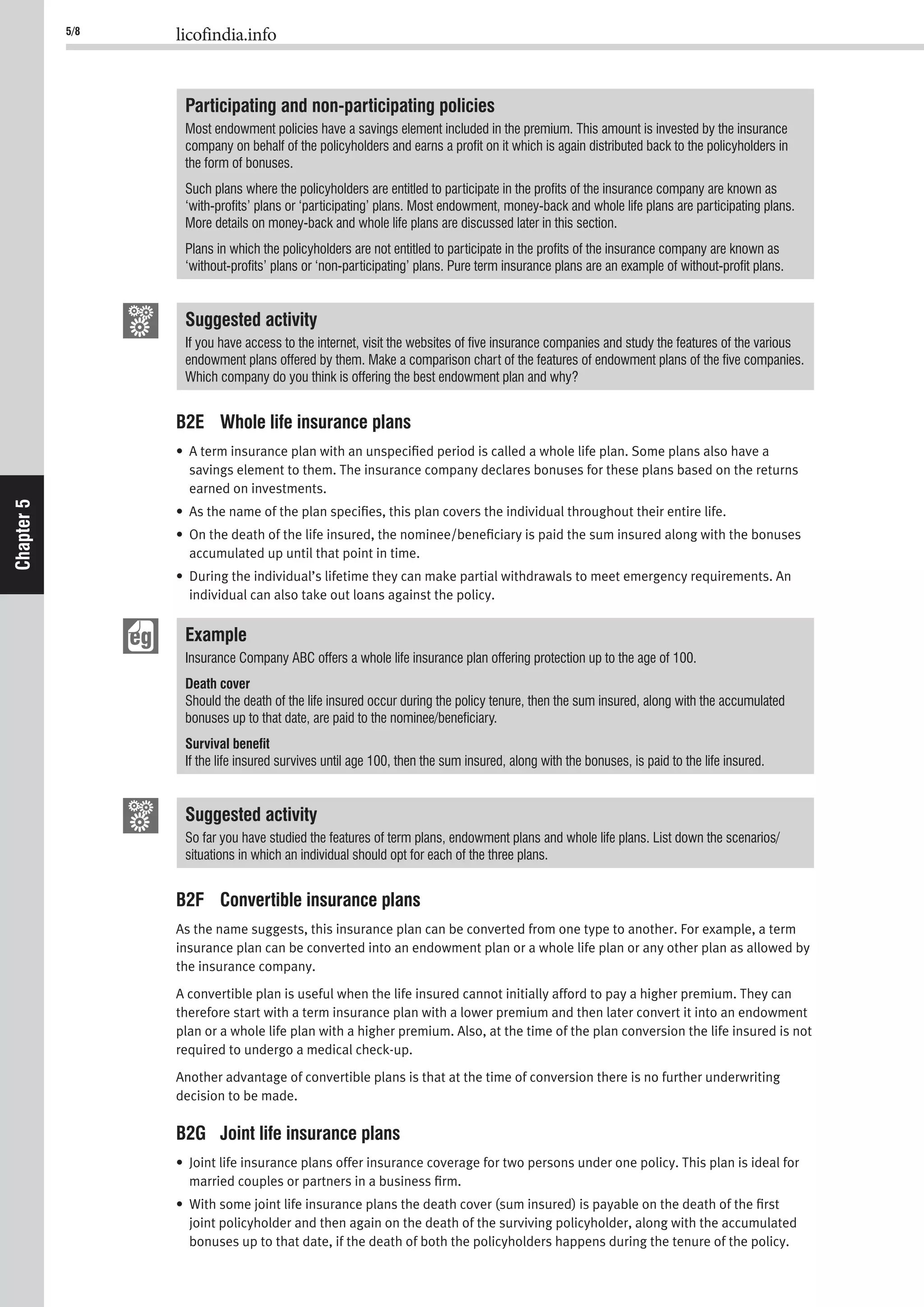

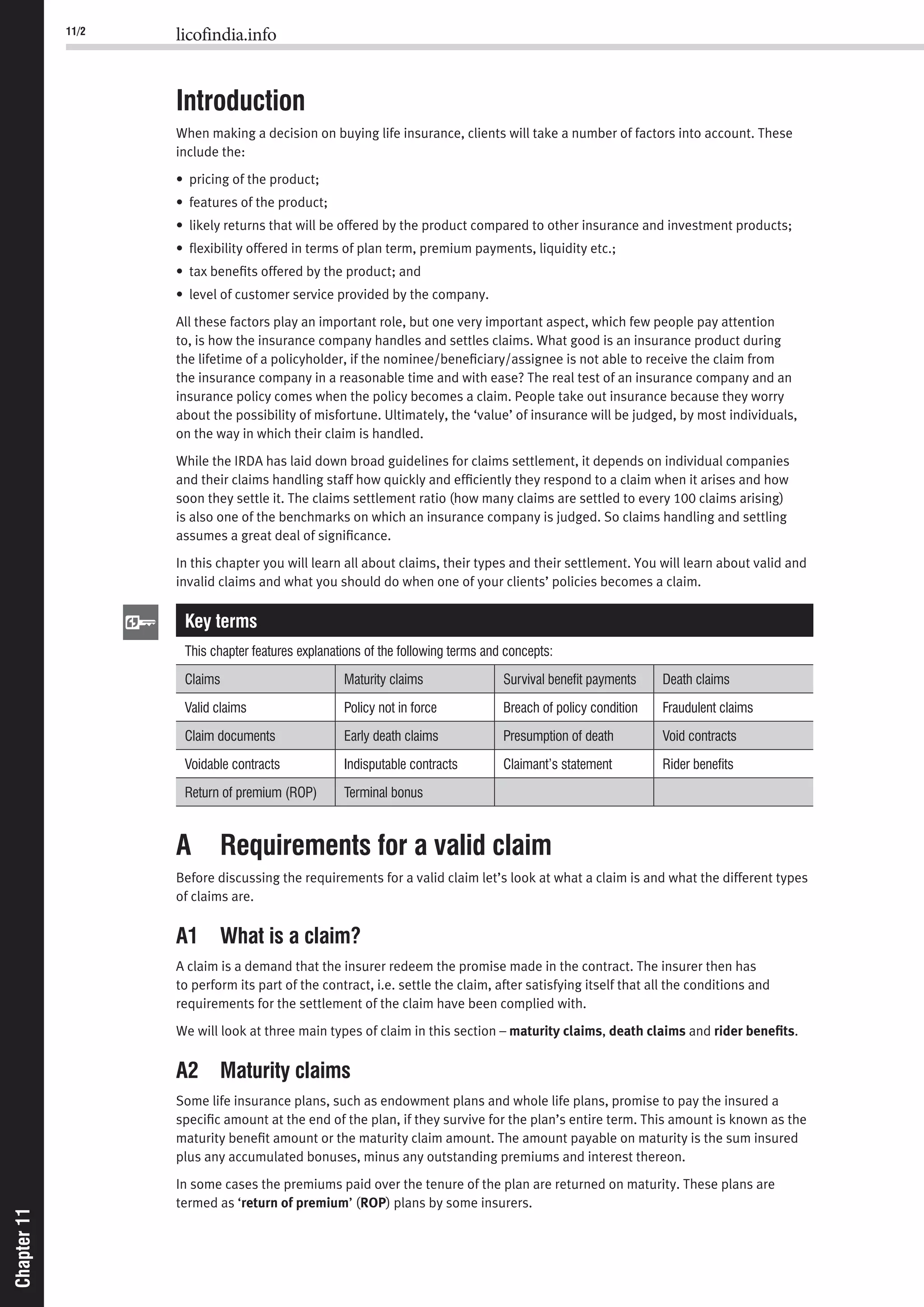

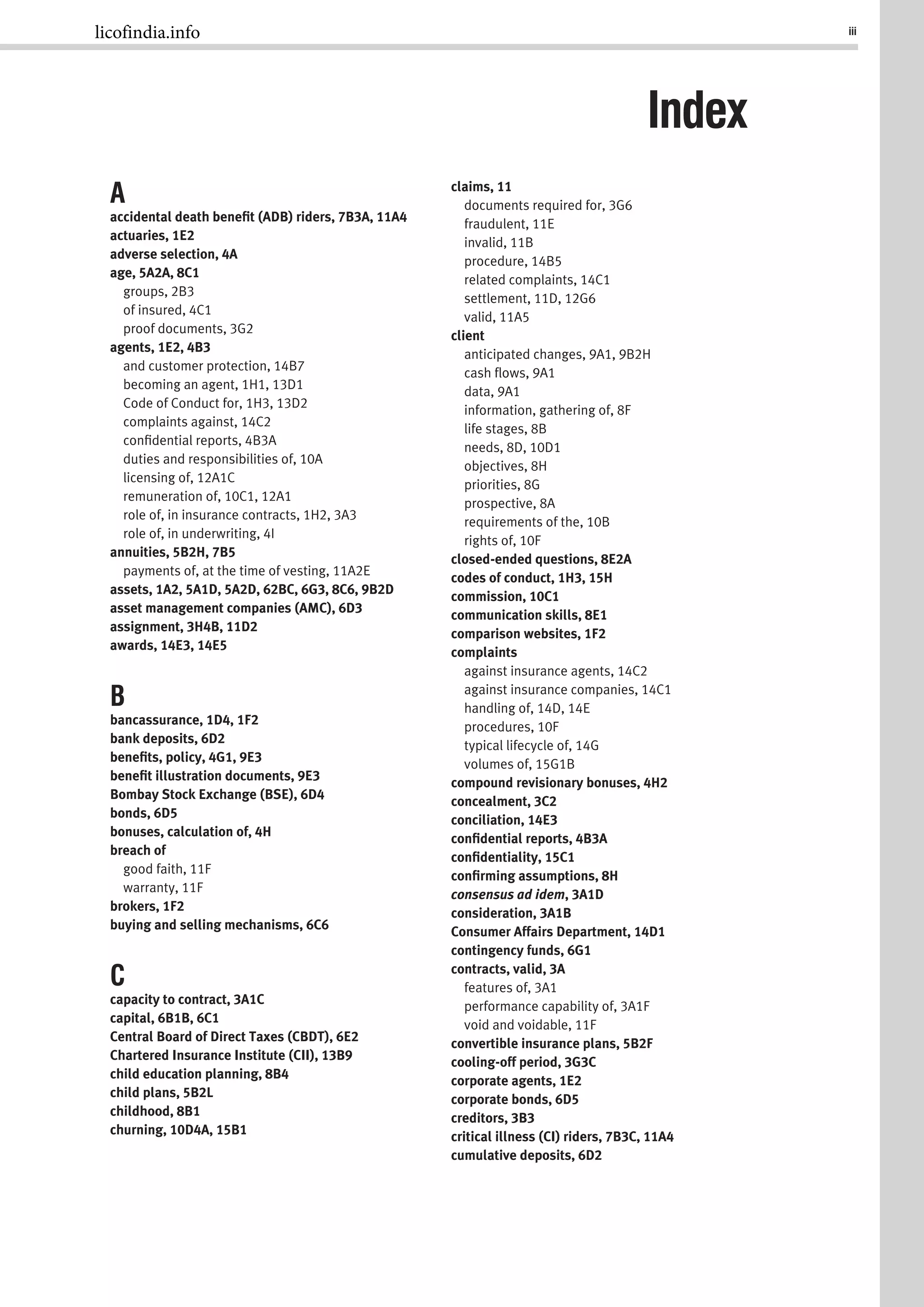

Figure 3.4

Total

number of

premiums

payable

Sum

insured

Paid up

value

Number

of premiums

paid

Bonus

(if any)÷ × + =

΄Ά · ΅

Insurance companies insist on a minimum amount that must be acquired as a paid up value. If the paid up

value works out to be lower than this minimum amount, this non-forfeiture benefit would not apply and the

policy would lapse. The policyholder may be able to collect the surrender value (which we will discuss in

section H1C).

Normally insurance companies will offer the policyholder the right to convert a normal policy into a paid up

policy if they have already paid premiums for a minimum of three years. After this period, if the policyholder

is unable to pay the remaining premiums then under the paid up option the policy is not cancelled. Instead,

the sum insured is reduced in proportion to the number of premiums paid. If other benefits related to the

sum insured are payable, the benefits will now be related to the reduced sum insured, which is the paid

up value.

What happens to bonuses if a with-profit policy is made paid up?

When calculating the paid up value of a with-profit policy, there is no change in the bonus already vested or

granted. Only the sum insured is reduced in proportion to the premiums paid. The accrued bonus is added

to the reduced sum insured to arrive at the paid up value. However, a paid up policy is not entitled to receive

further bonuses.

Example

Rakesh Singh has a savings policy. The following are the details of the policy:

Policy term 20 years

Date of commencement of policy 4 June 2001

Sum insured Rs. 5,00,000

Premium payment mode Annually

Last premium paid 4 June 2008

Number of premiums paid 8

Total number of premiums due 20

Vested bonus Rs. 50,000

As seen from the data above, Rakesh Singh stopped premium payment after the eighth year. The policy will not be fully

cancelled. Instead the sum insured will be reduced in proportion to the premiums paid.

Paid up value = [(number of premiums paid ÷ total premiums payable) × sum insured] + bonus

= [(8/20) × Rs. 5,00,000] + Rs. 50,000

= Rs. 2,00,000 + Rs. 50,000

= Rs. 2,50,000

The paid up value of the policy will be Rs. 2,50,000](https://image.slidesharecdn.com/ic33english1-160725141913/75/Ic-33-english-58-2048.jpg)