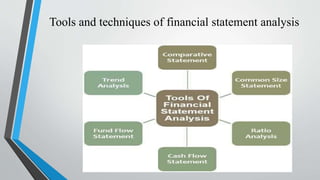

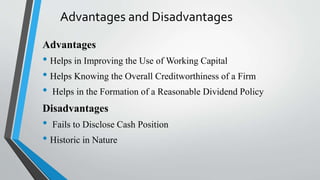

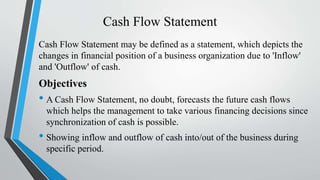

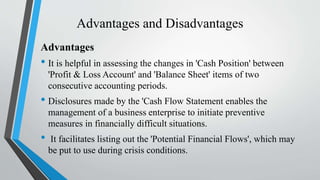

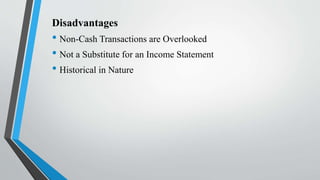

This document discusses financial statement analysis tools and techniques. It defines financial statements as formal records of a business entity's financial activities that reveal its financial health and help with decision making. The document then discusses fund flow statements, cash flow statements, and their objectives, advantages, and disadvantages. Fund flow statements depict the flow of working capital over time, show sources and uses of funds, and highlight financial strengths and weaknesses. Cash flow statements depict cash inflows and outflows and help with forecasting and financing decisions.