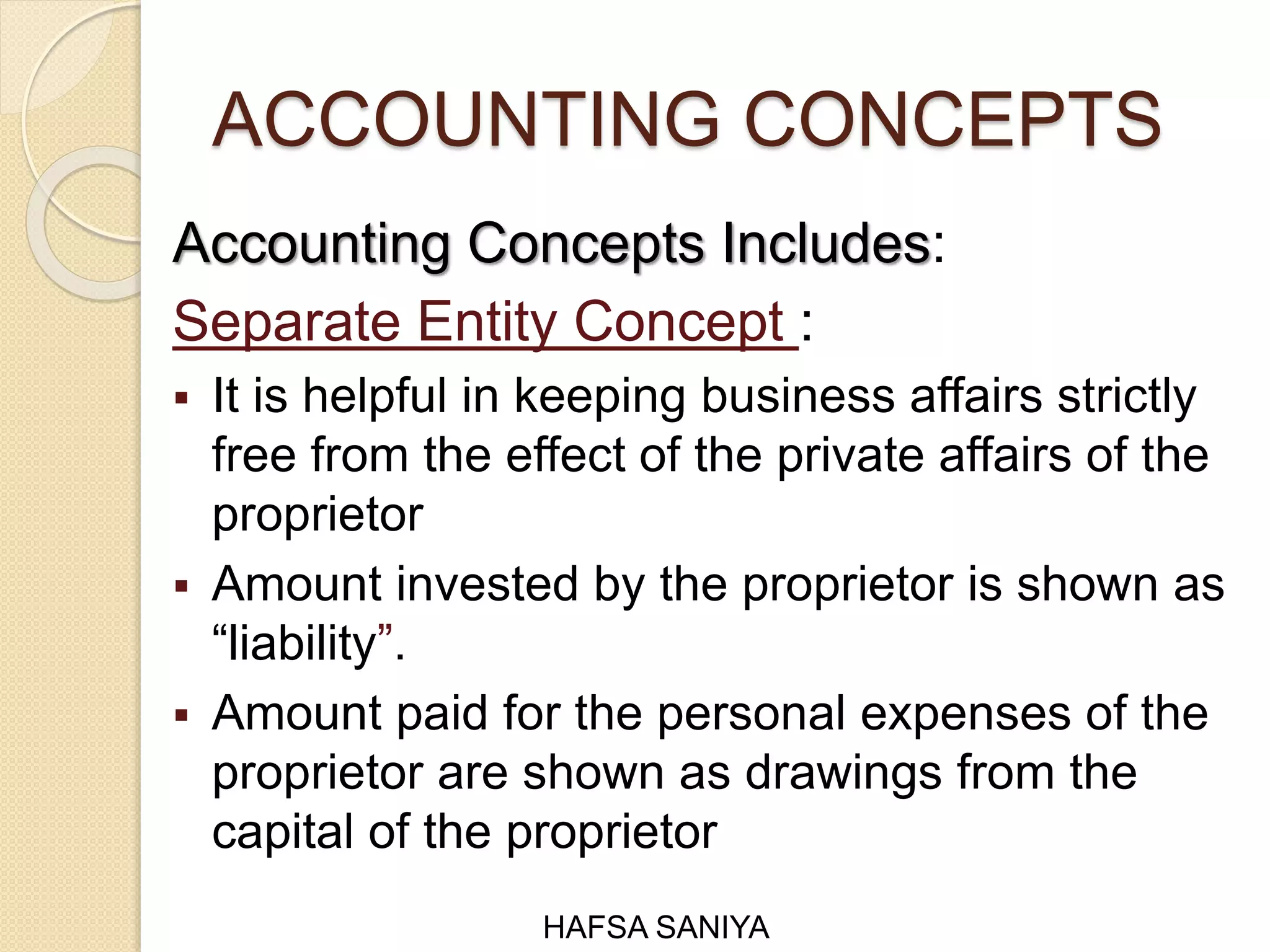

This document discusses key accounting concepts and principles known as Generally Accepted Accounting Principles (GAAP). It explains that GAAP provides uniform guidelines for preparing financial statements to ensure consistency and avoid confusion. The major GAAP concepts covered are the separate entity, money measurement, dual aspect, matching and going concern concepts. Accounting conventions like full disclosure and materiality are also summarized. Key accounting principles around assets, liabilities, equity, revenue and expense recognition are defined.