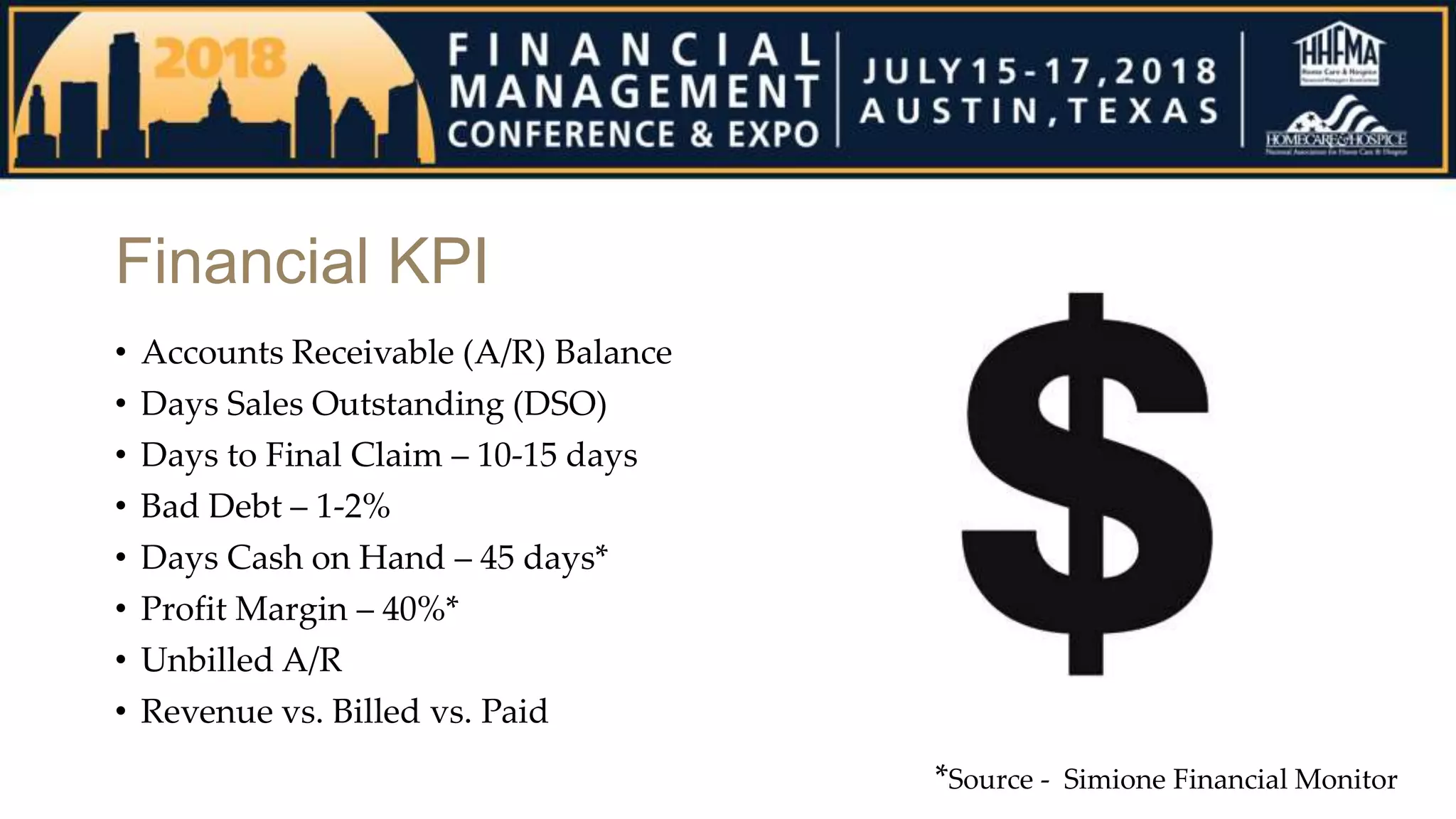

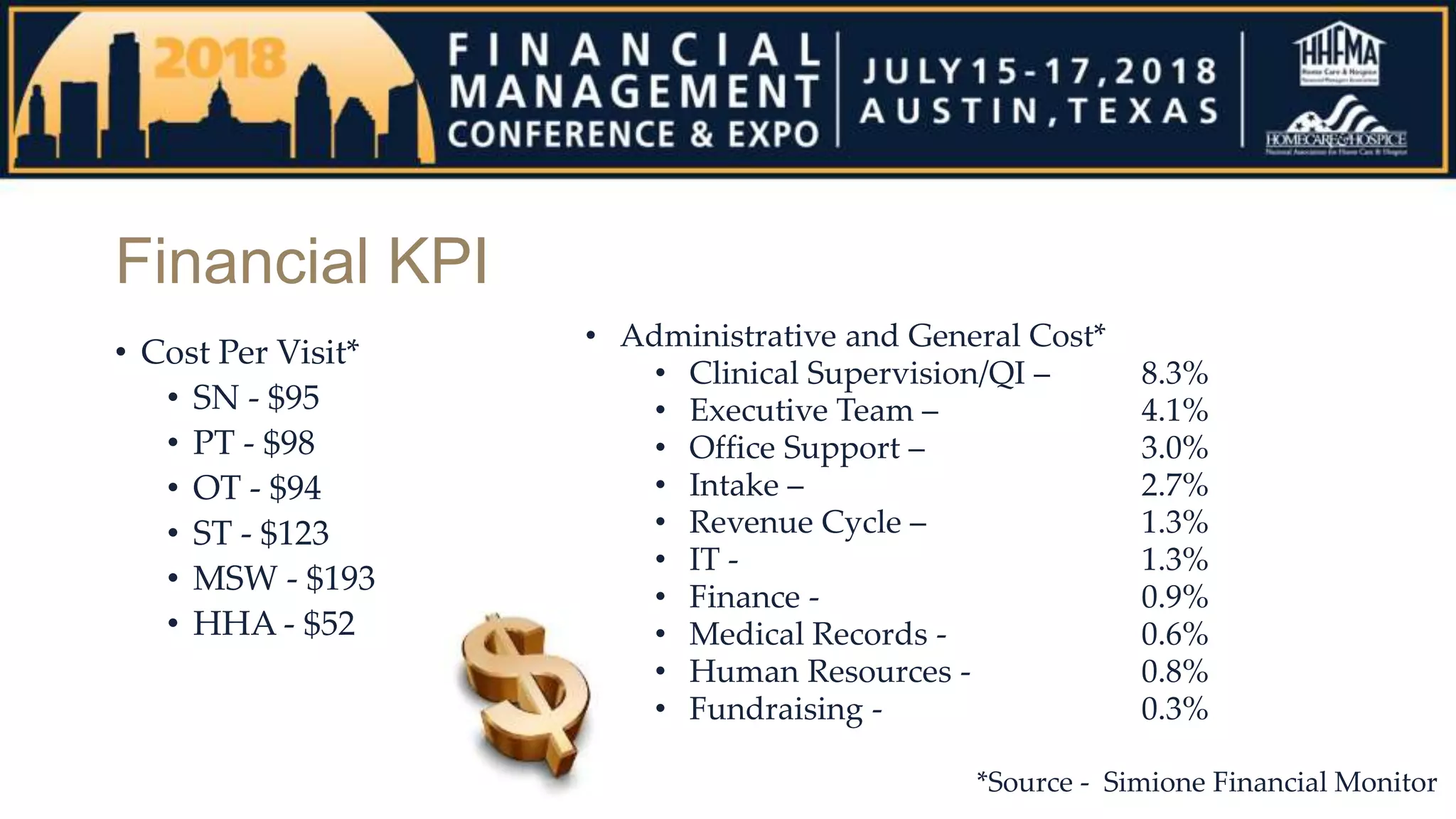

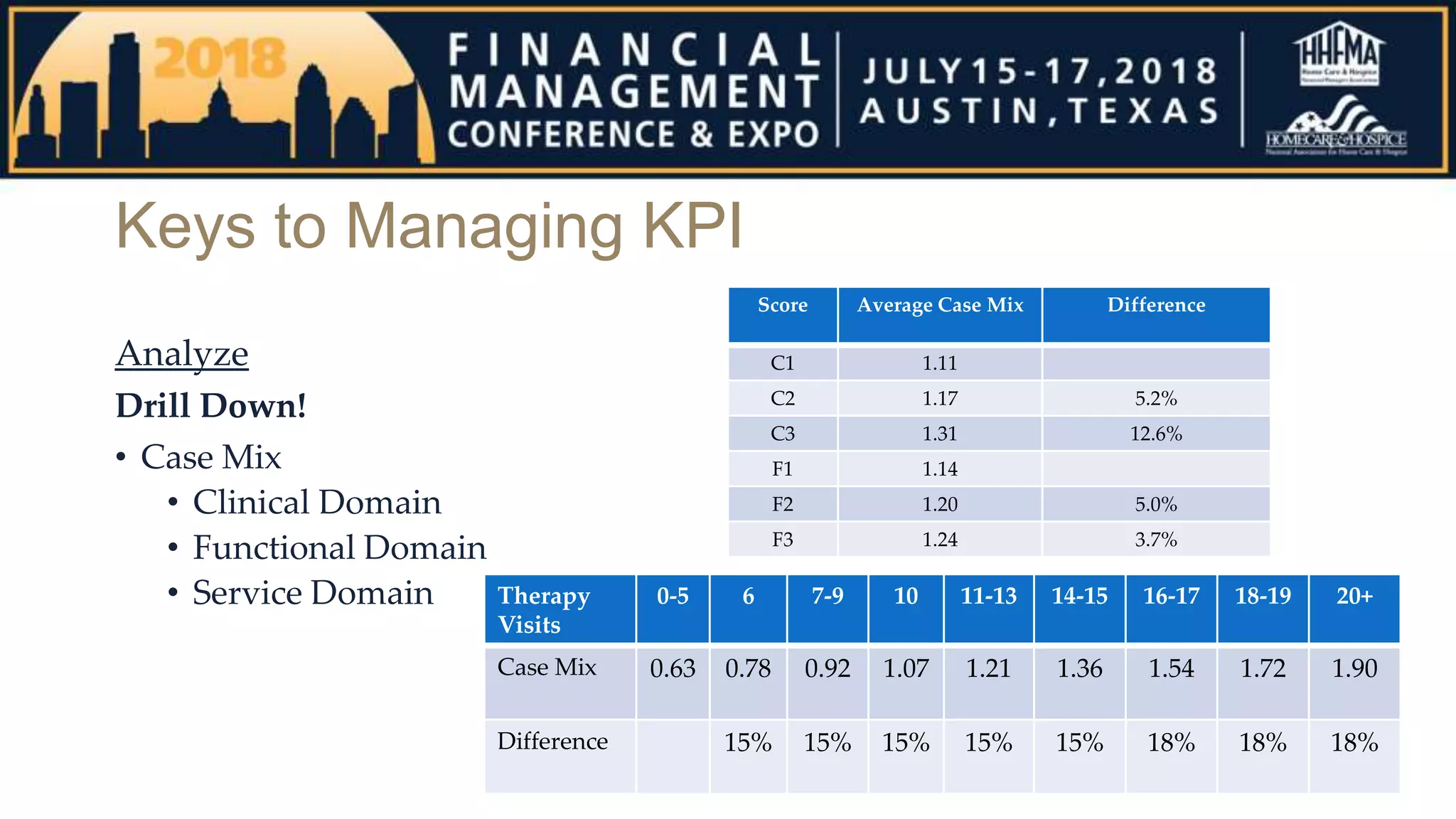

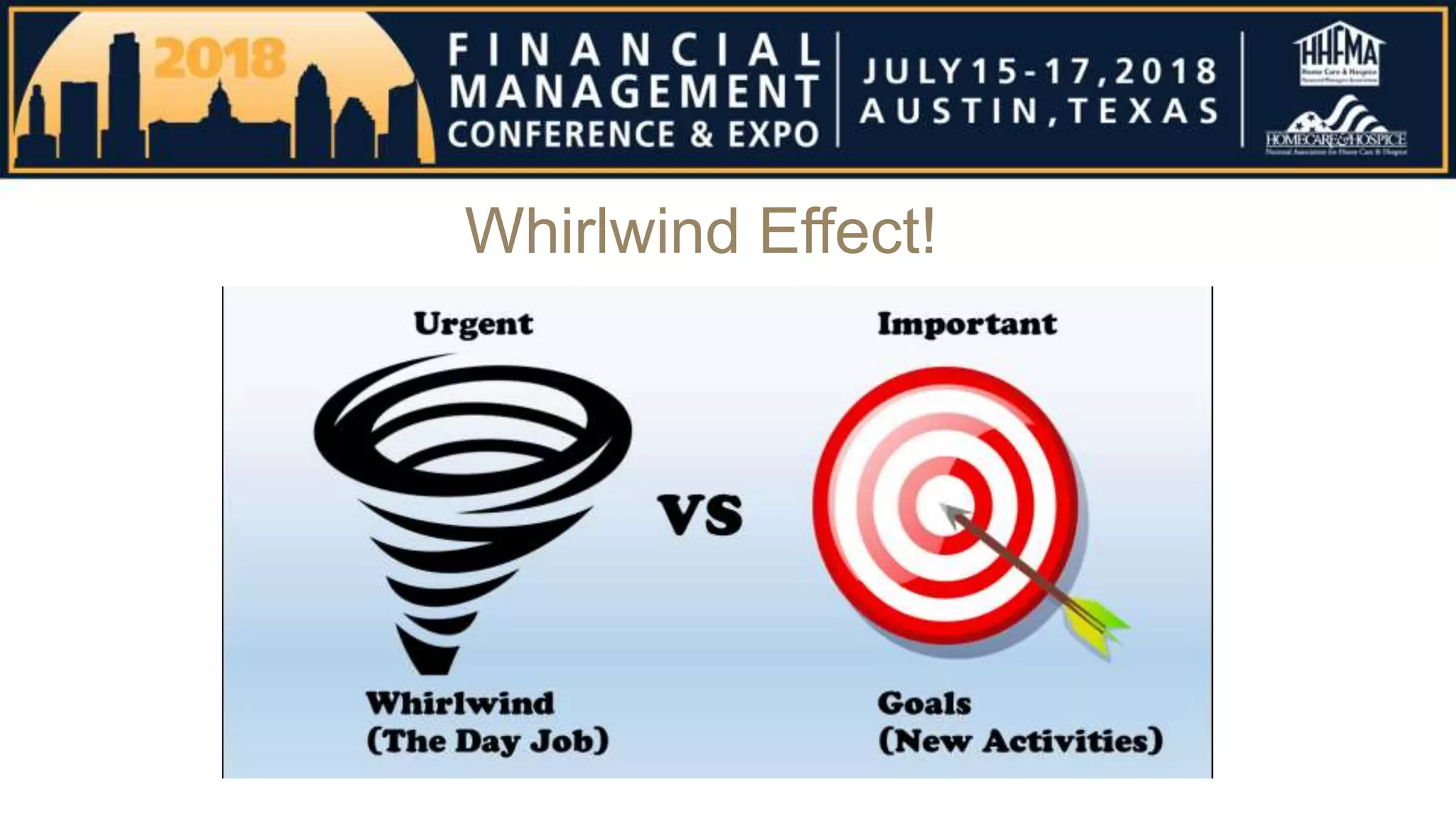

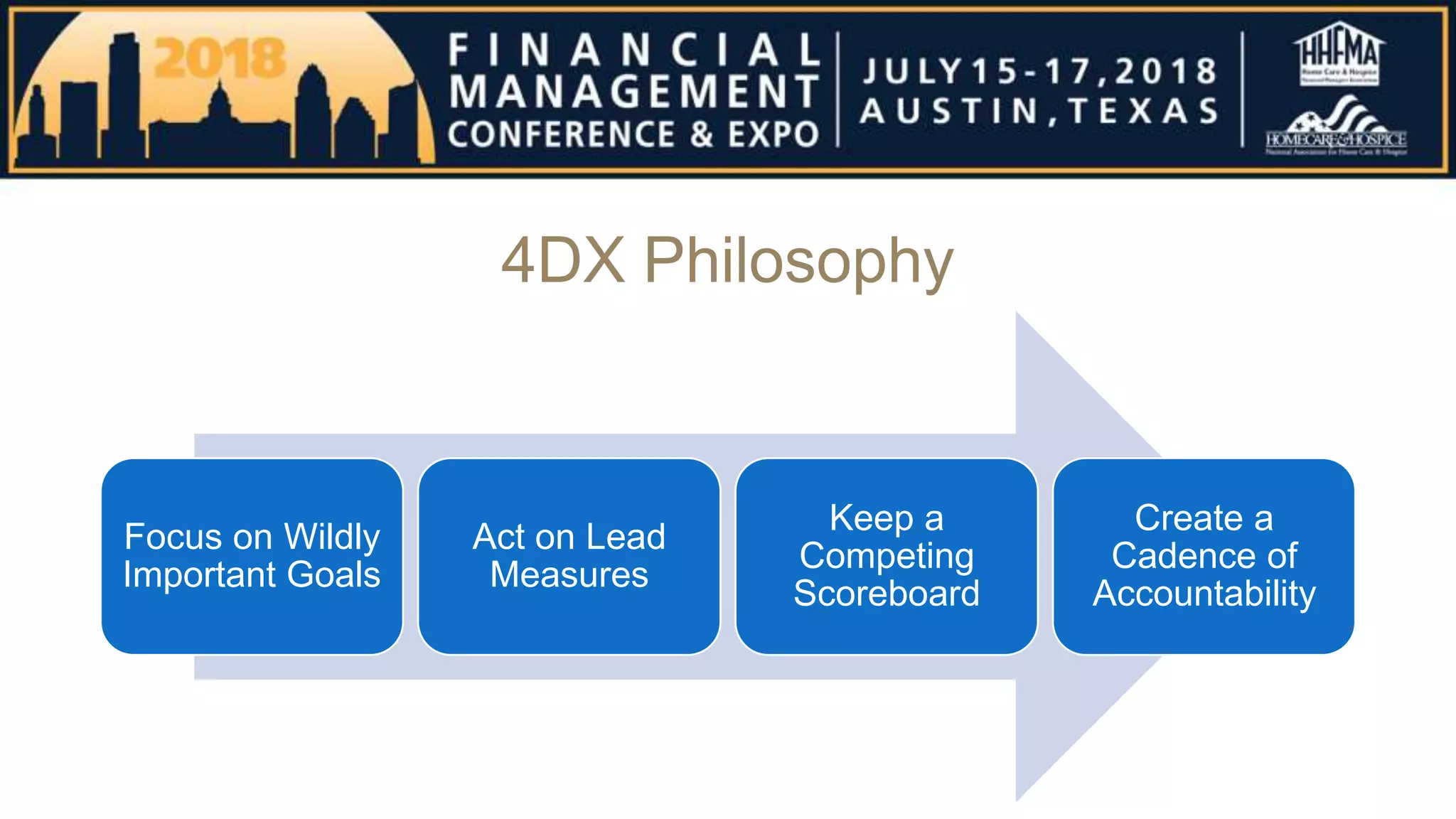

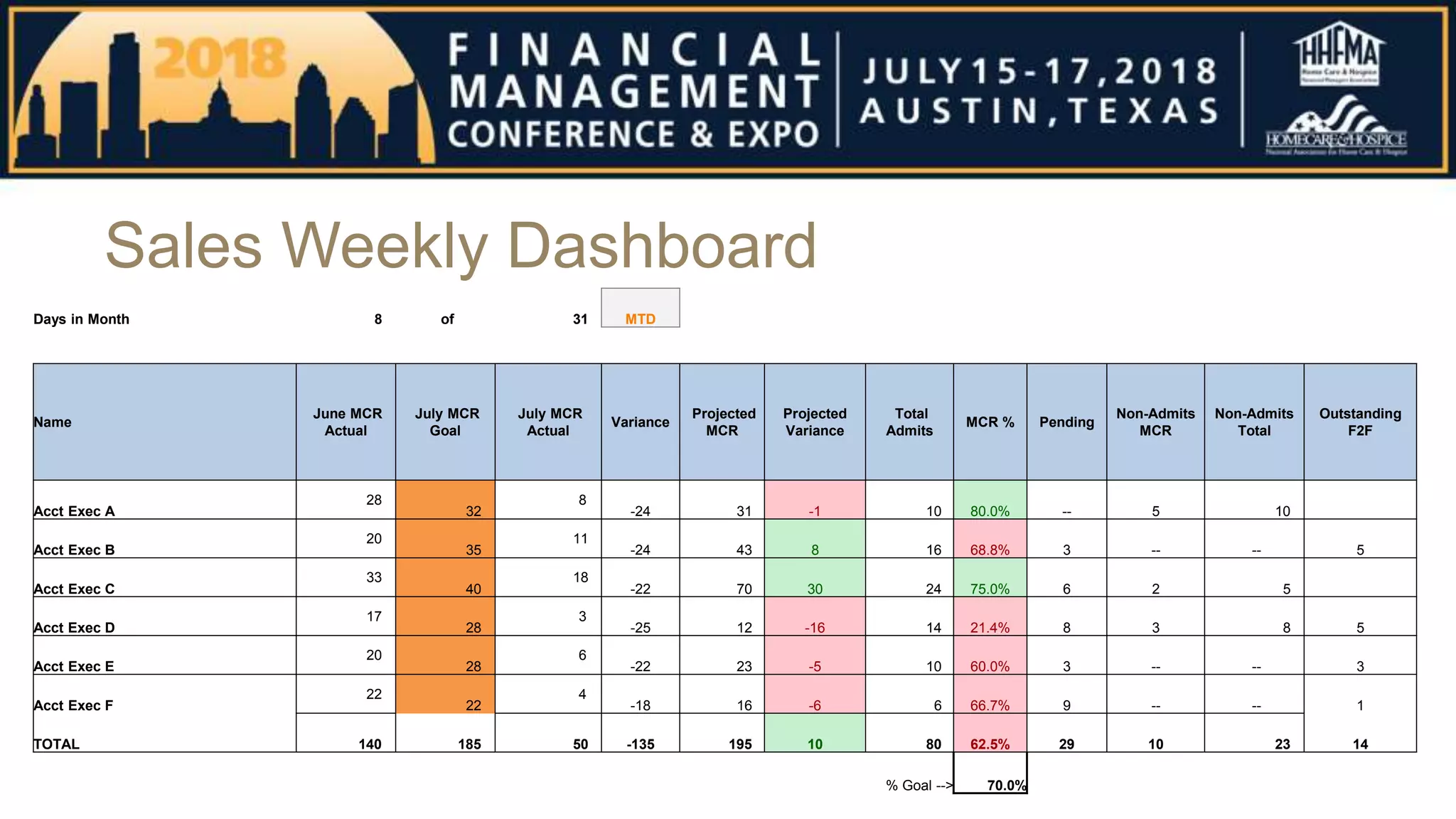

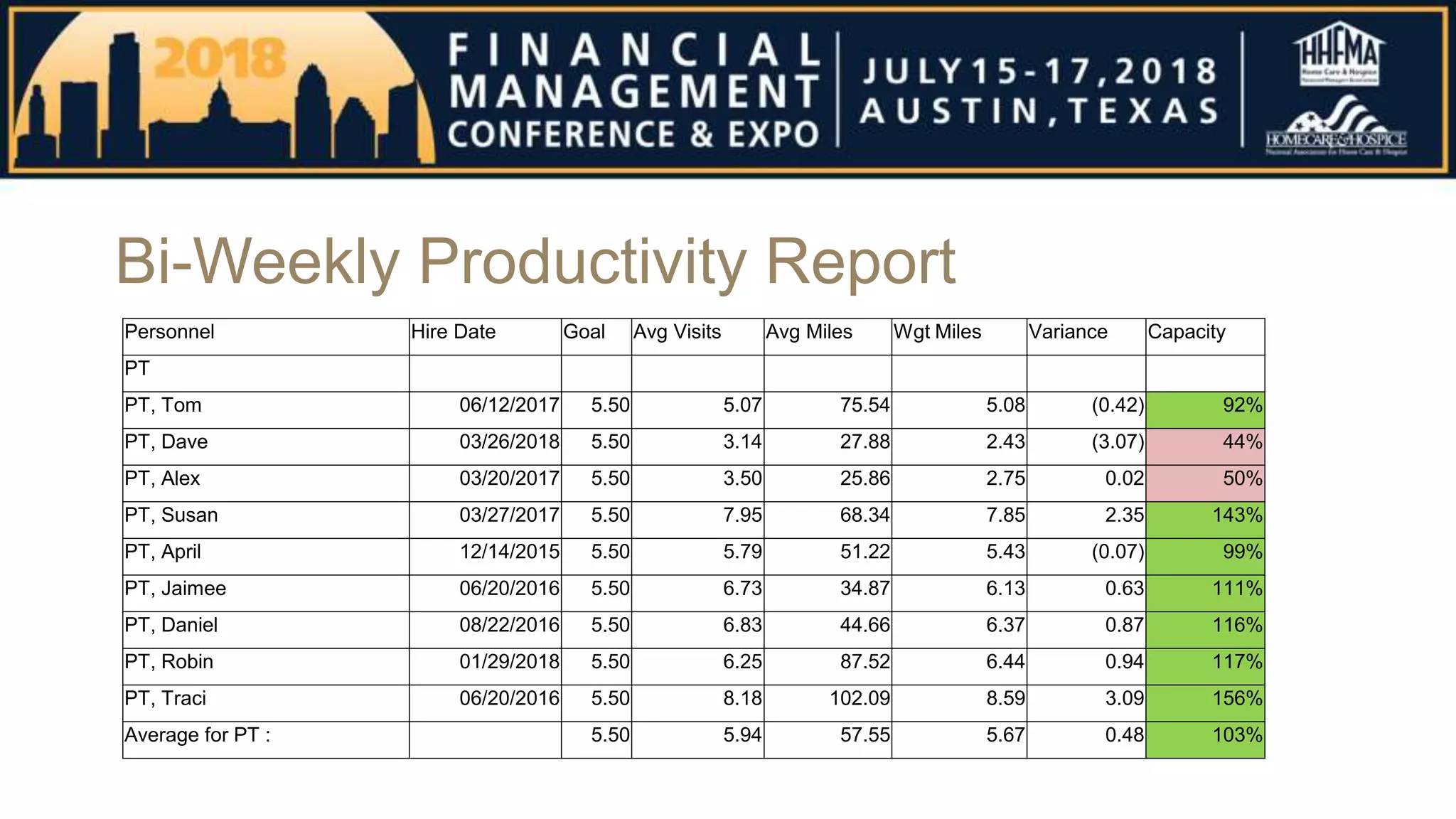

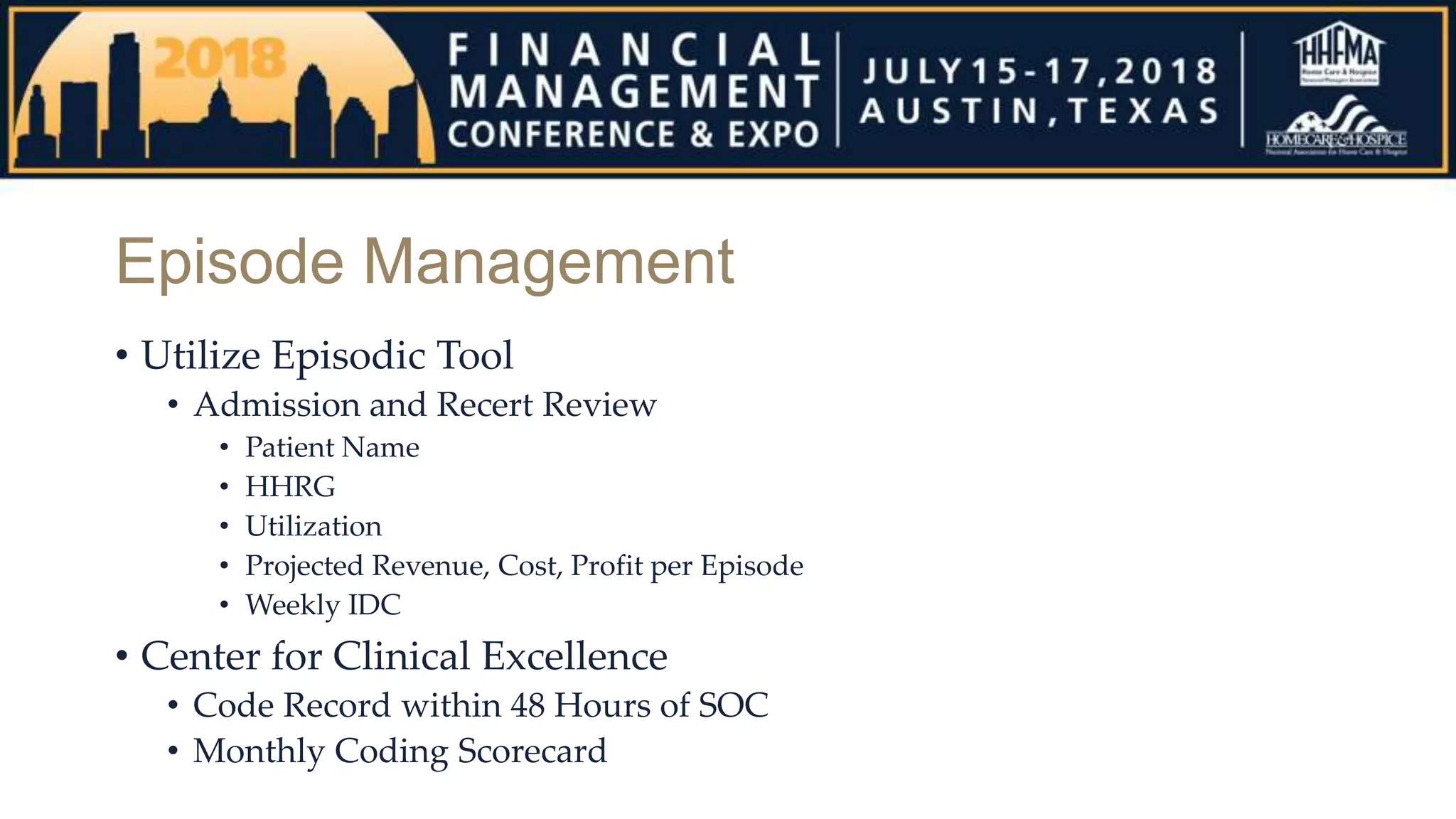

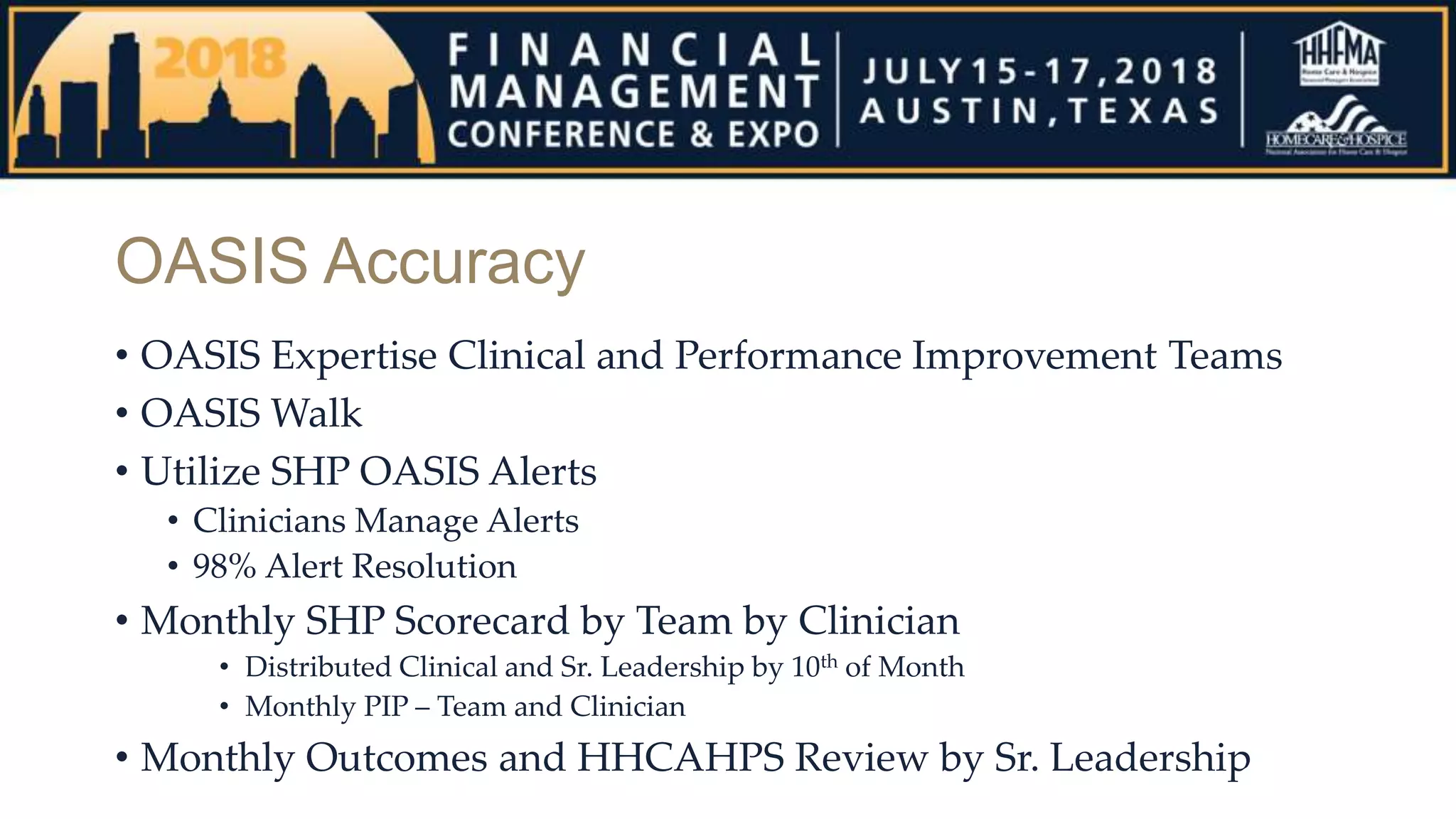

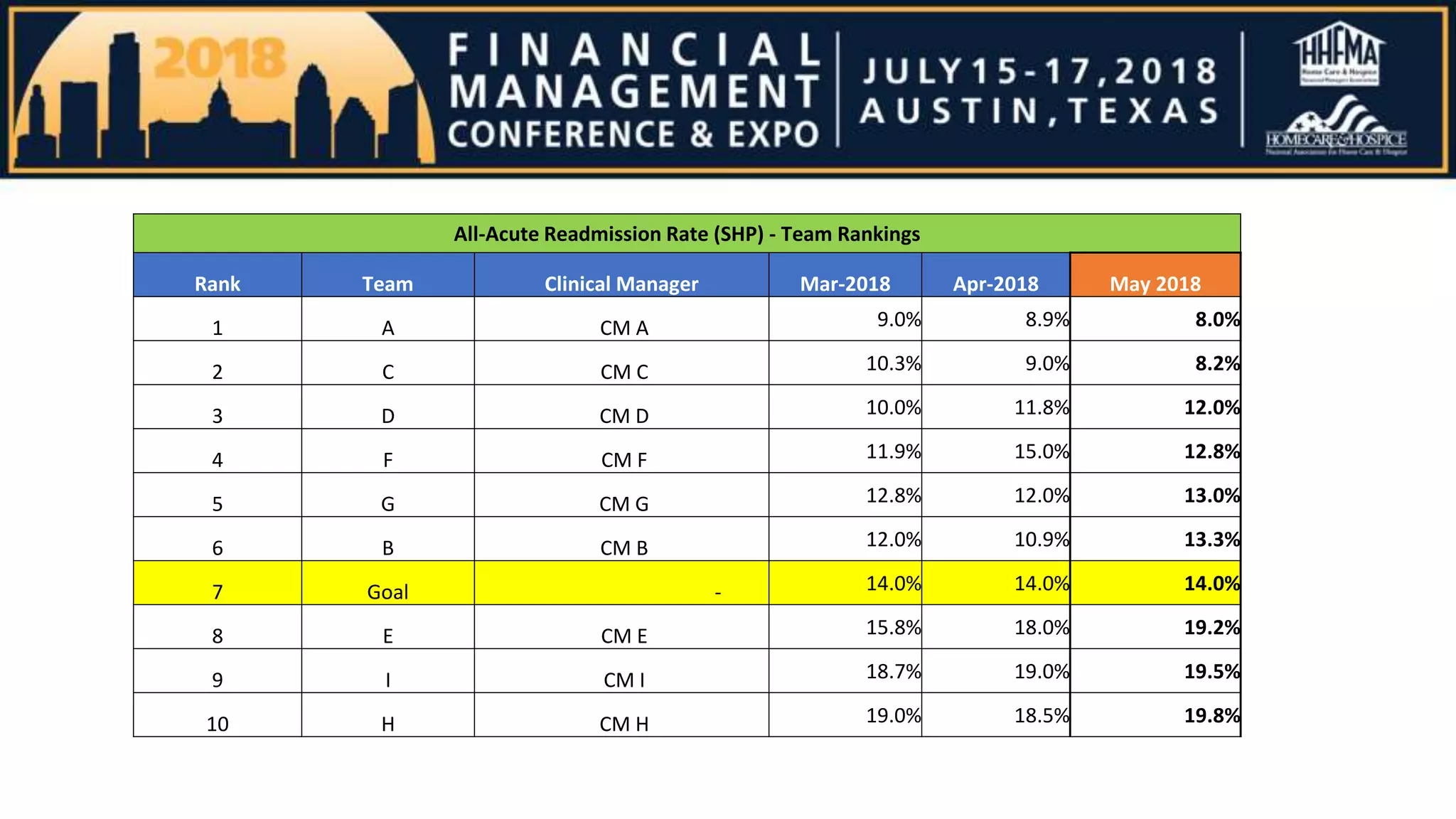

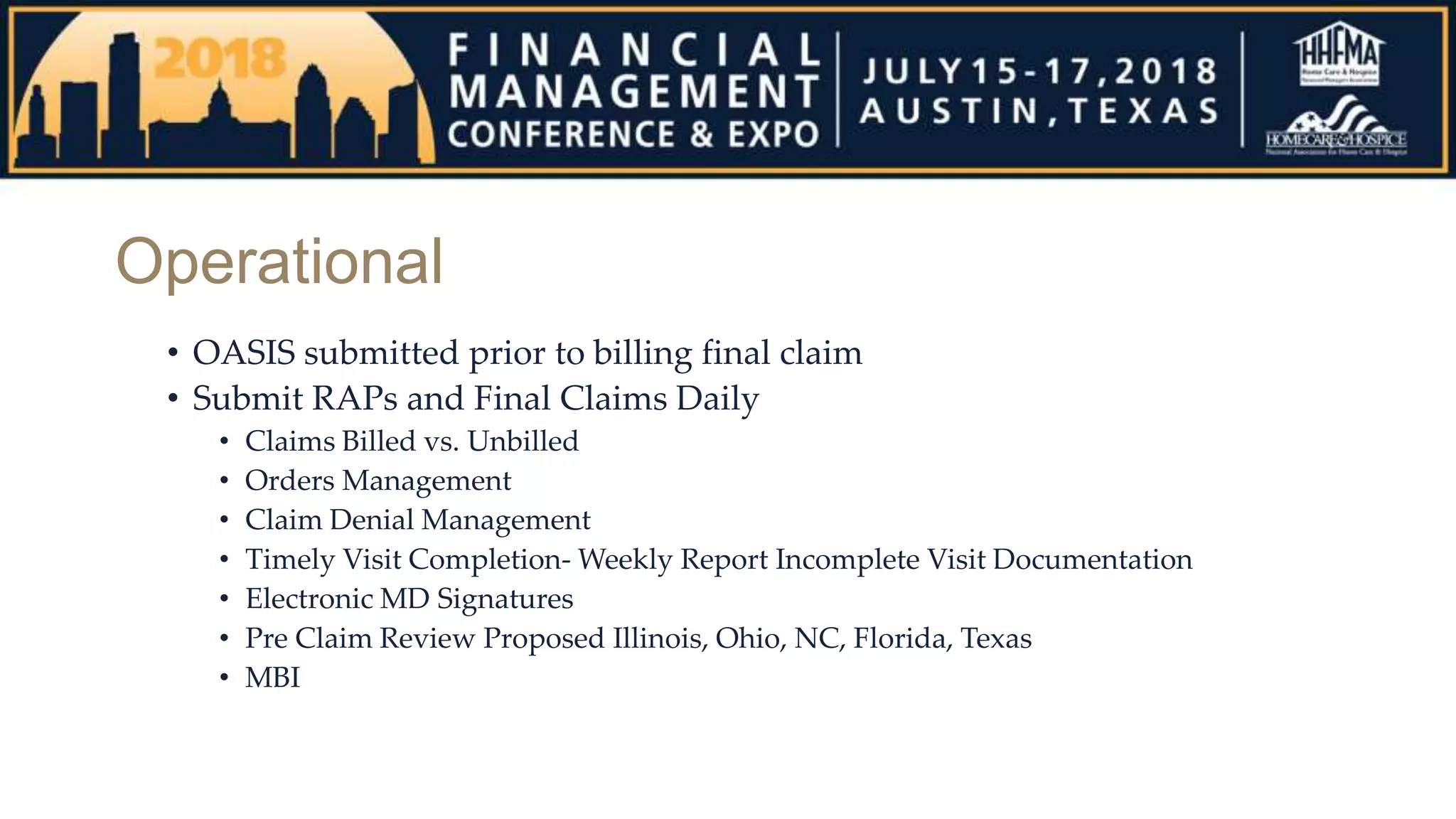

The document outlines key performance indicators (KPIs) essential for improving home health businesses, detailing how to prioritize and organize them into actionable dashboards. It emphasizes the importance of data transparency and monitoring to facilitate informed decision-making and set realistic goals within the agency's operations. Additionally, the text discusses strategies for effective KPI management, performance analysis, and operational improvement to enhance clinical and financial outcomes.