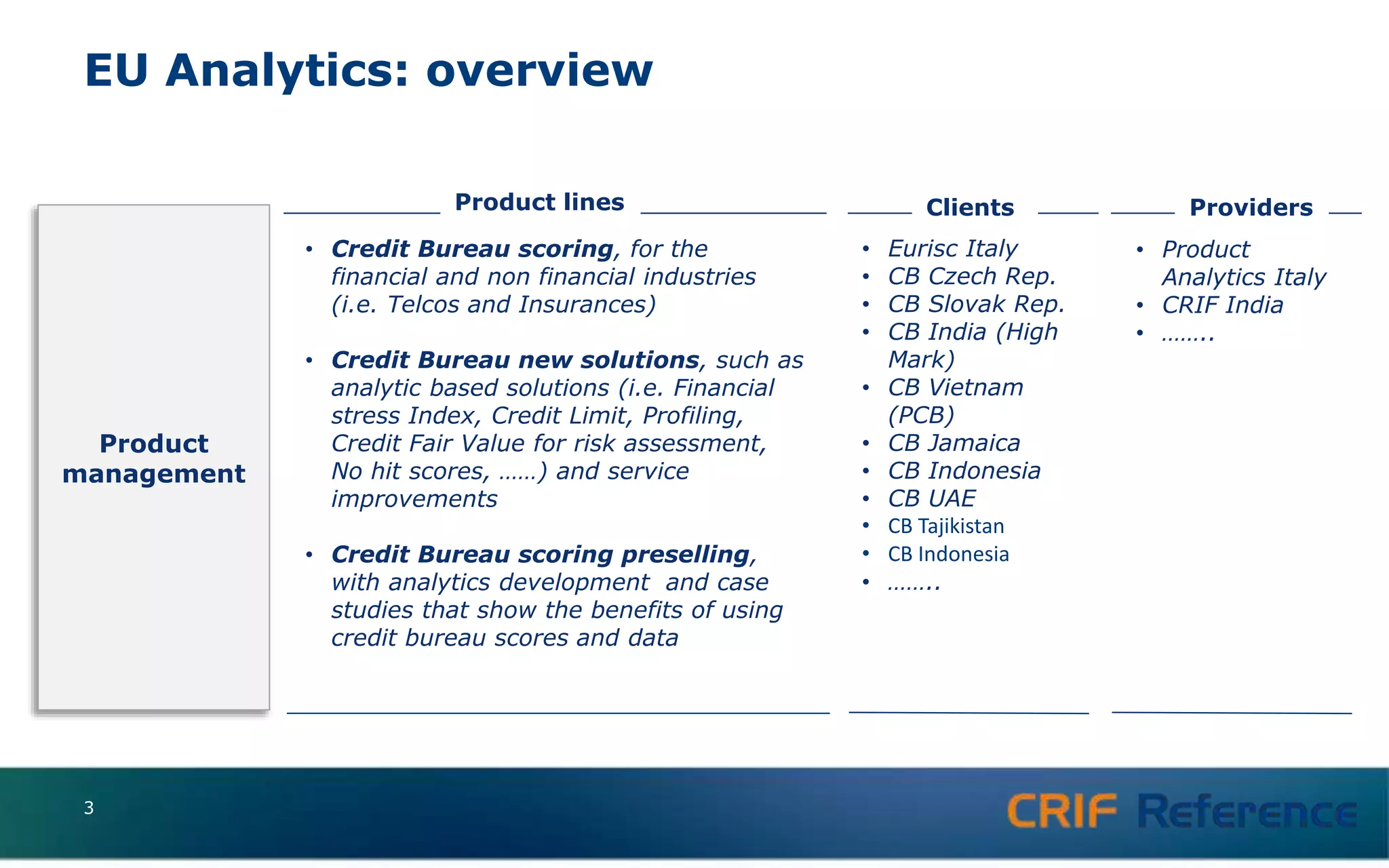

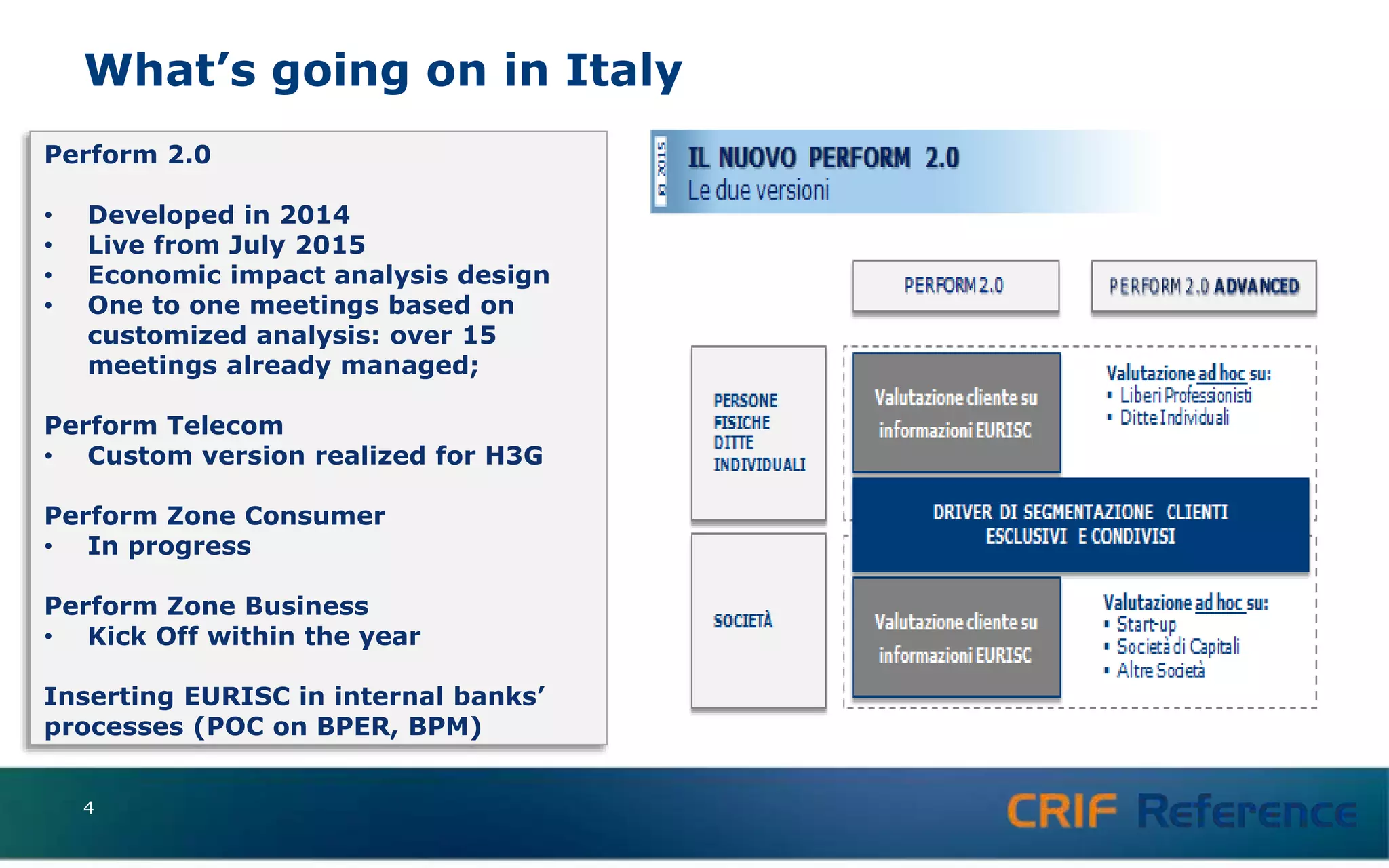

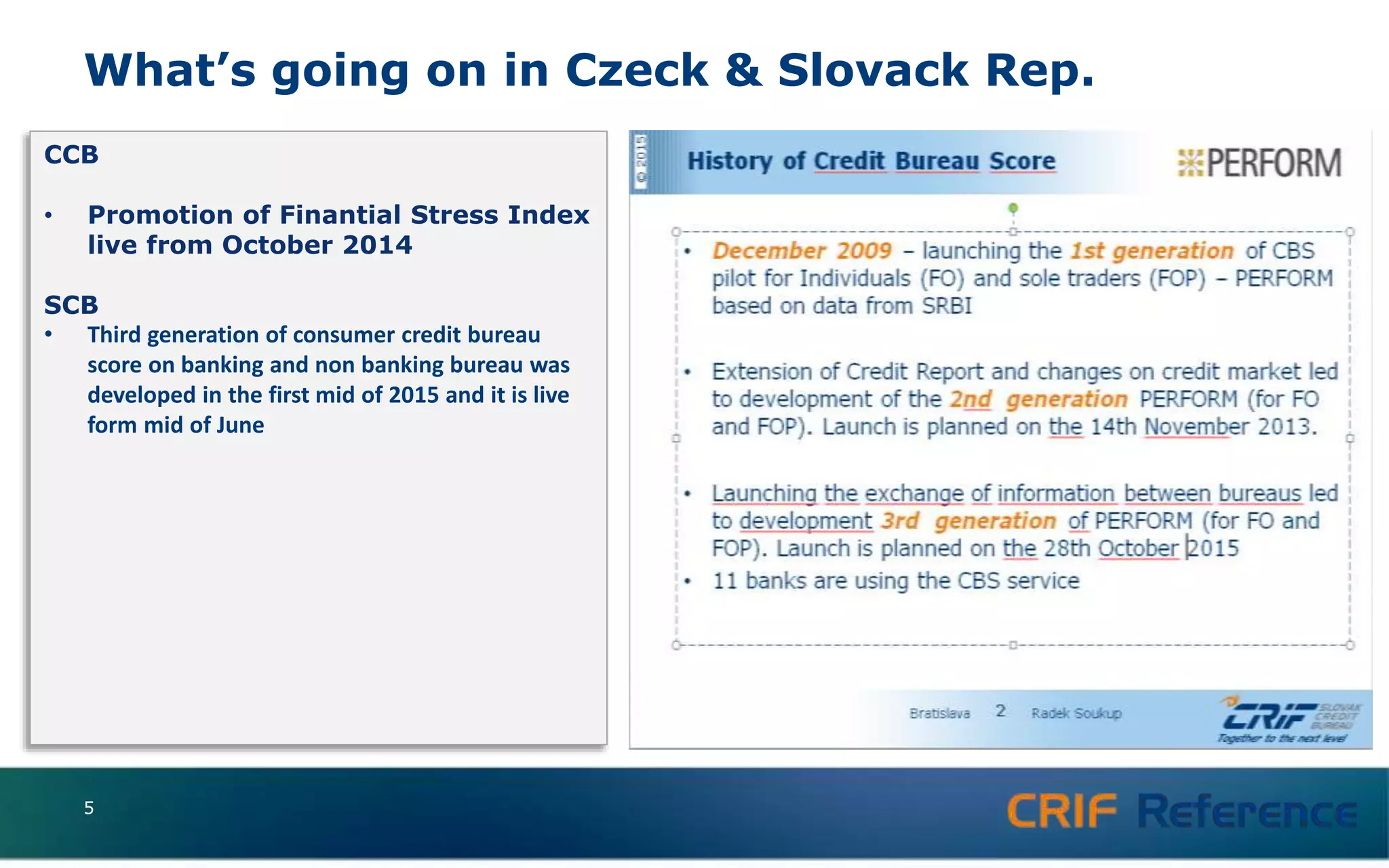

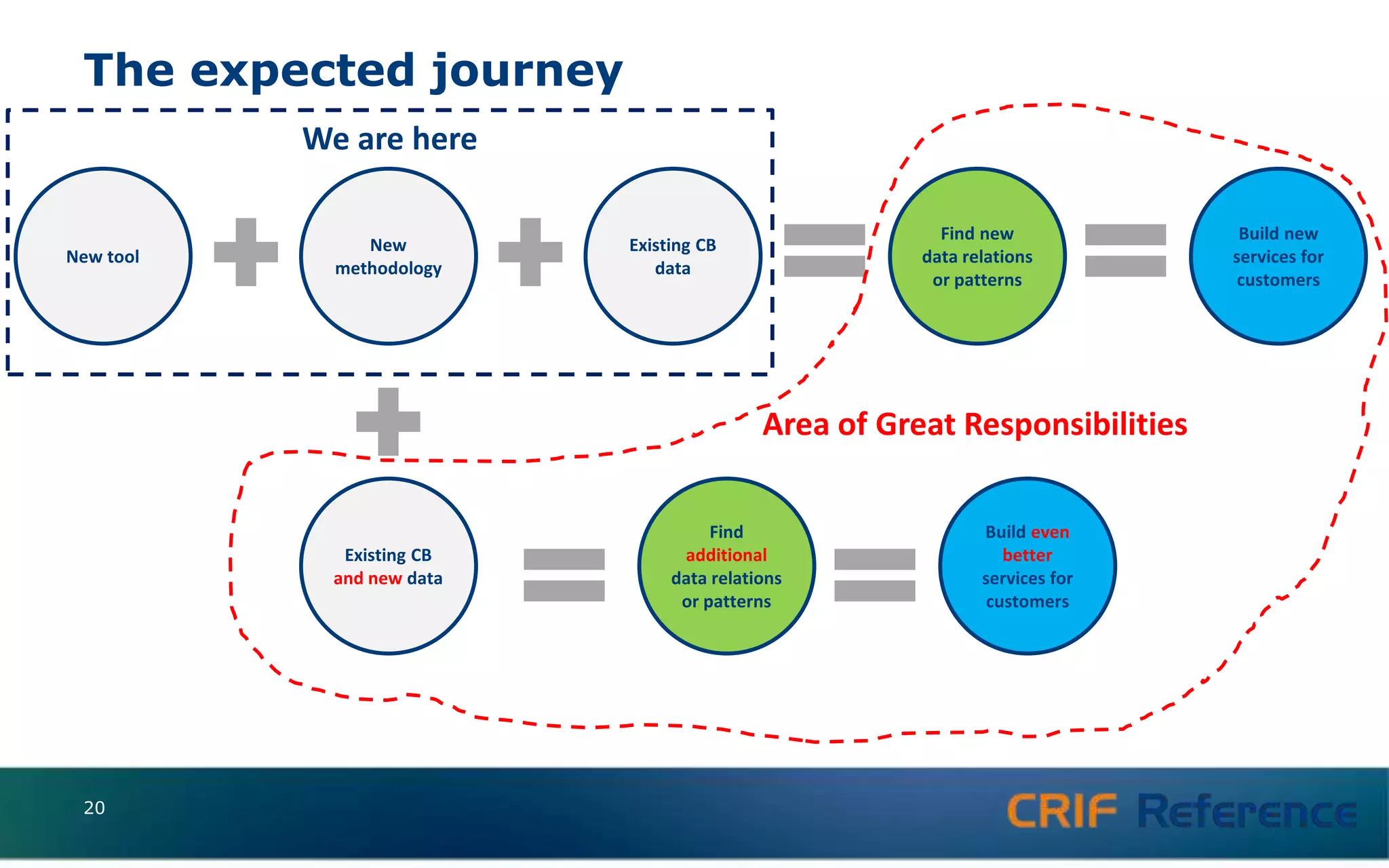

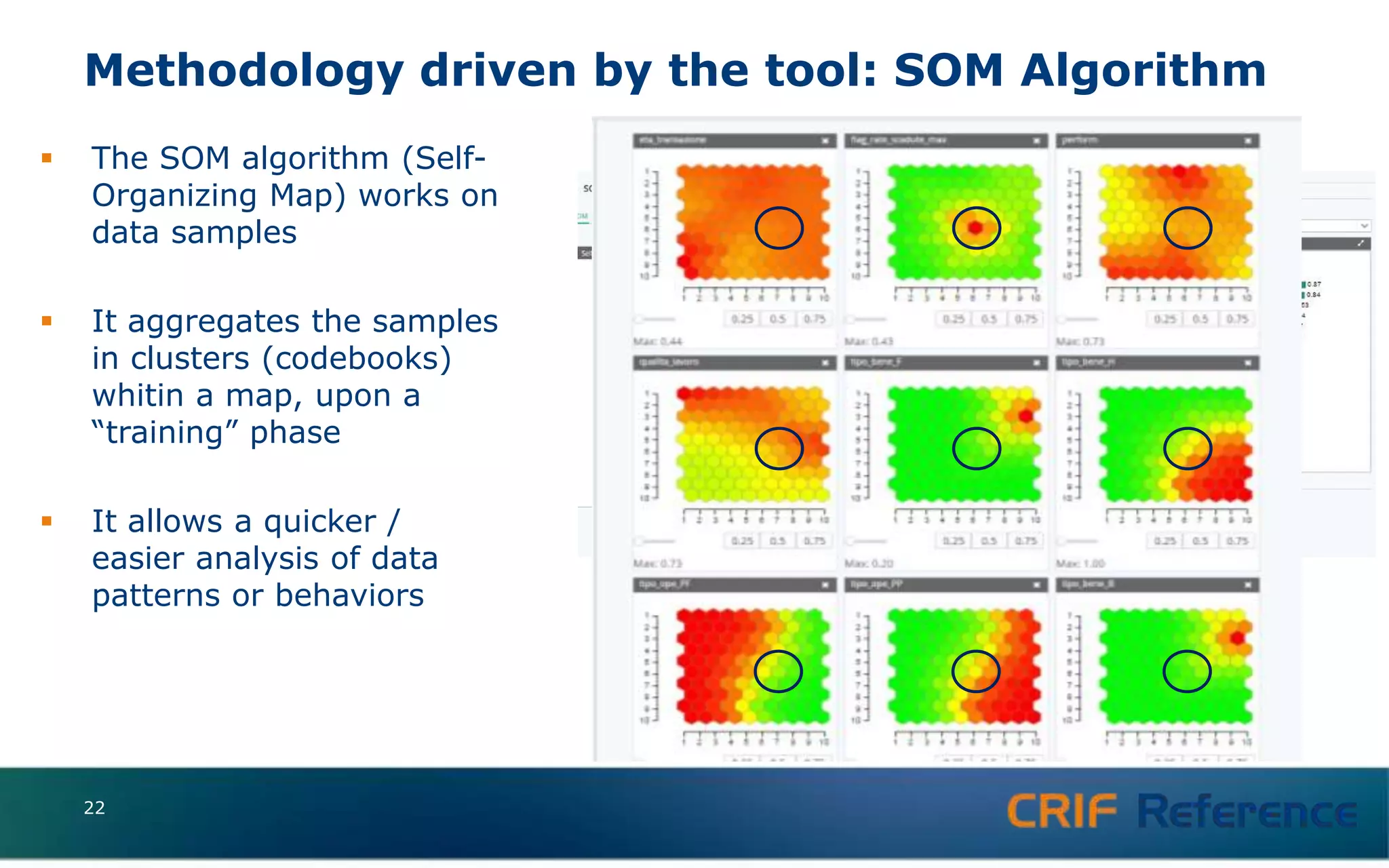

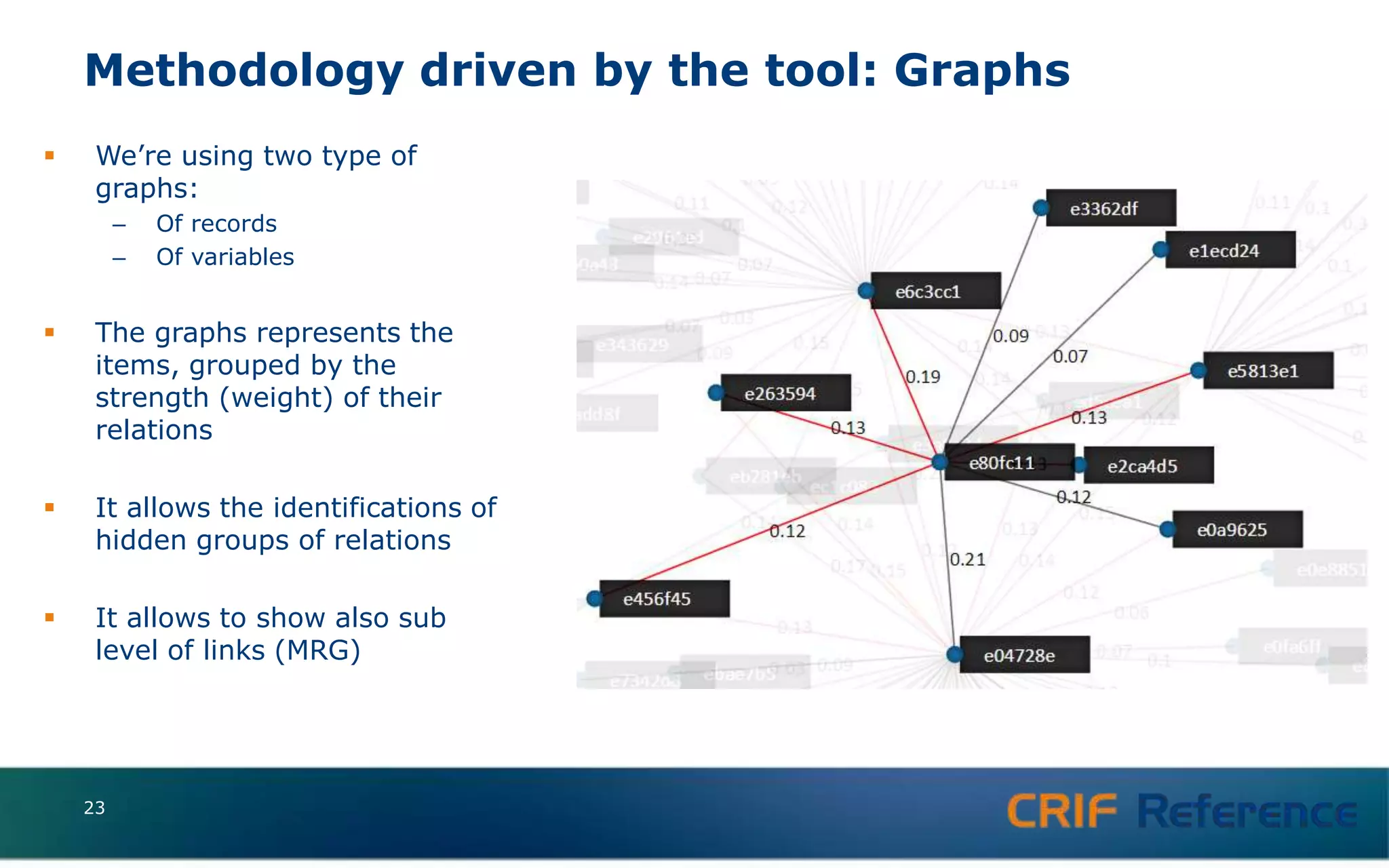

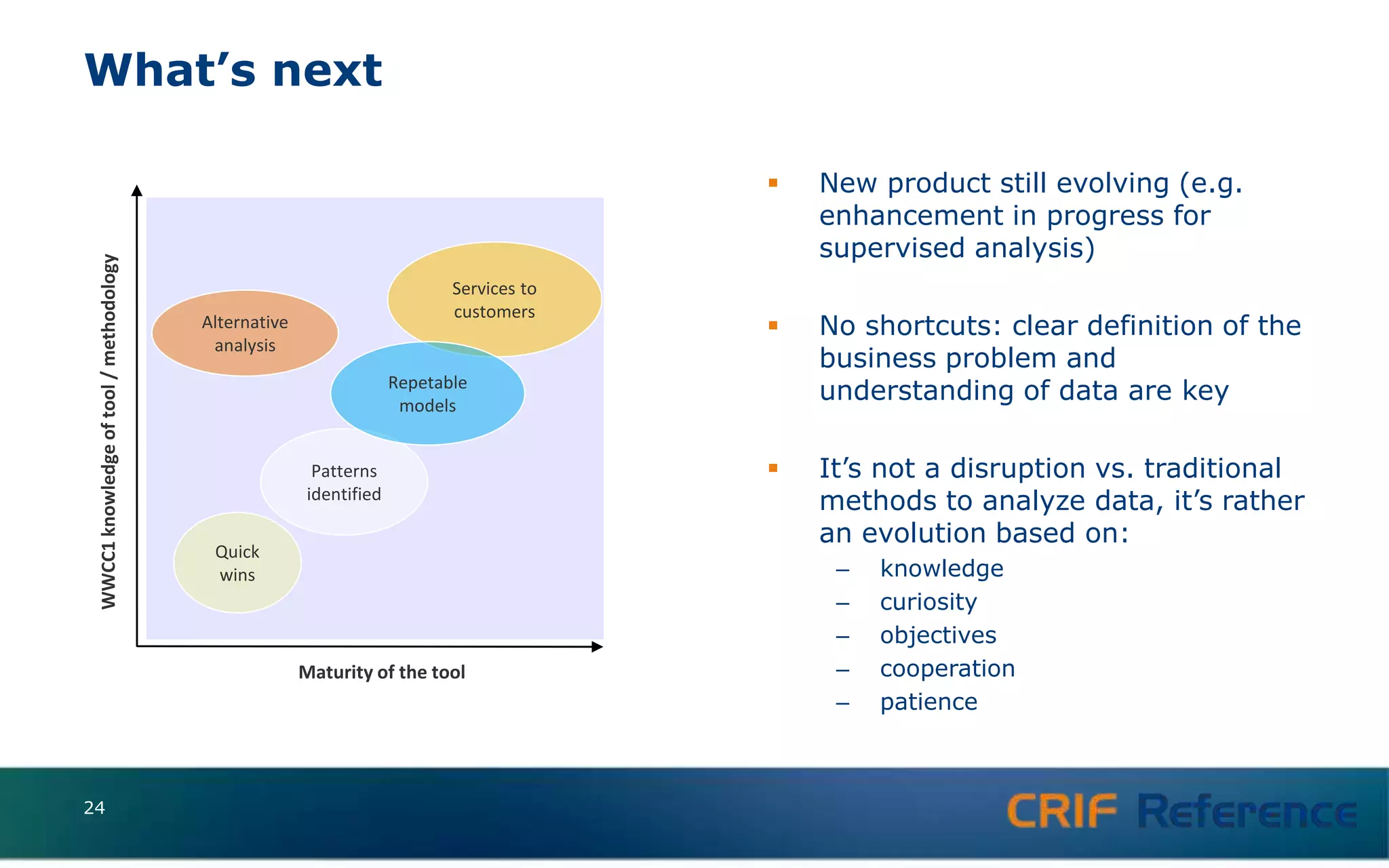

Eurisc Analytics provides credit bureau scoring and analytic solutions to financial and non-financial industries using data from credit bureaus in multiple countries. The presentation discusses new products and services being developed for credit bureaus in Italy, the Czech Republic, Slovakia, India, and Vietnam. It also outlines Eurisc's vision to defend the value of credit bureau data through more advanced analytic solutions that demonstrate real economic benefits for clients. Big data solutions using artificial neural networks and intelligent data mining techniques are presented as ways to discover new patterns and relationships in credit bureau data to develop improved services.