Embed presentation

Download to read offline

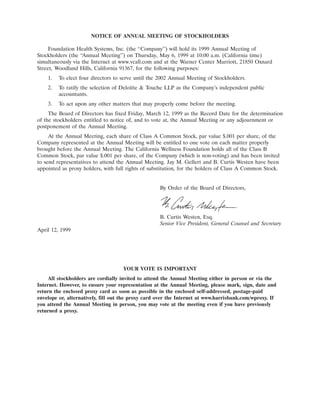

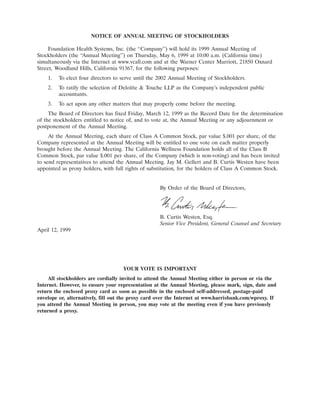

The document is a letter inviting stockholders to attend the 1999 Annual Meeting of Stockholders of Foundation Health Systems, Inc. It provides details on the date, time, and location of the meeting, as well as noting that each item of business from the Notice of Annual Meeting and Proxy Statement will be discussed. Stockholders who attend in person will have an opportunity to ask questions. It is important that stockholders vote their shares whether or not they plan to attend the meeting.