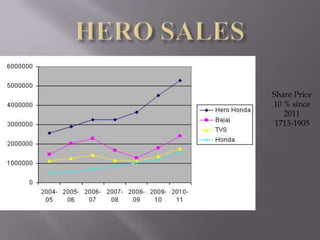

Hero MotoCorp Ltd., the world's largest two-wheeler manufacturer based in India, was formed from a joint venture between Hero Group and Honda in 1984, evolving into its current identity in 2011. The company dominates the Indian motorcycle market, selling a motorcycle every 30 seconds, and offers a diverse product range while maintaining a robust sales and service network with over 5,000 touchpoints. Hero MotoCorp aims to achieve $10 billion in revenue and 10 million two-wheeler sales by 2016-17, expanding its global market presence and operational capacity.