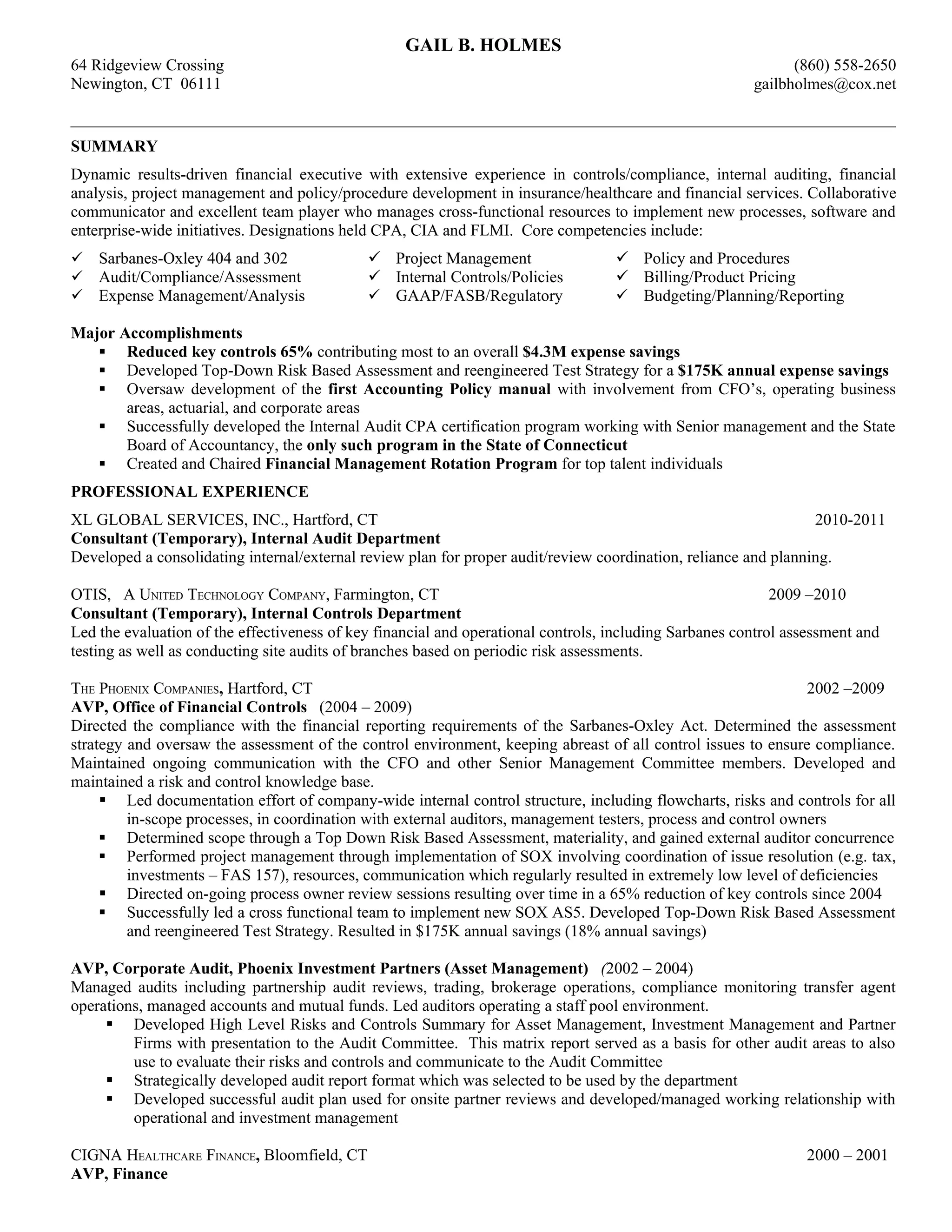

The document summarizes the professional experience and qualifications of Gail B. Holmes as a dynamic, results-driven financial executive with extensive experience in controls, compliance, internal auditing, financial analysis, and project management in insurance and healthcare. She has a proven track record of managing resources to implement new processes and initiatives, and reducing expenses through risk assessment and process improvement.