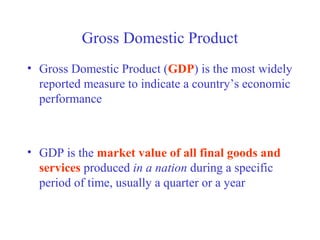

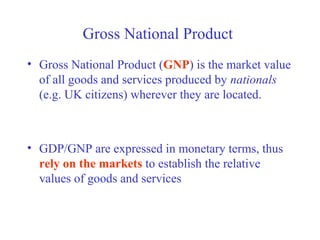

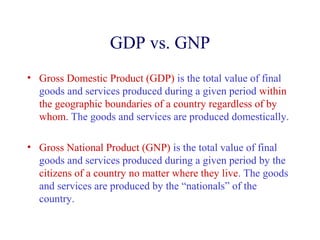

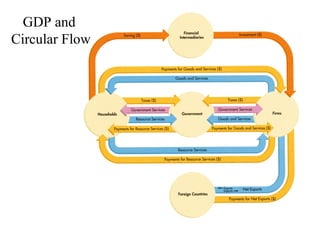

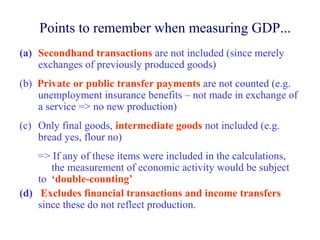

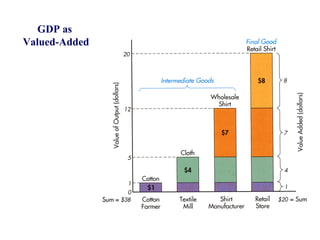

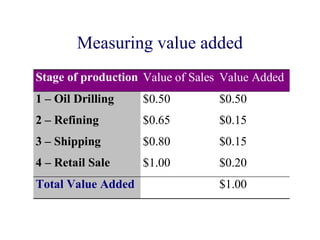

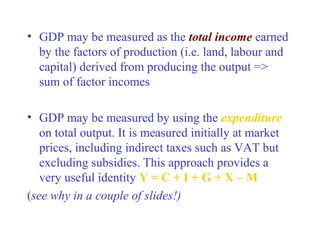

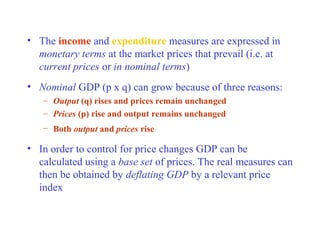

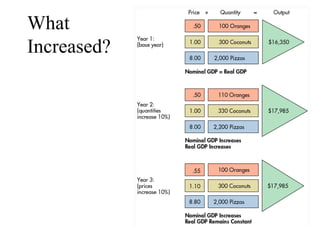

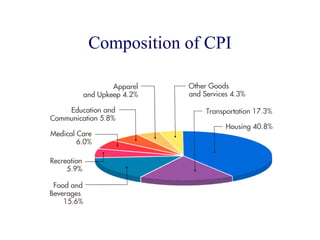

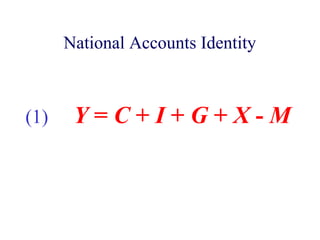

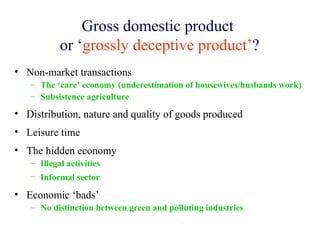

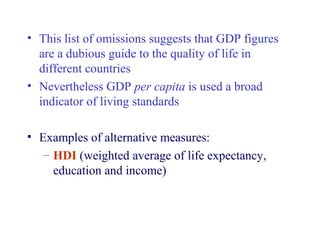

The document discusses national income accounting and how it was developed in response to the Great Depression. It explains how GDP, GNP, and other measures are calculated and what they represent. Specifically, it outlines the three approaches to calculating GDP - output, income, and expenditure - and how GDP is used to measure a country's economic performance and standard of living. However, it also notes some limitations of GDP as an indicator.

![Other national accounts

• GDP + Net Factor Income (NFI) = GNP

• Net National Product (NNP) = GNP - Depreciation

(depreciation: estimate of the capital worn out by producing GDP)

• National Income: total income earned by the owners of

resources, including wages, rents, interest and profits

NI = NNP - indirect taxes [taxes on goods sold, e.g. VAT]

• Personal Income: total income received by households that is

available for consumption, saving and the payment of personal

taxes

• Personal disposable Income (PDI): Personal Income minus

personal income taxes plus transfer payments received by

individuals

– PDI = PI – income taxes + transfers](https://image.slidesharecdn.com/gnp-120803124849-phpapp02/85/Gross-National-Product-23-320.jpg)