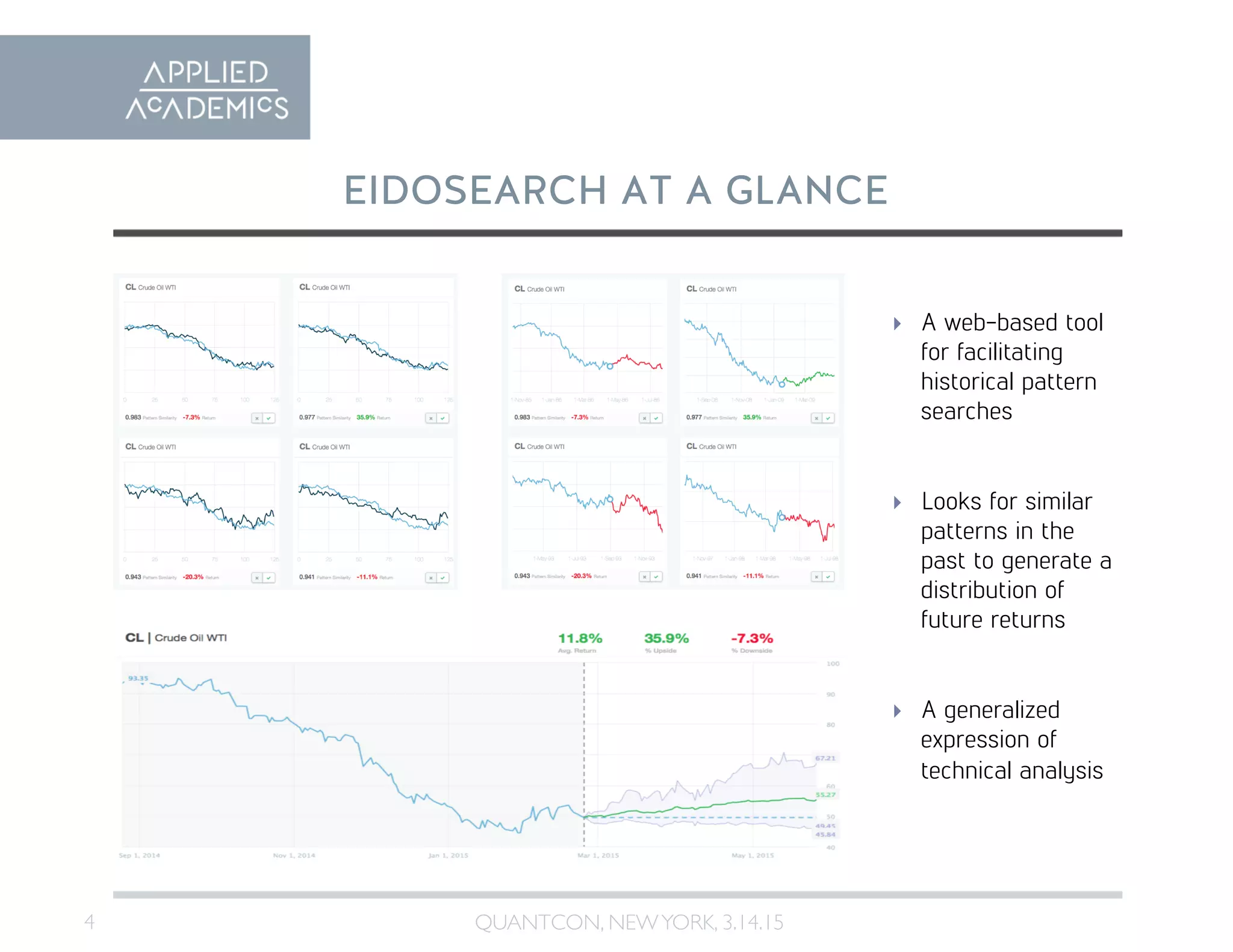

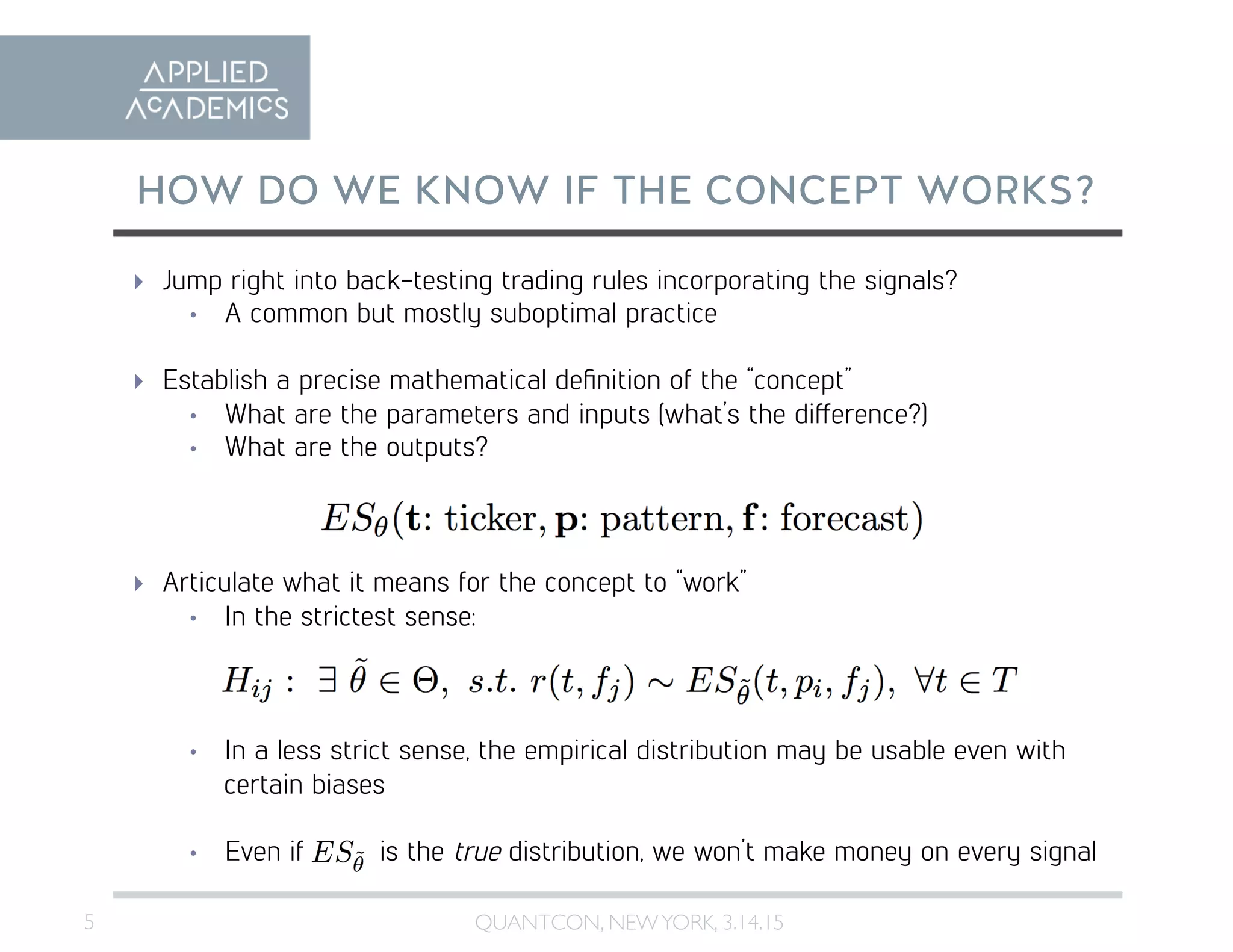

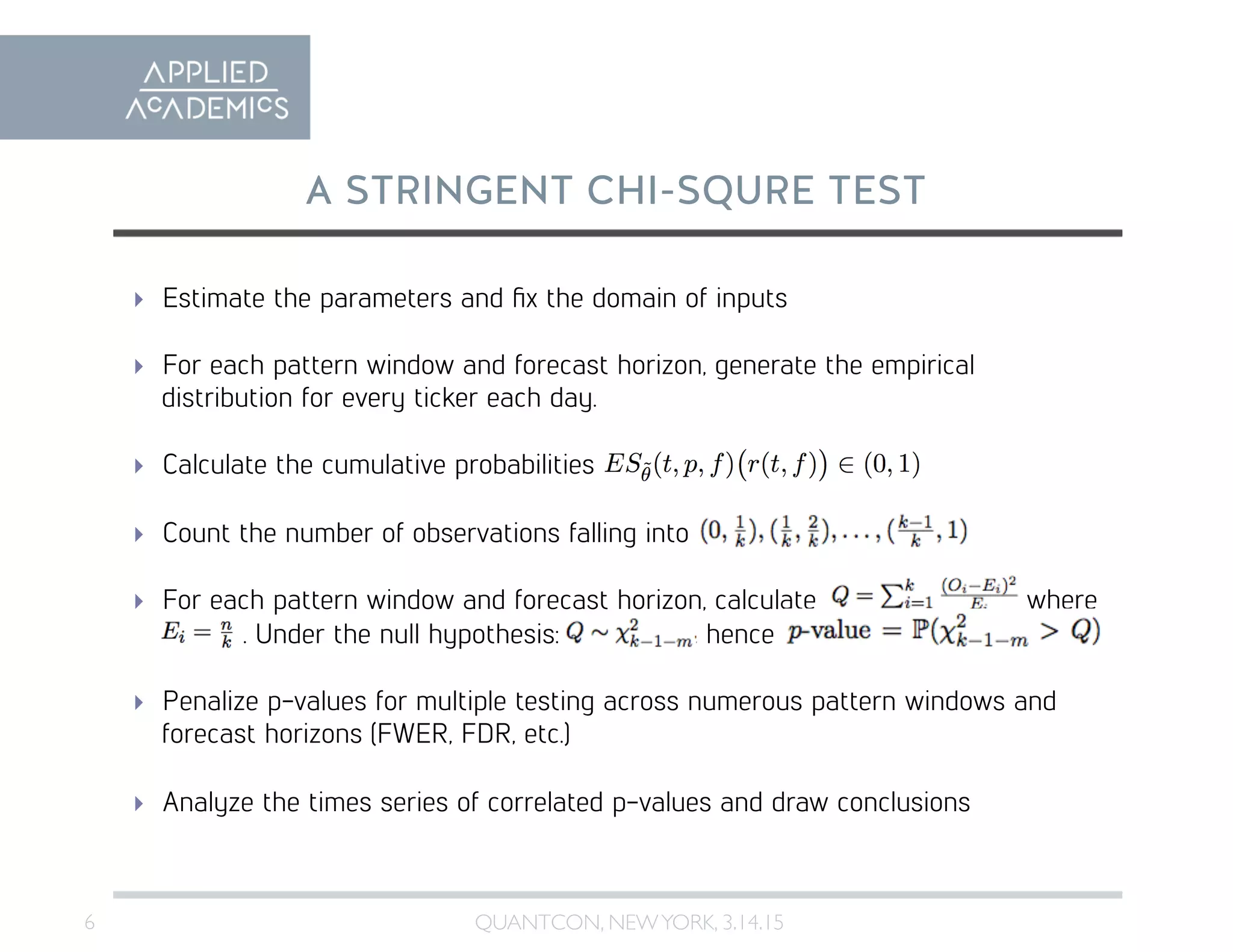

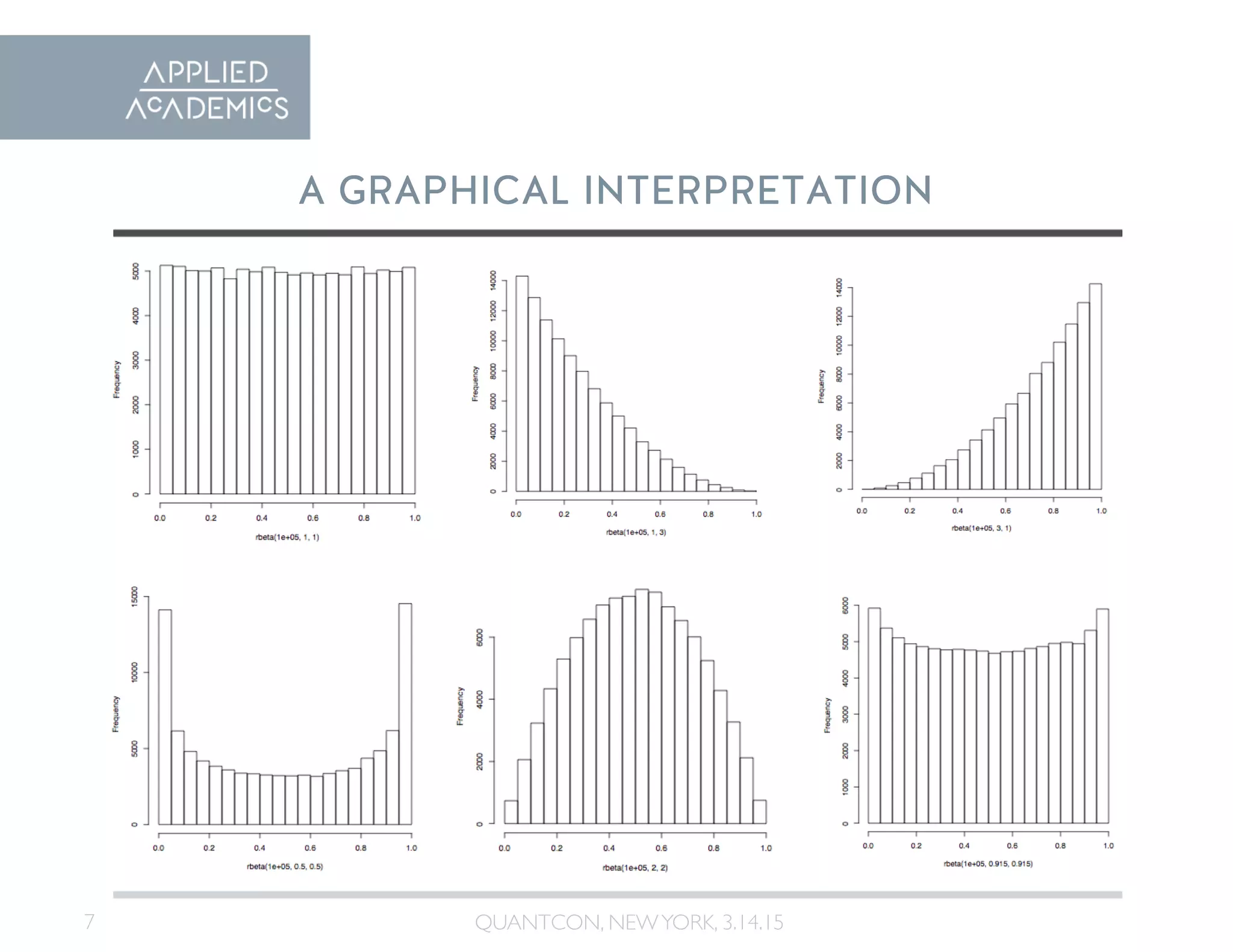

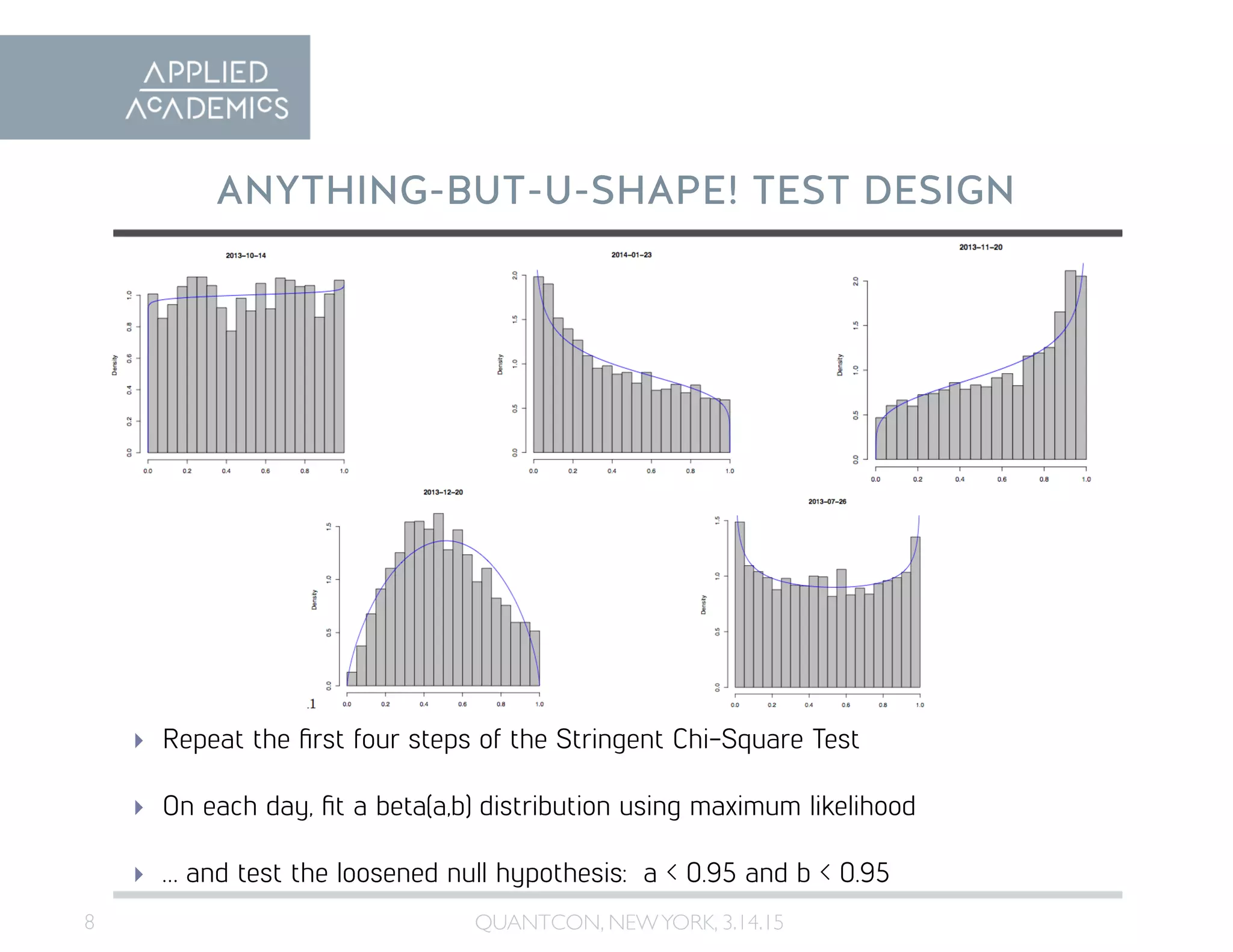

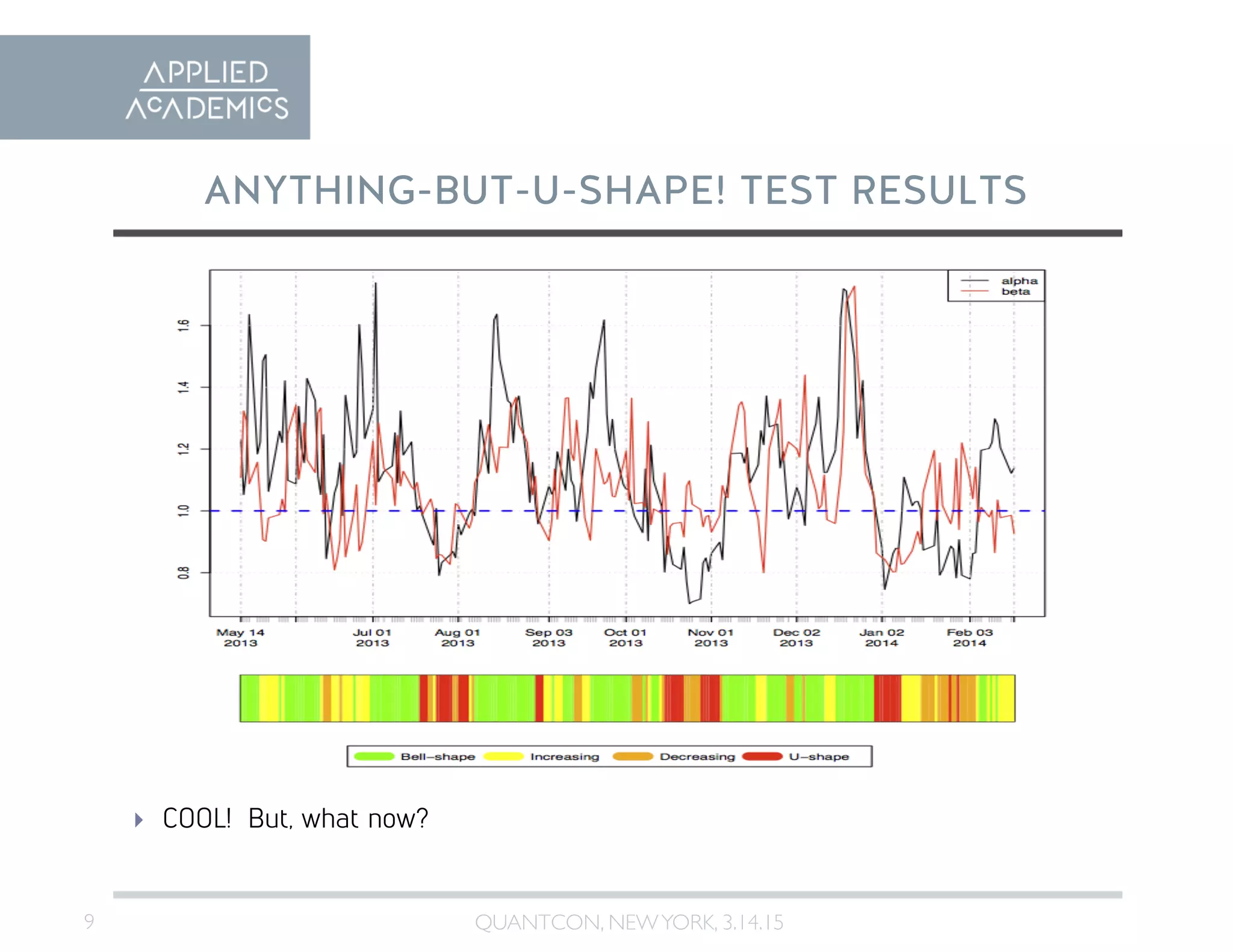

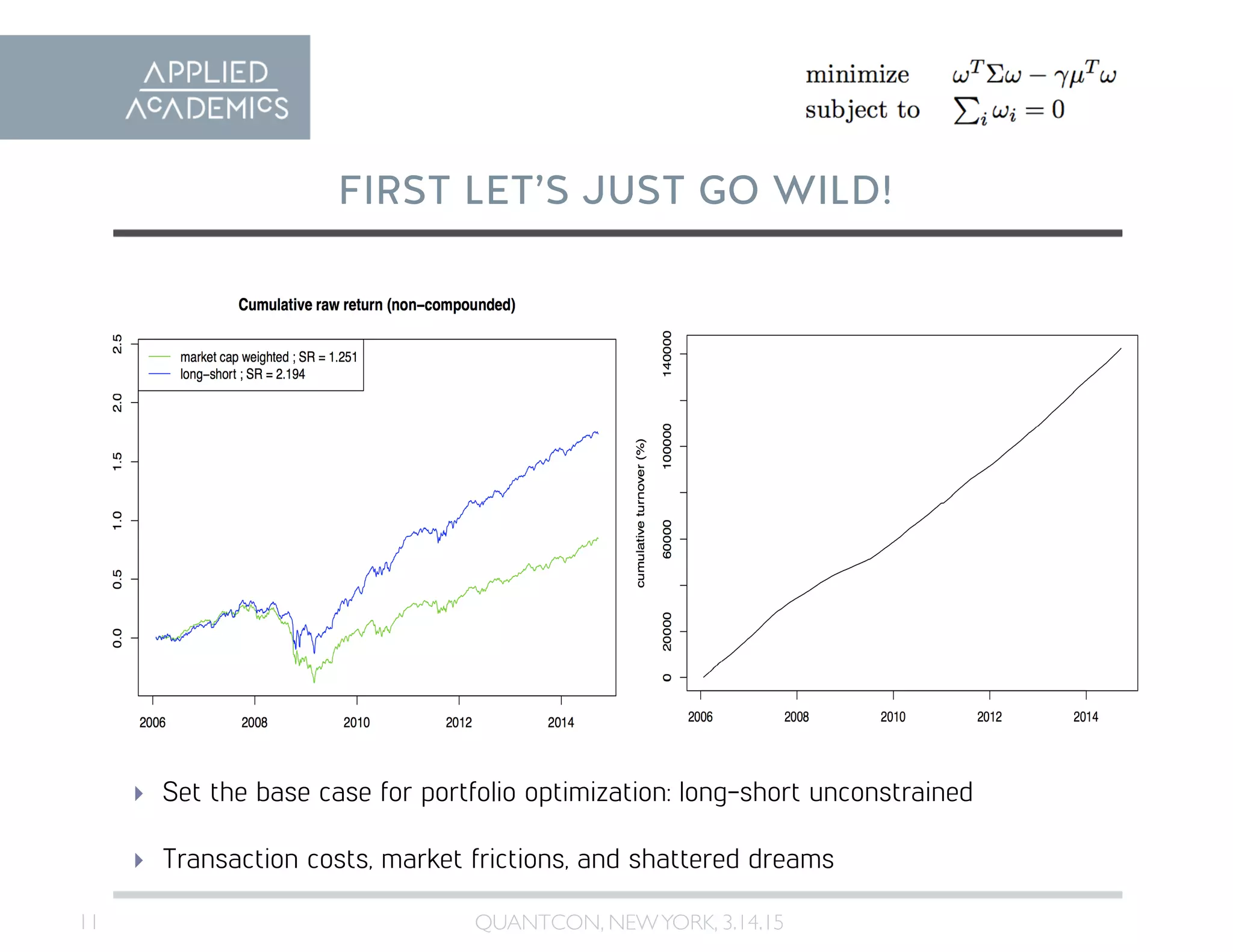

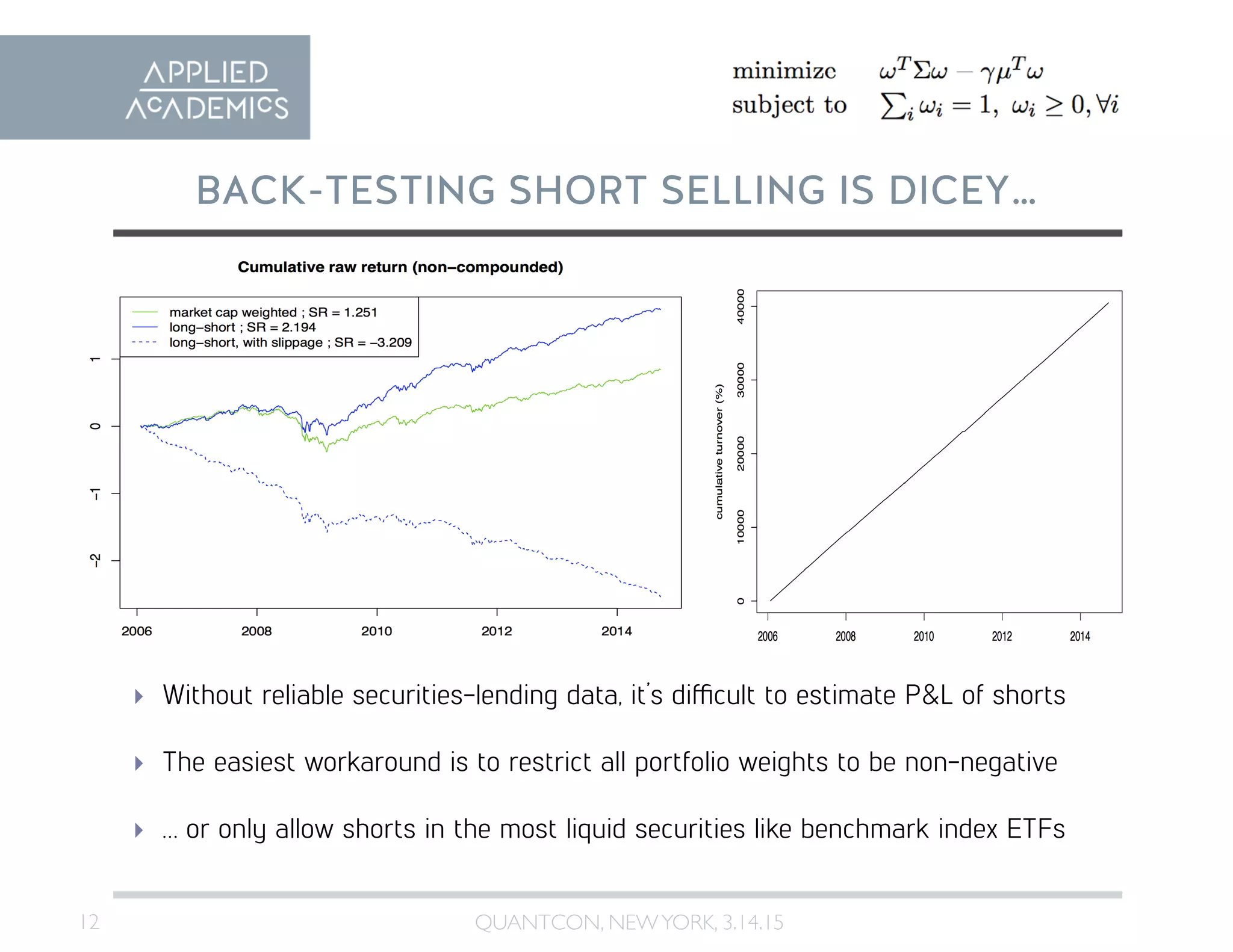

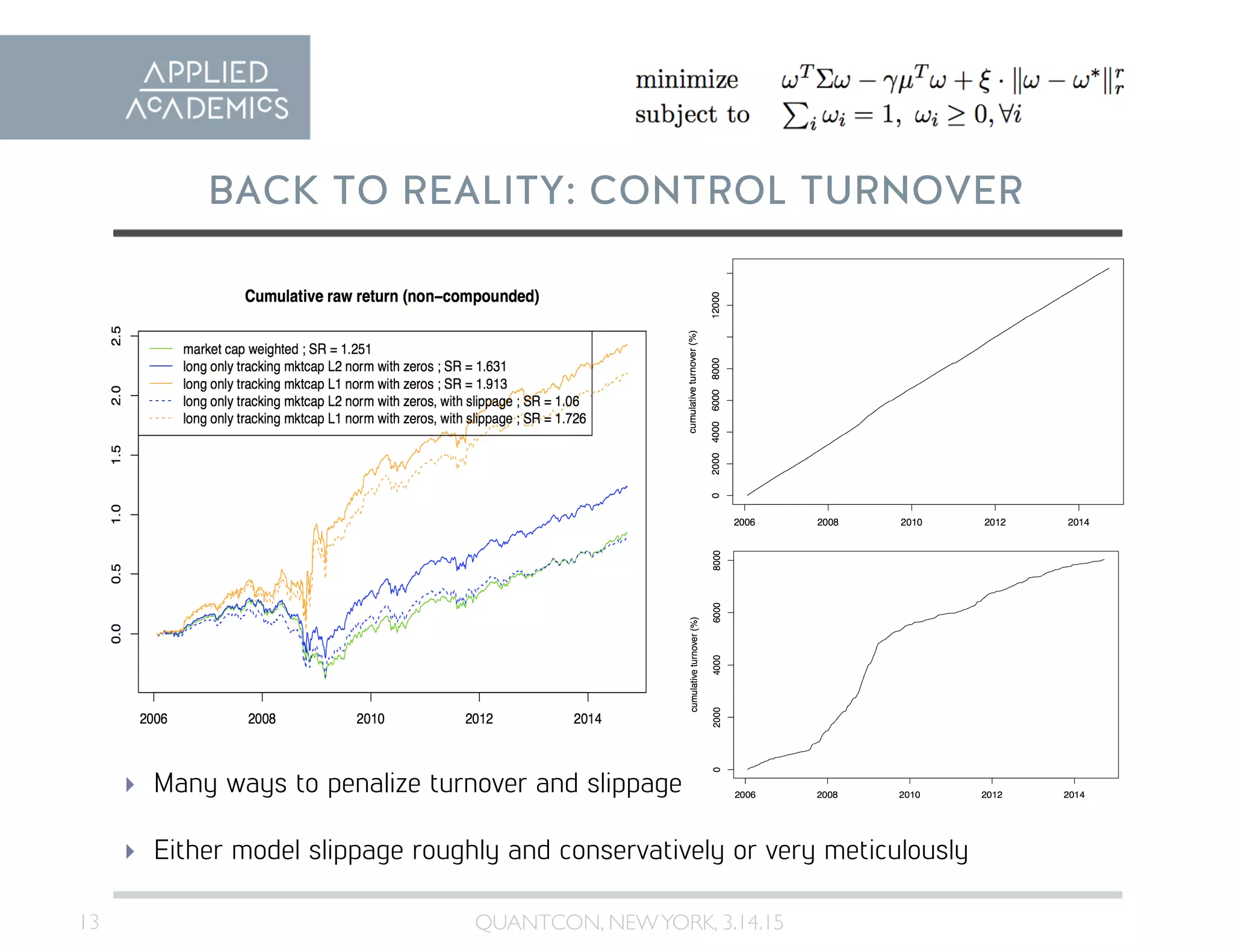

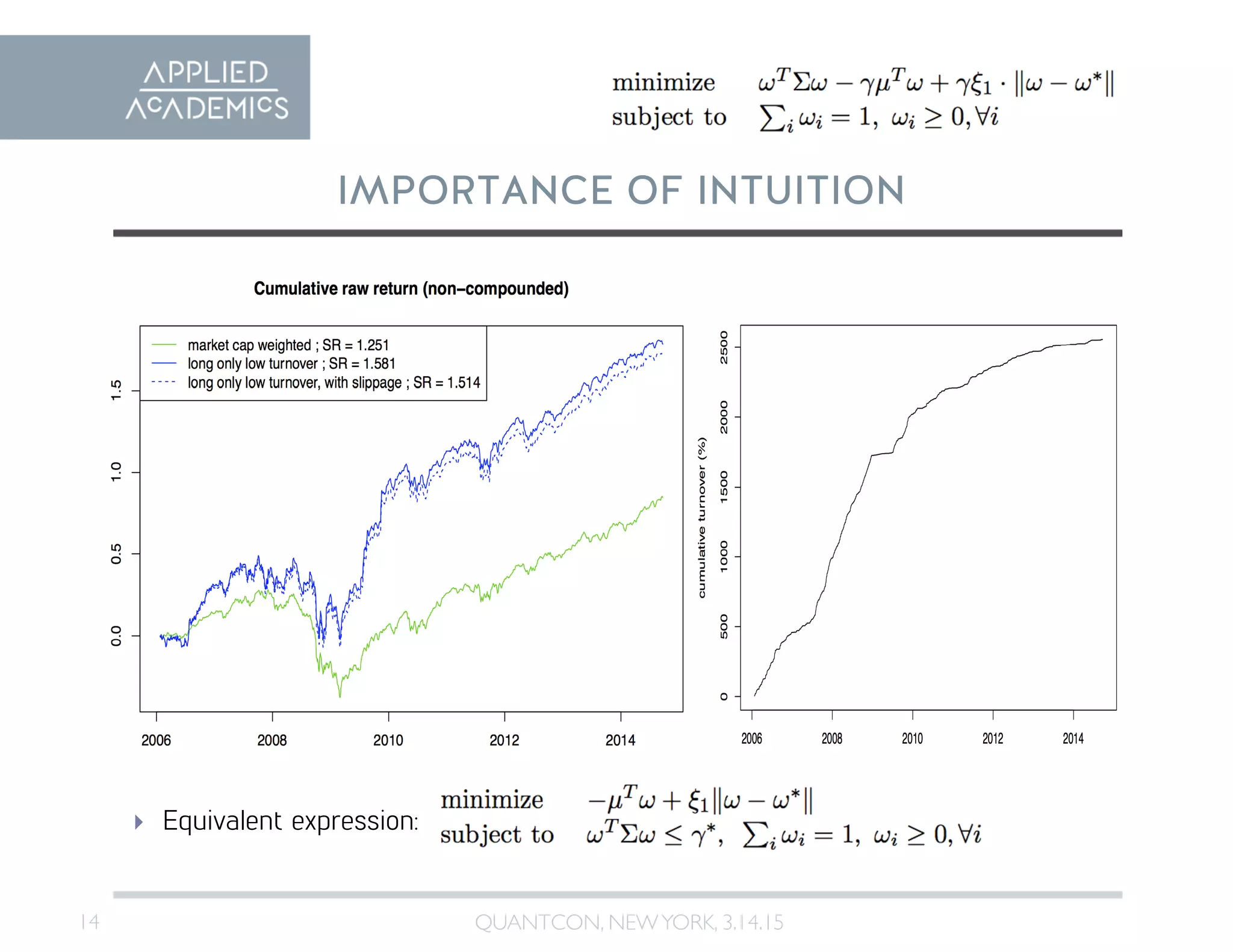

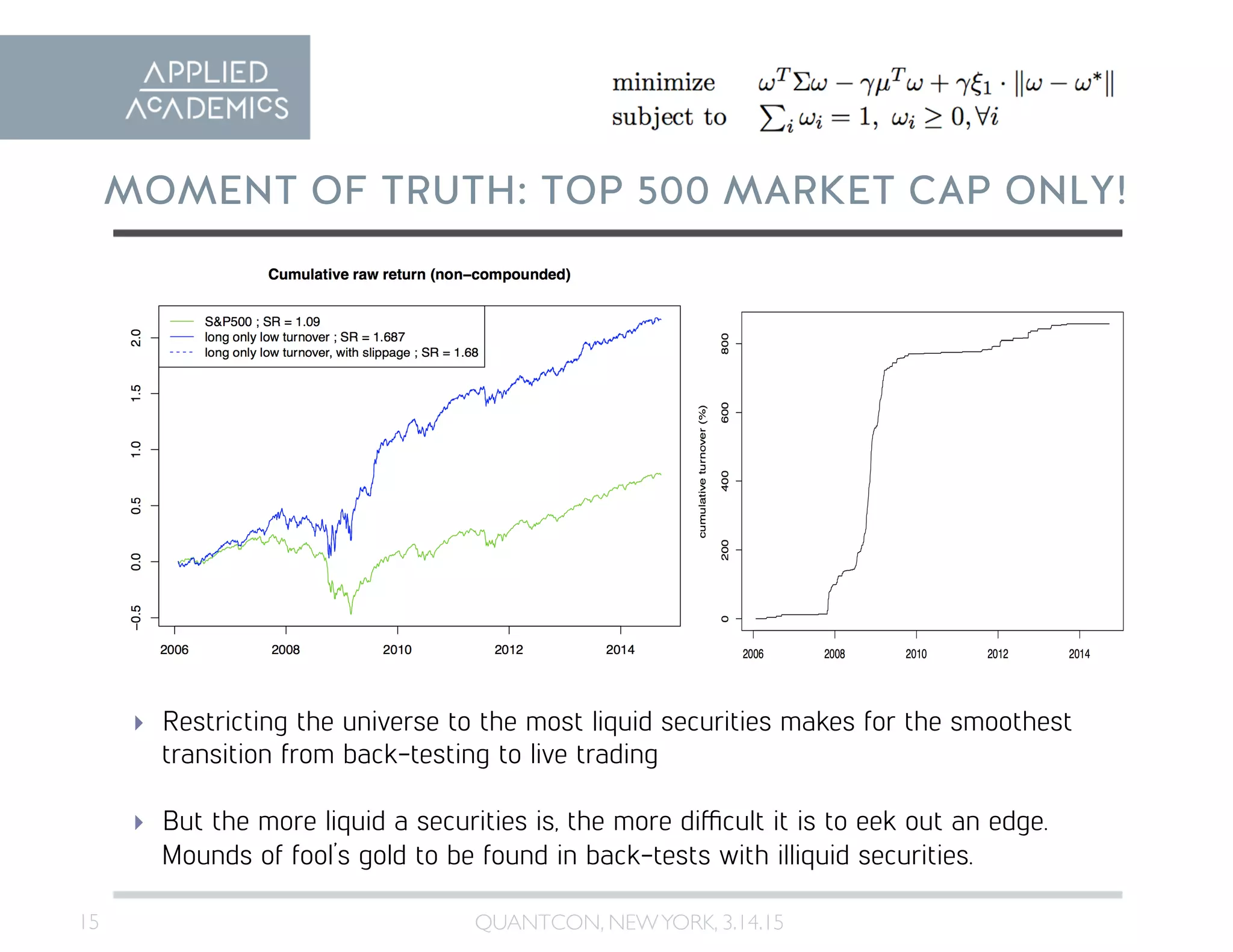

The document discusses the process of developing and executing trading strategies, highlighting the importance of refining ideas and investing time wisely. It covers techniques such as back-testing, parameter estimation, and signal interpretation, emphasizing the need for a clear understanding of strategy mechanics. Finally, it touches on practical considerations like liquidity, transaction costs, and the transition from back-testing to live trading.