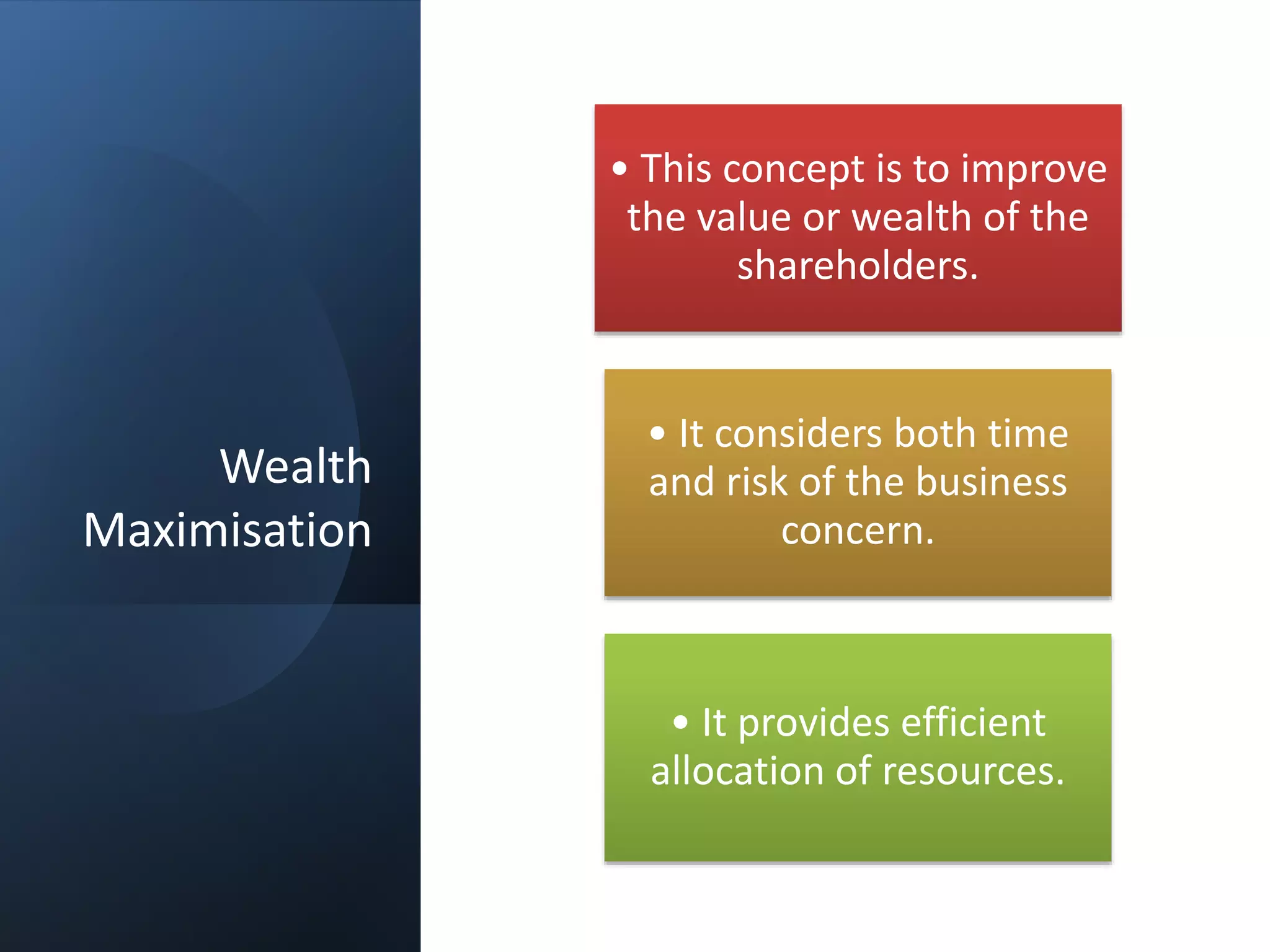

Finance is concerned with the management of assets and liabilities and planning for future growth, while accounting focuses on day-to-day financial transactions. The key functions of financial management include investment decisions about allocating funds, financing decisions around obtaining funds, and dividend decisions about distributing profits. The objectives of financial management are to maintain liquidity and profitability, maximize shareholder wealth over the long run, and ensure the efficient utilization of financial resources.