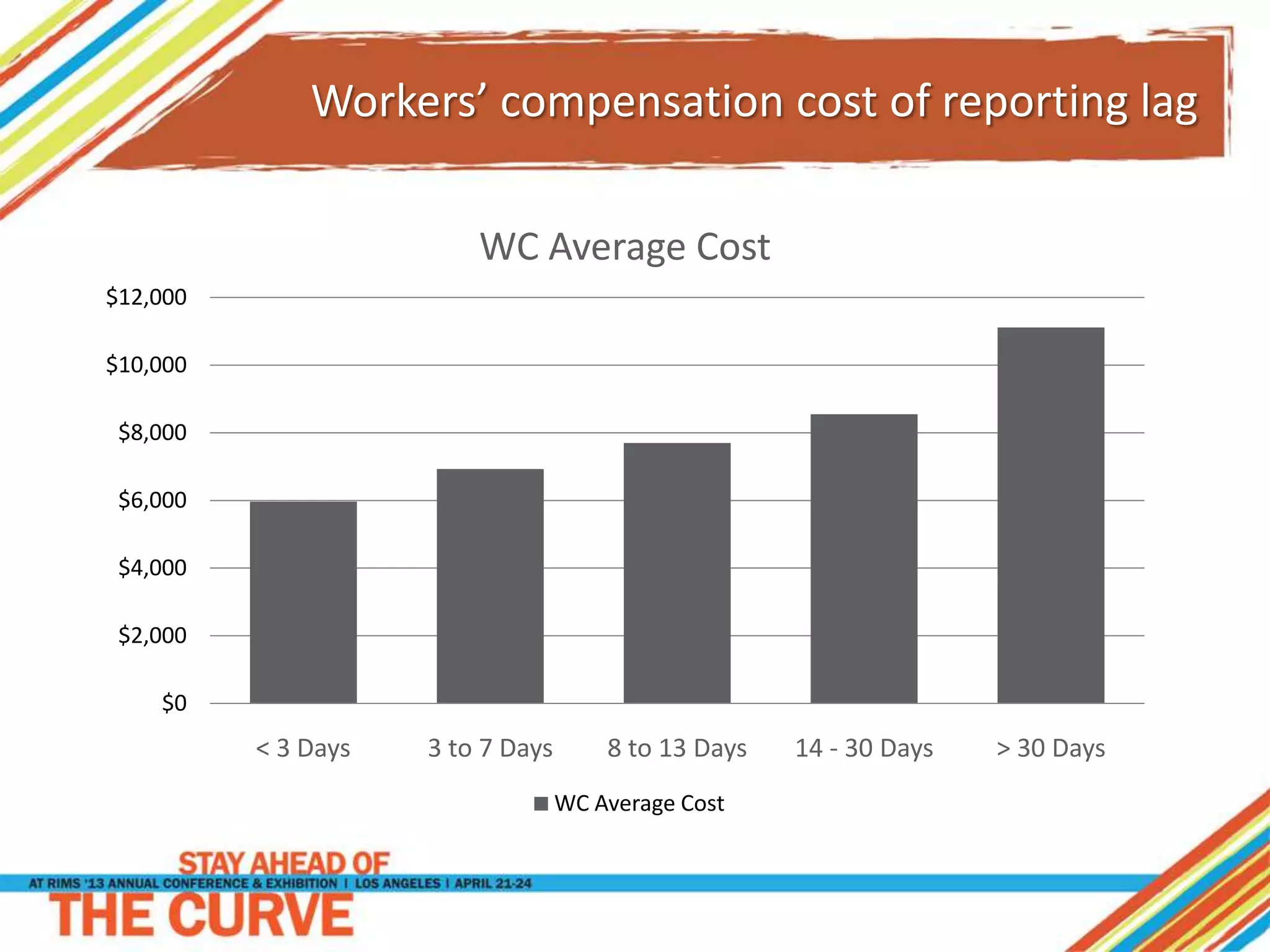

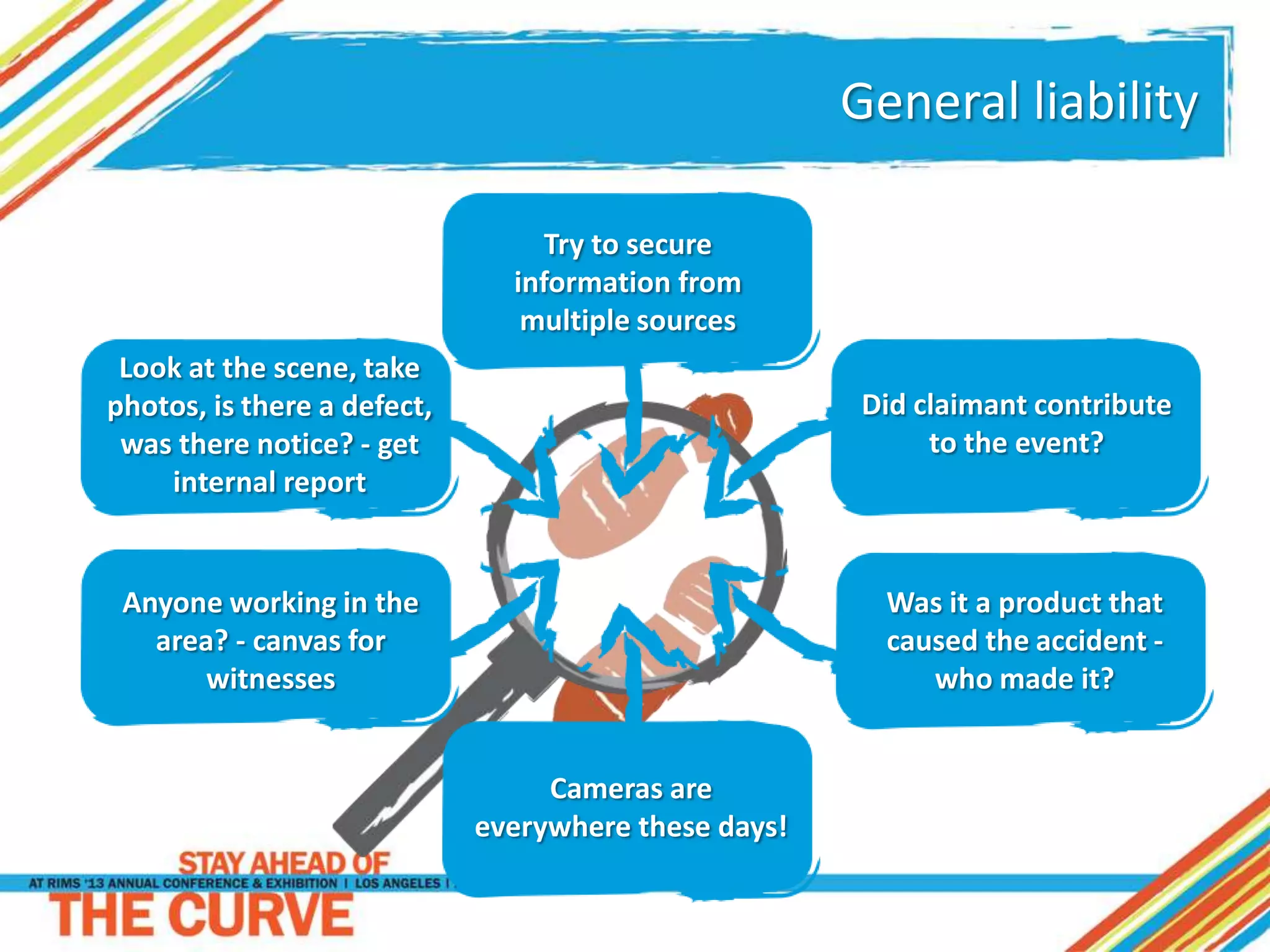

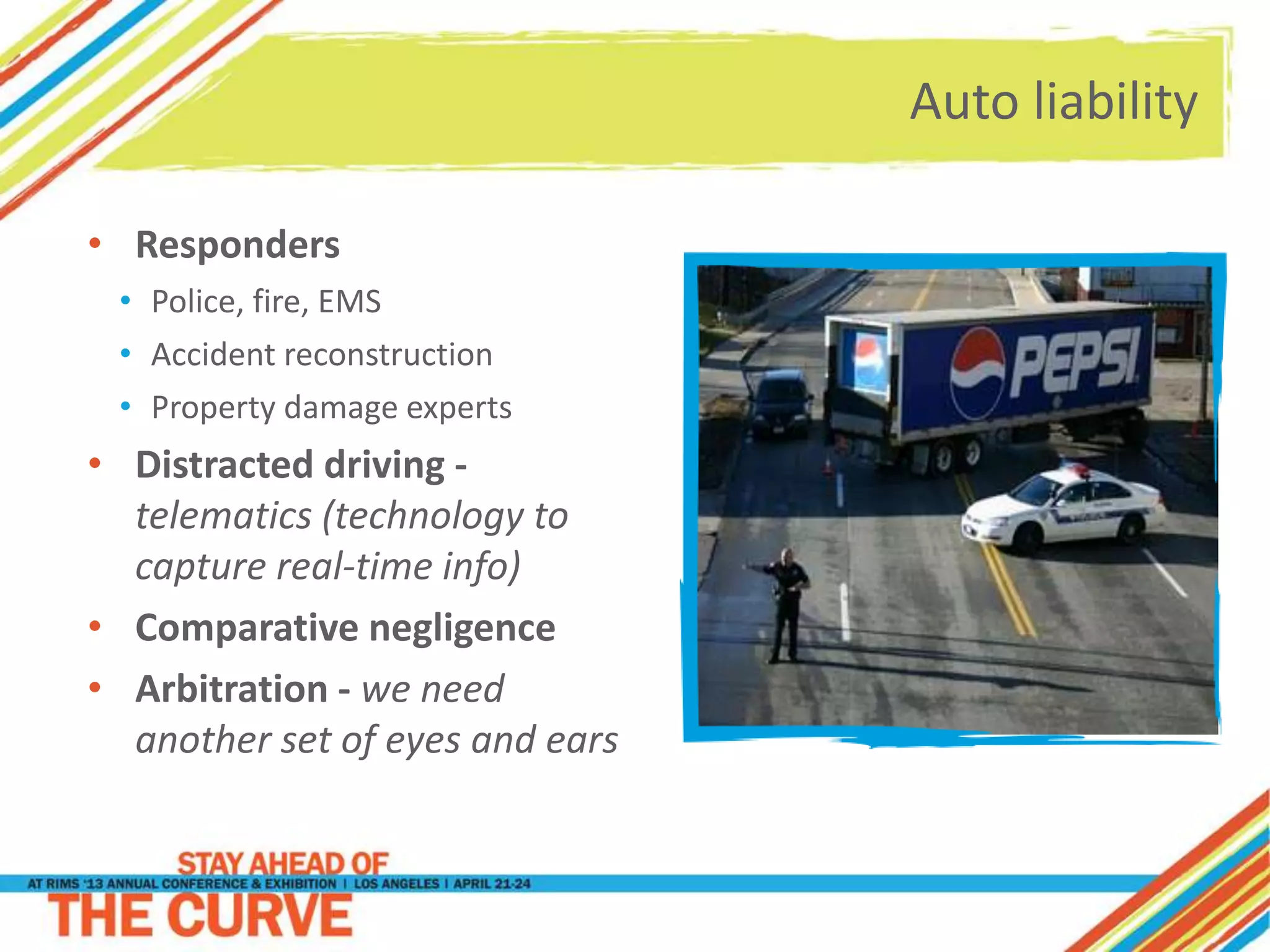

This document outlines key aspects of claims investigation and management in workers' compensation, general liability, and auto liability, focusing on improving processes through checklists and teamwork. It emphasizes the importance of timely investigations, detailed reporting, and managing medical treatment and disability claims while highlighting strategies for litigation management and resolution. The session aims to provide updates and developments in the claims management field, including the significance of fraud prevention and effective negotiation tactics.