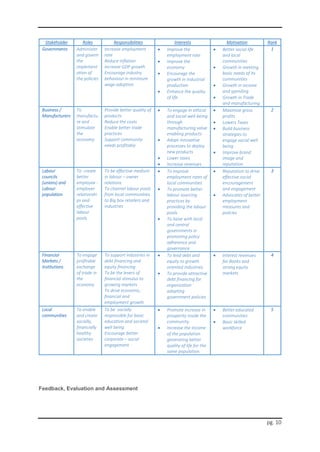

The document provides a summary of global wage trends based on data from the United Nations and International Labour Organisation. Some key points include:

- Global wage growth decelerated in 2013 compared to 2012 and has yet to rebound to pre-crisis rates.

- Wage growth has been driven mostly by emerging and developing economies, with China alone accounting for almost half of global wage growth.

- Growth in wages in developed economies has remained flat.

- Between 1999-2013, labor productivity growth in developed economies outstripped real wage growth and labor's share of national income.

- Average wages in emerging economies are slowly converging towards those in developed economies.

![pg. 8

Effects of CBO’s Options on Employment

According to CBO’s central estimate, implementing the, $10.10 option would reduce employment by roughly

500,000 workers in the second half of 2016, relative to what would happen under current law. That decrease would

be the net result of two effects: a slightly larger decrease in jobs for low-wage workers (because of their higher

cost) and an increase of a few tens of thousands of jobs for other workers (because of greater demand for goods

and services).

Under the $9.00 option, employment would decline by about 100,000 workers in the second half of 2016, relative

to what it would be under current law, according to CBO’s central estimate9.

Measurement & Impact

At first glance, a country's minimum wage rate may look like a definitive starting point for compensation

planning. Upon scrutiny, however, global minimum wage rates raise more compensation and workforce

planning questions than they answer.

“Managed effectively, a minimum wage rate can reduce poverty and deliver significant societal and

economic benefits” World Bank economist Jan Rutkowski.

“Minimum wages are "an indicator of wage inflation. When the minimum wage increased by 5 percent

[in Brazil], we essentially increased our entire salary structure by 5 percent." says Adam Goldman, vice

president of human resources for Safariland, a Jacksonville, Fla.-based provider of law enforcement

and security products and services, and a subsidiary of BAE Systems.

The analysis and debates present a challenge because definitions of "living" and "fair" wages continue

to evolve and change; Different organizations follow different standards, which often requires

conversion of demands and expectations into local currency. Exchange rate fluctuations and

differences effect the average workweeks e.g. 40 hours in the United States equals 48 hours in Mexico.

A "living wage" refers to a threshold that allows workers and their families to have decent living

standards. Location-specific living wage standards usually identify a minimum amount of money

required to cover food, basic non-food items and other discretionary expenditures.10

Wage levels and wage-fixing frameworks provide a living wage floor for workers, while conforming to

national wage regulations (such as the minimum wage, payment of wages, overtime payments,

provision of paid holidays and social insurance payments). It must try to ensure proper wage

adjustments and lead to rational wage increments in the country (with regard to wage disparity, skills,

individual and collective performance, and adequate internal communication and collective bargaining

on wage issues).

The Proposal

9

How CBO Estimated the Total Effects of the Options on Employment

CBO’s central estimates that the $10.10 and $9.00 options would reduce employment by roughly 500,000 and 100,000 workers,

respectively, were based on four main factors. 1. The number of low-wage workers directly affected by the options. 2. The

responsiveness of the employment of low-wage workers to increases in minimum wages. 3. The change in the wages of directly

affected workers and 4. The increase in demand for goods and services caused by each option. To calculate the total effect on

employment, CBO multiplied estimates of the first three factors together for teenagers; did the same for adults; added the results;

and then added an amount to account for the fourth factor. To reflect the considerable uncertainty in estimating the total

employment effect, CBO also reported a range within which, in the agency’s assessment, there was about a two-thirds chance

that the actual effect would lie.

10

Minimum’ vs. ‘Fair’ vs. ‘Living’ Wages: Eric Krell: Society for Human Resource Management](https://image.slidesharecdn.com/fc1639d4-aba7-4327-a0e2-86408bce483d-150313141006-conversion-gate01/85/Global-Wage-Trends-9-320.jpg)