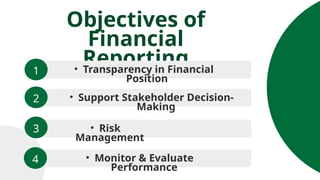

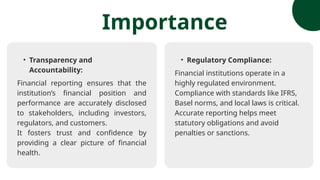

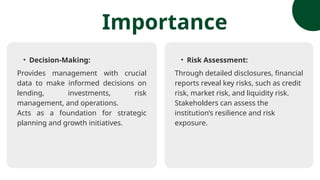

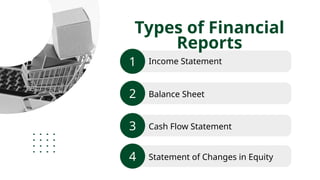

The document outlines the process of financial reporting for financial institutions, emphasizing its role in documenting and communicating financial activities over time. Key objectives include transparency, regulatory compliance, risk management, and supporting stakeholder decision-making. It highlights the importance of accuracy in reporting to bolster customer confidence, meet regulatory standards, and evaluate institutional performance.