Embed presentation

Download to read offline

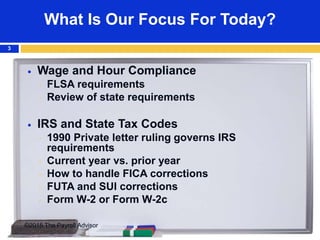

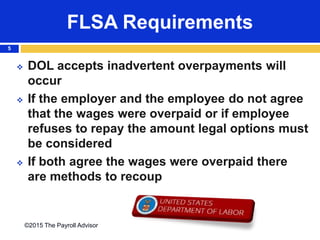

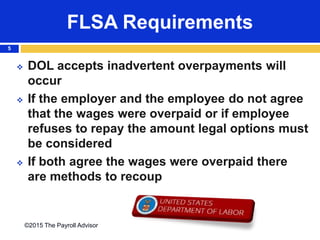

This document summarizes a presentation on handling payroll overpayments compliantly and effectively. It discusses following wage and hour compliance rules under the Fair Labor Standards Act and state laws when recovering overpayments. It also covers tax implications under IRS and state tax codes, including how to handle corrections for income, Social Security, Medicare, unemployment and income taxes. The full presentation provides more details on the FLSA and state requirements for recovering agreed upon overpayments, as well as options if the employee does not agree to repayment.